One of the most compelling opportunities on the ASX today

Lendlease (ASX: LLC) is one of the most compelling opportunities on the ASX today. While all the attention has been on the company's (now sold) engineering business, the significant progress made in a key area of shareholder value creation over the coming years has been overlooked.

Lendlease is a global leader in property development and investment management. Their expertise and reputation in property development has seen the development pipeline grow from $71 billion to over $110 billion in just three years.

In this article, we explain why we believe Lendlease presents a compelling investment opportunity and why a strategy to accelerate its highly sought-after developments has the potential to unlock value for its shareholders.

Lendlease 101

Lendlease operates across three business segments:

1. Property Development – Partnering with large capital partners to design and develop high-quality precincts in key gateway cities around the world.

2. Investment Management – Management of these property assets on behalf of large capital partners such as pension funds, insurers, and sovereign wealth funds for a recurring annual fee.

3. Construction – The construction of both external and Lendlease projects

Why is Lendlease undervalued?

Lendlease began reporting cost overruns and issues at its engineering projects in 2017. Several issues within the division such as tunnelling in North Connex, construction delays at Melbourne Metro and the recent provision on completed legacy projects has resulted in losses of almost $1 billion. A poor experience for Lendlease and their shareholders.

In late 2019, Lendlease sold its Engineering business to Spanish firm Acciona. We believe that the Engineering business has been a major reason the firm’s financial underperformance, in addition to the large valuation discount applied to the total business by the market. Exiting engineering has created an opportunity for Lendlease to simplify its business and focus on Property Development and Investment Management.

More recently, due to COVID, Lendlease has had to pause the development of some of its major urbanisation projects. Property sectors like Office have seen a slowdown in tenant demand which has negatively impacted near term earnings. However, the outlook for planning approvals and capital partners has improved. At its recent operational update, Lendlease announced the approval of its residential tower at One Sydney Harbour, secured an investment partner at Innovation District development in Milan and secured an anchor tenant at its third office tower at Melbourne Quarter and sold 100% of the development, with an end value of $1.2 billion.

Beyond some of the challenges today, the acceleration of the development pipeline looks very promising. As the development of major projects accelerates, we see upside to Lendlease’s Property Development and Investment Management segments. We explore both in further detail below.

The potential upside?

1. Accelerating the development pipeline

Lendlease’s reputation and property development expertise has resulted in significant growth in their development pipeline across key gateway cities including Sydney, London and Chicago. Over the last three years, project wins have accelerated, and the development pipeline has grown from $71 billion to more than $110 billion. Importantly, many of these projects have been secured with large capital partners, reducing the capital intensity and sharing the risk involved in major developments. Lendlease’s capital partnership model also allows them to leverage their strong relationships with large investors and institutional partners to accelerate future projects.

The development pipeline features several high profile and highly sought-after developments in key gateway cities such as:

1. The $21.5 billion Google project in San Francisco partnering with Google for the next 10 to 15 years to redevelop the tech firm’s land holdings into mixed-use communities including office, retail, residential and hospitality.

2. Silvertown Quays in East London which includes a mix of office, 3,000 residential units across build-to-sell and build-to-rent and retail space.

3. The Exchange TRX in Kuala Lumpur which comprises of over 2,000 residential units and 122,000sqm of retail property plus a hotel.

Figure 1. Lendlease’s development

projects in San Francisco, East London and Kuala Lumpur

Source: Company Data, Firetrail, June 2021

Lendlease also specialises in build-to-rent projects. These projects involve the development of major residential projects on behalf of long-term capital partners which are then leased out to provide a recurring income (yield) for the investor. Build-to-rent makes up 21% of the current development pipeline and Lendlease are seeing significant growth in the asset class due to undersupply of housing in cities like London, New York and Chicago.

Lendlease’s broad pipeline of highly sought-after developments have secured future earnings for the firm. Beyond the near-term challenges, Lendlease is well placed to grow future earnings by leveraging its capital partnership model and development expertise.

2. Growth in high-quality investment management earnings

As property development projects are completed, a large portion of these assets are managed by Lendlease’s Investment Management business. Upon completion, capital partners like superannuation and pension funds can outsource all management activities to Lendlease for a recurring annual fee (usually a % of the value of assets).

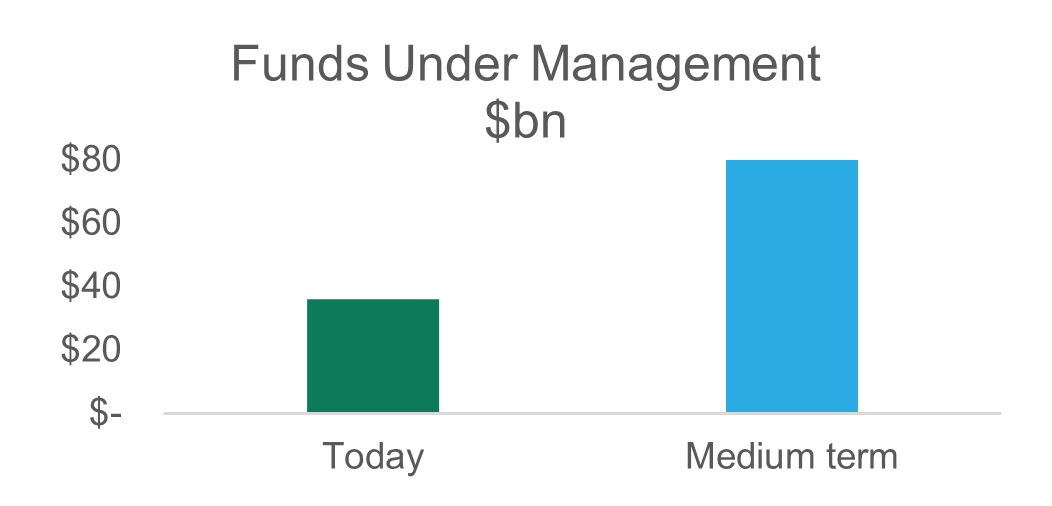

Today, Lendlease has $36 billion in Funds Under Management (FUM) which is expected to grow to over $80 billion in the coming years. In our view, Investment Management could account for around 50% of earnings in the next five years (compared to an average of 31% over the past five years).

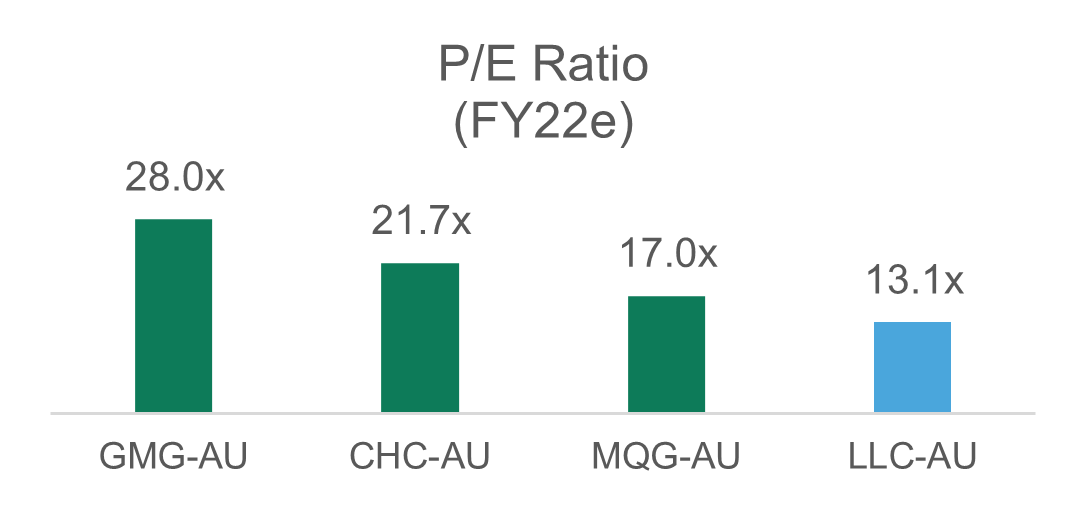

Investment management businesses generally trade at a premium to reflect the stable, recurring nature of their earnings. As seen in Figure 2., Lendlease currently trades at a discounted valuation to peer asset managers such as Macquarie (MQG) or Goodman (GMG). As FUM grows (Figure 3) and Investment Management becomes a larger part of Lendlease’s earnings, we expect the Lendlease valuation to re-rate to reflect the higher quality mix of its Investment Management earnings, and the sale of its problematic Engineering business (which generally trade at a lower valuation multiple).

Fig 2. Funds management businesses demand a premium

valuation to reflect their stable, recurring earnings

Source: Factset, Firetrail,

June 2021

Fig 3. Over the medium term, development completions will drive significant growth in funds under management

Source: Company data,

Firetrail, June 2021

Conclusion

Lendlease is a global

leader in Property Development and Investment Management. With a development

pipeline in excess of $110 billion and growing FUM in its investment management

business, Lendlease is a compelling investment opportunity currently unloved

and undervalued by the market. Lendlease is a holding in the Firetrail

Australian High Conviction Fund and Absolute Return Fund.

Want more market analysis?

We hope you enjoyed this wire on Firetrail's investment thesis behind LLC. If you want to read more market analysis like this, click the follow button below. We hope you enjoyed this wire. If you did, give it a like.

Welcome to Livewire, Australia’s most trusted source of investment insights and analysis.

To continue reading this wire and get unlimited access to Livewire, join for free now and become a more informed and confident investor.

Join Free to unlock all exclusive content

To continue reading and gain unlimited access to all Livewire content, join free to become a more informed, confident investor.

3 topics

1 stock mentioned

Comments

Comments