Our top picks for the next battery minerals surge

Lithium may be in the early stages of maturity. As the industry begins to consolidate through M&A, it is likely to become a battle of the big boys going forward. This as enough supply is coming on over the next few years, meaning margins and economies of scale will become more key to success.

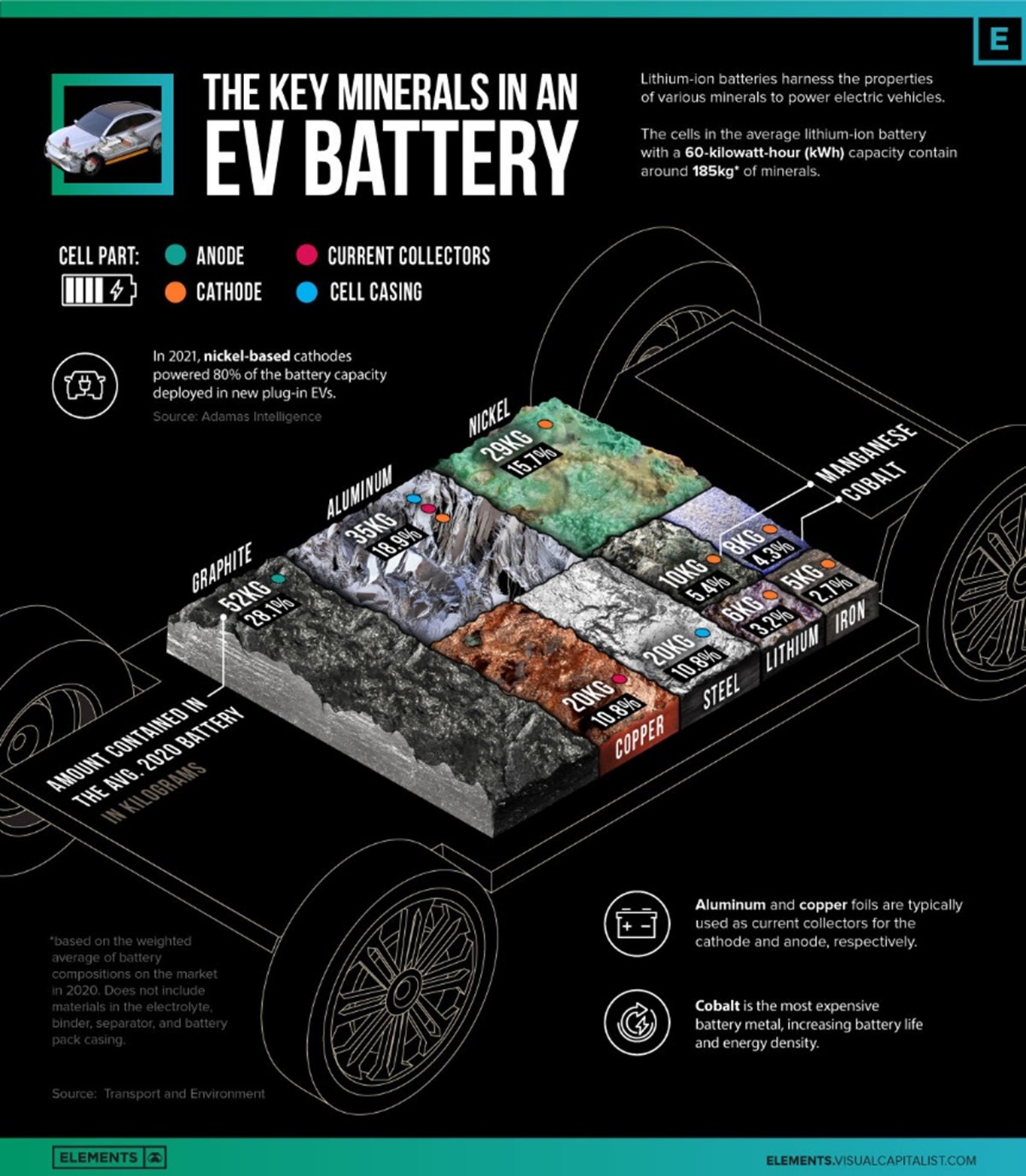

But as the lithium industry transitions from a scramble of junior miners to consolidation, it is important to remember that EV batteries are not just about lithium. In fact, they only make up around 3.2% of the total mix and there are many more supply gaps looming in the other battery minerals which are crucial to the transition. The shortage in these areas could potentially put upward price pressure on EV production.

Thus, the next focus for EV producers will be on securing graphite, nickel and copper supplies if they are to keep up with EV demand without sacrificing margins.

In this wire, I'll share five ideas (four stocks and an ETF) that marry up to those big themes.

The next focus for EV

producers will be on securing Graphite, Nickel and Copper supplies if they are

to keep up with EV demand without sacrificing margins. In this wire we give you

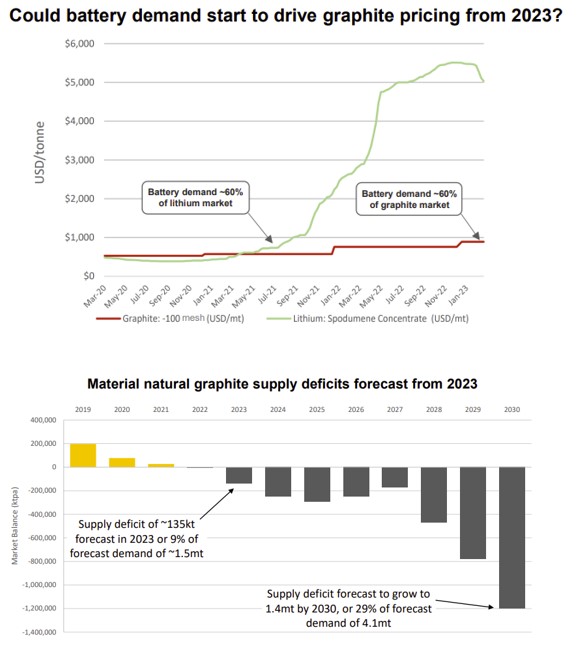

Natural Graphite: As you can see in the diagram above, there is a lot of graphite in a lithium battery. Similar to when the spike in lithium prices began, the demand from battery makers for graphite is expected to hit 60% of the total supply this year, coinciding with a 9% supply gap on projected demand from 2023 which is likely to deepen over the next 7 years.

While graphite can be synthetically created, the process is expensive, energy-intensive and holds less energy due to a lack of density.

Our pick in this space is mining junior, Black Rock Mining (ASX: BKT). Based in politically stable Tanzania, the company ticks all the boxes for an up-and-coming miner. A huge 26-year resource, key partners POSCO agreeing to a 30% off-take agreement for the life of the mine, margins of over 60% and government deals done for power and rail infrastructure.

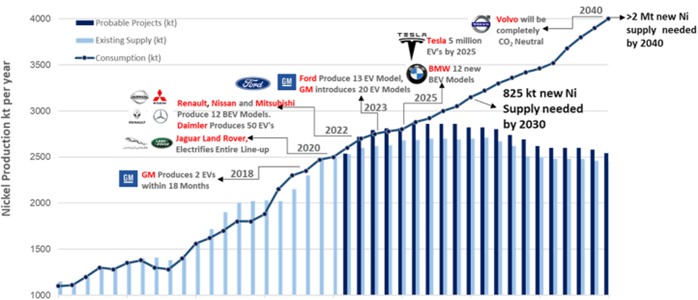

Nickel: In recent times, nickel production growth has been driven by the expansion of capacity for nickel pig iron (NPI), the class 2 product unsuitable for EV batteries. The high-grade class 1 nickel required for batteries making up most of the global supply chain is unsuitable for EVs and requires more intense processing with a number of growing concerns related to higher CO2 emissions and waste disposal.

With 20% of the world supply being uncertain given it originates from Russia, New Caledonia and Canada are the only other major producers of sulphide ore for class 1 nickel production. Japan, Canada, Russia and Australia are the other major suppliers of the metal produced from the ore. But on top of their current output, delivery of new material from ramp-ups at assets in these countries is still 18-24 months away.

With demand likely to stay robust, the class 1 nickel market is braced for short-term supply challenges and a higher carbon footprint from the use of nickel matte, until new mining and refining capacities start delivering.

Our pick in this space is South32 (ASX: S32) as it not only provides exposure to nickel but also alumina and Manganese, fringe battery minerals that will also benefit from EV battery demand

Copper and Cobalt: As outlined in my previous article on the looming copper shortage back in February, copper mines currently in operation are nearing their peak, suffering from reserve exhaustion, while ore quality in older mines is declining.

Add to this the political instability in South America which is threatening over 40% of the world's supply. New South American and Australian mines are being located in areas where water availability can be scarce causing setbacks given the high-water requirements needed for the mining process.

The reason I have cobalt in the same basket as copper is that 90% of cobalt produced is a by-product of nickel and copper, making new supplies subject to the development of these mines. Outside of this, the Democratic Republic of Congo and China account for around 70% of production both very difficult areas to predict in terms of geopolitics

Our pick in this space varies. For those looking for more stable exposure, BHP (ASX: BHP) and the WIRE ETF are your best options. At the small cap end, Aeris (ASX: AIS) is our favoured pick with four projects on the go.

2 topics

5 stocks mentioned