Opportunities after the market sell-off?

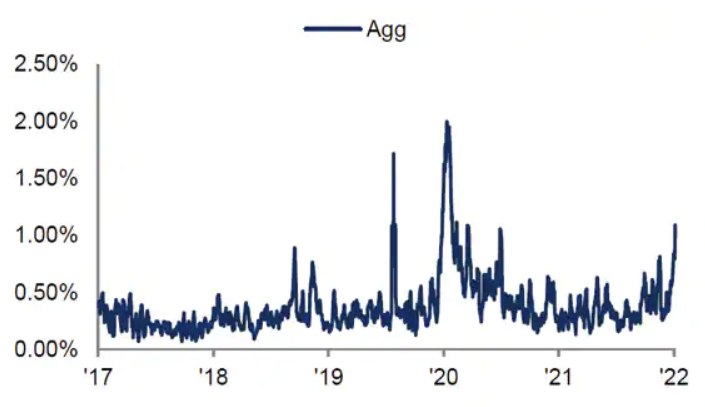

Year to date the MSCI World Index is down -15.7%, the technology sector is down -26.5% and the consumer discretionary sector is down -29%. After such a large correction, many investors are now looking for opportunities. As shown in figure 1, interest in “market bottoms” is on-trend. In this monthly note, we take a closer look at the characteristics of this correction to help assess the future opportunities.

Figure 1: Media intensity of “Market Bottom”

Market sell-off consistent with long term investor preferences

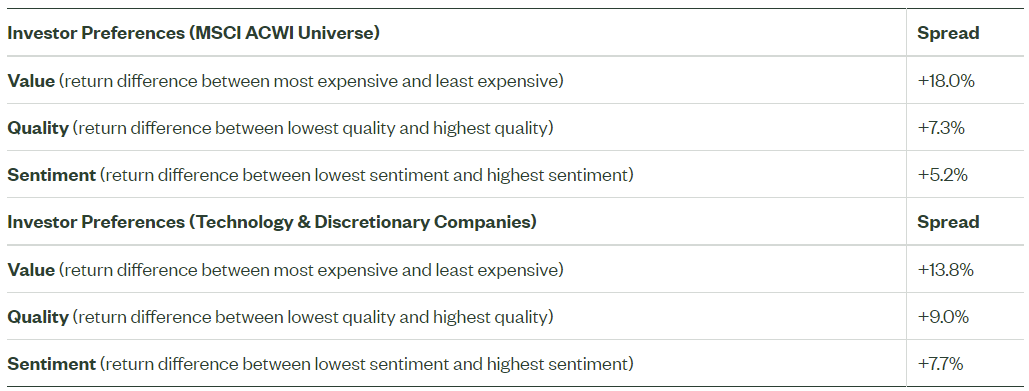

The sell-off in markets has been savage but has largely been rational. As the market has sold off we have seen investors act in line with longer-term preferences. We expect investors to prefer less expensive companies and to prefer high-quality proven business models and favour companies that have improving outlooks. Year to date these investor preferences have dominated stock selection and there is little evidence of the baby being thrown out with the bathwater. Figure 2 below highlights the excess return from owning value (+18.0%), quality (+7.3%) and sentiment (+5.2%). This has also been evident in the sectors that have sold off the most, namely technology and consumer discretionary. Across those sectors, investors have differentiated based on value (+13.8%), quality (+9.0%) and sentiment (+7.7%).

Figure 2: Rational investor preferences during the sell-off year to date

Source: State Street Global Advisors, Factset as of 24 May 2022. Returns are calculated based on local currency. Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income as applicable.

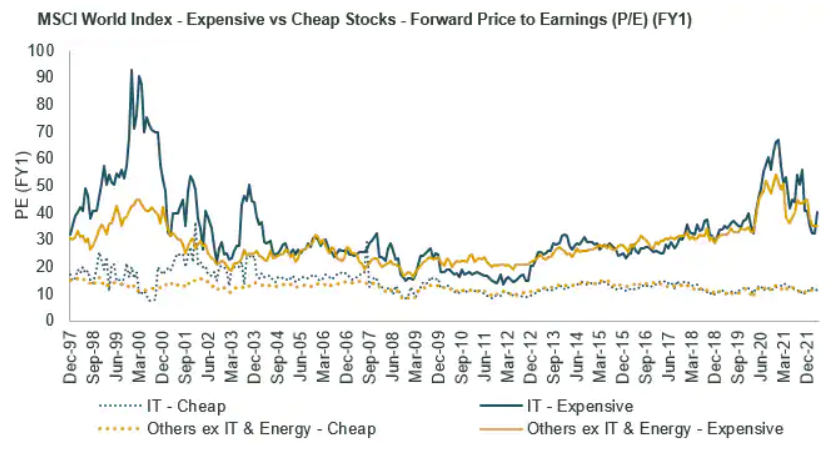

The recent correction is renormalising the market back towards fundamentals after many years of distorted mispricing of securities. Figure 3 provides some insights on the extent of the mispricing within value companies. Figure 3 shows the difference in price-to-earnings ratios between the most expensive and least expensive cohorts back to the technology bubble more than 20 years ago. We have definitely seen the most expensive companies de-rate but using the 2000 experience as a guide there is still room for the most expensive names to de-rate further and for the cheaper companies to re-rate higher. The “buy the dip” mentality appears to be alive and well and we have not as yet seen capitulation from investors buying into expensive growth.

Figure 3: Valuation differences between most and least expensive

Source: SSGA, Factset, MSCI as of 30 April 2022. Quintiles grouped monthly using AQE’s proprietary Value factor, P/E ratios are calculated using the weighted harmonic average method. Premium / Discount measured against the long term average P/E Ratio: from Dec-97 to Mar-22 Past performance is not a reliable indicator of future performance.

Technology and consumer discretionary preferences are largely unchanged

Across the Technology and Discretionary companies, we are not seeing large changes in our preferences since the sell-off. Technology Hardware and Storage was our most preferred cohort within the Technology sector at the start of the year. This group of companies outperformed this year (down only -15%) and remains our preference in the Technology sector.

Software was one of our least preferred areas within Technology at the beginning of the year and even after underperforming this year (down -34%) remains one of our least preferred. This trend is similar across Consumer Discretionary names. Internet and Direct Marketing was one of our least preferred groups within Consumer Discretionary and remains one of our least preferred despite being down on average -44% year to date.

Preferred industries post sell-off

Looking forward, we prefer some of the more defensive sectors including Communication Services, Multi Utilities and Healthcare Service Providers. On the cyclical side, we prefer a number of industrial subgroups including Construction and Engineering, Marine and Trading Companies.

The bottom line

Investors are naturally interested in looking for opportunities post a significant market correction. After examining the returns we find no obvious areas of mispricing. In contrast, we find investors have differentiated between securities in line with the long term return drivers of valuation, quality and sentiment. In what may appear somewhat contrary we continue to prefer some of the sectors that have outperformed year to date.

Never miss an insight

Stay up to date with our latest thoughts by clicking follow below and you'll be notified every time we post content on Livewire.

Bruce is Head of Active Quantitative Equity - Australia, for State Street Global Advisors. He has over 20 years' experience, covering Australian and global equites, long and short equities as well as global macro strategies.

Bruce is Head of Active Quantitative Equity - Australia, for State Street Global Advisors. He has over 20 years' experience, covering Australian and global equites, long and short equities as well as global macro strategies.