Not a sequel but an Origin story

A company trading at a discount to book value with tailwinds in key end markets: Is that something you might be interested in?

In our last public note, we commented that we were going down the Marvel track with a couple of consecutive sequels. Weeks later we observed another Livewire contributor emulate one of our publication franchises and we thought, "Why not embrace the Marvel moniker?". So here is our Origin story.

I was fortunate to commence a career in financial markets over 10 years ago(1) with an Adelaide based firm called Core Energy. It was there that I tuned my skills in financial modelling, report writing, business acumen and conference etiquette (2), advising clients on energy markets and energy companies. One of those companies was Origin Energy (ASX: ORG) – so I deeply appreciate how complex it can be to maintain a detailed model and live valuation of the company. Truth be told, it was the analysis of ORG that brought the founding Chester team together back in 2010. Over 10 years on, we were once again drawn to the company.

For those who haven’t heard our pitch, at Chester, we are style agnostic investors that invest within a portfolio construction framework that includes "predictables," "cyclicals" and "defensives". Despite half of the business being a utility (predictable) and half an E&P company, we classify ORG as cyclical. For stocks that we define as cyclical, our dominant assessment lens is value (3).

True value buyers love when the share price is below book value, but often that book value is stale and impairments see it eroded over time. Below we explain that ORG is in somewhat of a unique position in that literally all of its assets have recently been "marked to market", which has helped solidify our conviction around value. We formalised that view in mid-October 2021 by updating our internal ORG valuation and comparing it to that of the sell-side (the street) book value, and comparable market values (where appropriate). Since then, we have seen a transaction announced in APLNG (at above-market) and seen the street upgrade valuations.

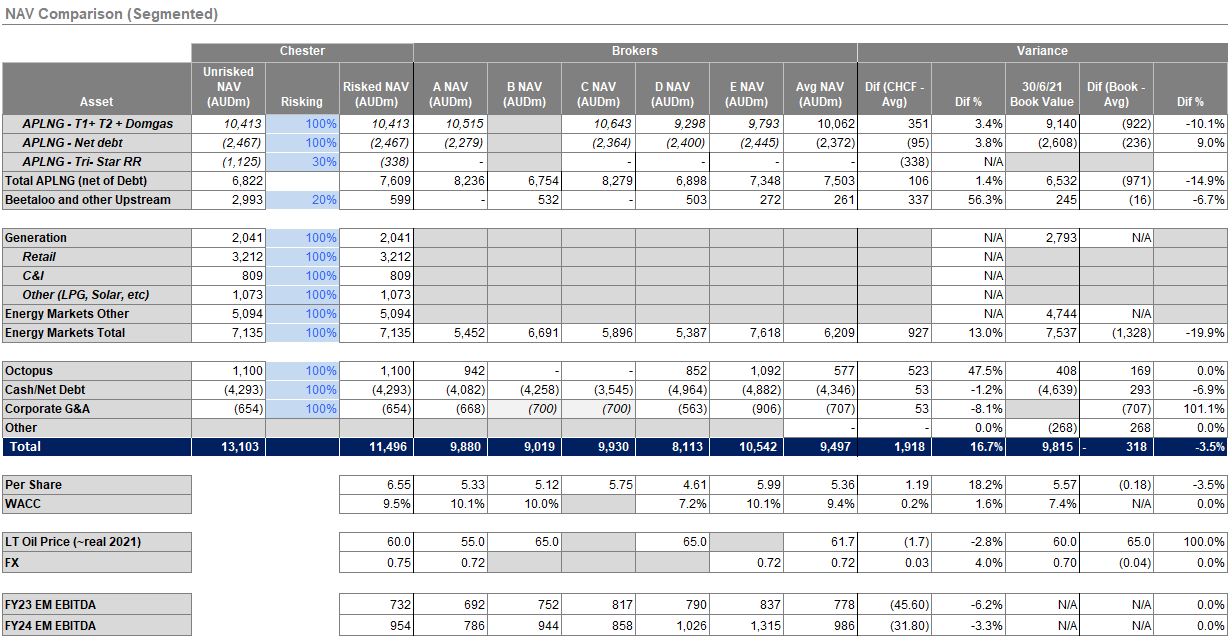

The summary of that comparison is tabled below with supporting notes on each of the key assets following.

Valuation comparison

APLNG

In October 2021, ORG owned an effective 37.5% interest in the 9Mtpa APLNG CSG to LNG project in QLD. Our analysis at the time revealed limited variability between the street’s APLNG valuations, likely a consequence of management’s granularity around: forward costs expected production levels, break-even costs, etc. and the street using fairly consistent assumptions to value the asset(4). Additionally, APLNG was impaired in FY2020 so the book value approximately equalled ORG’s latest view of valuation then, however since that time(5):

- Oil prices have increased from around US$40/bbl to more than US$70/bbl, slightly offset by an increase in the AUD/USD foreign exchange rate (from 0.69 to over 0.70)

- APLNG has demonstrated improved well productivity, at Talinga and Orana in particular

- Project breakeven costs have improved (19% FY21 versus FY20)

Obviously, numerous swing factors exist but we specifically note the following key negative and positive:

- Tri Star reversionary rights. Per 30/6/2021 relates to 20% of 2P reserves for which 45% would revert. ORG share of 2P = 4,252PJ, hence reversion relates to 850PJ (20% x 4,252PJ) of which 45% would potentially revert (340PJ). Within the Chester valuation, we have included a risked contingent liability of AUD340m (~AUD1/GJ) to account for some of this risk.

Infrastructure monetisation. There are mixed reports as to the willingness of JV parties to entertain a sale and leaseback of APLNG infrastructure but there are transactions in the marketplace to support a potential value uplift. If we think about the EV of APLNG as ~AUD10.5bn and then accept our FY2021 EBITDA assessment of around $1.75 billion APLNG is effectively being valued at 6x EV/EBITDA. APA is on around 12x EV/EBITDA so we would think any deal would be around that mark (10-12x EBITDA). Gross PP&E in APLNG is around $31 billion(6) with more than 50% of that in the downstream. So, if we assume $15 billion of booked PP&E was ‘liberated’ the uplift could essentially be between $5 billion and $7 billion (ORG share 37.5% = AUD1,875m to AUD2,626). I.e. AUD1-1.50/share

Sale of APLNG interest

After our assessment, ORG announced the sale of a 10% APLNG stake to EIG for AUD2.12bn, taking ORG’s interest to 27.5%(7). On 9/12/2021 ORG announced ConocoPhillips had exercised their pre-emptive rights for the stake. A comparison of the sale price to our value assessment in October is tabled below.

Some thoughts from the transaction:

- Valuation Premium. With a highly levered balance sheet and market ESG concerns, you could be forgiven for thinking that anywhere from 80-100% of NAV would be a good result for ORG. But the sale price was 6% above the street’s valuation of APLNG, 4.5% above Chester’s and 21.7% above book value. That is, it would add 25 cents a share (ignoring transaction costs) against the street or 81 cents a share to book value

Upgrade. ORG had previously indicated more than $1 billion of cash flow from APLNG for FY2022 at 37.5%. That guidance is unchanged and by simple maths, if we assumed the cash flow was split evenly across the two halves, that implies guidance of around $1,200 million (at 37.5% for the full year).

Reversionary rights. Anyone acquiring a stake in APLNG has to gain comfort with the position on Tri-Star’s reversionary rights. The premium to (street) NAV is a good sign, particularly given reversion is about to get tested in court

EIG. EIG was previously a substantial shareholder in Senex Energy (ASX: SXY). The company has also been reported as underbidders on stakes in the QCLNG infrastructure sell down. We suspect the premium reflects some confidence of EIG to monetise assets via a sale and leaseback within the APLNG JV

Optionality. ORG noted the capital injection provides flexibility to deliver returns to shareholders and pay down debt while allowing ORG to accelerate investment in growth opportunities. Is there an acquisition lined up?

Pre-emption. Pre-emption provides us greater comfort that EIG’s offer wasn’t just a one-off bid from a cashed-up suitor but reflective of reasonable market value

Beetaloo and Other E&P assets

The bulk of ORG’s upstream assets were called Lattice Energy and were divested to Beach Energy (ASX: BPT) in 2017. The remaining assets, as evident in the table above are often overlooked by the market, except for perhaps ORG’s 77.5% interest in the Beetaloo project, which consists of potentially four stacked unconventional plays within 18,500 sqkms. To date 6.6Tcf of contingent resource has been booked related to just the Velkerri B (dry) shale gas play.

ORG’s JV partner, Falcon Oil and Gas is actually listed so we can perform an implied valuation based on their market cap.

The market only really considers Beetaloo of what’s left partly because ORG wrote down it’s Poseidon asset(8) in 2017. But as Santos proved with Barossa those assets can have value in the right part of the cycle and Asian LNG prices have recently topped USD30/mmbtu. We add an addition AUD50m+ for Poseidon (+ ORG’s Canning basin interests) but note upside risk to this as we see Poseidon as potential Darwin LNG feed, reminding that ORG did pay Karoon USD600m in 2014 for its stake in the asset.

The difference noted between us and the street’s/book value, for ORG’s E&P assets is ~AUD350m (~AUD0.20/share), again it’s not huge but it adds up.

Octopus Energy

For those unfamiliar with Octopus Energy, it is a UK based, global retailer of gas and electricity that specialises in renewable energy. The company operates an energy tech platform (Kraken) which is built around a scalable, cloud based architecture specifically for the energy sector. Kraken has been licensed to support over 25 million accounts worldwide (including ORG’s retail base) with plans to exceed 100 million accounts by 2027. ORG currently owns 20% of the business.

We recently heard from Octopus Energy’s founder Greg Jackson and simplistically it sounds like Octopus (through Kraken) are taking existing energy markets from a ‘taxi-like’ state with fixed pricing and limited visibility for customers to an ‘uber-like’ model where the grid is becoming: more flexible, with customers able to access variable pricing; more distributed, with rooftop solar, storage batteries and other generation; and more transparent, allowing greater information flow of data. For the historians amongst us on an interesting side note, the founding company of the oil and gas sector, Standard Oil was often famously depicted as a sprawling, grasping octopus. We are unsure if Greg made the link when founding and naming the company but we appreciate the full circle nature of the symbolism.

Per above we did note a variance in street valuations of ORG’s Octopus Energy interest, with some analysts completely ignoring it. We admit to finding this somewhat unusual given the recent transaction by Generation Investment Management (GIM) providing a ‘mark-to-market’ value for Octopus Energy to ~AUD5.5bn, meaning ORG’s stake is worth ~AUD1,100m, refer table below.

The sample of us vs the sell side in October showed a difference of ~AUD500m in average valuations (AUD0.33/share), ~6% of the current share price. The difference to book is even more pronounced at ~AUD690m (AUD0.39/share). And just as we finish writing we are reading of Canada Pension Plan Investment Board taking a 6% stake in Octopus for USD300m, implying a further AUD0.15/share increase to ORG's stake per the GIM transaction.

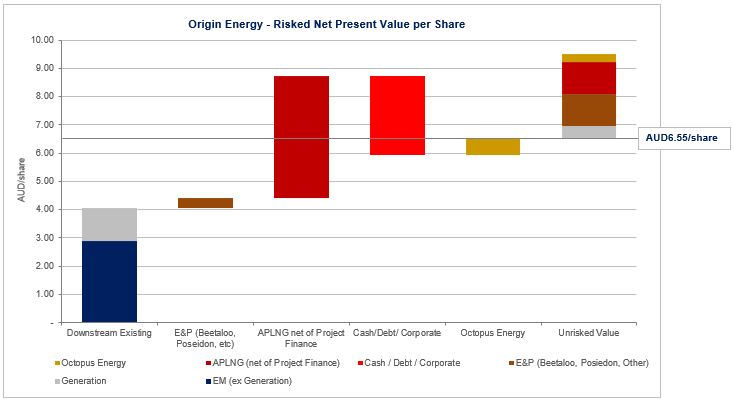

Although we don’t model Octopus separately we would imagine given: the current growth trajectory, material interest in the company and SaaS nature of Kraken the valuation could continue to grow. We have assumed an upside case of AUD500m beyond our base case valuation within the waterfall chart below.

Energy Markets (EM)

In the preceding paragraphs we have presented over AUD0.70/share of incremental mark to market value to the street’s (October) ORG valuations and over AUD1.30/share to book values, but the biggest swing factor in valuation is Energy Markets (EM). The market generally values EM using an earnings capitalisation approach (which ignores what point of the cycle we are in). We have observed some analysts realise the risk in doing this and progress to an average capitalisation of the next 3 years. This still potentially understates the true value of all components of the business, as it is capitalising the trough year of FY2022 (~AUD525m EBITDA at guidance midpoint) within the valuation, which compares with FY19 and FY20 EM EBITDA of AUD1,574m and AUD1,459m and earnings guidance in FY2023 of ~AUD725m.

What we do know is that ORG impaired both the PP&E in generation and EM Goodwill during FY21 such that:

- Generation closing book value was AUD2,793m at 30/6/2021

- EM Goodwill was written down to AUD3,812m at 30/6/2021. This was on top of net book value of remaining EM assets of AUD932m taking the written down non Generation assets to AUD4,744m (AUD932m + AUD3,812m).

- The total of these two (Generation + EM Other) is AUD7,537m(9)

This is well above the average sell side valuation of the division, sampled at AUD6,209m i.e., AUD0.75/share (~15% of current share price). We have essentially tried to address this difference by performing 2 separate exercises:

- A valuation of EM’s subcomponents, with where possible reference to market transactions

- A detailed analysis of the earnings movements year to year (Earnings bridge)

A warning that we may offend some detailed readers with this crude exercise by trying to simplify what can be relatively complex(10)/ opaque subsectors of EM.

EM Valuation Exercise

Generation

As is evident in the list of generators, beyond Eraring, ORG’s fleet is predominantly OCGT and CCGT(11) assets. Valuation of these assets is complex as ORG provide limited details, but historically we have modelled each of these generators separately. One of the key challenges in performing any valuation is this peaking generation provides insurance against price spikes in the NEM to the cap of AUD15,000/MWh which can save the company millions of dollars but projecting when and the value of the cost of that insurance can be complex. Hence beyond our DCF we have considered book value (AUD2,793m), replacement cost and comparable market transactions as a valuation cross check.

The most notable current (replacement cost) is the proposed, Federal Government backed Kurri Kurri, 660MW OCGT project which has a proposed price tag of AUD600m (AUD0.9m/MW). This price tag is actually below other quoted OCGT plants of ~AUD1.1m/MW and CCGT of AUD1.4m but notably is the most recent cost of a new plant we can find. Given ORG’s peaking fleet is quite aged we view the Smithfield transaction from May 2019 as a more reasonable comparison. This deal saw Infigen acquire the Smithfield OCGT plant 109MW for AUD60m (AUD0.55/MW).

ORG's internal generation is 3,167MW, ex Eraring, which would equate to ~AUD1,740m at AUD0.55m/MW. This is reasonably in line with our valuation of ORG’s non Eraring Generation fleet. To that we need to add Eraring an valuation, which we derive by assuming AUD60/MWh NSW electricity price from FY2025 onwards, generating a margin of ~AUD10/MWh on ~12TWhpa which gets us to ~AUD400m for Eraring.

Hence our generation valuation (~AUD2.1bn) is below ORG book value, with the upside to our valuation vs book value (AUD700m) captured in the waterfall graph below. As a side note, adding ~AUD5/MWh, i.e., assumed AUD65/MWh real long term in NSW increases our Eraring value by ~AUD400m so represents a key area of sensitivity in our valuation.

Retail

We model each of ORG’s electricity and gas businesses separately including cost to serve. For more detail on the earnings of the subcomponents refer ‘Earnings Review’ below. We do note that there has been increasing desire for service providers to bundle packages, to avoid regulation requirements and amortise the cost to serve across a greater denominator with both ORG and AGL offering white label broadband, and Telstra offering energy services and pay TV. Intervention by Governments makes it harder to earn super profits in the space but the question remains what is a reasonable profit and what does that mean for the valuation of retail assets? There are many inputs into our valuation but the key variable we employ is long term EBITDA margins of ~5%.

To our valuation we have performed a cross check based on comparable market transactions for energy retailers. By way of reference lower quality retail customers have historically transacted at AUD400-500/customer(12) but stronger more attractive books have transacted at >AUD1,000/customer. ORG itself paid ~AUD1,300/customer for Integral and Country Energy back in 2010.

In November 2021 Shell and ICG group paid AUD729m for Powershop’s 185k customers and energy infrastructure (~300MW renewable capacity). This would be a relevant comparable transaction but annoyingly we don’t have the split in value between the infrastructure and retail assets. If we make some general assumptions like ~AUD1.8/MW of renewable capacity implied by the Infigen takevoer, ICG could be paying ~AUD540m for the energy infrastructure and Shell could be paying AUD189m ~AUD1,000/customer for the retail book.

In a cleaner comparison, in June 2021 Mercury acquired Trustpower’s retail business of 416k customers for NZD441m (~AUD1,000/customer). The drawback for this comparable however is that it is NZ, but NZ retailers do have similar profitability per customer as Australia.

ORG had 3.855m gas and electricity customer accounts at 30/6/2021 (4.266m if we include LPG and Broadband). At AUD1,000/customer that equates to AUD3,855m, compared to our net retail valuation of ~AUD3.2bn I.e., Chester retail valuation (electricity + gas) equates to AUD830/customer.

Hence we are comfortable with our retail valuation(s) and see upside (>AUD600m) if we were to assume valuation towards AUD1,000/customer.

C&I including merchant electricity and gas operations

C&I we rely on our DCF valuation but notably there isn’t much visibility to valuation. Further challenged since ERM power was acquired by Shell we have lost public visibility into margins available in C&I or ‘Business’. We assume longer term ~2% EBITDA margins in this part of the business plus the impact of existing books particularly the margin on the APLNG gas contract, refer to Gas GM in Earnings review below.

LPG

Origin supplies LPG and propane to residential and business customers across Australia and the Pacific. We value the LPG business as relatively steady, continuing to generate ~AUD90m p.a. On 7-8x EBITDA we see the LPG business being worth ~AUD600-700m which represents the core of our ‘Other’ valuation.

Solar and Energy Services + Future Energy

Within Solar and Energy Services ORG provides installation of batteries and solar systems to both business and residential customers as well as ongoing support. Plus, the supply of electricity and gas to apartment tenants through embedded networks and hot water.

Future Energy is ORG’s business unit that focuses on developing and commercialising new technologies and products in a changing energy environment. Included within operations are ORG’s virtual power plant of connected services, 159MW from 79k at 30/6/2021 of which 56k were from the Spike program.

We value the combination of these business at ~AUD300-400m

EM – Earnings Review

If we assume 7-8x EBITDA as the appropriate multiple(13) under a capitalised earnings approach FY2024 earnings and beyond would need to increase AUD250-300m on FY23 to justify the ORG book value and Chester Valuation (AUD7,537 / 7.5 = ~AUD1,000m vs FY2023 guidance of ~AUD725m).

Kraken is set to deliver a further AUD100-150m in operating cost savings (with the bulk of that in FY24) leaving a further AUD150-200m to be achieved. With the closure of coal plants like Liddel we could see a >AUD10/MWh increase in base NSW electricity prices(14) noting Victorian prices averaged ~AUD30/MWh higher following the 3 years post Hazelwood closure. This is as contentious an argument as monetary inflation and we have come across both electricity price deflationists (renewable SRMC ~0) and electricity price inflationistas.

Putting that argument to one side through, from our sell side sample the average for what we can see is a AUD200m(15) increase in EM earnings from FY23 to FY24, which isn't necessarily captured within valuations I.e., we can see why valuations would need to rise by AUD0.50-AUD1.00/share as FY2023 and FY2024 earnings are capitalised rather than FY2022 and FY2023.

We have performed an exercise below demonstrating how we can see EM EBITDA back above AUD900m p.a. by FY2024.

Cash / Net Debt + Corporate

Net Debt is a function of our earnings and cash flow projections. Corporate Costs is an after tax valuation of the ongoing cost of corporate overheads for which we value at ~(AUD650m). Notably to compare apples with apples we arbitrarily took the average across our sample of AUD700m and isolated that for the analysts that didn’t account for it separately.

Closing

At this time of year when everyone is trying to make unknowable predictions about the year ahead, in a highly uncertain macro environment, we are focusing on individual stock stories and emphasising why we have conviction in the value of assets we are investing in. We trust the above has helped provide clarity as to why we were comfortable acquiring ORG in the low 4’s with a view to a base case valuation of ~AUD6.50/share.

It’s also worth pointing out that if we marked to market ORG’s assets that have recently transacted: APLNG, Beetaloo and Octopus and added them to the book value of remaining assets we get AUD7.12/share(16).

Happy holidays and hopefully there’s some coal leftover for ORG after Santa’s visits.

References

(1) This writer is ignoring the painful 4 years he spent as an auditor

(3) Of the 3 lenses we consider, Quality and Edge being the other two

(4) USD60-65/bbl brent price LT and a WACC of ~10%.

(5) For those unfamiliar with the accounting treatment, you don’t write back these improvements

(8) 40% interest in Browse Basin field – previously reported as 7.6Tcf of gas and liquids

(9) i.e., ORG’s internal updated view of Energy Markets EV, supported by their auditors at 30/6/2021 using a discount rate of 9.6-9.8% pre-tax

(10) In doing so, for simplicity we have chosen to spend little time on RECs

(11) OCGT = Open Cycle Gas Turbine and CCGT= Combined Cycle Gas turbine

(12) AGL’s takeover of Australian Power and gas being notably around this mark

(13) ~Historical AGL multiple prior to its issues) and the ~average the street is capitalising ORG EM EBITDA at

(14) Note this was written in October and we have started to witness coal and gas price increases putting upward pressure on the wholesale electricity price

(16) AUD5.57/share + AUD0.81/share + AUD0.20/share + AUD0.39/share + AUD0.15/share = AUD7.12/share

3 topics

7 stocks mentioned