Oil below zero as volatility & opportunity both return!

The ASX200 was clobbered 134-points yesterday as the local market put in an awful performance considering the Dow rallied over 700-points on Friday and Asian indices were generally fairly quiet. The market followed MM’s short-term bearish outlook to the tee with 85% of the ASX200 closing in the red headlined by 26 names tumbling by over 5%, for good measure all 11-sectors also declined on a day which had an ominous feel about it. The chart below illustrates perfectly we’ve still hardly dented the aggressive recovery from the March lows.

Our opinion remains that equities have simply run out of enough short-term “good news” to support a market that’s already run 26% in under 4-weeks:

1 – The media and financial markets have become optimistic that we’ve “flattened the curve” with regard to COVID-19, few people are considering the risks of secondary outbreaks as countries slowly return to work.

2 – Markets are currently pricing in a smooth recovery for the global economy fuelled primarily by liquidity as opposed to underlying fundamentals.

3 – We feel the crescendo of capital raisings we’ve witnessed over the last few weeks has satisfied a decent portion of the short-term buying.

Yesterday MM took the flagged short-term profit in Magellan (MFG) increasing our cash position in the Platinum Portfolio up to 17% adding some buying flexibility into any future meaningful correction.

MM remains bullish equities medium-term and hence in net “buy mode”.

The ASX’s worst session in April adds weight to our view that the next 5-8% move for stocks is to the downside hence we remain focussed on identifying buying opportunities into current weakness as ongoing fascinating news flow greeted investors this morning i.e. crude oil futures traded negative overnight which sounds as crazy with interest rates below zero, history can clearly only help so far with forecasting how markets are set to unfold post the coronavirus.

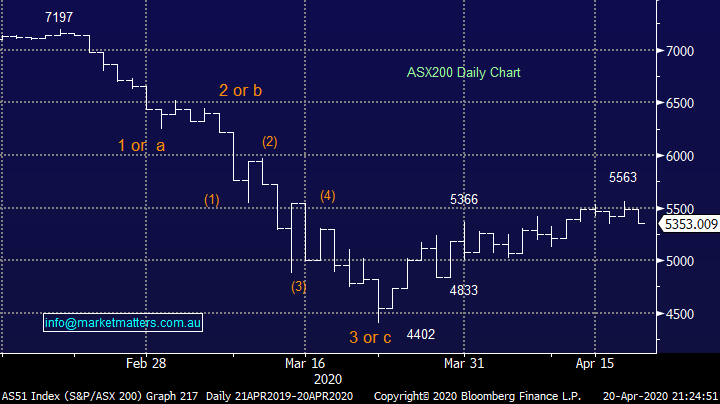

ASX200 Index Chart

Virtually all technical research I’m reading presents a similar picture to the labeled chart below with a break of Februarys 4402 low looming in the coming weeks – I’m very uncomfortable running with the crowd, makes me think of Pamplona when the bulls always seem to catch a few of the herd. My best guess at present is a pullback towards 5000 before the buyers re-emerge – remember US Fund Managers are sitting on very elevated cash levels. However, we must remain cognisant of the aggressive downtrend since February and the most common “set up” in history after such rapid declines is at least a retest of the lows i.e. 4402.

MM remains bullish equities but in a selective and cautious manner at current levels.

ASX200 Index Chart

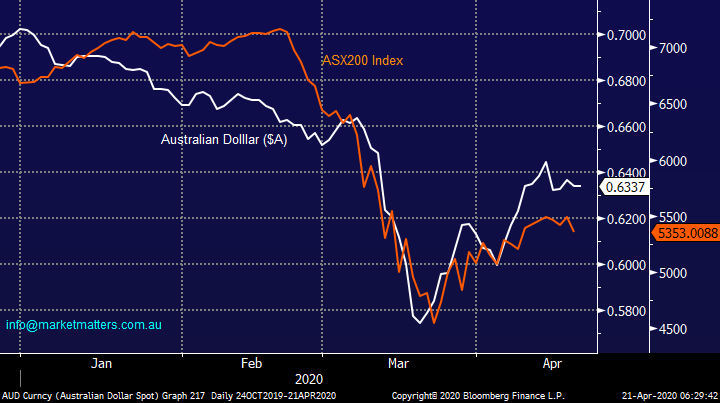

The $A is only sitting ~1c below its recent high which implies FX traders/investors are not losing confidence in risk assets and global growth in the year (s) ahead. The ASX has again followed suit by drifting lower, the correlation of the $A leading Australian equities remains intact and at this stage, it suggests to us buyers should remain a little patient & selective short-term although we feel a test of the 62-62.5c looks likely to find some buyers and hence ultimately support for stocks.

MM is bullish both the $A and ASX200 medium-term.

The Australian $A and ASX200 Index Chart

“Dr Copper” is usually a reliable indicator for the global economy, or in today’s environment how / when investors are betting things will return to a degree of pre-COVID-19 normality - as subscribers know we believe things will never be quite the same. Similar to my observation on the ASX earlier all technical research I read on copper is calling for a test of $US/lb200 but a crowded trade (idea) is fraught with danger. We like copper into weakness and would throw the proverbial “kitchen sink” at the view if it were to test 200, a fall that would be implying an extended period of global contraction.

Copper is an industrial metal with growing usage as we evolve down the EV (electric vehicle) path, things are obviously slow today but in a few months’ time copper will be on the menu for a number of industries.

MM is bullish copper into any weakness.

Copper June Futures ($US/lb) Chart

Last night crude oil reminded investors, if they still needed it after March, to “Never say never” (a very James Bond like phrase) as we saw spot crude oil futures trade to NEGATIVE $US40/barrel. The explanation is simple but the likely pain immense:

1 – Last night was the last opportunity to close out long May crude oil futures otherwise holders have to take delivery and there’s basically no storage left as we’ve all stopped driving!

2 – Hence we had mass forced selling sending the spot (May) contract spiralling out of control while more longer dated contracts held up far better i.e. near dated contracts are trading well under longer dated ones, a phenomenon called Contango.

3 – December 2020 crude oil closed at $US32.57/barrel and December 2021 at $US32.75 another example of Contango. NB Interestingly both of these contracts traded and closed well above their March lows.

The distant contracts trading well above their respective March lows tells me players believe the global economy is on a far better footing than a few weeks ago.

Crude Oil May Futures ($US/barrel) Chart

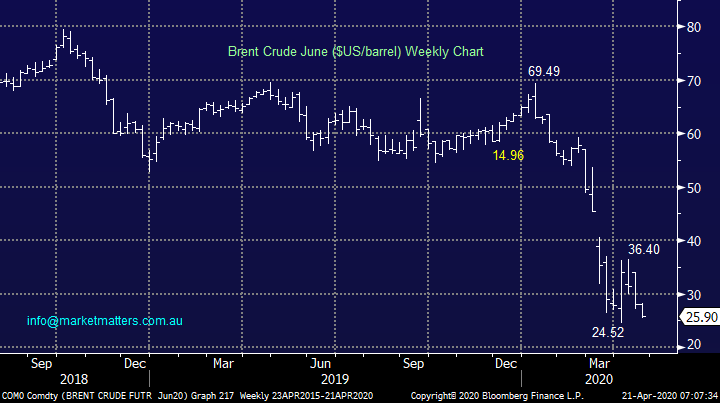

Similar to the longer dated crude oil futures contract Brent Crude closed above its March low but only just for the June contract shown below. After last nights panic drop in short-term crude prices we expect some stability to arrive sooner rather than later but on balance we still expect new lows for many contracts which is easy to comprehended fundamentally as the worlds still producing too much oil due to the unprecedented massive demand hit courtesy of COVID-19. Ultimately we will need to see meaningful supply cuts to address this imbalance – which will happen. There is no surer remedy to low prices than low prices themselves.

To put things into numerical perspective global demand has just fallen by 2.2 million barrels per day, the most ever in one week. April is now showing oversupply to the tune of 25 million barrels per day - that’s a lot of oil when storage is full. A supertanker can only hold 2m barrels and it costs a whopping $US350,000 per day, up a massive 100% in just one month – supply and demand effects are in play everywhere. Time to drain the pool perhaps – not sure the kids or the bride would go for it!

MM is looking for a low in Brent Crude.

Brent Crude June Futures ($US/barrel) Chart

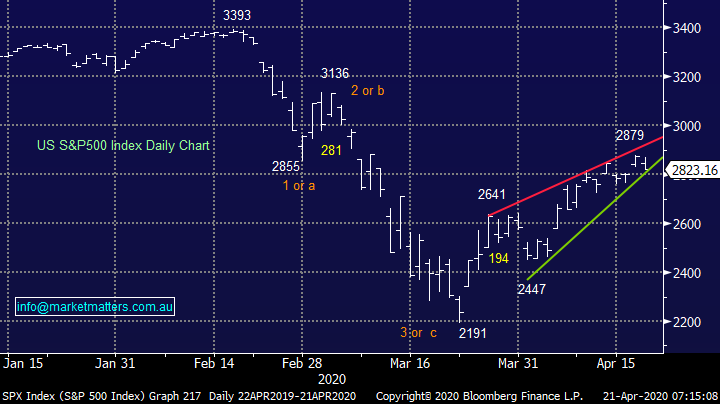

Overnight US stocks gave back most of Fridays’ gains with the S&P500 falling -1.8%, best on ground was again the IT based NASDAQ which only slipped -1.2% lower. The rising wedge we illustrated in the Weekend Report remains in play with a decent spike lower still feeling a strong possibility. Remember the classic investor phrase: “Sell in May and go away” – its easy to imagine when we consider Marchs volatility and the major bounce from the lows that any shorter-term bounce investors will be taking some money from table and putting their feet up.

MM remains net buyers of weakness in some US stocks but we’re short-term bearish.

US S&P500 Index Chart

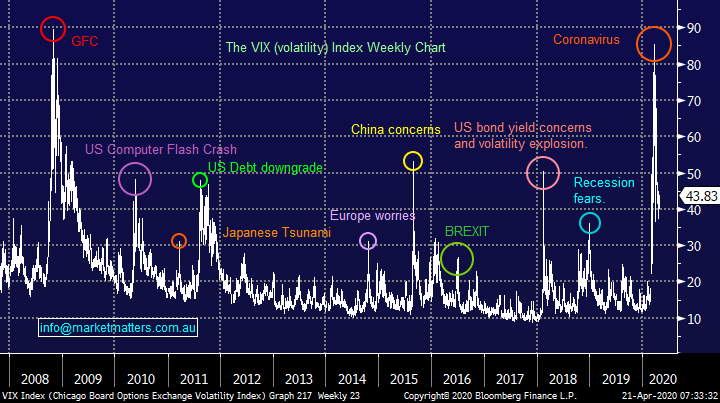

Pandemonium in the oil markets overnight helped the VIX (volatility Index) rally 15% while we can see the market bouncing around between 40 & 50% overall we remain bearish volatility through 2020 anticipating gradual return to normality.

MM remains bearish the VIX.

The “VIX” Volatility Index (Fear Gauge) Chart

Register for a free trial to Market Matters

At Market Matters we write a straight talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. To see the stocks currently on our radar sign up for a free trial to Market Matters click the 'CONTACT' button on my profile below.

1 topic

6 stocks mentioned