Pizza wars: plenty of dough to be made

Whether you prefer a thick crust or thin, or you’re a purist when it comes to toppings – does pineapple have a place? – pizza holds universal appeal. Dough, cheese and an almost limitless variety of toppings caters for most, and its versatility ensures a tasty meal whether eaten on-site or delivered to be consumed in the comfort of your own home.

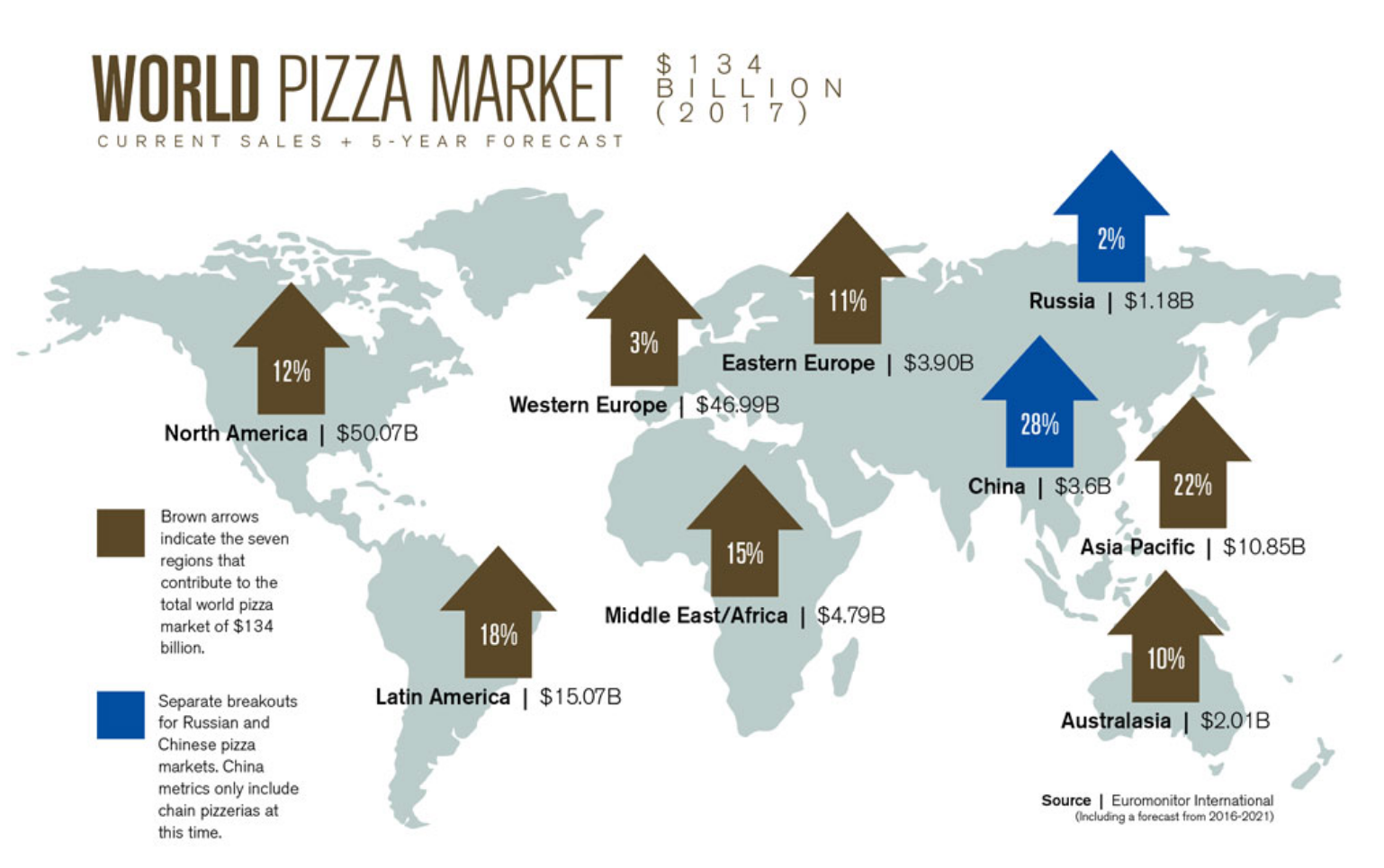

Pizza is not only delicious, it can also make a good investment. According to research undertaken by Euromonitor International in 2018, the worldwide pizza market reached US$134 billion in 2017; pizza represents nearly 5% of global consumer food service sales. The research also showed continued growth in the number of pizza delivery and takeaway outlets, with market leaders being the US, Italy and Brazil.

Telepizza: portfolio stock

Telepizza is the largest non-US heritage pizza delivery company worldwide. It was founded in Madrid during the 1980s and expanded rapidly throughout Spain in the early 1990s before going public in 1996. Over the following 10 years, Telepizza expanded internationally across Latin America and Portugal. The company was taken private by Permira private equity fund in 2006 and, following the recovery in the Spanish economy, was relisted in 2016.

In May 2018, Telepizza entered a deal with Yum Brands to significantly reshape the business and become the largest master franchisee of Pizza Hut, running its Latin American operations.

Before the Pizza Hut deal, 65% of Telepizza’s revenues were generated from Spain, with the remainder roughly split between the rest of Europe and Latin America. In its core markets, Telepizza has strong market share positions:

- Spain 53%

- Portugal 52%

- Chile 52%

- Colombia 37%.

In Spain, where Telepizza has 600 stores and a strong brand, it’s been able to maintain share and grow above the market, despite challenges from aggregators and other leading brands such as Dominos and Pizza Hut.

Digitisation will be a key growth driver for the business. Although Spain has similar levels of internet and smartphone penetration as the UK and US, only 27% of the population is transacting via ecommerce, compared to 65% in the US and 78% in the UK. This is a significant opportunity given digital customers order more frequently and have a higher average spend. Digitisation will also improve the efficiency of the business, already at a very high standard given its vertically integrated supply chain.

The private equity play

Telepizza was the best contributor to the Perpetual Global Share Fund over the December 2018 quarter thanks to a bid by private equity group, Kohlberg Kravis Roberts (KKR). Private equity refers to investors – funds, individuals or companies – that take an ownership stake in private companies or buyout public companies and take them private. The goal of private equity is to restructure a company to open new markets or seize new opportunities and ultimately, increase profitability to position it for a future sale or market listing.

Over the years, Perpetual has owned a number of companies that were taken over by either private equity or corporate players. This results from our focus on high quality companies with strong balance sheets that are mispriced by the market for different reasons. We usually buy these companies on low multiples. Private equity players try to take advantage of emotional equity markets and the resultant short sightedness.

Perpetual has been accumulating Telepizza recently, in response to the view that the market has underappreciated the significance of the deal with Yum Brands and its Pizza Hut operations in Latin America. KKR made a cheeky bid for the company at 6€ per share in December 2018, during a major fall in global equity markets. Telepizza was trading above 6€ a share in May 2018 after the Pizza Hut merger was announced; we believe Telepizza is worth significantly more than 6€ per share.

Share prices go up and down daily, but do not necessarily reflect the underlying fundamental value of a business. If private equity thought that the underlying value of the business they were buying was the price they were paying, they would soon be out of business!

A sound investment

Telepizza has solid positions in core markets, a sound management team, a strong balance sheet and a long runway for growth in key markets, driven by digitisation and further global expansion. When we entered the position, the valuation was compelling, and we still think it is compelling – as does KKR.

The team has spent a lot of time analysing the merger between Telepizza and Pizza Hut in Iberia and Latin America. The benefits for Telepizza are numerous and include:

- The number of stores managed by the business increases by 60%

- Global operations expand from 20 countries to 37

- Spain’s contribution to total sales increases to 40%

- Latin America’s contribution to total sales increases to 45% of total sales.

From our conversations with Telepizza and Yum Brands management, as well as Latin American pizza business operators, it’s evident the opportunity within Latin America is very large and potentially misunderstood by the market. A large portion of the initial opportunity lies with Telepizza vertically integrating the supply chain within Latin America as it relates to the Pizza Hut franchisees.

We believe the company has been fairly conservative in their guidance of increasing earnings (EBITDA) from around 70 million euros to 100 million by 2021. This will deliver a double-digit revenue growth CAGR and ~13% EBTIDA CAGR over the next three years. The business is integral to Yum Brands’ growth in Latin America. We will not part with our 3% stake in the company unless we receive a fair price for our shareholding.

Never miss an update

Stay up to date with the latest news from Perpetual by hitting the 'follow' button below and you'll be notified every time I post a wire.

Want to learn more about Perpetual's Global Fund? Hit the 'contact' button to get in touch with us.