Opportunities and risks in the pricing of LICs

There are now more than 100 closed end listed investment funds on the ASX including Listed Investment Companies (“LICs”) and Listed Investment Trusts (“LITs”). For simplicity I will refer to them all as “LICs”. LICs differ from other listed funds such as ETFs and active ETFs in a range of ways but most importantly in that there are no explicit mechanisms to ensure they trade at or very close to Net Tangible Assets (NTA).

It is this key difference - the dynamic of variable discounts and premiums to NTA over time - that can help to make LICs a particularly interesting investment universe, providing attractive opportunities, as well as potential unappreciated risks.

In addition, as the number of LICs has increased so has the quality of investment managers, range of strategies and shareholder focus of the vehicles although some poorly structured and managed vehicles remain.

Discount and premium cycles

One common criticism of LICs is that they “always trade at a discount.” This is clearly not correct with many in Australia currently trading at a premium. However, it is true that over the longer term, both here and overseas, LICs have tended to trade at discounts on average. Why is this the case?

One theory is that discounts reflect the future value of management fees and other costs. I find this explanation lacking. After all, you don’t expect to be able to buy your unlisted funds at a discount to the NTA because of their fees. It is true that some LIC fees are too high or poorly structured and their funds are shunned because of this, but the number of these is limited. In any case, this theory does nothing to explain funds trading at premiums.

Another theory is that discounts reflect the inbuilt tax liabilities on the underlying portfolio but again you don’t expect to buy unlisted funds at a discount to compensate for this and most LICs are actually more transparent on such liabilities than unlisted funds.

Yet another theory suggests that it is the discount/premium dynamics that creates an additional uncertainty/risk for investors that is compensated by trading at a modest discount. However, this provides no explanation of the large range of discounts and premiums. Further, such discounts are more an opportunity than a risk if investors are selective.

Having been involved in researching and investing in the LIC space now for almost three decades, both locally and overseas, my view is that discounts and premiums primarily reflect fluctuating investor sentiment towards the vehicles.

Some of this is investor sentiment is rationally based but much is irrational and subject to broadly repeating cycles. Discerning the difference and true inefficiencies is the key to assessing opportunities and risks in the LIC space.

The discount/premium sentiment cycle

The LIC “sentiment cycle” consists of self-reinforcing feedback loops and can be particularly noticeable in the first few years of a fund’s life and relates to the way these funds are initially sold to investors. Assume a new fund IPOs at $1.00. Because of costs of the issue its initial NTA is 96-97 cents. (Fortunately, managers are increasingly wearing some or all of these costs). Suppose initial investment performance is subdued or slightly negative. Within months some less patient investors begin to get frustrated and sell and the fund drifts to a small discount to NTA, say the low 90s.

Meanwhile, new secondary market buyers are scarce, especially if options are outstanding that dilute the NTA upside for potential buyers. Investors assessing performance are mainly judging the movement of the share price not the NAV. As the share price falls and discount widens, investors perceive investment performance of the portfolio to be poor when it may well be adequate or even quite good.

Disillusioned or bored investors sell it down further, often on the recommendations of the brokers and advisers who placed them there, as they put forward new “sexier” investment ideas. This selling further increases the discount and the perception that the fund’s investments are performing poorly.

In my experience some of the best buying opportunities in LICs arise 18 months to 2 years after a fund launch, following a period of subdued or negative NTA performance, when any options have expired or been exercised, the majority of “weak hands” have departed the shareholder base, the discount to NTA is probably in the teens or higher and more sophisticated and opportunistic money is moving onto the share register.

The table later in this article includes some funds with such characteristics.

The reverse of this sentiment cycle can occur on the upside. Funds that have good short term returns (and this performance is well marketed) may move to trade to a premium to NTA. Investors perceive that this re-rating to a premium is part of underlying portfolio performance and are therefore prepared to chase the share price higher, elevating the premium even further. Ability to pay dividends may add to the attraction. This process continues until eventually the large premium to NTA makes the fund vulnerable to an unwind of the high rating.

Why does buying at a discount work (mostly)

Buying at a discount to NTA can work to improve returns at more levels than you might think. Essentially, there are three main potential drivers to more attractive returns from buying (selective) LICs at discounts.

1. A higher dividend/distribution yield

2. Mean reversion of an “out of favour” strategy/style/asset class or underperforming manager

3. Catalysts for, and re-rating to, lower discounts or premiums

Interestingly, only the last of these requires the discount to NTA to actually narrow over time to generate extra return.

The first driver is often ignored perhaps because it is modest and gradual over time. Assume a portfolio of assets or a strategy that reliably generates a yield of 4% and this is distributed back to investors. As an investor buying an LIC at a 20% discount to NTA (80 cents in the dollar) your yield is actually 5% (i.e. 4/80), 1% higher than a direct holding in this portfolio or equivalent unlisted unit trust (ignoring tax issues). Some investors may spend this higher yield but others may reinvest this dividend yield at that same 20% discount resulting in an additional compounding benefit over time.

The second driver relates to the common situation in financial markets where the best performing market/sector/strategies of the future are often those that have performed poorly recently. The LIC structure often accentuates this situation because these disappointing funds are often trading at the highest discounts to NTA. LICs can therefore often provide an ideal way to highlight and implement a contrarian investing approach benefiting from the tendency of performance of underlying assets to “mean-revert” over time.

Finally, the third driver relates to soft or hard catalysts that result in discounts narrowing in the future. This could be as simple as market recognition of improving performance and the manager coming back into favour. It could be Boards and/or Managers becoming more active in marketing their fund, increasing dividends or introducing capital management initiatives such as share buybacks. It could also relate to more activist investors buying into the fund and becoming more vocal about the introduction of measures to narrow the discount.

Some believe that share buybacks are relatively ineffective in narrowing a discount. While they are not a magic bullet it is clear that adding a new buyer in the market does help to soak up excess share supply. More importantly perhaps, a buyback at a reasonable discount is accretive to NTA and a valuable source of “free alpha”. Of course buybacks will reduce the size of the fund so this needs to be considered for smaller funds.

In a low return world discount narrowing give returns a sizable boost.

If investors expect returns in general to be low in the future generally, the additional return benefit from “discount narrowing” can become a significant part of total return. For example, assume an underlying portfolio returns 5%. If the discount were to narrow from 20% to 10% over a three year period the return to the LIC investor becomes 9.2% per annum, close to doubling the base return. In a world where both predictable beta and alpha returns are far from assured enhancing returns from “discount narrowing” strategies makes a lot of sense.

The danger in buying at premiums

Buying LICs at premiums, especially substantial premiums (say greater than 10-15%) rarely makes much sense. In doing so, investors are exposing themselves to the opposite drivers that can make buying at a discount so attractive. Firstly, they may earn a lower yield than the actual underlying investment portfolio. Secondly, the portfolios of funds at a premium have usually performed well lately, may be in a “hot” sector and there may be an increasing chance of upcoming poor or subdued returns that disappoint elevated investor expectations. Finally, it is unlikely many catalysts or actions aimed at expanding premiums will be introduced. Boards and managers will not be buying back shares, or even aggressively marketing the fund, unless of course they are planning a rights issue which would effectively increase the supply of shares and narrow the premium. Activists are certainly not going to be invested in funds with the objective of expanding premiums further.

Of course the real investment world is not as black and white as I have painted, nor do they always follow the scripts I have described, however, these basic patterns are persistent. Indeed, it is because the real world is somewhat more opaque and complex than I’ve described that these opportunities and inefficiencies exist.

Discounts and premiums in practice

A well-known principle in finance is that valuation works as a guide to long term returns but can be a poor indicator of shorter term returns. Interestingly, “value” investing in the LIC space can sometimes work quite well over reasonably short or at least medium term time frames as discounts and premiums can sometimes mean revert quite quickly.

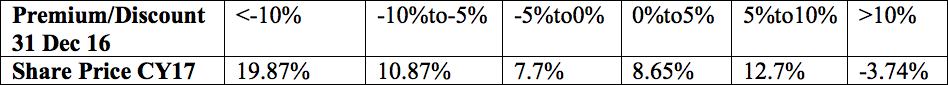

Macquarie Wealth Management recently highlighted that buying at a discount was a winning strategy in 2017. They tracked 25 LICs that started 2017 trading at a discount and ultimately generated an average +13.0% share price return. On the other hand 18 LICs starting 2017 at a premium only generated an average +6.3%. As the table below shows as discounts increased so did price gains while those at large premiums (greater than 10%) saw negative moves over the year.

Buying at a discount delivered better returns in 2017

Source: Macquarie Wealth Management January 2018

Of course one could argue the methodology here is relatively simple and doesn't capture differences in strategies, fund size etc. but the principle of buying cheap and selling expensive is valid.

Some discounts are well deserved and other things matter too

I am not suggesting that investors blindly buy all the funds trading at large discounts. Certain funds deserve to trade at large and even increasing discounts. This tends to be funds with extremely high costs, very poor transparency and marketing, questions about the ethics of management and quality of the board and an enduring unwillingness to introduce shareholder friendly measures (dividends, buybacks etc.).

On the other hand, quality LICs that trade at or around NTA often still deserve a role in portfolios, even without the “kicker” that can come from discount narrowing. In all cases the quality and integrity of the manager and board, the strategy, its suitability to the investment environment, the fund cost and structure are all factors that need to be properly assessed.

While well selected discounted funds can provide an additional source of return and arguably lower risk, investing in LICs is certainly not only about the level of the discount.

Opportunities in the current market

A current problem is that many of the more prominent LICs are trading at premiums to NTA. I believe some of these, particularly those at large premiums, are vulnerable to a de-rating for the reasons discussed above and which may relate to fund specific factors or general market weakness.

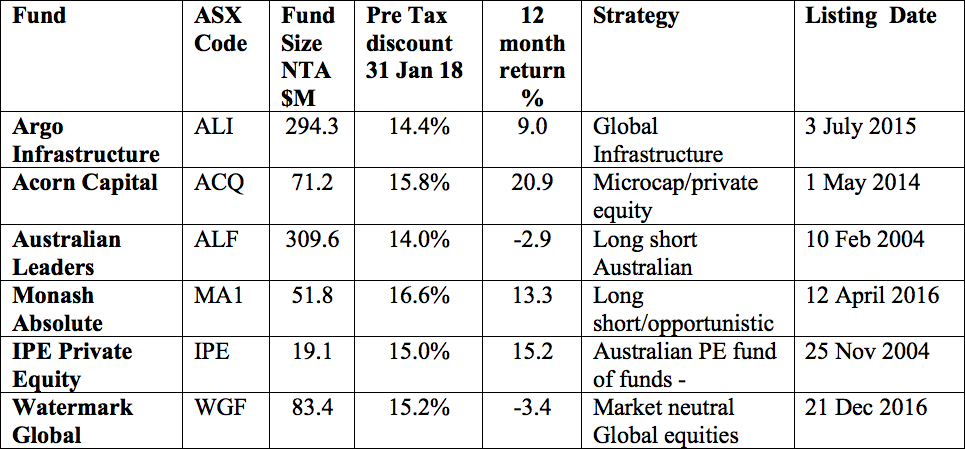

Nevertheless, there is still some interesting LIC opportunities currently where sizable discounts to NTA exist and the prospective return outlook is sound. The table below shows a small selection of ASX listed LICs trading at greater than 14% discount to pre-tax NTA at January 31 2018.

These are a subset of funds held in the Select Listed Investments Portfolio for which I am Portfolio Manager and which I believe offer the potential for both good underlying portfolio returns and some narrowing of the discount over time. Of course, all of these funds come with a range of risks but a reasonable discount can moderate these.

Many of these funds adopt somewhat niche strategies and some are also relatively small which can raise some issues including higher cost and lower liquidity. However, it is this smaller size, complexity and lower profile that can contribute to a higher discount and more attractive opportunity. Lower trading liquidity is not necessarily a major constraint for direct and boutique investors taking a medium to long term view. Indeed, the lower trading liquidity of some LICs mean that market selloffs can provide excellent opportunities to purchase true bargains, as long as investors can handle the occasional extreme short term price moves.

Conclusions

In the current market environment where many assets classes are expensive and volatility is increasing, finding attractive investment opportunities is difficult and downside risks are growing. LICs can often amplify both the opportunities and risks because investor sentiment can drive prices substantially away from underlying NTA.

The key is being cognizant of the level of the discount/premiums across funds, the factors impacting these now and in the future and a willingness to approach these from a true contrarian perspective to decrease risk and increase return potential.

Clearly, despite a range of funds trading at premiums, some attractive discounted opportunities in the LIC sector do exist now and more are likely coming if market volatility increases. This is not the time to ignore this increasingly interesting and fertile investment universe.

3 topics

4 stocks mentioned