Newmont attempts to buy Newcrest. Are Northern Star and Evolution Mining next?

The Australian equity market has its first major M&A headline for 2023 and it concerns our largest gold miner by market capitalisation. Newcrest Mining (ASX: NCM) has had an indicative takeover offer from US-based Newmont Mining. The bid is valued at $24.4 billion, or a 21% premium to Newcrest's closing share price on Friday February 3rd.

So does it make good financial sense? And what does it all mean for the shareholders of other major gold companies like Northern Star (ASX: NST) and Evolution Mining (ASX: EVN)?

In this wire, I'll attempt to answer those two questions with the help of Blake Henricks at Firetrail Investments and Mathan Somasundaram of Deep Data Analytics. Plus, I'll share a chart that gold bugs may very well be of interest.

The art of the deal(s)

$24 billion is a lot of money - but what will Newcrest shareholders get in return? The initial offer is priced at $27.16/share. That's well above where Newcrest shares closed on the day of the filing ($24.53/share) and above its recent highs in April last year.

Newmont's filing says shareholders will get 0.38 Newmont shares for every Newcrest share, should it go through.

We don't know the specific reasons that Newmont wants to buy Newcrest but we do know they have a history. In 1966, Newmont established an Australian subsidiary called Newmont Holdings. That company went on to become Newmont Australia.

In 1990, Newmont bought industry rival Australmin then merged with BHP's then-gold assets to create Newcrest Mining.

It's also the second offer made by Newmont in recent times. The first offer, of $26.15/share, was rejected by Newcrest's board on value grounds.

So is this price any good?

Firetrail Investments recently penned a piece on the three big themes investors should watch out for. One of those big themes involved the slow demise of the US Dollar as the world's dominant currency. A decline in the US Dollar is great news for gold miners like Newcrest Mining. Newcrest is a top holding in the Firetrail Australian High Conviction Portfolio.

Henricks said that he was unsurprised by the offer.

"The Newcrest assets are large, low cost and have very long reserve life," he said. "Our view is there is significant value in undeveloped assets like Red Chris and Wafi Golpu and the market hasn’t been recognising that."

But what about the $27 offer on the table? Henricks shares the view that others (e.g. Citi and Macquarie's sell-side analysts) have already expressed - it's still too low.

"It’s pleasing to see corporate interest, but we believe the stock is worth a lot more at fair value for the assets plus a control premium," he said.

Somasundaram views the offer as coming at a time when Newcrest has been in the relative doldrums. Shares have lagged rival Northern Star's gains over the past year.

"It was an opportunistic bid due to recent weakness and management change. I suspect shareholders would want it close to $30 before this dance is over," Somasundaram told me.

What about the other major players?

The news of the Newcrest offer sent the other gold miners' shares higher initially as well. But could Newmont's bid spark a flurry of bidding for the other major gold miners listed on the ASX? Henricks doesn't think so.

"NST and EVN don’t have the same reserve life and growth upside as Newcrest and as a result we see little read through for the sector," Henricks said.

Somasundaram feels differently, arguing Northern Star and Evolution Mining are much better at asset trading. He actually thinks those two could end up making the bids for other gold miners, rather than another foreign player entering the market.

"NST and EVN are high quality plays and will be targets for global consolidation while the mid to small cap producers are a bigger target in this cycle. We continue to like Gold Road (ASX: GOR), Silver Lake Resources (ASX: SLR), Regis Resources (ASX: RRL) and Westgold Resources (ASX: WGX). The consolidation play for smaller players delivers a better global target and lower costs," he said.

One last chart

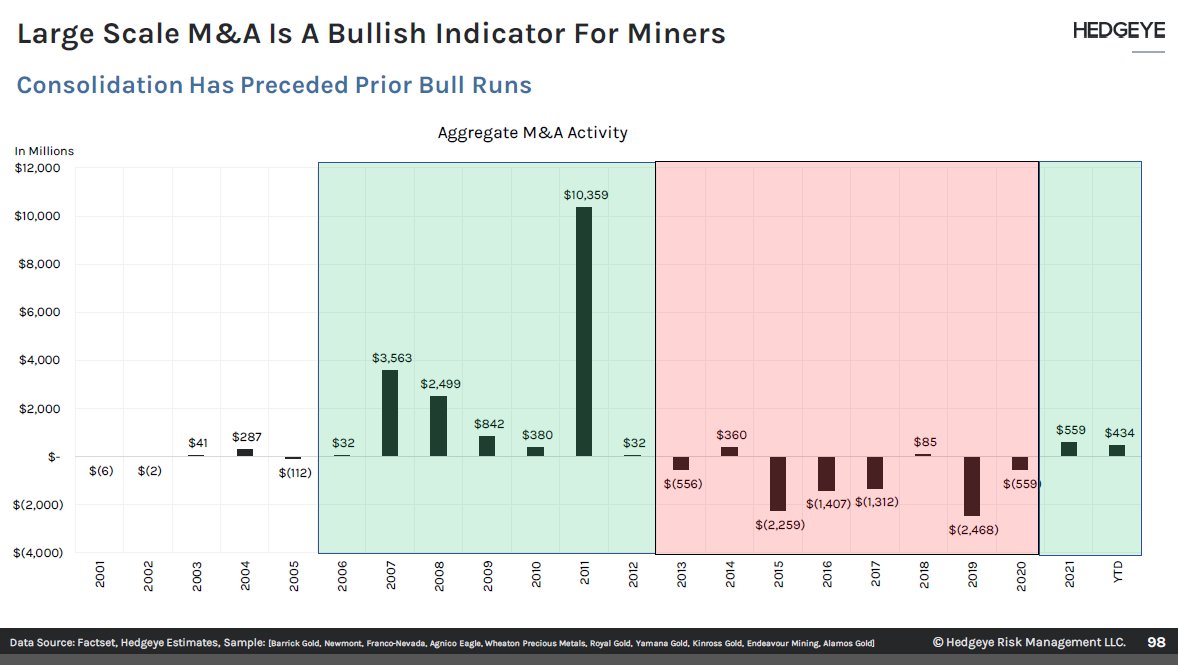

If you feel like you missed out on the Newcrest deal by not being a shareholder, you may not need to worry. As this chart from Hedgeye explains, large scale M&A has traditionally preceded a bull run for the commodities in question.

Do you believe the Newcrest offer price is too low? We want to hear from you - especially if you're a shareholder! Get in touch via the comments section below.

3 topics

7 stocks mentioned

1 fund mentioned

2 contributors mentioned