Psych test your investment manager

In financial markets, a peculiar paradox exists - inefficiency abounds, yet most active managers fail to outperform long-term. What behavioural short-comings of investors cause this? And what should asset allocators look for in their manager selection process, to increase the odds of backing a manager with a repeatable source of alpha?

Wouldn’t it be ridiculous if the common house price varied 50% within a given year. Today, the median house price across Australia’s capital cities is roughly $900k. Imagine it was a common experience if a house selling for $900k in January, was $1.4mn in June, and back to $900k again by November. Then imagine this was the case for every house, or suburb, across the country.

It feels laughable to think that much variance might occur every year for the common house, or collection of houses in a given suburb. That sort of inefficiency would no doubt attract a long line of investors seeking to exploit the opportunity to consistently buy low, sell high.

But that’s what happens in the stock market - the listed price of publicly traded businesses.

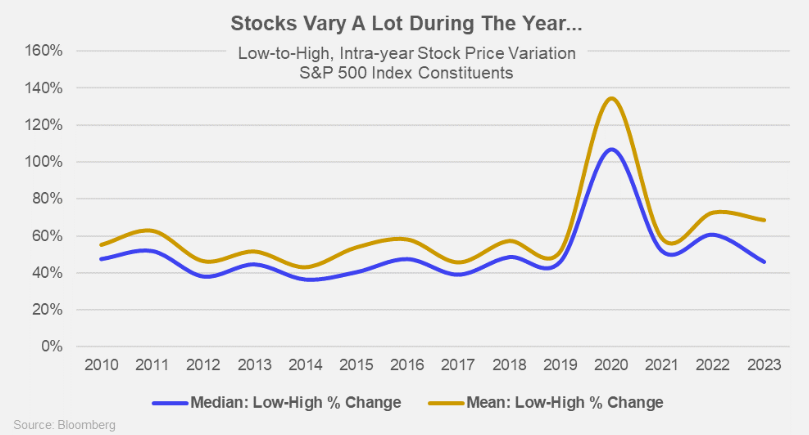

Between 2010 to 2019 - a period without a major economic cycle - the average low-high variation of a stock price within the S&P 500 Index was 50% in each calendar year.

With business fundamentals only changing incrementally year-by-year, and discount rates less volatile through this period, did listed company ‘fair values’ - over such a large sample set of large cap stocks - really shift in each passing year as much as the average stock price would suggest? Or perhaps is it indicative of the consistency with which short-term sentiment (greed and fear led overreactions) drives price movements?

The opportunity to exploit stock market pricing inefficiency, has attracted a global mass of highly competitive fund managers - all seeking to outperform the market over time.

And given the persistence (every year), breadth (S&P 500 constituents) and magnitude (50% low-high) of variance in the common stock price, a natural presumption might be that a large percentage of professional fund managers consistently add value, outperforming their benchmarks.

However, the data suggests otherwise.

Recent S&P research (published in 2022) updates the well-known statistic that most investment managers underperform long-term. Their data suggests that 83% of Australian Equity Funds underperformed the ASX200 benchmark over a 15 year horizon, while International Equity Funds showed 95% underperformed over a 10 year horizon.

It's no wonder major asset allocators are increasingly allocating capital away from active toward passive investing - from 25% of global assets in 2018 to 34% by 2022.

We Must First Understand What Drives Underperformance

How do you back a manager, when history suggesting the average selection will disappoint long-term? To answer this question, a clearer understanding of why most managers fail is first needed.

One of the critical academic assumptions in financial markets is that professional investors are perfectly rational - continually optimising long-term, value-maximising decisions across stock selection and portfolio allocation.

In reality, investors are in the business of operating with incomplete information, and are continually making decisions today with uncertain long-term outcomes.

With this uncertainty in mind, it is not primarily the outcome the investor is attempting to maximise, rather, it’s how they feel about the decisions they are making today, and the comfort with these they are seeking to maximise.

According to Andrew Lo’s Adaptive Market Hypothesis (2004), human decision making follows evolutionary constructs, whereby investors - with their limited computational bandwidth - develop heuristics based on recent experiences, and continually adapt these to changing market conditions.

To build on this idea, we’d go further and suggest that these evolutionary constructs extend to investor sentiment. Or more simply, recent market experience directly impacts how investors respond to uncertainty, resulting in “comfort-adjusted” decision making.

Take for example, the sentiment that feeds on itself in a bull market. Retail investors expand visions of wealth maximisation (dreams of retirement) and asset allocation is influenced by a growing comfort with risk-taking as uncertainties become down-weighted in the investor’s mind. Continual rewards in one year will influence behaviour in the next. Meanwhile, institutional fund managers - where client satisfaction is heavily influenced by the latest one-year market comparison - strive to outperform rising benchmarks and shift to a ‘where's the upside’ mentality.

In bear markets, investor psychology evolves. Retail investors - experiencing the pain of losses - increasingly optimise decisions toward wealth preservation, striving to reduce the growing discomfort with uncertainty. Institutional investors ‘get defensive’ looking to minimise underperformance, client outflows and career risk.

While this example depicts psychology through a larger market cycle, the same behaviour manifests itself at the individual stock level.

A business’ longer-term risks are often quietened in the investor’s mind when it is presently reporting positive earnings momentum, the crowd cheer the stock on, resulting in an expanding PE ratio paid on rising earnings. When the momentum slows - perhaps temporarily reversing - the narrative shifts and long-term risks become a heightened focus again. Uncertainty rises as the bearish internal monologue gets louder and the crowd of sell-side analysts offer an echo-chamber of cautious commentary, resulting in rapid PE ratio compression on falling earnings expectations. In this way, recent experience directly affects the feeling of uncertainty, resulting in greed-and-fear motivated comfort-adjusting of positions.

To overcome the involuntary nature by which humans are hard-wired to adapt decision making in response to recent experience, and sustain a consistency of outperformance over the long-term, an investment process needs to be dehumanised - insulated from the practitioners conditioning by recent experience.

Testing Managers on Psychological Considerations in Active Management

S&P data also tells us that skilled managers do exist. They’re just rare: 5-15% of those that have survived over 10 years.

Herein lies the opportunity - asset allocators that go against the trend of passive investing have an opportunity to generate premium returns - but a skilled manager selection process is a necessity.

It requires asset allocators to uncover professional managers with systemised processes to dispassionately generate ideas and allocate capital within a portfolio, and a culture designed to manage for human fallibility - preventing them from overriding the investment process.

Below we explore what we believe are the three most underappreciated team constructs and psychological attributes of successful investment managers that asset allocators should look for when assessing managers - the attributes worth testing for, beyond traditional performance analytics.

A firm-wide articulation of why and how.

Although this should be a given, it's worth restating upfront. Every manager must have a clear articulation of why their investment philosophy drives alpha over the long-run, and must be able to articulate how this is captured within their investment process.

We've observed many multi-style fund managers come and go - few have stood the test of time. Often the primary edge that's marketed is how the mix of style-based skills across a team creates a diversity of ideas conducive to all market cycles.

Theoretically this has merit. However, its achilles heel is the psychological bias that can manifest across a team. More specifically, where recency bias - overemphasising recent experience - results in style drift.

What we've observed is that without a unified philosophy, the loudest voice often becomes the most influential in the portfolio. The problem being that the loudest voice tends to shift over time toward those led by an investment style has been performing in recent years - often reaching its peak dominance when style-leadership is set to change. In contrast, the team members whose ideas have failed to perform for some years due to style headwinds see falling portfolio influence, and sometimes themselves abandon their prior convictions in order to maintain value within the team.

A better approach is to let the asset allocators blend the styles. That is, finding the best performing teams of stock pickers specialising in a singular style philosophy, and blending strategies together in their own asset allocation process.

Asset allocators should question investment managers & team buy-in on their core philosophy, and study whether or not historic performance was generated in a manner consistent with it. We recommend allocators take the time to meet team members individually, testing historic investment theses, depth of due diligence and the logic of sell decisions - looking for consistency with the firm’s investment philosophy.

Structures to overcome fallible human decision-making.

All managers are fallible humans, susceptible to emotions and bias. To manage these shortcomings, systems and processes create guardrails that hold an investment strategy to account. Structures allow for the repeatability of an investment process to maximise the durability of long-term alpha. At the other end of the continuum, overreliance on discretionary judgement can lead to a spiralling of poor decisions during a period of underperformance.

Asset allocators should seek transparency into the systems and processes used through the entire idea generation, research, and portfolio management process - looking back in history to see audit trails that provide evidence of how those processes were used through periods of heightened market volatility, when episodes of misjudgment are more likely to occur.

Allocators should obtain access to fund manager proprietary research documentation that supported historic investments, and study the research process undertaken on the portfolio position through time. A lot can be gained by observing the transparency and depth with which the analyst researched new risks, adjusted forecasts, valuations, and communicated with the team as the thesis played out, or broke down - tying this back to portfolio management decisions that were taken.

Cultural comfort & transparency in admitting to mistakes.

There's an old saying in funds management, "bad news travels slowly". We see this play out across listed companies and markets more broadly. For listed companies, perhaps it explains why the first profit downgrade is often followed by more, and in markets it links to why investors hang on to pre-existing investment theses despite new, disconfirming evidence.

The psychological factors that prevent a pragmatic acceptance and communication of bad news can come from multiple places: a fear of looking stupid or being wrong; an urge to appear consistent with previously stated beliefs; endowment toward an idea with significant historic research effort; the list goes on.

Investment management is the business of making future assessments based on incomplete information. We are fallible of being on the wrong side of a future probabilistic outcome, despite our best research-based efforts. Optimal cultures accept this, embracing bad news so teams can act pragmatically, making faster, better decisions.

We believe less is gained from listening to current stock investment theses - which one would expect always amount to compelling stories - and that more benefit is derived from digging into the past, looking for what went wrong, seeking evidence of research as a prior thesis broke down, and the manner in which the research was communicated to the team.

By questioning managers about historic mistakes made and looking for thoughtful explanations of what went wrong, and what was learned, asset allocators can uncover whether or not there is substance behind the sales pitch.

Investors unable to engage in thoughtful discussion as such, are either blind to their own shortcomings, or contributing to untransparent, ego-driven cultures.

Equally, managers should be able to demonstrate a clear understanding of what could go wrong with existing investments, and showcase proactive research to evaluate the potential risks they’re exposed to. Rather than ask, “why is XYZ stock one of your biggest positions?”, one could ask, “given XYZ is one of your biggest positions, please walk through what could go wrong, and the research you’ve completed to understand the risk?”.

What ECP Does To Address These Issues

With transparency at the heart of our core values at ECP, we constantly ask ourselves how we perform along these lines. When clients come in, we are transparent about all aspects of our research process, our systems, our wins and our losses, our lessons and strategies to improve - going back as far as clients wish to test us.

Over a decade, we've recruited our team around a singular philosophy - a belief that the economics of a business will drive its long-term share price performance, best captured by owning companies in the growth phase of their lifecycle. No investor has joined ECP without this philosophy already ingrained in their personal belief system.

We've built systems and processes to take the emotion and bias out of both the research and the portfolio management process. After ideas are generated they flow through an evidence-based research process to balance the investment case for review by the entire investment committee. At the portfolio level, no one individual makes subjective judgements about portfolio exposures: our models systematically reallocate capital toward our highest risk-adjusted return opportunities.

And finally, our culture has been steadily built upon for over a decade. As a team, we live or die by the performance of the entire portfolio. There's a 'no hero' and 'no blame' culture here - without it our team would not have functioned as cohesively as it has, driving the ECP Growth Companies Strategy, our long-running Australian all-cap strategy, to outperform its benchmark over the last decade^.

I would encourage all asset allocators to test their managers along these frameworks, and see what they uncover.

2 topics