Observations from across ‘the ditch’

Whilst you can learn a lot from behind your desk, there is no substitute for visiting a company’s operations in person not only to get a better understanding of how a business operates but perhaps more importantly, to get a feeling for a company’s culture as well as the industry conditions and economic drivers in which a company operates.

We recently spent some time in the North Island of New Zealand meeting with companies and trying to better understand how the economy is placed moving into 2025. It is worth mentioning that our views are based only on our experiences and given such a small sample size, this should not be interpreted as fact. Below are 5 key observations from our travels:

Taxi Driver Economic Index

It is often said that taxi drivers have a great handle on economic conditions through their conversations with a wide array of customers and are somewhere near the ‘tip of the spear’ of discretionary spending. In the modern-day world, we can substitute taxi drivers for Uber drivers.

It is common knowledge that the New Zealand economy has been through a challenging recession but speaking to our Uber drivers it didn’t take long to get a handle on just how deep this recession has been. Without fail every driver we spoke to mentioned it was the worst 12-24 months they had ever experienced.

“That’s just the way it is these days”

Anyone who works in the Australian CBD will be aware that it seems the new post-COVID normal is people working from home on Monday and/or Friday. In effect ‘Thursdays are the new Fridays’ when it comes to hospitality venues in CBD locations, and are now often the busiest day/night of the week.

Undertaking an exercise of walking through and speaking with staff at various retail outlets & hospitality venues, we were surprised at just how quiet it was on a Thursday evening which we would expect to have been close to peak time. One conversation with a staff member at a long-standing venue which is renowned for being busy was of particular interest. Echoing the taxi driver comments, this staff member mentioned that this past winter had been horrendous and on some occasions the staff to customer ratio was far closer to 1x than a multiple thereof (which it should typically be). Another lengthy conversation with a worker at a value-focused clothing store (in which no other customers entered the store during that time) was best summed up when talking about how quiet it was as “that’s just the way it is these days”.

Infrastructure Challenges

The demand/requirement for significant public sector infrastructure improvements is a challenge experienced by many countries. Unsurprisingly, so is finding the funding for this work, and in a higher inflationary environment where construction costs have experienced severe increases, infrastructure cost blowouts seem to be occurring more and more often.

The KiwiRail-operated Interislander was cancelled in late 2023. Given its geography across two main islands, the country has used this state-owned KiwiRail ferry service as an extension of their main arterial Highway 1 from North Island to South Island. A scheme to replace the ageing fleet with two larger ships and accompanied infrastructure upgrades saw cost blowouts which become impossible to fund. A year on from this ferry service ceasing, from what we can gather it seems there is no doubt that it has been disruptive to say the least.

We are not here to pass judgement on New Zealand politics however it became reasonably clear from our conversations that it appears there is a genuine push by the newly elected government to streamline regulatory processes in order to meet some of New Zealand’s infrastructure challenges.

Light on the Horizon

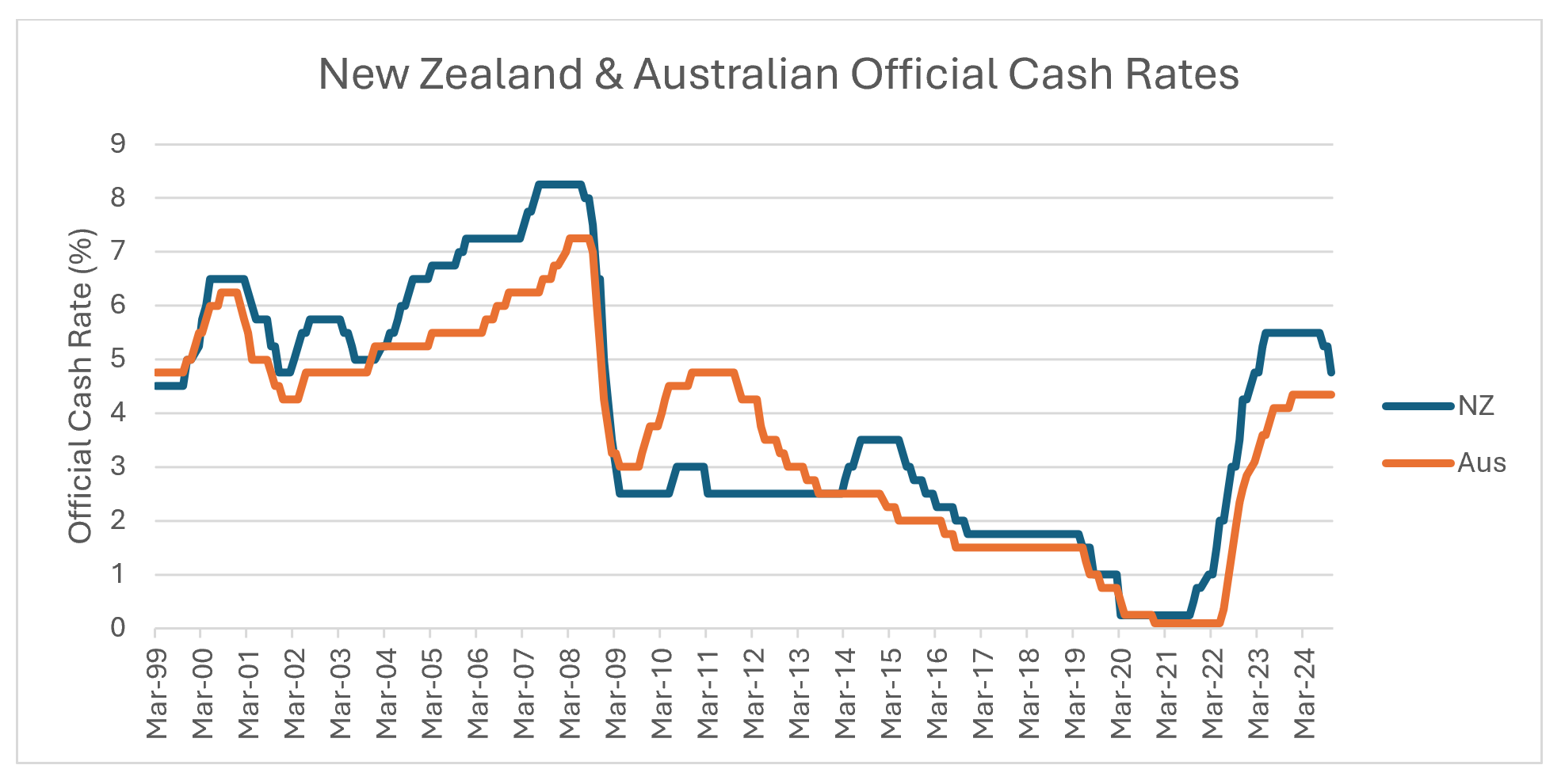

As shown in the below chart, in the recent rate increase cycle, the Reserve Bank of New Zealand (RBNZ) hiked rates earlier, with more conviction, and went higher than the Reserve Bank of Australia.

Source: RBNZ, RBA

However, the RBNZ have since delivered 75 basis points (bps) of interest rate cuts since August, and the expectation is that there is far more to come over the next 12 months. For example, UBS still sees -50bps RBNZ rate cuts in both November and February, followed by four -25bps cuts, resulting in a terminal rate of 2.75% in Aug-25.

Whilst markets look forward, the reality is that the impact of interest rate changes take time to filter through an economy, so it was too early to see any direct benefits of these rate cuts. Whilst it was indisputable that the consensus view was that these rate cuts should have come earlier, there was genuine optimism about their impacts heading into 2025. As with anything, the range of outcomes that could occur is always far greater than the range of outcomes which will actually occur. Our belief is that New Zealand will see a gradual, then more rapid return to optimism in 2025. As the saying goes, “it’s always darkest before the dawn.”

5 topics