Plenty of upside ahead for Woodside, even after a record result

Australia’s largest oil and gas company yesterday reported $5.23 billion in net profit after tax for calendar 2022, a record 220% ahead of the NPAT figure for the same period 12 months earlier.

The market eagerly awaited the result, given it covers Woodside’s first half-year since the merger with BHP Petroleum was completed last June. Martin Currie’s head of research Michael Slack described it as “a messy result that looked a little light on earnings”.

Slack also noted that much of the result was well-telegraphed by the quarterly production results, which were handed down last month, and the extraordinary line-item guidance management provided a couple of weeks ago. The latter of these updates related directly to the complexities of the Woodside-BHP deal, providing further clues ahead of yesterday’s interim result.

The high energy prices we’ve seen over the last 12 months, particularly on the back of the Russia-Ukraine war, also fed into the anticipation of a strong result from Woodside. Platts JKM LNG prices last year averaged US$33.97 per million metric British thermal units, up from US$18.59 MMBTU in 2021.

Even so, Slack found several pleasant surprises in the result, as he details in the following interview.

The one-year daily chart of WDS in comparison to the S&P/ASX 200 (Source: Market Index)

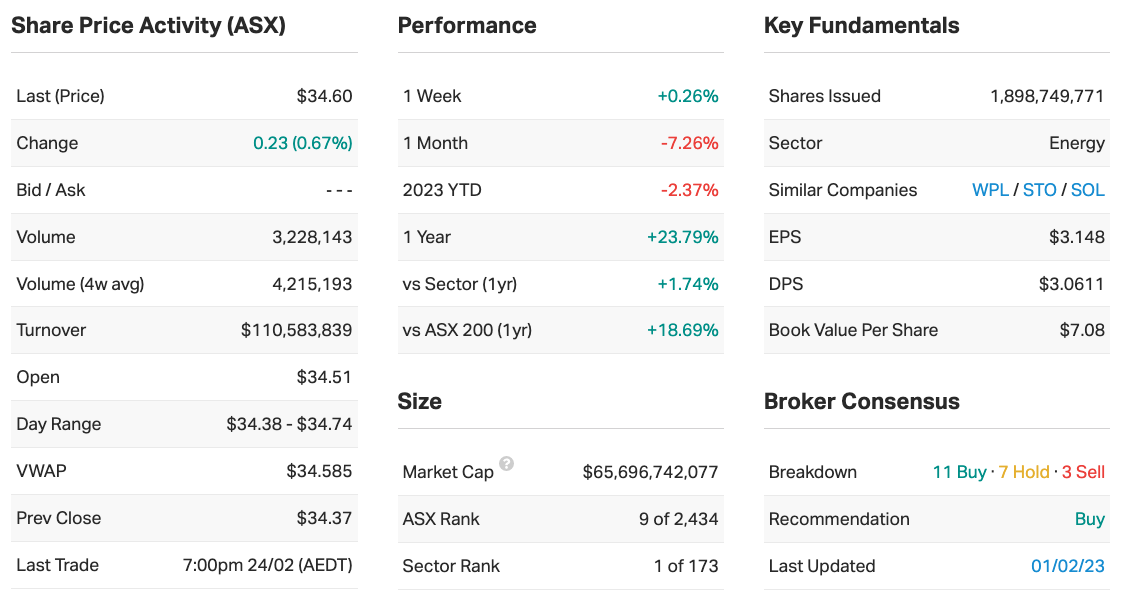

Woodside's key results for calendar 2022

- Underlying NPAT of $5.23 billion, up 223% on the same period last year

- Operating revenue of $16.8 billion, up 142%

- Free cash flow of $6.54 billion

- A dividend of US$1.44, fully franked, bringing the full-year dividend to US$2.53

Key company data for Woodside

Note: This interview took place on Monday 27 February 2023.

What were the key takeaways from this result? What surprised you the most?

It was a messy result that looked a little light on earnings. But the strength of the cash flow was a key takeaway, where it beat market expectations by between 5% and 8%.

The balance sheet is extremely strong, with only half a billion of debt on the balance sheet at the end of the period. And that cash flow is a result of good operational performance through the period, even with the merged assets coming through and the strong prices.

That’s what you want your companies to be doing – operating well and being able to deliver during a period where you have very strong pricing.

The surprise was really only in the strength of the result, particularly the balance sheet. And this comes at a time when there’s a lot of capital on developing Sangomar (in Senegal) and Scarborough (in Western Australia), where they’ll spend $6 billion in the coming year on these and other projects.

They also were able to maintain a payout ratio of 80% and to finish the period with gearing of 1.6%. Even after they pay that dividend, the gearing of 9% will still be below their range – which is very strong, even after having paid shareholders and funded their growth projects.

What was the market’s reaction to this result? Was this an overreaction, underdone, or appropriate?

I think it’s in line. They’re outperforming today, in a weak market, with a result that saw very strong cash flow. And at the end of the day, that’s what we’re measuring – the cash flow generation of these companies. I’d say that the share price movement is an appropriate reaction.

Would you buy, hold or sell Woodside on the back of these results?

Rating: BUY

I think there’s still some good upside in Woodside. The other thing that will bear out over time, now that the merger with BHP petroleum is complete, is the pipeline of opportunities for WDS. Not only will it have access to its own pipeline of strong future gas markets – and we like gas as a transition fuel – BHP has contributed a lot of that pipeline, which will now get the focus of a dedicated energy company.

We’ll see things like the development of Trion in the Gulf of Mexico alongside other tiebacks here, and Calypso LNG in Trinidad. There’s a strong pipeline of projects that WDS can take advantage of.

What’s your outlook on Woodside and the ASX energy sector for FY23?

Of all the sectors, the China post-COVID reopening story is most bullish for energy markets, because mobility will pick up, as will demand for energy, in a market that is already short on product. And Woodside is right in the sweet spot to benefit from that.

That’s also because the company doesn’t just sell on contract, with around 20% of their product sold on the spot market. So, if there’s some irregular pricing in the market, Woodside has the option to sell more product into that and benefit from higher prices.

There’s a strong pipeline of projects WDS can take advantage of to provide the world with energy. Even though requirements (for oil and gas) may decline because of emissions, they still have to develop new sources.

If the commodity price is buoyant, the stock will perform well, and WDS has strong production and a good commercial book. Prices may not be as strong as they were last year, which was exceptional in many respects, with a lot of geopolitical turbulence. But we’d still say 2023 will see above-normal conditions.

Even though Woodside is spending capital on new projects, its balance sheet should be strong and so should shareholder returns.

Are there any risks for Woodside and its sector that investors should be aware of given the current market environment?

A global recession would affect demand for everything. If it’s mild, it probably won’t have too much impact but if a recession is severe, as we’ve seen in the past, it can reduce demand and knock prices around.

Declining dividends are another risk. With the company’s strong cash flow, Woodside can pay high dividends. And if prices come under pressure, that dividend stream declines – it’s a simple mathematical outcome.

Government intervention in energy markets is also a risk.

And in terms of the development projects, they are spending money and building projects in an inflationary environment, so delivering "on time and on budget" is a risk for Woodside.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now?

Rating: 3.

I would say it’s a 3 – fairly valued. If we were to see better inflationary outcomes down the track and less interest rate concern, I think there’s more upside to the market. Likewise, if the market does go into recession, there’s more downside.

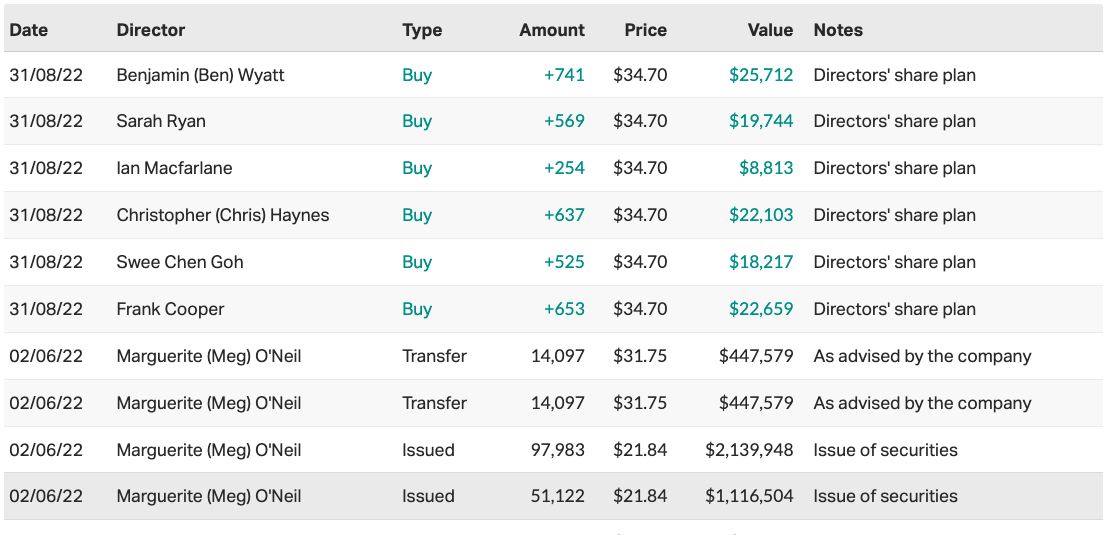

10 most recent director transactions

Catch all of our February 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

4 topics

1 stock mentioned

1 contributor mentioned