Origin CEO quizzed on company splits and power pricing

Origin’s Frank Calabria answered some pointed questions during a recent sit-down with Allan Gray Australia Equity Fund's Dr. Suhas Nayak, including questions about a potential split similar to AGL’s recent announcement.

Nayak, an Allan Gray portfolio manager, peppered Calabria with questions about Origin’s strategy into the pandemic and the stop-start recovery that’s now emerging, during an investor webinar on Thursday. Topics on the table included the company’s free cash flow; how it is grappling with shifting regulations; and the effect of rising renewable energy production in Australia.

Another of Australia’s biggest national energy suppliers and Origin competitor, AGL Energy (ASX: AGL), announced late last month it would split into two separately-listed entities: one a retailer and clean-generation business underpinned by natural gas, the other dominated by coal power. The announcement has drawn mixed views from the market, and shares have dipped around 5% since the news broke on 30 March.

In the wire below I address the big issues under discussion and how they were answered.

The key takeaways:

- An Origin split similar to that announced by AGL is unlikely, but not impossible

- Why cost-out is crucial for energy businesses

- What's the point of Octopus?

- Why Origin is good value, in Allan Gray's eyes

Calabria doesn't rule out a split

Asked whether he would consider a similar sort of demerger to realise some of the same benefits AGL management expects, Calabria reaffirmed his view he will continue to review the portfolio of companies, as he did before the $1.25 billion spin-off of its upstream (exploration and production) oil and gas business in 2017.

“We made some calls on what was best for our investors very early, regarding the conventional gas business and clearly, through a different structural holding, we would continue to explore that,” Calabria said.

“We do have the benefit now of two strong cash flow generating businesses, such that we’ve reduced debt over the last four years … to around $4 billion now.”

He made one clear distinction with AGL, in that only one part of Origin looks similar to a portion of its competitor’s soon-to-be split business – with the exception of Eraring Power Station north of Sydney, which Origin plans to exit in 2032.

“Clearly the other side of the business is quite different to the one AGL has described…it’s a gas, liquified natural gas production and sales portfolio, so I’d just make the distinction around that, but we will continue to assess the portfolio,” Calabria said. This side of the business is dominated by Australia Pacific LNG, a 6,000megawatt coal seam gas joint venture project with ConocoPhillips and Sinopec, which own stakes of 37.5% and 25%.

The Origin CEO also spoke about the effect of regulation, following on from his robust views on wholesale power prices, which are being ratcheted downward by the Australian Energy Regulator. In this context, he says companies – and their shareholders - need to weigh up investments increasingly carefully. Lower operating costs are particularly important in this operating environment, also because of how higher penetration of renewable energy sources is affecting costs.

“But I think the market has currently got a pretty good handle on what’s ahead in earnings outlooks based on those wholesale prices,” he said.

Calabria also referenced Origin’s 20% stake in Europe-based Octopus Energy Group, a $65 million deal struck in late 2020. This is something that Allan Gray, an avowed contrarian investment firm, hasn’t always been eye-to-eye on with Origin: “We have been sceptical about investments like Octopus in the past,” said Allan Gray's Nayak.

But in response, Calabria said: “It is the fastest-growing retailer in the UK … it’s a company that in three years has four million customers, and it does that by being the best customer experience and having the lowest costs to serve.”

The Origin CEO emphasised Octopus had grown by 90,000 customers a month, far ahead of its expectations and has generated “great excitement across multiple markets and jurisdictions”.

“The key thing we need to focus on is that there’s around $100 million a year in cash we’ve committed and like anything, that requires implementation, in this case across four million customer accounts,” said Calabria.

“You’ve got to get that right, but we feel very confident.”

And in renewables and storage, including electric battery assets and pumped hydroelectricity, Calabria said they will play an increasing role. “That enables energy to be moved within a day, to respond at an individual community scale and at a grid-scale.”

“We would continue to drive renewables investment into the market … but I wouldn’t have investors think that we’re about to underwrite a whole range of renewables today, but we might do things like we did with Stockyard, which is to develop and then sell once we have the capacity available,” Calabria said.

Stockyard Hill Wind Farm near Ballarat, Victoria is a 530MW, 150-turbine wind farm that Origin acquired in 2009 before developing and selling it to Xinjiang Goldwind Science and Technology Co in 2017.

During the discussion, the Allan Gray portfolio manager Nayak also discussed other areas of the resources space represented in his fund. Following from the contrarian approach alluded to earlier, it "dodges the darlings" in avoiding the high-growth technology sector and the healthcare and consumer staples sectors may seem extreme. Its laser-like focus on cyclicals avoids the hottest sectors because valuations are usually also over-amped, says Nayak.

Origin’s enduring appeal

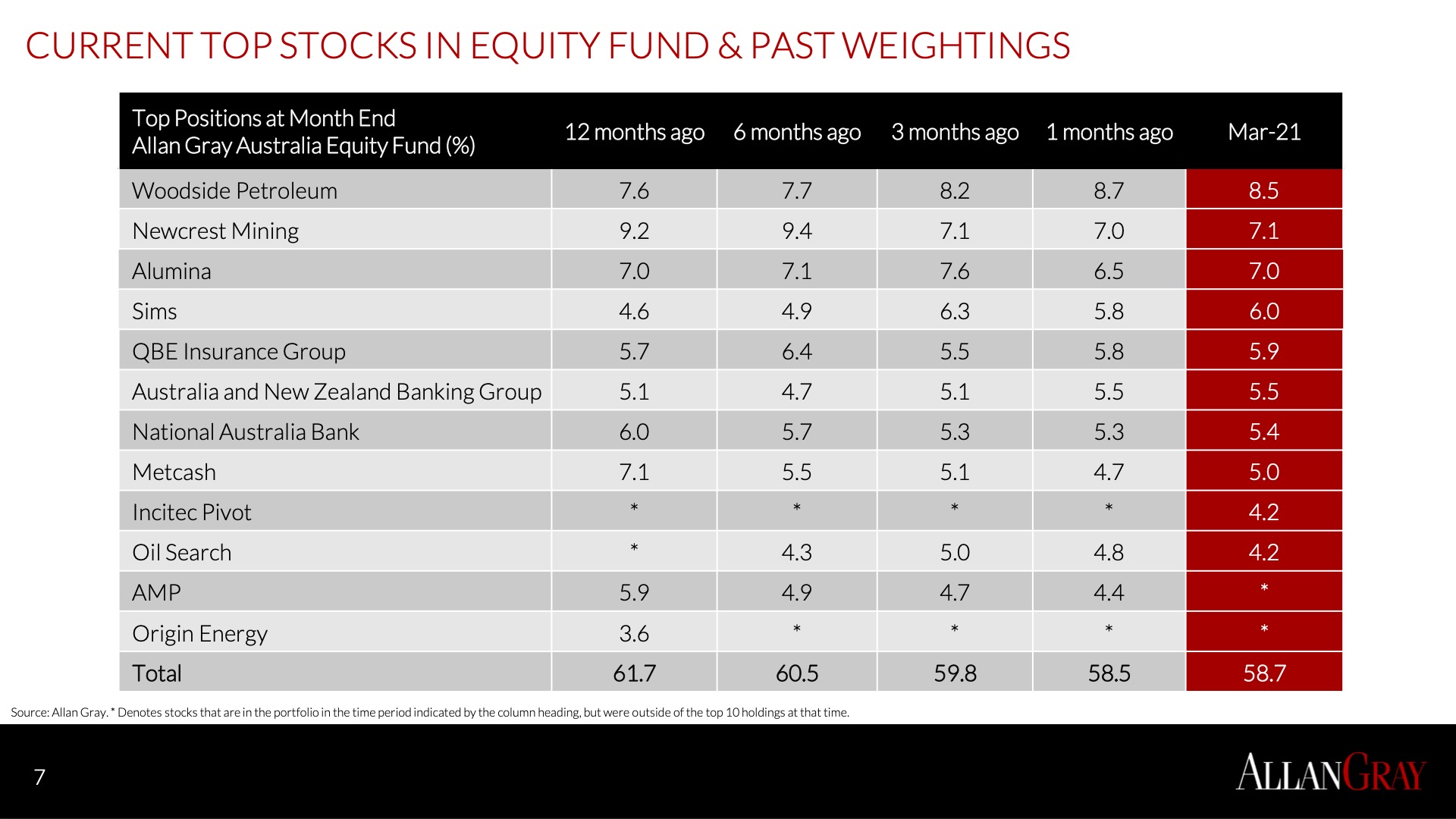

Nayak emphasised Allan Gray’s thesis in Origin revolves around the company’s lagging of both the Brent oil price index and other overseas peers, along with the local index: “That’s the context for our holding … and at today’s prices we see Origin having a market cap of about $8.3 billion.”

“Our thesis is the APLNG business should deliver more than $800 million of free cash flow back to Origin – you could argue that the market cap and value of Origin is explained by APLNG,” Nayak said.

“And that leaves energy markets that, while still challenged, will still probably deliver free cash flow to the company, and for which we don’t think we’re paying much at all. The payoff profile is skewed in our favour, and those are the sorts of companies we like to invest in.”

Learn more about Allan Gray

Contrarian investing is not for everyone, however, there can be rewards for the patient investor who embraces Allan Gray’s approach. Visit the Allan Gray Australia Equity Fund profile to find out more.

4 topics

2 stocks mentioned

1 fund mentioned

1 contributor mentioned