Off The Charts! JPMorgan's crypto-180, Afterpay-day, and a housing handbrake ahead

Today, well over half the population of Australia is in some form of lockdown. Despite this terrible cloud overhanging the nation, vaccination rates are slowly creeping upward with over 13 million doses administered as of 4 August. And there's the shining hope of more vaccine supply arriving this month.

In response to fresh waves of lockdowns, markets have not just been resilient, they've been deliriously optimistic. The Aussie share market has reached record-breaking highs this week, showing that investors can look beyond current lockdowns to the pent up spending that will follow.

It's all being helped along, of course, by some hefty M&A activity, including an update on tech darling Afterpay. While another soaring reporting season with multi-year high earnings is providing additional buoyancy. So this week, we've got an M&A update and the essentials from the August reporting season so far.

Plus, in true Off the Charts! fashion, we've collected a few stories you didn't know you needed.

Let's jump in ...

#1 Payday for Afterpay

Well folks, you know Off the Charts! likes an M&A deal as much as the next person, but we did not see this one coming.

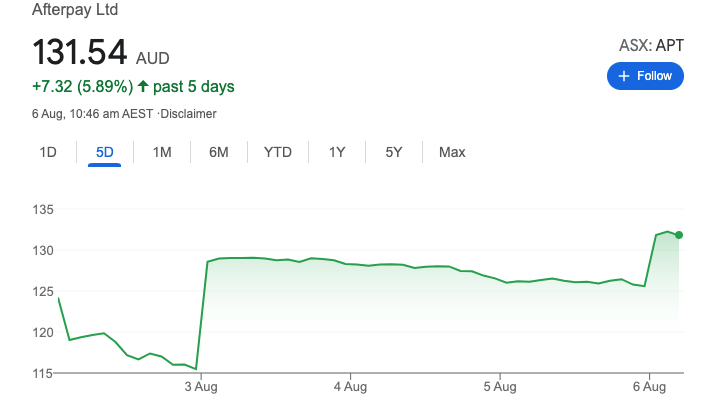

The biggest news of the week was Square’s acquisition of our beloved Afterpay. The $39 billion deal is the biggest in Australia’s history and shareholders have been rewarded with the share price shooting up by a whopping 30% in the last week.

But is this bad news for APT, signalling the end of a short and sweet road, or is it just the beginning?

Source: Google Stocks.

On the back of the news, Livewire’s Ally Selby sat down with Lakehouse Capital’s Joe Magyer to discuss.

“Square brings scale, distribution, and a structurally lower cost of capital that Afterpay would never be able to match on its own, while Square will benefit greatly from leveraging those strengths to enhance the value of Afterpay… As long-term holders, we couldn’t be any happier for them today”

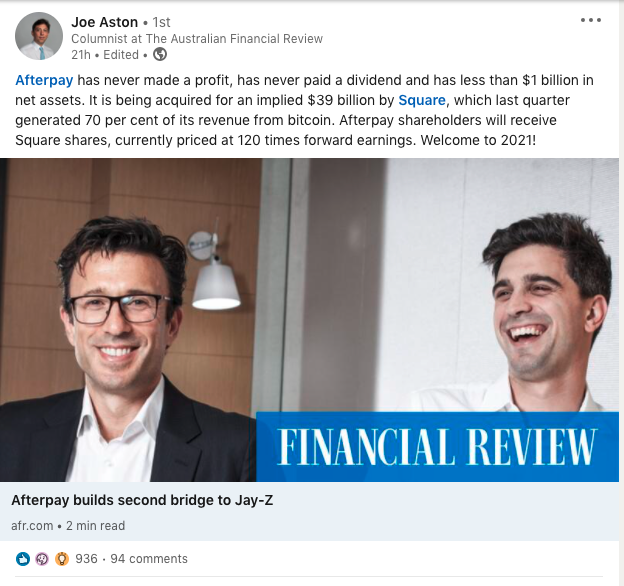

But others think this deal is a red flag, signalling that founder's Nick Molnar and Anthony Eisen are looking for a way out. Namely, Joe Aston from the AFR had his doubts.

Source: LinkedIn

According to Jack Dorsey, CEO of Square, the acquisition will be beneficial for both services and will assist each other to drive new e-commerce activities amongst young shoppers.

Either way, with a bid of $126.21 per share, we’re in for a long road ahead of us.

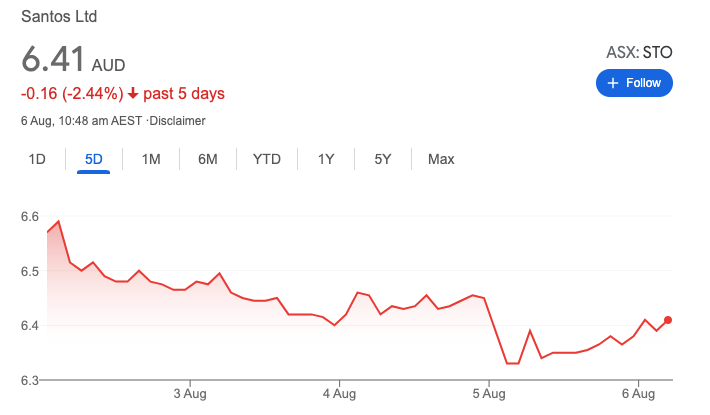

But while the Afterpay acquisition dominated the headlines, it wasn’t the only M&A deal for the week. We saw the merger of two Aussie greats Oil Search and Santos. While oil hasn’t been the place to be over the last twelve months, the two companies are hoping to grow stronger together. The merger will create a $21 billion Asian player which will hope to manage the risk that net-zero emissions poses to the oil and gas producers.

Santos shareholders weren’t too impressed though, sending the stock price down over 2% in the last five days.

Source: Google Stocks

Another week, another set of M&A deals. Whatever shape (get it? ...Square?) or form they come in, I’m sure we’ll be back next week with another one. Until then!

#2 AUGUST REPORTING SEASON UPDATE: The pinnacle of news

On the topic of buoyant M&A activity, ASX-star Pinnacle Investments (ASX:PNI) has built up cash stores of over $96 million ready to unleash when the right company comes along. Pinnacle already owns meaty stakes across 16 fund managers including Coolabah, Spheria, Firetrail and Plato, and reported a 108% climb in net profit after tax as well as a 52% increase in funds under management.

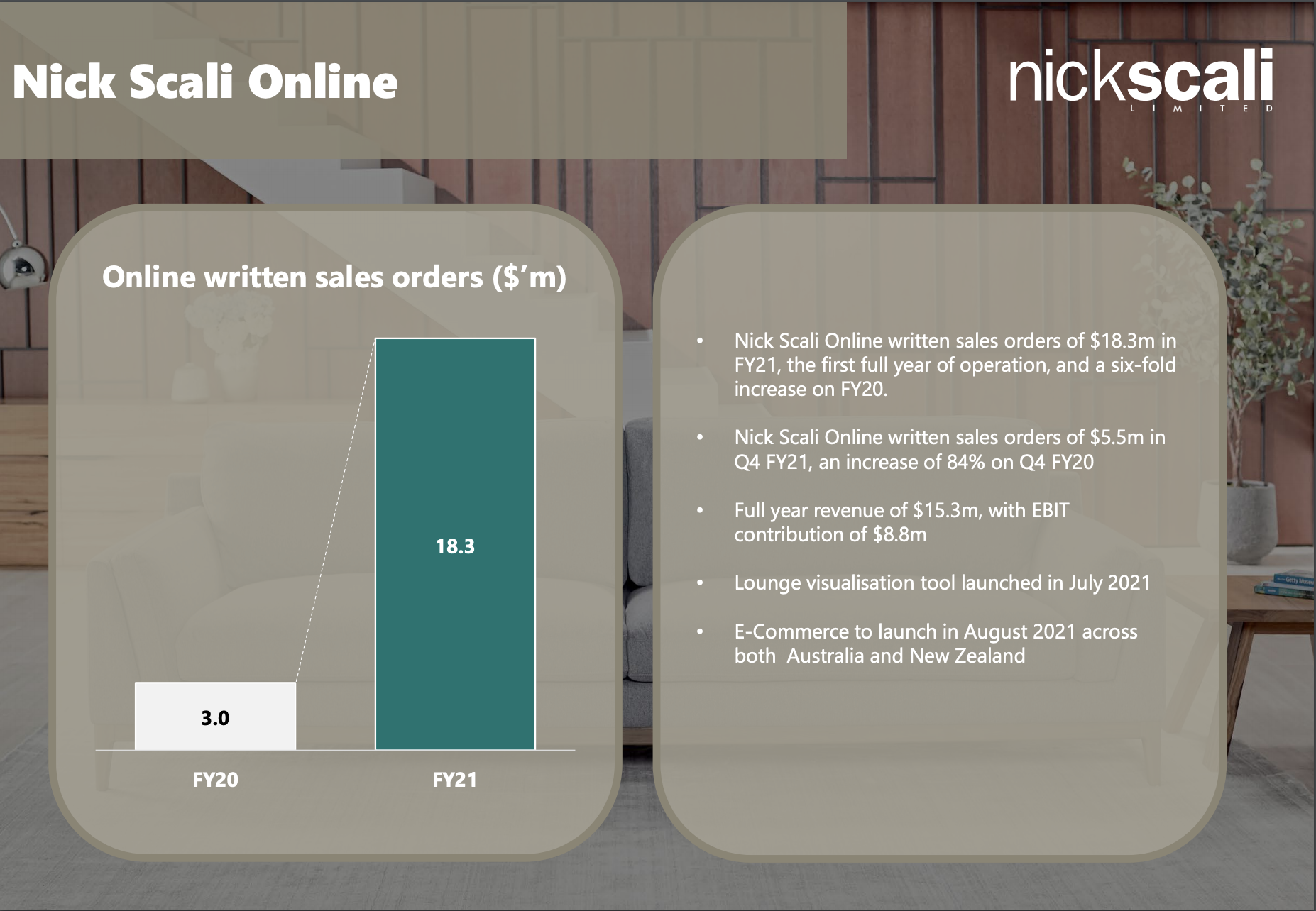

Looking at other parts of the market, Australian furniture retailer Nick Scali (ASX:NCK) announced it had doubled net profit and increased its dividend by 37%. This payout was slightly lower than expected, with management exercising caution given the uncertain retail outlook and supply chain concerns (perhaps Sca-rred by 2020? I'll see myself out). In light of this, they did not issue any guidance for 2022.

This year’s explosive result has been fuelled by a focus on home improvements among homebound Aussies, as well as an increasing presence across the ditch in New Zealand. They have also invested a lot in building an online presence, and it certainly paid off this year.

Source: Nick Scali FY21 Results Presentation

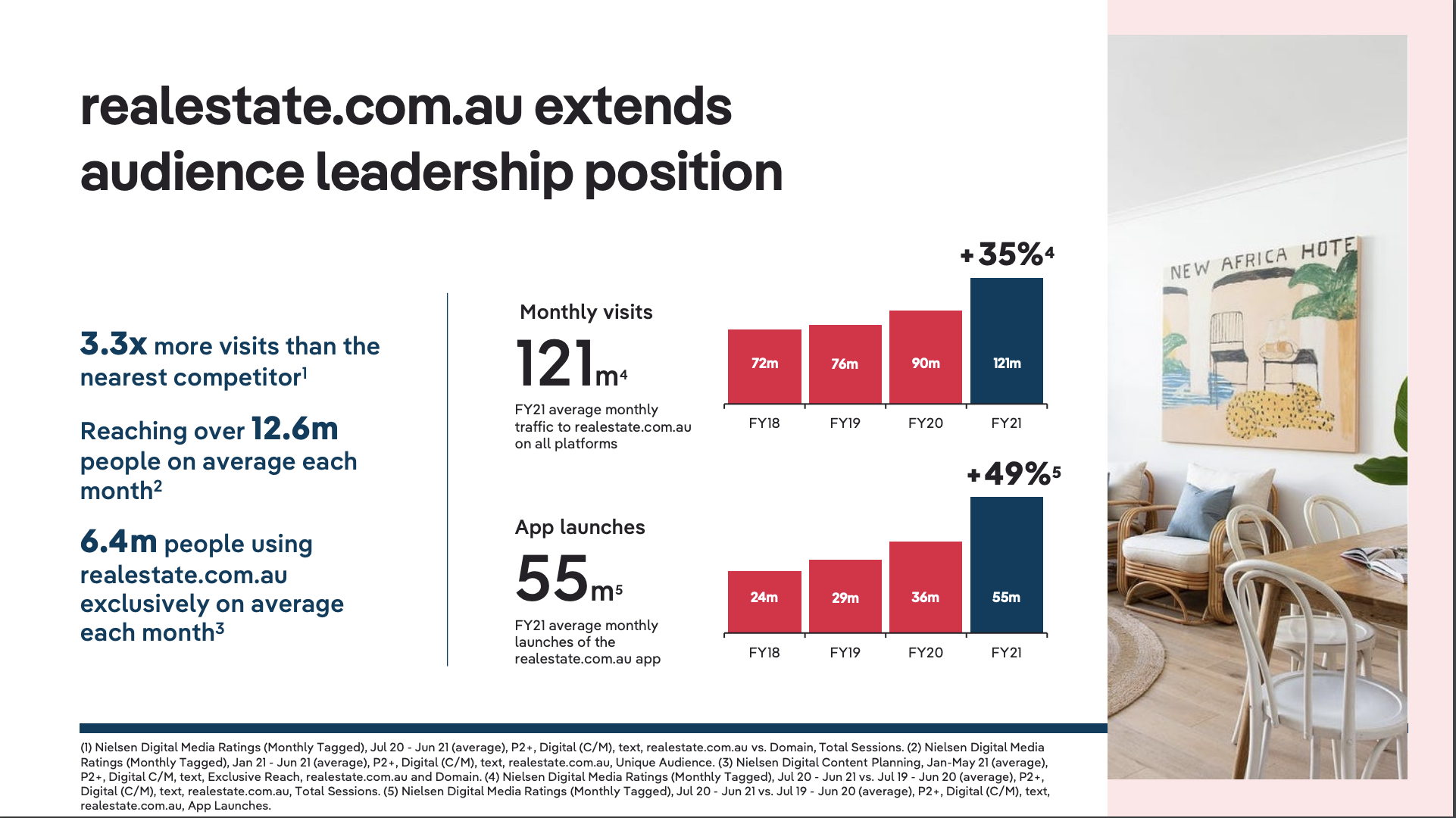

Speaking of houses, if a new sofa can’t rejuvenate your humble abode, then why not just buy a new house. REA Group (ASX:REA), owners of Realestate.com saw a 178% net profit boost on the back of a bubbling residential property market. It also announced a record dividend of 72 cents. National listings were up 15% year-on-year, and the number of people on the lookout for their dream house also skyrocketed (or maybe mansion-browsing is the lockdown activity of choice).

Source: REA Group FY21 Results Presentation

For those of us that are stuck at home watching television on our new Nick Scali couch, at least there is ample content to keep us occupied. News Corp (ASX: NWS) reported their most profitable year since inception, driven by a rampaging upward trajectory for Foxtel (and accompanists Kayo and Binge), which grew its paid subscriber base by 40%. Having committed to acquisitions across books, journalism and online platforms such as Oil Price Information, the team is taking an expansion mentality into FY22.

"We are generating record profits in cash and that has given us the ability to make opportunistic acquisitions to bolster the company and to generate even more momentum. We will certainly be thoughtful and strategic in deploying our assets and we will, as always be, cognisant of our responsibilities to and the interests of our shareholders.” – Robert Thompson, News Corp chief executive.

A handsome 62% stake in REA Group wouldn’t have done any harm either.

Finally, but certainly not least in what has been an exciting week 2 of reporting season, we head to the medical side of the market. Sleep and respiratory solutions provider ResMed (ASX:RMD) increased annual profits by 12%. Major competitor Phillips issued a €250 million major product recall in June, and the market was expecting ResMed to fill this gap. They were left somewhat disappointed, however, after ResMed failed to capitalise on this opening, with the share price falling 3% on market opening. The rationale behind this inability to ramp up production and distribution was down to supply chain issues and limited access to parts.

“The supply chain is constrained. Every one we make, we sell. Wherever the bottleneck is around the world, I’m personally calling those suppliers’ CEOs .... and asking them to please give us these parts.” - Mick Farrell, ResMed chief executive

That wraps things up for now. Keep an eye out for the Reporting Season Monitor from Rudi Filapek-Vandyck for an extensive list of the hits and misses this month.

#3 Bezos, dethroned

The title "world's richest person" was once reserved for Amazon founder Jeff Bezos, but now the crown is sitting on a new head. Ladies and gentlemen, let me introduce 2021’s world’s richest person – Bernard Arnault.

Sound familiar? Well, Mr Arnault is the owner of luxury goods brand LVMH. This conglomerate is responsible for brands including Louis Vuitton, Moet, Hennesy, Christian Dior and Sephora.

Arnault owns a 47% stake in LVMH, providing him with a net worth of AU$265 billion. He only just gets the gold medal, with Bezos in silver position with a net worth of AU$251 billion.

So what happened? Why has Mr Arnault managed to snake the crown from Bezos? Well, there are two reasons.

First, the pandemic has been a great outcome for LVMH as it’s captured record sales and profits over the last eighteen months. In the company’s latest earnings update, it recorded a second-quarter revenue of US$17.4 billion. This is up a staggering 14% since the beginning of the pandemic. But wait, wasn’t Amazon the king of COVID and in pole position to capitalise on the move to e-commerce?

Well, here comes our second reason. Last week was US earnings season and while Alphabet and Microsoft managed to report record numbers, Amazon was quite the opposite. After reporting disappointing numbers for Q2, the share price took a dive, down 7%.

As a result, Bezos’ net worth declined $US14 billion in one day!!

This was enough to send Mr Arnault to the top of the list.

Let’s see how long he can hold the top spot. Inching closer in the bronze medal position is none other than Elon Musk with US$185 billion .

#4 CRYPTO'S QUIET RESURRECTION: JPMORGAN

If you thought crypto was dead then I'm sorry to say this rollercoaster ride is far from over. The last few weeks have seen the first major US bank give retail exposure to crypto investing and the first EU-approved crypto ETF.

Perhaps these big backers are a sign that crypto has left the zeitgeist and instead, doing the unbelievable, by becoming a formal (albeit high risk) part of your investment portfolio.

On the sly, JPMorgan Chase has launched access to six crypto funds for its wealth management clients - the first major US bank to do so. From the end of July (that's last week for those of us who are in lockdown and have lost all concept of time), CNBC reports these clients will be able to select from:

- Grayscale Bitcoin Trust

- Grayscale Bitcoin Cash Trust

- Grayscale Ethereum Trust

- Grayscale Ethereum Classic Trust

- Osprey Bitcoin Trust

- A new fund from NYDIG, the Bitcoin subsidiary of asset manager Stone Ridge

From firing to hiring: JPMorgan's messaging on Bitcoin and crypto has done a radical backflip in the past few years. In 2017, AFR reported the CEO Jamie Dimon claimed any employee trading crypto should be fired. Earlier this year, it was reported JPMorgan's strategist could see Bitcoin reaching US$146,000 (it's currently at US$35,000).

Meanwhile, if you spin the globe a little bit, French fund manager Melanion Capital has created a Bitcoin price-tracking ETF by using a "picks and shovels" approach to crypto.

According to the Financial Times, the fund will hold up to 30 stocks cryptocurrency-adjacent sectors, such as mining and blockchain. Melanion has said these are up to 90% correlated to the price of Bitcoin. It's the first of its kind and will be listed on the Euronext exchange.

#5 HOUSE PRICES CONTINUE TO BOOM BUT SLOWDOWN EXPECTED

Another week, another asset price hitting all-time highs.

This week, data from CoreLogic reveals that property prices continued to surge in July with Sydney, Brisbane and Canberra all growing by 2% or more. Proving once again, that the only thing Aussies love more than dividends is property.

The increase in house prices caps off a stellar year for property with Sydney house prices gaining 18.2% in the last 12 months. Australia's second most populated city, Melbourne, lagged behind rising 10.4%. Behind the demand is cheap debt and the expectations that rates will remain lower for longer, but the gain train does appear to be losing steam. Worsening affordability and negative consumer sentiment driven by the recent lockdowns are beginning to put pressure on these prices.

For how long these good times keep rolling is hard to say. Across markets, all measures of value are hitting their all-time highs this year. Experts continue to debate whether we are entering a new bull market, or the 11th hour before the crash. With the RBA indicating that house prices are not their job and property-loving government on the case, it looks like these bulls have a little more room to run in 2021.

Contributor stories of the week

- First up, Michael Frazis finds a rare buying opportunity in the whirlwind Chinese markets. A big dip in China stocks has reset pricing on some absolute gems.

- Rudi Filapek-Vandyck is back with his reporting season bonanza. This week he gives readers The prominent themes that will dominate this reporting season. It's time to get excited.

- This week, James Gerrish writes "just as everyone is talking about the likes of Afterpay ...we shouldn’t ignore something that’s rewarded Australian investors for decades" in Our favourite 3 yield plays into 2022.

- It's indisputable. Valuations are rising, debt is rising and the growth runway is a risk. Damien Klassen asks Is a growth shock coming?

- Plus, Coppo's reporting season preview has been a great precursor with all your reporting season needs. Read Richard Coppleson's Reporting Season Preview: Looking forward by looking back.

Coming up next week...

- The next episode of Buy Hold Sell is where Neil Margolis and Dr Don Hamson are back with a bang! They analyse 5 long-term compounders with dividends for days.

- Bob Desmond gives his reflections on US earnings and the stocks that exceeded his expectations and the high valuations in the tech sector.

- From dodging growth traps (Antipodes Partners); navigating The Matrix-like modern investment world of global small and micro-cap investing (Spheria Asset Management), finding the most sustainable dividend stocks Down Under (Solaris Investment Management) and more, Glenn Freeman gives the highlights of the Pinnacle Investment Summit.

What did we miss?

- Bella Kidman, Angus Kennedy, Mia Kwok and Nicholas Plessas.

It is with a sense of deep appreciation, quiet awe, and no little sadness that we farewell one of the great contributors to the Livewire content team, the multi-talented Bella Kidman. Whether she's presenting, writing, editing, or Off-the-charts-ing, Bella has undertaken all these roles with flair. Fittingly she is leaving our team to add yet another string to her bow, a legal internship no less. We wish her well and we will miss her a lot. All the best Bella!

3 topics

6 stocks mentioned

12 contributors mentioned