Philip Lowe led the RBA for 7 years, but what legacy has he left behind?

For seven years, he's been the public face of the Reserve Bank of Australia. He has overseen the end of ultra-accommodative monetary policy, the COVID-19 pandemic, yield curve control, and the steepest rate hiking cycle in the central bank's history. Through it all, he's copped a lot of heat from all sides of the political spectrum and especially from financial markets.

Now, Philip Lowe will pass the baton on to the central bank's first female governor - Michele Bullock. And with it, an ultra-tight labour market, anaemic economic growth, and a bank desperately wanting to see inflation come back down to that 2-3% band without the need for further rate increases.

As he leaves the job he has held for seven years (and an organisation he has been at for more than 40 years), we couldn't help but wonder what his legacy actually looks like. This wire will attempt to look at exactly that.

Lowe's Performance Review

Every job has a performance review and the Reserve Bank had its organisational review earlier this year. Here is a pure data snapshot of Lowe's tenure on the job.

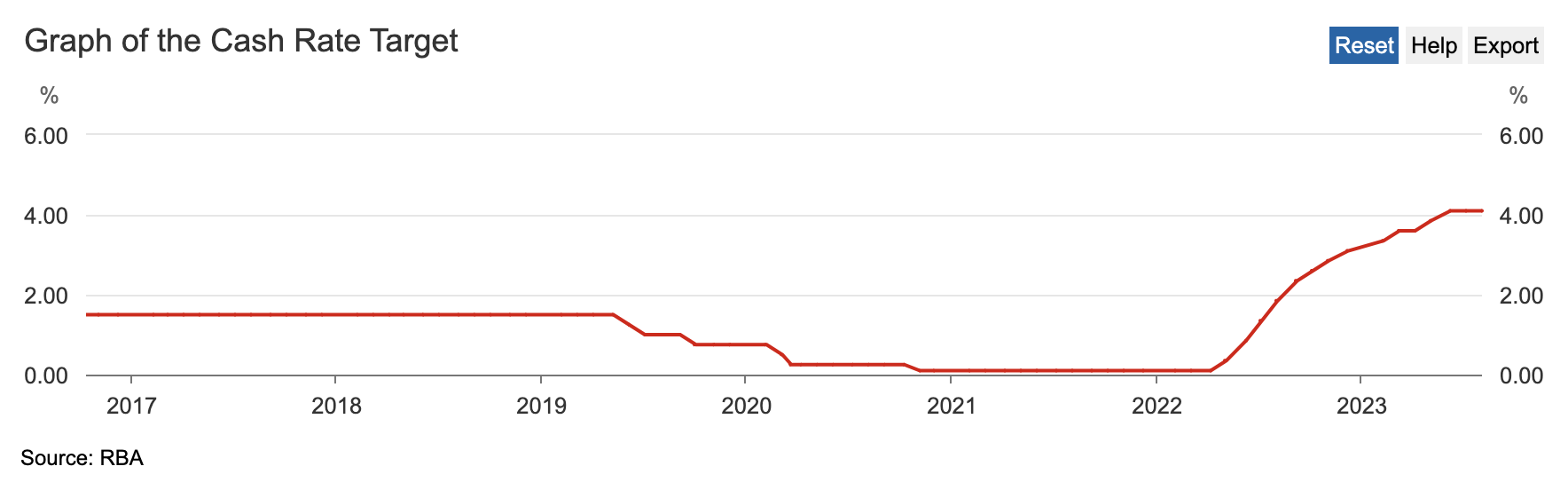

First, the cash rate itself. Lowe will leave the job with interest rates at their highest levels since late 2011.

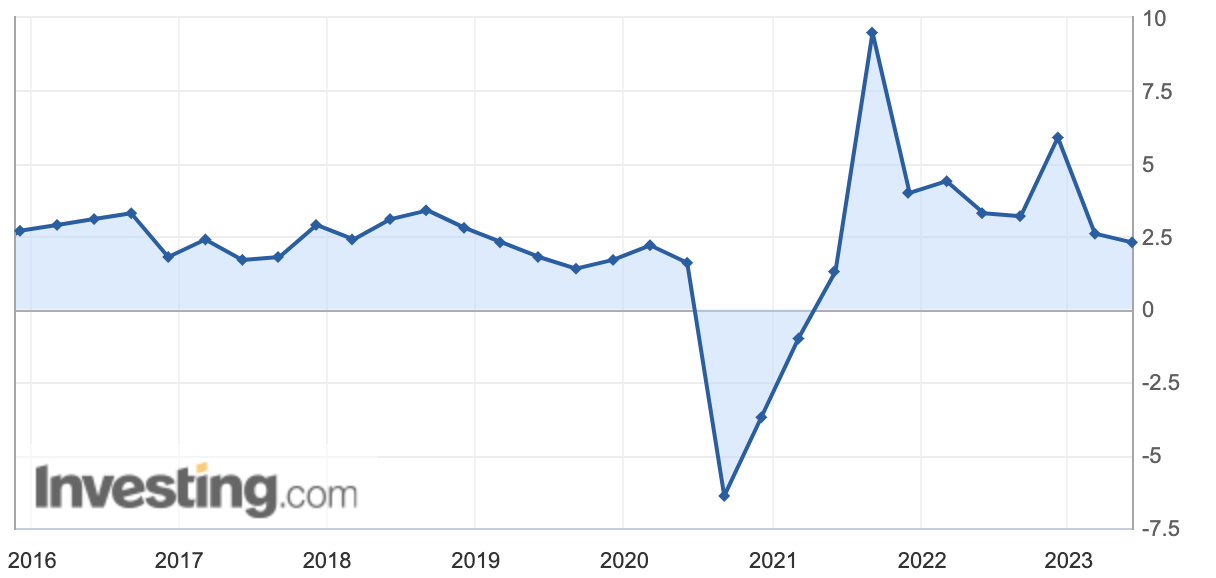

Economic growth, measured through GDP, has been volatile (although we all know why). If you cut out the COVID-19 pandemic and the wild swings it caused, GDP growth (on a year-on-year basis) has remained relatively healthy. During his watch, Australia recorded the biggest quarterly fall in economic output since the Great Depression. It also recorded its single-largest quarter of growth since the mid-1970s.

But these 2%+ prints will likely not last. The RBA has already forecast that GDP growth will slow to just 1.25% over the rest of 2023 and 2024.

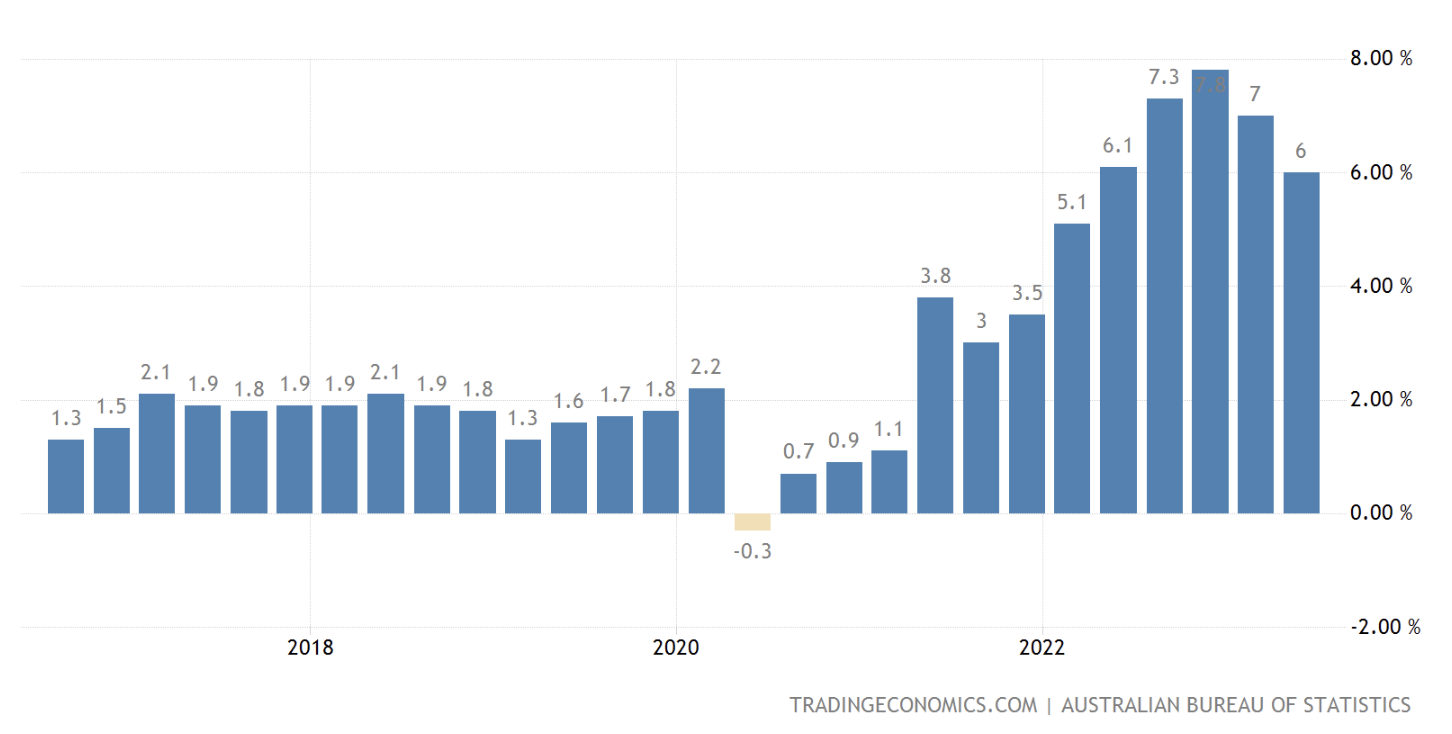

Next up, the inflation report. And there's no mincing words with this one.

Inflation became way too out of control and we are still paying the long and slow price of trying to bring it back down. Of the seven years (and 28 quarters) he led the bank, the inflation figure was within its target band just four times.

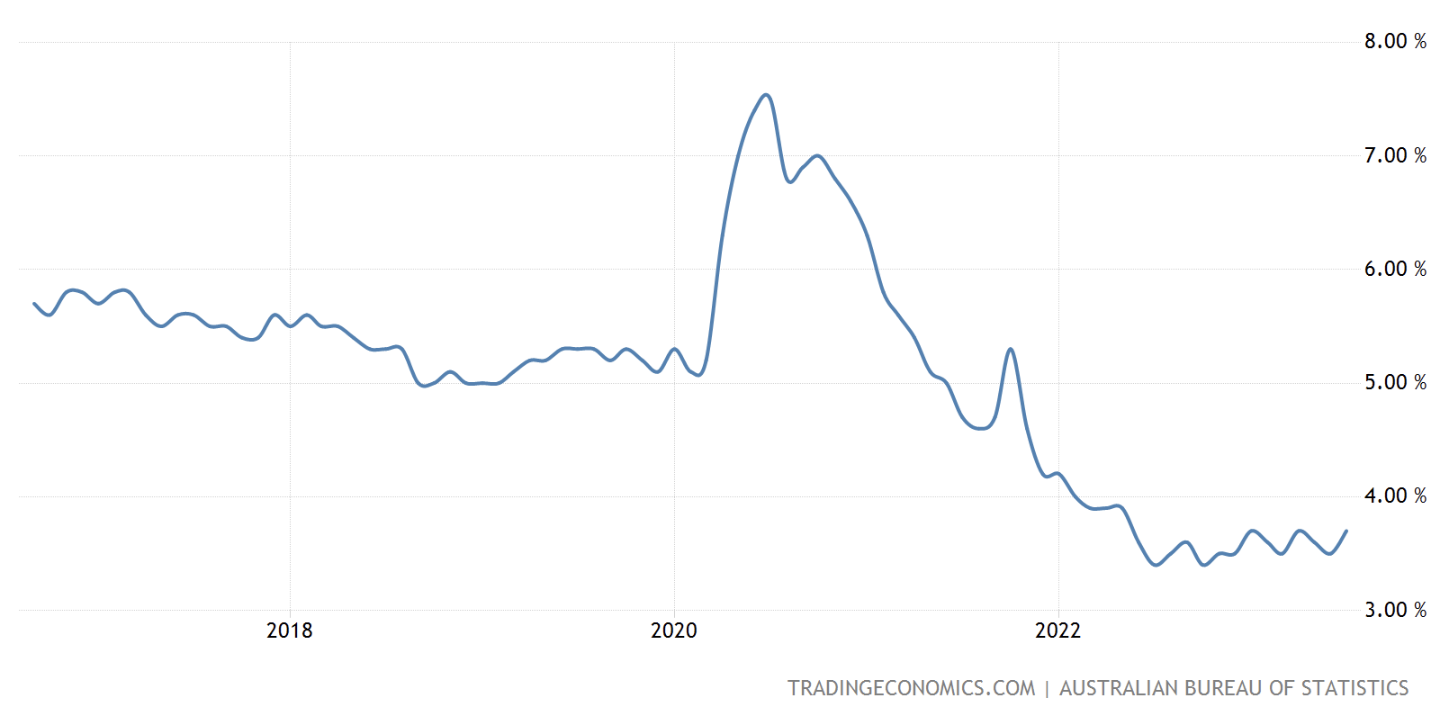

Next up, the labour market. Under Lowe's tenure, the labour market became very tight.

Since 2022, the unemployment rate has not been above 4%, although an ultra-tight labour market is the case in many countries (and not just Australia). Real wages have also decreased notably during this time - eroded away by higher for longer inflation.

Finally, two charts on financial markets. Central banks target two main asset classes - bonds and the local currency. The Australian 10-year bond yield is at multi-year highs, in line with the experience of other countries and its rate hiking cycles. Meanwhile, the Australian Dollar is sitting at a level not seen since November 2022 - and far lower than when Governor Lowe began his term.

Needless to say, the Reserve Bank is not responsible for all of the storylines associated with these data points. I also could have picked more data points - some of which will undoubtedly tell a rosier picture of the RBA's efforts over the last seven years. But these are the issues that economists, consumers, and market participants look at most closely.

Lowe's pivotal moments

Although he's led the central bank for seven years, his career at the top will likely be judged primarily by the gaffes he made over his final three years.

1. His first speechEvery six months, the RBA Governor delivers a testimony to the House of Representatives Economics Committee. In his first address way back in September 2016, he had this to say about the outlook for the Australian economy.

"We expect the economy to continue to be supported by low interest rates and the depreciation of the exchange rate since early 2013. Importantly, the drag from the fall in mining investment will also come to an end," he said in his prepared remarks to the committee.

"The story on income growth has been less positive, with growth in nominal GDP being disappointing. Over the past five years, nominal GDP has increased at an average rate of around 3% per year. To put this number in context, between 2000 and 2007, nominal GDP grew at an average rate of 7.5% per year. This is quite a change. It goes some way to explaining the sense of disappointment in parts of the community about recent economic outcomes.

"Inflation is expected to remain low for some time, but then to gradually pick up as labour market conditions strengthen further."

Isn't it funny how the more things change, the more they stay the same?

2. COVID-19In the top job, Lowe has led the board, the Bank's near-1500 strong staff, handled the media, dealt with politicians and attended dozens of international meetings with central bankers, regulators and finance ministers. But he has also had to handle something he could never have expected - COVID-19 itself.

Upon the COVID emergency being declared, the Board did four very important things:

- Lower the cash rate to 0.1%

- Institute a bond buying program to sustain some level of liquidity in financial markets

- Initiate a term funding facility for banks and loosen lending criteria for businesses

- And one other thing that we will get to later...

While these measures no doubt got Australia through the worst of the COVID-19 pandemic, it has also left a lasting legacy in financial markets. Even when all indicators pointed to inflation rising beyond the target band, the RBA didn't move the cash rate until May 2022 - one meeting after the April quarterly inflation print. By then, it was too late.

The term funding facility was closed for new drawdowns in June 2021. The last of the money withdrawn using this system will mature in June 2024.

3. Yield curve controlYou will notice I only mentioned three of the four things in that last paragraph. That's because the last one deserves a subheading of its own. Yield curve control - or YCC - is arguably the most embarrassing initiative the RBA instituted in the eyes of global markets. YCC involved extending the then-record low 0.1 per cent RBA cash rate out to three years, by pinning the three-year government bond rate at the same level.

To keep it there, the RBA kept buying government bonds at that rate. The idea is that it would keep some liquidity and reduce panic during the depths of the COVID-19 pandemic. The only problem is - like many things - they kept it around for way too long.

By the time yield curve control was discontinued, the bond markets had already called the RBA's bluff - sending yields sharply higher and cornering the RBA into admitting that it had gotten it spectacularly wrong on inflation.

As NAB's Tapas Strickland wrote way back in 2022, “[YCC] was successful in the depths of the crisis, but there’s no good exit for it.”

4. Speaking of inflation...

There were indicators that inflation was on the rise (and quickly) as early as mid-to-late 2021. A combination of supply chain bottlenecks, the war in Ukraine, and resilient consumer demand for at-home services were all driving inflation higher. But the RBA kept saying - as late as December 2021 - that inflation was rising but not enough to worry them.

"Members observed that inflation had increased, but remained low in underlying terms ... Members noted that inflation pressures in Australia were lower than in many other countries, owing to a range of factors, including differences in energy markets and modest wages growth in Australia. A further, but only gradual, pick-up in underlying inflation was expected," said the December 2021 meeting minutes.

Well, that ended awkwardly. The RBA was forced to raise interest rates just six months later.

"Inflation has picked up significantly and by more than expected, although it remains lower than in most other advanced economies ... A further rise in inflation is expected in the near term, but as supply-side disruptions are resolved, inflation is expected to decline back towards the target range of 2 to 3%," the Board said in May 2022.

And nope, it did not decline either. Inflation is still twice the central bank's own target. And it will be up to new Governor Michele Bullock to get it back down to the 2-3% band it sets in agreement with the Treasurer.

5. Finally... the most egregious error of them all: Forward guidance

Unfortunately, for Lowe himself, the soon-to-be ex-RBA governor will be remembered most of all for this line from the RBA's monetary policy decision in March 2021.

"The Board remains committed to maintaining highly supportive monetary conditions until its goals are achieved. The Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. For this to occur, wages growth will have to be materially higher than it is currently. This will require significant gains in employment and a return to a tight labour market. The Board does not expect these conditions to be met until 2024 at the earliest."

This was reinforced at the Financial Review summit days later.

"Our judgment is that we are unlikely to see wages growth consistent with the inflation target before 2024. This is the basis for our assessment that the cash rate is very likely to remain at its current level until at least 2024," Lowe said.

Clearly, that did not end well. The RBA was forced to a) start an interest rate hiking cycle and b) take out all the easy money it had pumped into the economy in the years prior. Both, as of writing, are still taking place.

3 topics