Off the Charts! Cryptos smashed by Avocados, Qantas' vaccine incentive, and a $2bn SPAC-tacular business

The recent buoyancy in market confidence has been utterly hinged on the vaccine roll-out. So it's not surprising to see the private sector stepping in to lift the dismal vaccination rate in Australia, not least when they'll benefit - and why not? Qantas, for instance, is helping lift the country's vaccination stats with an offer of free flights and other incentives (see below). So is Tinder but that's another story.

(Speaking of other stories: Before we go any further we'd like to take a moment to blow the bugle about the brand new Top-Rated Funds Series coming to Livewire readers. From 1 June, Livewire Markets will launch a new series featuring a list of Australia's 100 top-rated funds, putting a spotlight on some of Australia's most highly-rated funds, according to Lonsec, Morningstar and Zenith. If you want to learn how researchers are thinking about markets, the asset classes they believe are being overlooked and the biggest myths about picking good fund managers register here. More details can be found at the foot of this wire, and Livewire's James Marlay writes about it here.)

Now. Where were we? Oh yes.

Elsewhere, there's an inconvenient truth for the Federal Minister for Environment to face up to. A crackdown on coal seems a likely result after a prominent legal finding this week.

It's getting harder and harder not to write about crypto in Off the Charts!. We aim to capture the wondrous and weird corners of markets, and there's always something crypto-y lurking there. This week was no different. A leaked report shows Goldman Sachs is backing Ethereum as a better store of value than Bitcoin. While others make the same claim for a very popular stone fruit (you'll see). But buyer beware. Scammers are using crypto-mania to prey on unsuspecting investors using increasingly sophisticated looking websites.

Let's jump in...

#1 GOLDMAN, GAMESTOP: The not so ephemeral EtherEUM

At this point, we don't even know what's what in the world of crypto.

Is it up down left or right? Market darling to demon to dark horse... it seems to change every day. What we do know is that we will be getting through today's update without mentioning the E-word (yes, breaking the four-week streak) and our very own Mia Kwok unpacked everything you need to know in this handy guide.

A leaked update from the Goldman Sachs Macro Research team this week revealed they have put chips behind Bitcoin's little cousin Ethereum (ether) as the currency of the future.

“Ether beats bitcoin as a store of value. The Ethereum ecosystem...provides developers a way to create new apps. Most of DeFi apps are being built on Ethereum. The greater number of transactions in ether vs bitcoin reflects this dominance” - Goldman Sachs Global Macro Research (allegedly).

The performance seems to reflect the broader market holding a similar opinion, with Ethereum outgrowing Bitcoin comprehensively over the past 12 months (+1000% vs +300%).

A phase you may have thought was fizzling out also seems to be on the Ether train, with OG meme stock Gamestop developing their own non-fungible token (NFT) platform. Having settled around the $170-180 mark, this announcement sent their share price zooming past the double century; they are currently sitting pretty at a touch over $240. We will be waiting patiently to see what emerges from this, as will a potentially fatigued market:

"Between 27 April and 26 May, the number of daily sales (of NFTs) had dropped from a peak of 34,000 tokens to 20,236. The value of daily sales fell from a high of $176m recorded on 9 May to $15.1m on 26 May." - NonFungible

And finally, to put this Elongated saga (the streak continues) in terms our millennial readers will understand :

Source: Tracy Alloway/Twitter.

#2 Aussie EV the target of spac-tacular $2 bn offer

The only thing investors love more than investing seems to be quoting other investors. Charlie Munger provided us with a gem earlier in the year and it did not leave much to the imagination:

“Crazy speculation in enterprises not even found or picked out yet is a sign of an irritating bubble...The investment banking profession will sell sh-t as long as sh-t can be sold.” - Munger on SPACs

Well, I'm sure everyone will be incredibly pleased to hear that the AFL Hub was not the only 'irritating bubble' to reach our shores in 2021, with Decarbonization Plus Acquisition Corporation II of California securing electric vehicle fast-charger Tritium of Brisbane. At an enterprise value of $2.2 billion and the title of the world's second-largest fast-charging business, Tritium's arrival on the NASDAQ is set to make a splash.

"Tritium’s technology is based around a unique liquid-based cooling system rather than air-cooled system in which a build up of dust hampers performance and longevity."

Let's hope their management team, like their batteries, are not too dusty after celebrating this milestone.

#3 EIGHT TEENS AND A NUN - AND THE COURTS CRACKDOWN ON COAL

On Thursday, the Federal Court of Australia handed down their decision on the matter between a group of climate activist teens and the Environment Minister, Sussan Ley.

The plaintiffs, 8 teens and a nun*, sought an injunction to prevent Ley from approving a proposal by Whitehaven Coal (ASX: WHC) to expand their operations in NSW. The group argued that the Minister had a duty to protect younger people from the harm of climate change. The court found that the Minister did in fact have a duty to not act in a way that would cause future harm to young people. But the judge did not find that the approval of Whitehaven's expansion was a breach of this duty.

The decision is highly relevant for Aussie investors. Future projects of non-renewable companies may now be challenged under a breach of this duty. Another headwind for non-renewable companies.

For a government painfully slow to act on the issue of climate change, the judgement puts further responsibility on the Environment Minister to protect our climate. One wonders how the Coalition will get around this one. Maybe the Environment Minister will get rolled into Infrastructure. No Minister, no duty.

The decision follows developments in Holland, where a court in the Hague found that Shell's commitment to be carbon neutral by 2050 was insufficiently concrete, ordering the oil giant to cut its global carbon emissions by 45% by 2030. Further cementing the global push by courts to crack down on fossil fuels.

*Which reminds us. How many good puns can you make out of the word "habit": Nun

#4 WHY QANTAS - AND TINDER - NEED YOU TO GET THE POINT

To put it ever so mildly Australia's vaccination program hasn't exactly matched our success in flattening the curve. Far from it.

As we write this, Victoria has just begun its fourth lockdown (memo to Mr Andrews: a centralised contact-tracing app that doesn't monetise your private information is a GOOD idea) and though vaccination stations are gradually appearing here and there we've still only given one shot to 3.7 million people, or about 14.8% of Australia's overall population

The phrase, not being able to organise a booze-up in a brewery seems about right.

Image: NT News

But it's not just the administration of the vaccine that is the problem. In Australia, and elsewhere, trepidation about the safety of a fast-tracked vaccine has slowed the take-up among populations, not only imperilling the global recovery and giving perverse encouragement to Anti-Vaxxers (who really need to familiarise themselves with the Dunning Kruger effect, pronto, because they're the loving embodiments of it) but also giving international airlines - and our very own Qantas - pause just as things looked to be (forgive us) taking off once more.

As Bloomberg reported: "Qantas airways is considering giving free flight vouchers or air miles to people who’ve had Covid-19 shots, joining a growing list of businesses offering vaccination incentives to kick-start global travel.

While details haven’t been finalized, fully inoculated Qantas frequent fliers might also be offered free loyalty status credits, Qantas said in a statement Friday. The program is due to run until the end of 2021, when Australia’s vaccination program is expected to be mostly complete, the airline said.

They're not alone: "United Airlines Holdings Inc is offering vaccinated frequent fliers the chance to win free flights for a year. Even dating sites including Tinder are rolling out incentives such as profile boosts for users who’ve been jabbed."

#5 PUTTING THE 'CRY' INTO CRYPTO

It's easy to point to FOMO and greed as the twin impulses driving the crypto rage (alongside, say, the almost daily news of vaster and vaster institutional commitments, and people such as ARK's

Cathie Wood shooting fresh new Bitcoin price forecasts into the sky on days that end in a 'y'.

True - some are making a motza. But more and more stories are emerging of all manner of folks being separated from their savings. As 2GB reported earlier this week, "According to the ACCC, nearly 2500 Aussies lost $20 million to crypto scams in the first quarter of the year."

So, FOMO, greed ... and gullibility, then? Not so fast. There's striking evidence online crypto-grifters are getting by wilier and wilier by the minute.

This month alone we saw "Jonathan" who blew not only thousands of his own money on a crypto scam advertising 50% returns on Instagram but also encouraged his friends to commit and lose their own savings to the same swine. The trick was providing early actual returns to whet his appetite and grease the hinges to his account.

When the money came in, he spread the "good" news to his friends, one of whom sold his car for $10,000 and was fleeced of it almost as quickly. Jonathan said: "It was like my integrity just vanished all of a sudden," he told the ABC earlier this month, "because I'd convinced my friends. I'd shown them my profits, and I was actively promoting it, almost like a salesman for her," he says.

Then there was the devastating account of a nurse, "Rhonda" who told 2GB's Ben Fordham she'd lost "everything I had", and that when she went to find out where "We apologise for your account being empty, we'll look into it." Then, when she looked to retrieve it she unearthed a level of sophistication most of us don't suspect.

"I think they're working in a group," Rhonda told Fordham. "When I was trying to work out where my money had gone then I would get phone calls from people saying they were a money monitoring fund who'd heard I lost money and if I gave them more money they could help me find it."

As the ACCC put it in a release titled Record losses expected as scammers target Australians: "Many people are confident they would never fall for a scam but often it’s this sense of confidence that scammers target,” ACCC Deputy Chair Delia Rickard said.

“People need to update their idea of what a scam is so that we are less vulnerable. Scammers are professional businesses dedicated to ripping us off. They have call centres with convincing scripts, staff training programs, and corporate performance indicators their ‘employees’ need to meet.”

As Livewire contributor Romano Sala Tenna recently wrote in his piece An extraordinary scam that is netting millions, scams are getting more and more sophisticated. In the piece he outlined three key pieces of advice; to detect a scam:

- Never feel rushed - take your time and independently verify the offer. If you're pressured to act quickly, it's almost certainly a scam

- Only use a licensed financial adviser - and check every financial decision with them. We are blessed in this country that we have a strong regulatory framework that licenses and monitors financial advisers; you can check to see if someone is registered at https://moneysmart.gov.au/financial-advice/financial-advisers-register.

- Watch for above-average returns or a capital guarantee: Every scam must offer something that you can’t get elsewhere, or you won’t take the bait.

And, as he also said: Take the time to report any scams to Scamwatch. The short time it takes to fill out the form may very well save someone else’s life savings.

The Top 5 articles from Livewire's contributors this week

Our wonderful contributors have had a stellar week.

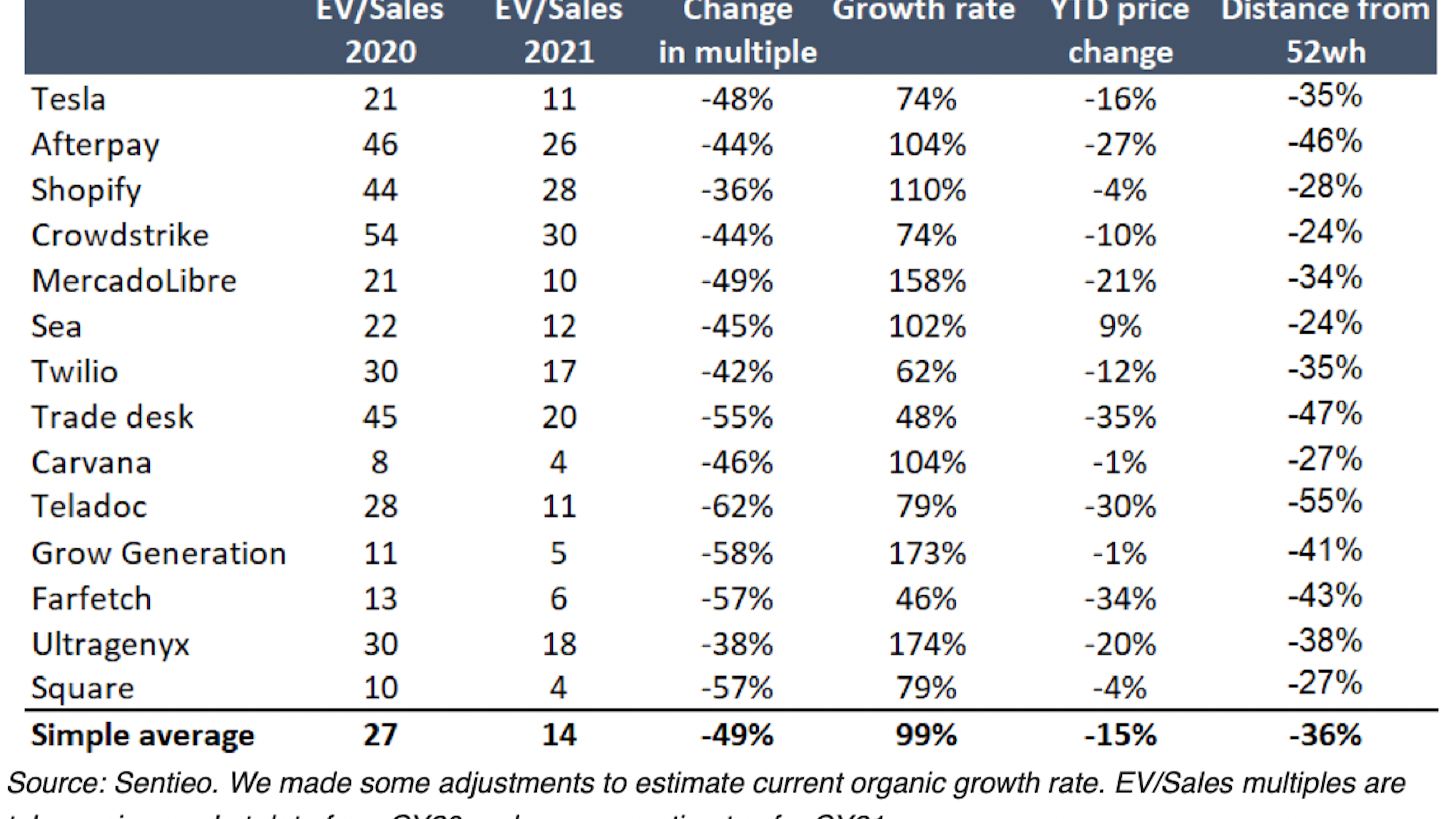

Michael Frazis has led the pack with his argument for growth stocks. James Gerrish gives us a deep dive into Altium via his podcast Direct from the Desk.

If you've ever felt like advertisers were stalking you around the internet, Heath Behncke has two interesting solutions for your privacy concerns.

Finally, inflation is the ghost haunting markets today. For both sides of the inflation debate, we have Damien Klassen asking how afraid should you be? And Shane Oliver offering sensible safe havens for an upcoming risk.

_11.png)

And coming up week beginning 31 May...

Drum roll, please ...

Our Top-Rated Fund Series is launching Tuesday 1 June. You won't want to miss this one. We have exclusive interviews with the most-highly rated fund managers in Australia.

Register now and be the first to know who has made it to the top.

This series will put a spotlight on some of Australia's most highly-rated funds, according to Lonsec, Morningstar and Zenith. You'll learn how researchers are thinking about markets, and the asset classes they believe are being overlooked. Plus, they'll open up on some of the biggest myths about picking good fund managers.

What did we miss?

- Matt Buchanan, Mia Kwok, Nicholas Plessas and Angus Kennedy

1 topic

1 stock mentioned

6 contributors mentioned