Private credit is a globally attractive opportunity – investors should take notice

Large institutional investors around the globe now include global private credit as a core portfolio component, including the Future Fund and Industry Super Funds. Access for all but the largest Australian investors has been an issue, yet as more global private credit investment opportunities open up other investors may ask why this fast-growing asset class has become so attractive.

What has driven the growth of global private credit?

The global private credit market has more than tripled over the past 10 years to over $1 trillion, with 97% of opportunities in North America and Europe. Growth is expected to continue, with banking regulators in the US and Europe expected to increase regulatory oversight and impose more restrictions on banks following the failures of SVB and Credit Suisse.

Prior to the GFC, banks were the dominant providers of credit to companies on a hold-to-maturity basis. Post-GFC, regulators imposed more stringent regulatory capital and liquidity requirements on banks. Loans to middle-market companies, and certain types of loans to non-bank lenders, became unattractive.

The banks’ withdrawal from this market, combined with significant bank consolidation in the USA and Europe, created a significant liquidity gap in the market – this liquidity gap is being filled by private credit managers, and providing investments characterised by high-risk adjusted returns, floating rate yields, diversification, and capital stability.

In Australia, private credit has not played the same role in replacing bank financing to large segments of the commercial lending market, mainly because our banking system has demonstrated greater resilience to market shocks. Yet while Australian banks dominate the lending landscape, there are areas where banks have reduced their risk appetite, including commercial real estate, large leveraged corporate borrowing and subordinated positions in asset-backed financing vehicles. Australian private credit managers play a very important role in these areas but remain only a small portion of the market.

It’s very different in North America and Europe, where private credit plays a significant and important role in providing middle-market borrowers and non-bank lenders with access to credit.

How does private credit work?

Global Private Credit is a very large and diverse asset class. At Pengana Credit, our focus is on specialist fund managers who raise funds from investors to lend directly to middle-market companies with profitable operations. They are typically companies with EBITDA of $10 million to $300 million, or non-bank lenders with profitable pools of assets (like mortgage originators or providers of consumer or commercial finance), at sensible loan-to-value ratios.

The loans are bilateral, which means the Private Credit manager has access to detailed business and financial information from the borrower to assess the borrower’s ability to pay interest and repay loan principal from operating cash flows and assess the value and adequacy of security.

Armed with this information, the private credit provider negotiates an appropriate interest rate to compensate for the risk, and an illiquidity premium to compensate for the fact loans are held to maturity, meaning they are not traded.

The private credit provider also negotiates certain protections, including legally enforceable rights to intervene in a borrower’s operations to reduce the probability of loss should pre-agreed operating and financial parameters deteriorate.

How investors benefit from global private credit

Today, an estimated 84% of mid-market lending in the US and Europe is provided by private credit lenders, and 16% by banks on a hold-to-maturity basis (pre-GFC it was the reverse).

This liquidity gap, combined with the illiquidity of private credit loans, has driven substantial yield premiums relative to publicly traded credit alternatives. Institutional investors have accessed these attractive returns via private credit fund managers to diversify their fixed-income portfolios.

Characteristics of the asset class include the potential for higher returns than traded fixed-income alternatives, reflecting the fact that the loans are held to maturity by the lender, who is compensated for the illiquidity. Floating rate yields provide some insulation from rising interest rates and inflation.

The diversification aspect is attractive due to the low correlation to more traditional asset classes like traded credit and equities. As the securities are not traded on the market, they also exhibit low volatility.

But the returns and diversification wouldn’t mean much without capital stability. These investments are relatively resilient as the loans are individually negotiated and structured – they generally have seniority and security over a borrower’s cash flows and assets, and have the right to force a borrower to take corrective actions to protect the value of the lender’s capital if necessary.

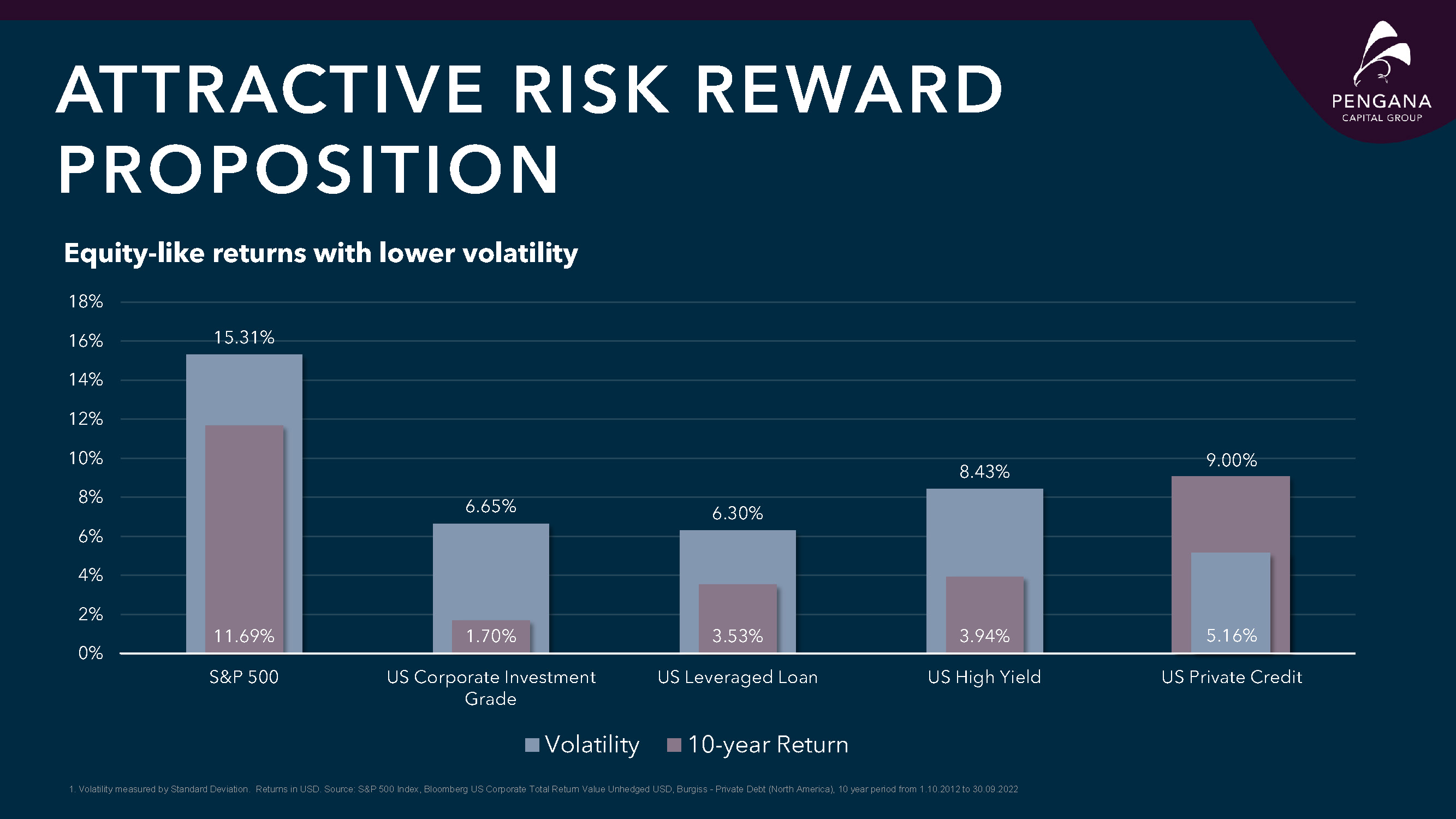

Global private credit’s attractiveness is borne out via comparison with other asset classes.

We compared an index representing the returns and volatility of US private credit over the last 10 years versus US-traded asset classes including the S&P 500 equity index, and three traded credit alternatives: the US corporate IG bond index; the US leverage loan index (being bank syndicated loans); and the US high yield market.

This comparison shows the volatility of the traded asset classes is multiples above the actual annualised return.

Only US Private Credit delivered a return that exceeded the volatility of the asset class over that period of time. This is precisely the reason institutional investors have found private credit to be so attractive.

Access has been an issue for other investors, including high-net-worth investors because the capital required to build a truly diverse portfolio on your own is so large it ceases to be viable. But more options to access this asset class are on the horizon.

And there’s little doubt Australian investors, including high-net-worth, wholesale, retail and self-managed super investors, will find private credit’s potential for higher returns, diversification benefits, and capital stability useful.

3 topics