Off the Charts! Zip smashes expectations, Alibaba thanks the CCP and a $100 million deli

G'day and welcome back to the latest instalment of Off the Charts! bringing you the biggest headlines of the week on all things investing. The theme of this week, frothy markets and manic buying sprees. Strap yourselves in for this one.

Off the Charts stories

#1 Zip smashes US reporting season

First up, the divisive BNPL Zip announced record figures from its US subsidiary QuadPay. The company beat expectations with customer acquisitions and transactions volume up 153% and 234% respectively year on year. QuadPay now boasts 1.2 million more customers than its AU parent. At its peak, shareholders were rewarded with a 19% rise over two days.

It is clear that the war for global BNPL dominance is on. One has to wonder - after we've had QuadPay, Afterpay, OpenPay, Latitude Pay, Zip Pay, Pay in 4 and Limepay in Australia alone - if there will be any other words with the suffix '-pay' left to trademark soon.

In any case, the news serves as another opportunity for bag holders to exit and new hopefuls to join the spiky ride of owning Zip.

(Source: Apple stocks/Yahoo finance)

#2 Coinbase IPO

This week we're filling in for Angus Kennedy with a lite instalment of IPO watch with the IPO of US crypto marketplace and wallet provider Coinbase.

The start-up made its way to the market via direct listing, meaning it has no issue price to compare it to, but at close on its first day Coinbase's market cap rounded out to $111 billion.

For comparison, that would place the firm as the fourth biggest company in Australia, if locally listed.

The marketplace's earnings are tied to the value of these currencies as the firm takes commissions on each coin transaction, so its listing comes at an opportune time as the largest coins have broken to new all-time highs this week. Most notably, the crypto that started as a joke, Dogecoin, is up 190% this week. I wonder when this music will stop.

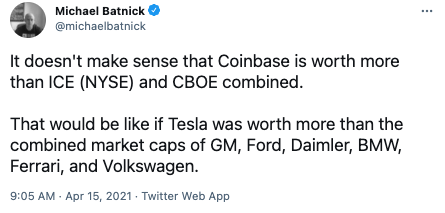

Michael Batnick's tweet sums it up well here.

(Source: Twitter/@ Michael Batnick)

#3 ETFs hit record inflows

New data this week broke that over $102 billion has been invested in exchange-traded funds (ETFs) in Australia, with almost half of that amount ($46 billion) invested over the past 12 months alone. It marks the massive thematic shift from individual stocks to ETFs. Most popular of these being index funds, utilised for passive investing.

ETFs are an asset this author is all about. Unlike another investment vehicle also taking the market by storm in 2021 (*ahem* SPACS).

To commemorate this achievement, Buy Hold Sell held an ETF bonanza with Shaw and Partners' Adam Dawes, VFS Group's James Whelan and Livewire's Bella Kidman. Today's episode covers 2 core ETFs and 4 satellites for some sizzle in your portfolio.

#4 Alibaba thanks Beijing for record-breaking fine

Earlier in the week, China's market regulator handed down a record AU$3.7 billion fine to Alibaba Group for apparently violating competitions laws. The fine is three times the previous record for corporate fines in China, which was earned by US chipmaker Qualcomm (also for monopolistic practices).

Like a child leaving the naughty corner, Alibaba accepted the fines with sincerity. "(We) reflect the regulators’ thoughtful and normative expectations toward our industry’s development," said the e-commerce giant through sniffles. Odd. This is the first time we've seen a company so thankful for a fine.

This decision follows the storied history between Alibaba's founder Jack Ma and the CCP. Chris Johnson - one of the West's foremost experts on China - believes the action against Alibaba, Ant Financial and Jack Ma's disappearance was a mix between genuine anti-trust regulation and political power play.

As Johnson put it in February:

Most in China would be lucky to cross the leadership once without being sent away, no one does it twice.

#5 New Jersy deli WITH US$35,000 in sales valued at $100 million

The final story for some Friday fun. Yes, you read that headline correctly, there is a deli in New Jersey worth $100 million.

The company is Hometown International, and it simply owns one single deli in New Jersey.

One man, Paul Morina, wears the hats of CEO, CFO, Treasurer and President. The business was closed through most of 2020 during the height of lockdowns. Despite this, the company's share price ran up from $3.25 to $9.95. Could this be the next GameStop?

We are living in strange times for markets folks.

Pictured: Hometown International's prime asset - the famed deli. (Source: CNBC/Google Earth)

Top articles from the Livewire contributors this week

-

Joe Magyer, and one global stock story that his fund Lakehouse Capital is bullish on.

- How to profit from the boom in batteries - Coverage of the commodities boom and how to play the EV shift from Montgomery Investment Management's Roger Montgomery.

- Shane Wakelin from Fawkner Property makes the case for why investing in service stations and quick-service restaurants are reliable property plays for an income-focused investor.

- A beaten-up cyclical due for a rebound - In this wire, Simon Mawhinney from Allan Gray identifies one beaten-up miner that is due for a rebound.

- Gabi Dishi from Pengana Captial group. In this wire, Gabi identifies what makes the young nation a 'start-up central'.

And coming up week beginning 19 April...

- Next week on Buy Hold Sell, you'll be treated to two episodes hosted by Ally Selby featuring Perpetual's Anthony Aboud and Sage Capital's Sean Fenton - two of the industries best long/short managers - for their thoughts on 6 quality compounders, 4 stocks trading at all-time highs, and the ASX's most shorted stock. You won't want to miss this one! Subscribe to our YouTube channel so you are the first to see it.

- Keep an eye out for a new CIO profile coming where Mia Kwok sits down with Shane Oliver to talk about markets and the most common mistakes investors make

- Patrick Poke will be delivering another stellar podcast on Rules of Investing featuring guest Nathan Lim

- Bella Kidman will be serving up part two of a deep dive into the ASX-20. You can read part one here.

- Plus, Tuesday will be a smorgasbord of economic data with CBA's consumer sentiment and household spending, not to mention the RBA meeting minutes and ABS labour statistics.

What did we miss?

Did you catch a story this week that you thought was Off the Charts? Let us know in the comment section below! Or email content@livewiremarkets.com.- Nicholas Plessas and Mia Kwok

3 topics

1 stock mentioned

11 contributors mentioned