Phil King’s next three big plays

Livewire Markets

Phil King is a gold mine of new ideas and they tend to pay off. Regal's listed investment company RF1, which draws on Regal's wholesale funds, has gained 82% since its inception in 2019 (net of fees). Looking under the bonnet, two strategies have outperformed spectacularly. The Emerging Companies strategy has increased by 185% over the same period and the Global Alpha strategy 301% (gross of fees).

In the current market King sees no signs of a bursting bubble, in fact, he sees the opposite.

"Certainly on our analysis, the market is not over-extended. Returns in the market, over the last five years - of around 5.1% in capital appreciation - have been well below the 100-year average of 5.6%... That means the risk of a large correction is low.

"Most crashes in the market occur after the market becomes overextended and after the returns, on a rolling five-year basis, are a long way above average," says King.

He posits the COVID-recovery as a sound case study for this market philosophy. One of the reasons the market was able to bounce back so quickly, he said, was because the market was not over-extended at the time. The big lesson will come as no surprise: watch out for the bond market.

King has previously spoken at the Livewire Live event about his four-step stock selection process, which he reiterated for his investors at a recent fund presentation. The four steps are:

- Value: what is the true value of a business?

- Macro: what is happening in the market?

- Catalyst: what is the timing for a change?

- Contrarian: where can we go to avoid those consensus trades?

And his strategy remains unwavering. With one eye on the market, the other staring intently at company records, King's strategy has paid off. According to his keen eye, there are three definitive plays moving forward.

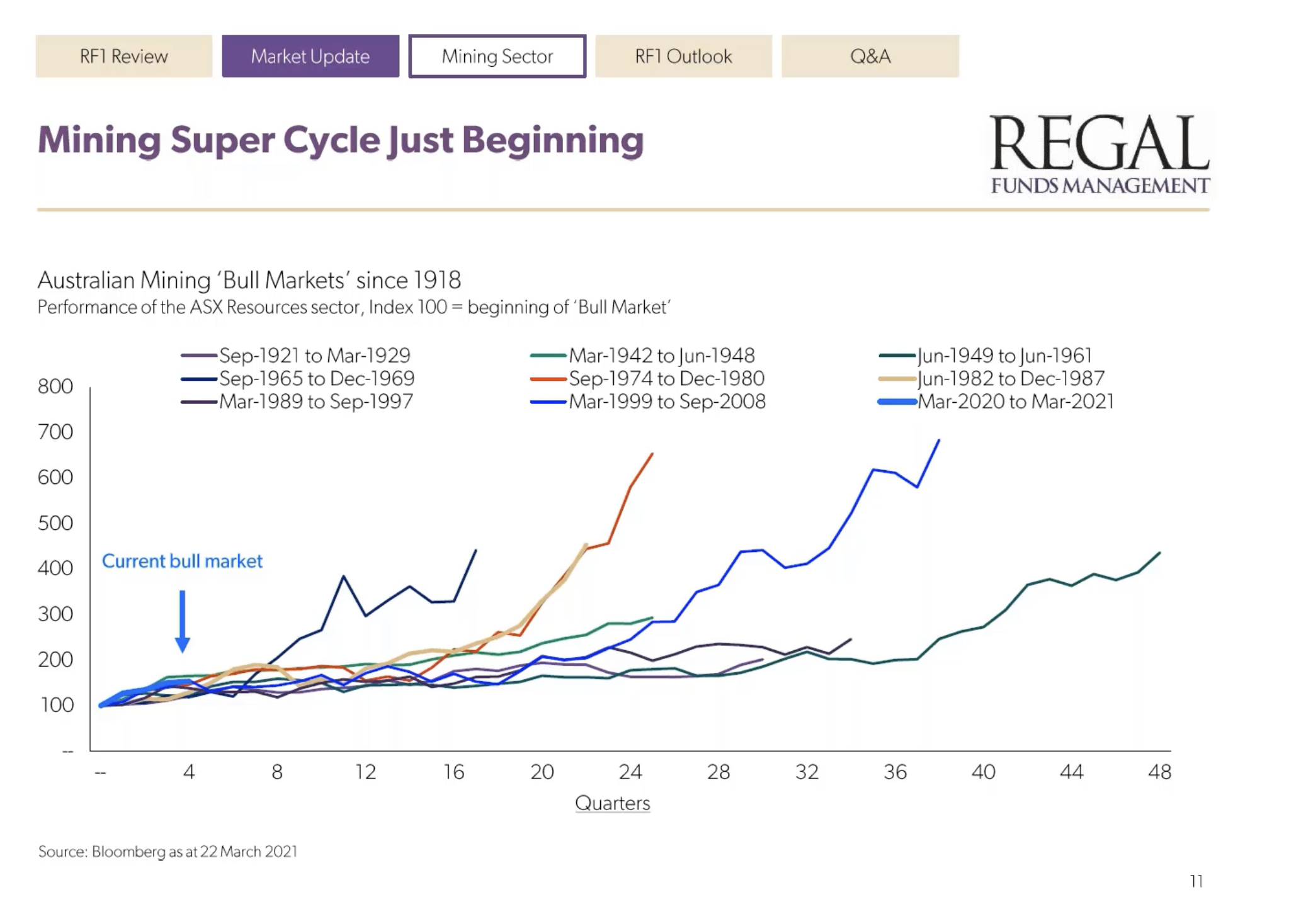

#1 The mining bull market could go up 500%

"Many people underestimate both the duration and the leverage of the mining bull market. Mining markets last, on average, at least five years and they go up around 500%, on average.

"We think the current bull market in the mining sector is only just starting," said King at Regal's RF1 investor conference.

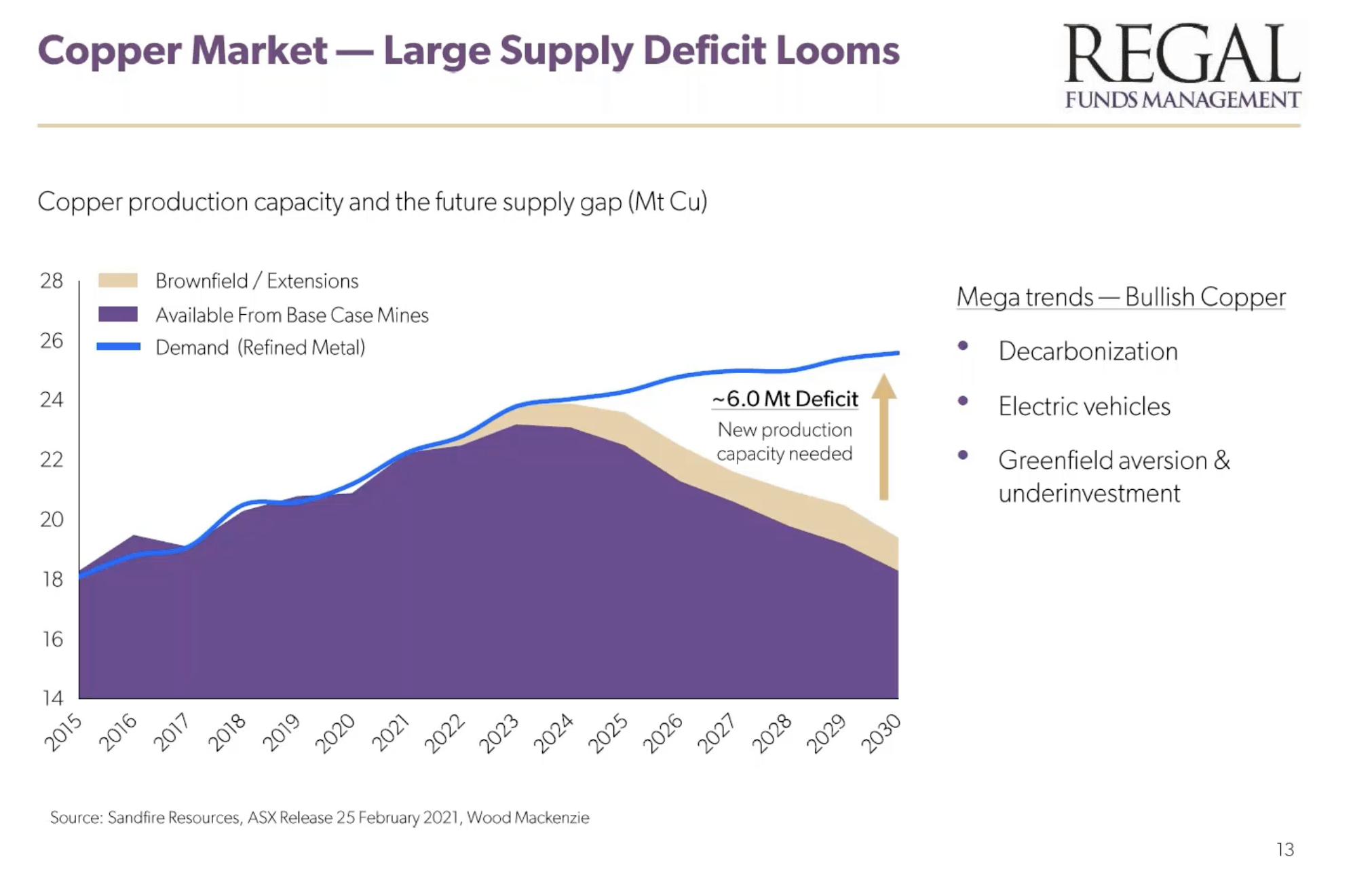

Since the commodity prices collapsed we've seen a huge hangover in the mining sector, he said. There has been very little re-investment in the mining sector and the big mining companies have avoided large acquisitions and new mine openings. But this could be about to change.

"Companies like BHP, RIO and Fortescue have started focusing on shareholder returns, increasing dividends, doing share buybacks, and not investing the new capacity. And we think that this underinvestment in supply is going to lead to a period of very strong commodity prices," he said.

The surge of global fiscal stimulus will be the cure to this underinvestment.

"After World War Two's fiscal stimulus we saw the longest bull market in mining stocks in Australia, and we think we're going to see something similar going forward. This global fiscal stimulus has meant that economic growth over the next five years will be almost twice what has been over the last five years, and we'll get back to the levels that we saw in the 2000s," he said.

"We're bullish both bottom-up reasons just because of the supply and demand dynamics, but also for top-down reasons. And as bond yields trend higher over the next few years, that usually leads to mining stocks outperforming the broader market," said King.

Regal is extremely bullish on copper because of the global trends towards electrification and decarbonisation. Regal's two key stock picks are Oz Minerals (ASX:OZL) for its liquid exposure to copper, solid cash flow and strong organic growth, and Chalice (ASX:CHN), which owns 100% of the Julimar project, a tier-one ore body which could produce as much as 15 to 20 tonnes per annum - "one of the best discoveries we've seen in a decade," said Regal's head of mining, Tim Elliott.

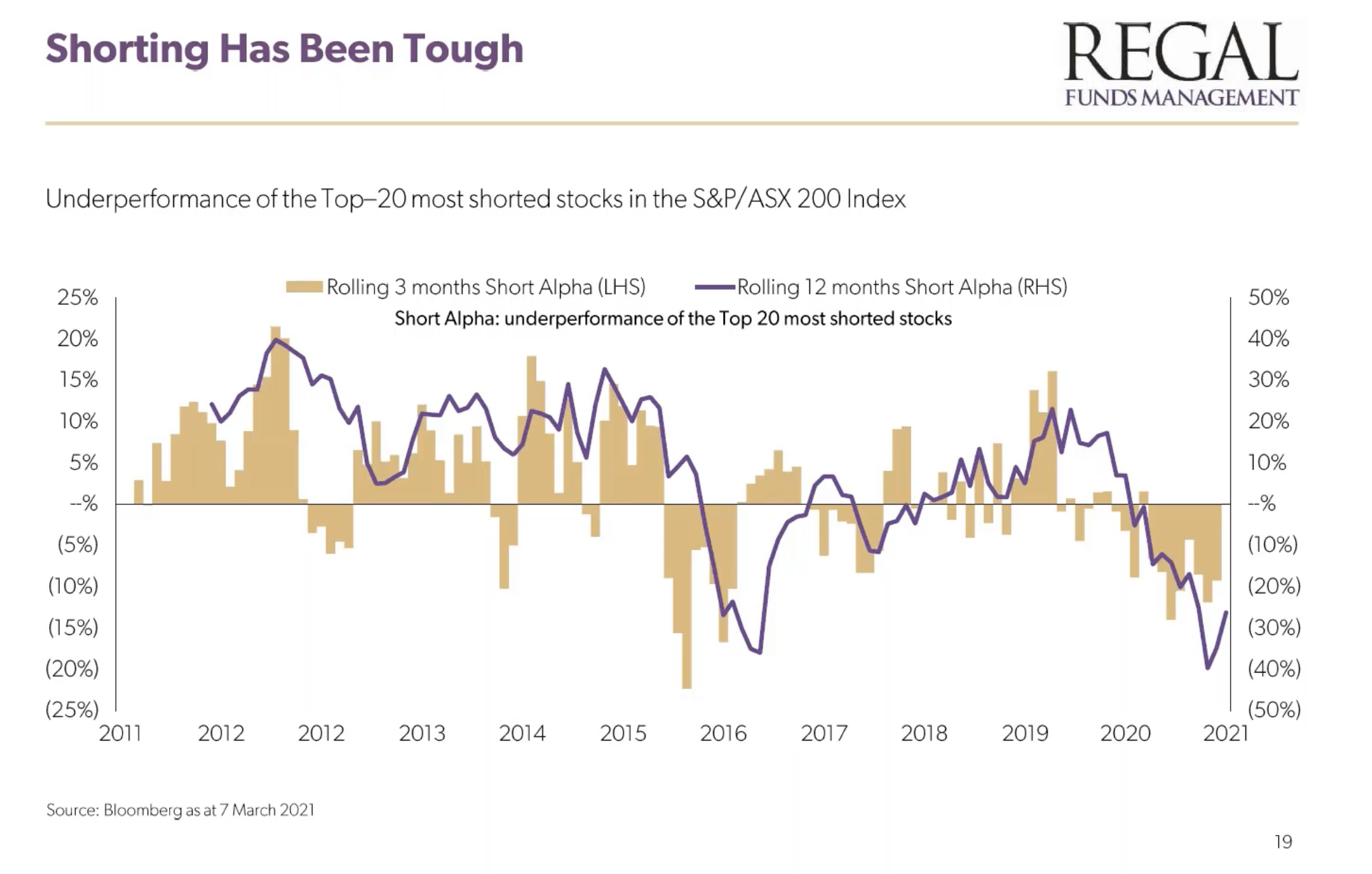

#2 Shorting opportunities will return

The market-neutral strategy contains a range of shorts, but Regal has been reducing its exposure to the shorts of late because the opportunities have been much more scarce.

"One of the great attractions of our fund is that we do invest across a diversified portfolio of strategies, and we can use dynamic allocation to switch between these strategies, some of the changes we've made since listing have been to reduce our exposure to the market neutral strategy, which has the largest exposure to shorting, and increase the exposure to some of the other strategies like smaller companies and emerging companies, which have been very successful"

There are three reasons shorting has been tough in Australia:

- Macro factors, like COVID-19, and fiscal policy responses have made it hard to identify shorts

- Low interest rate environment: usually weak balance sheets are a clear sign to short, but in a low rate environment, there has been less pressure on companies to do any equity raising.

- Passive and retail flows: the rise of retail brokers have changed some of the dynamics of markets. Companies like Tesla have continued to outperform despite low valuations and continue to attract a passive buy.

But, King believes as interest rates begin to rise again (eventually) and fiscal stimulus dries up then fundamental valuation will become more important, so, in turn, the shorters can flock back to the scene.

#3 The pre-IPO homecoming

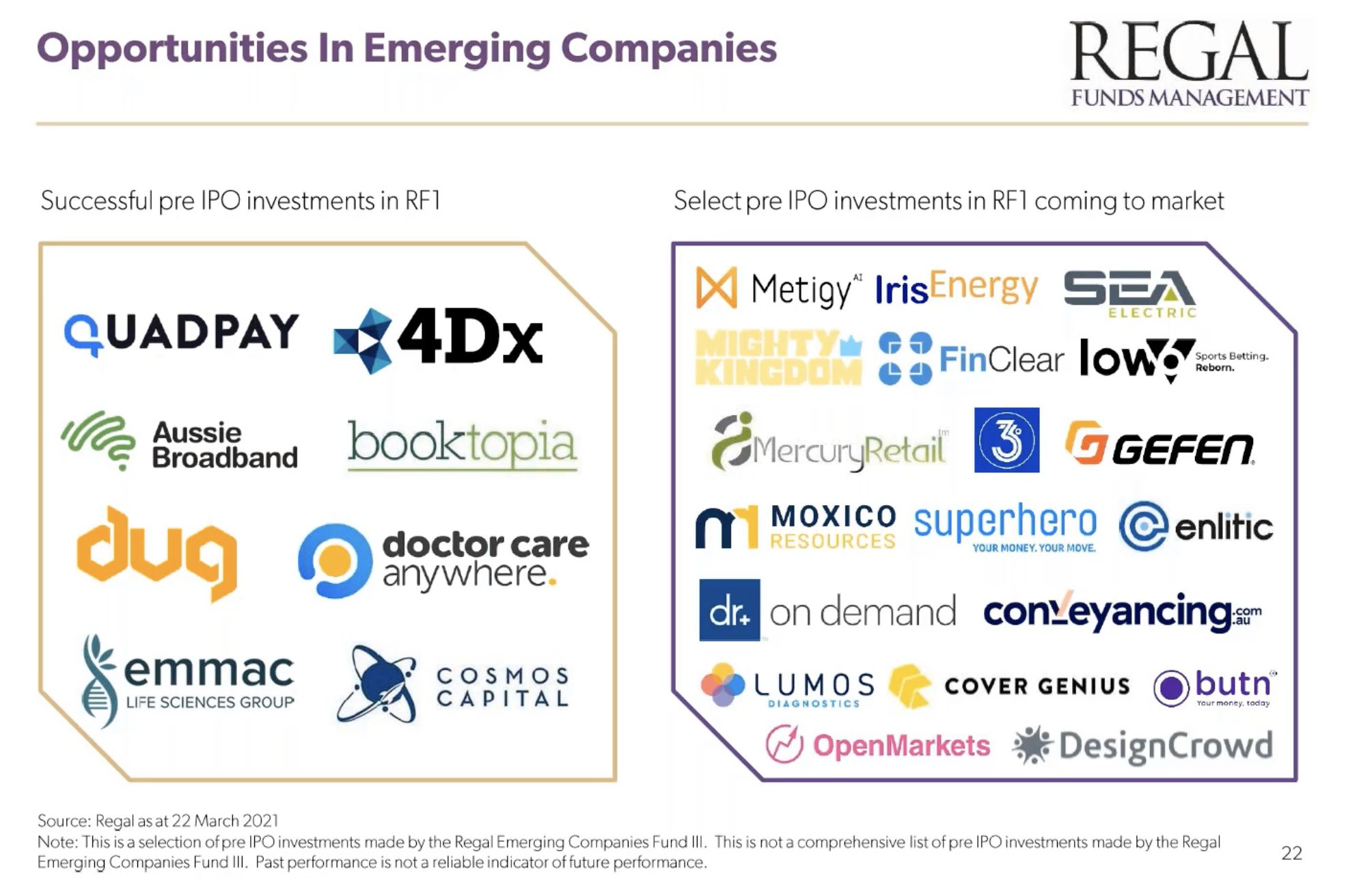

The pre-IPO market is heating up and Regal has the edge on entering this market.

One of the big factors at play is, perhaps unexpectedly, drawing on the souring US-China relations and China's ongoing integration of Hong Kong. According to King, China wants to leverage the credibility of the Hang Seng to compete with US stock exchanges.

"This obviously provides opportunities for firms, like Regal, that can buy alongside the Chinese investors. That's been one great source of alpha in our global Alpha strategy," said King.

"I think Australia has become a little bit like the US, which is where the performance of many IPOs have been a little bit mixed in recent time periods, but the performance of pre-IPO investments, has been very, very strong," he said.

"Our emerging companies fund invests in both listed markets, as well as many companies that aren't yet listed on an exchange," he said.

At the end of last year, King was reporting 'float fatigue', according to the Australian Financial Review, but business is back and better than ever.

King presented an extensive list of pre-IPO and emerging companies. His key examples included: buy now pay later Quadpay which was taken over by Zip Pay, Bitcoin miners Cosmos Capital, and copper producer Moxico Resources.

Never miss an insight

Enjoy this wire? Stay up to date with our content by hitting the ‘follow’ button below and you’ll be notified every time we post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

5 topics

7 stocks mentioned

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...

Expertise

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...