No flashy screens or sell-side research: How this investor cuts through the noise

The advent of social media, a 24/7 news cycle, the introduction of algorithmic trades, and the advent of day trading have reduced the average holding period for stocks dramatically in recent decades. Patience is now short, especially for stocks that report one bad half's worth of earnings or for companies that are at the receiving end of one bad headline in the press.

As the following chart from Trahan Macro Research shows, the average holding period for a stock has been in structural decline for some time but in 2020, the period fell below one year for the first time on record.

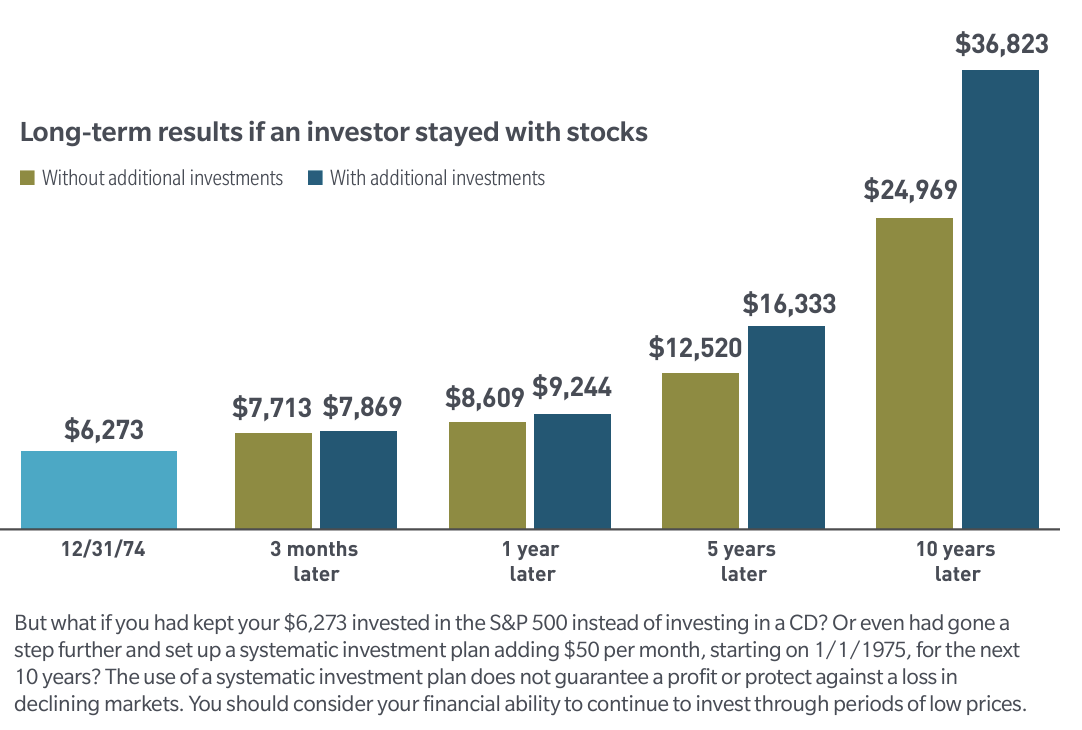

That's despite all the evidence suggesting that a) holding long-term pays off dramatically in the long run and b) short-term reactions can leave you at a serious loss later on.

In this wire, we're going to put long-term investing through the wringer with the help of someone who knows how to ignore the short-term noise and stay focused on the long-term fundamentals of the business - Aoris Investment Management's Stephen Arnold. Aoris' flagship global equities fund was set up in 2017, and although it only has 15 stocks, four of them have been held during the entire seven-year run while a fifth was only just sold.

What is your strategy for tuning out the short-term noise as an investor?

I find it helps to remind yourself that when you invest in an equity, what you own is a part of a business. That’s why it’s called a share. Your returns from owning it over a reasonably long time frame will be determined by how the value of the business grows, and to a lesser extent by whether you paid more or less than the business is worth at the time you made your investment. The rest is mostly noise.

I don’t have a clue who will win the US election or what the US Federal Reserve will do next. The reality is that over the long term, these things matter much less than they may feel in the moment when we’re reading or watching the daily news.

We do our best to tune out the noise by not having business television in our office and not receiving any sell-side research.

What is your average holding period as an investor?

Our average holding period is 3-4 years. We consider ourselves patient, long-term owners of growing, successful businesses. It’s important to keep front of mind that price matters to your outcome as an investor. After periods of strong share price performance, a great business may no longer be a great investment. So, we may sell a stock based on its valuation.

We want to own great businesses that become progressively stronger over time, but we know sometimes the opposite happens. Management may get complacent or distracted, or competition may get stronger. We look hard to identify the early warning signs and we will sell if we see evidence of competitive fade. We sold Nike (NYSE: NKE) in mid-2023 for this reason.

Your fund has 15 stocks in it. What are two or three traits that all of your portfolio holdings share?

We primarily own businesses that provide essential products and services to other businesses. One common trait is they are all established leaders in their respective markets. A second is they have all consistently outgrown their markets over many years, strengthening their leadership position. Thirdly, they all have breadth and serve many different customer groups across many different end markets. This adds resilience. A fourth is they are all highly profitable and remain so during periods of economic stress. It is this profitability and attractive long-term growth that we are participating in as owners.

Tell us about a stock you have held in the portfolio since the beginning.

We’ve owned Accenture (NYSE: ACN) since the fund’s inception. Accenture is the world’s leading IT outsourcing and consulting company and helps the world’s largest organisations deal with change. It helps customers evolve and transform their IT infrastructure to get the most out of advancements such as cloud computing and AI, make their data more secure, and make their businesses more efficient.

Accenture has done an impressive job of evolving its capabilities to satisfy its clients' evolving needs. All of Accenture’s 100 largest customers have been its customers for more than a decade, which speaks to its durability and relevance. As the world continues to change and requires businesses to change with it, we see a bright future for Accenture.

What is one company in your universe that you have never bought but would love to make a long-term holding in the future?

Let me instead tell you about one that we have owned, sold, and would love to own again. We had owned Costco (NASDAQ: COST) for four years before selling it earlier this year for reasons of valuation. Costco is a retailer unusual in its business model and unusual in its success. In the words of the late Charlie Munger, “I wish everything else in America was working as well as Costco does”.

3 topics

2 stocks mentioned

1 contributor mentioned