Prices fall but conviction grows

Everywhere you turn, there is something happening that is causing the advancement and adoption of digital assets and making this space more exciting, even though the underlying cryptocurrencies and crypto companies are currently trading well below their record highs.

While price is ultimately a primary concern to investors, looking solely at price is, in my opinion, the wrong way to value the crypto space and its long-term prospects. What should be of importance is that the asset class is expected to attract greater regulation, adoption of the technology is growing, and the traditional financial system is becoming more involved.

Regions everywhere are deciding their crypto fate and trying to ensure they get their regulatory decisions right. These decisions will dictate if they become a leader or a bystander.

Crypto around the world

U.S. President Joe Biden signed an executive order on March 9th, laying out a national policy for digital assets across six key priorities:

- consumer and investor protection;

- financial stability;

- illicit finance;

- U.S. leadership in the global financial system and economic competitiveness;

- financial inclusion;

- and responsible innovation.1

Less than a week later, the EU Parliament Committee voted against banning mining and proof-of-work (PoW) protocols.2 Last October, the Australian Senate Committee delivered a groundbreaking report calling for a complete overhaul of crypto legislation and licensing in the country as an opportunity to attract jobs, investment and innovation to Australia and to retain talent.3 Most recently, the U.K. has unveiled a detailed plan of reforms and initiatives in the digital asset space with the aim of becoming “a global cryptoasset technology hub and a hospitable place for crypto.” 4 These regions, along with many others, such as Japan, South Korea, Singapore and UAE, are all effectively saying: “Yes, we accept that crypto is here to stay”, and all want to be leaders in the digital assets space.

It’s been only six months since El Salvador became the first country to approve bitcoin as legal tender, but the country has continued to receive a lot of heat from the IMF for doing so. More recently, in restructuring their debt with the IMF, the Argentine congress had to approve a deal that would discourage crypto usage.5 However, the idea of ‘bitcoin as legal tender’ is slowly gaining steam, and this would tend to encourage mass adoption. There are already more bitcoin wallets in El Salvador than there are bank accounts in the country.6

Although no other country has as yet approved bitcoin as legal tender, the Swiss city of Lugano is set to introduce Bitcoin (BTC), Tether (USDT), and its own LVGA token as legal tender. The city is aiming to become a hub for blockchain adoption in Europe and plans to have all its businesses use crypto for everyday transactions. It will also allow taxes to be paid using the three cryptocurrencies.7 In addition, certain U.S. states such as Arizona, Wyoming and Texas are exploring the possibility of making bitcoin legal tender.8

This will all take time, but the walls appear to be crumbling and the argument that bitcoin would never be used as a medium of exchange is losing force. Similarly, fund managers who only a couple of years ago didn’t give bitcoin the time of day as a potential investment are revising their views.

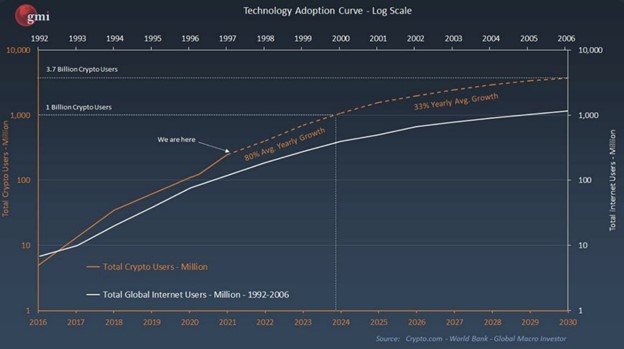

As the chart below shows, crypto adoption is growing at a significantly faster rate than the internet at a similar stage of its evolution. Starting from when both technologies had 100 million users, if current growth rates continue, crypto will achieve 1 billion users in around half the time.

Crypto as an investment

Last year the long-awaited launch of the first bitcoin ETF in the U.S. was approved. Although it was not the spot bitcoin ETF that everyone was hoping for, which is already available in Canada and Europe, it was a very important step in unlocking mass adoption.

In Australia, spot ETFs over Bitcoin and Ethereum have been announced and are ready to list.

Currently, to pursue cryptocurrency as an investment, you need to wrap your head around the technology, learn how to keep your coins safe, or put your trust in local and overseas exchanges. Getting involved in other sectors such as NFTs, de-fi, game-fi and the metaverse adds further technological complexity.

However, more traditional investment options are becoming available, making it easier to participate. These include ETFs, managed funds and hedge funds that will safely hold the digital assets, do the staking, and pick which cryptocurrency, NFTs or DAOs to get involved in.

As an investor in digital assets, rather than price being the main driver of investment, adoption of the technology, use cases and network size could be a better indication of future value. A country’s tax system, its support for the businesses involved in the industry, and its support for its citizens to get involved, will be an important influence on how the asset class and industry evolve.

State of play

Putting price considerations to one side, 2022 is shaping up to be a big year for crypto. The market cap of the entire crypto currency space is around US$1.86T and the growth of the space is fuelling thousands of jobs, attracting billions of dollars in venture capital, and creating multi-billion-dollar companies laying down the infrastructure for the crypto economy to thrive.

Learn more

BetaShares offers the broadest range of technology-focused ETFs in Australia providing access to global tech giants, cybersecurity, Australian technology and more. To stay up to date with my latest insights into the digital assets market click FOLLOW below, find out more about investing in crypto with BetaShares here.

References:

2 topics

1 stock mentioned

1 fund mentioned