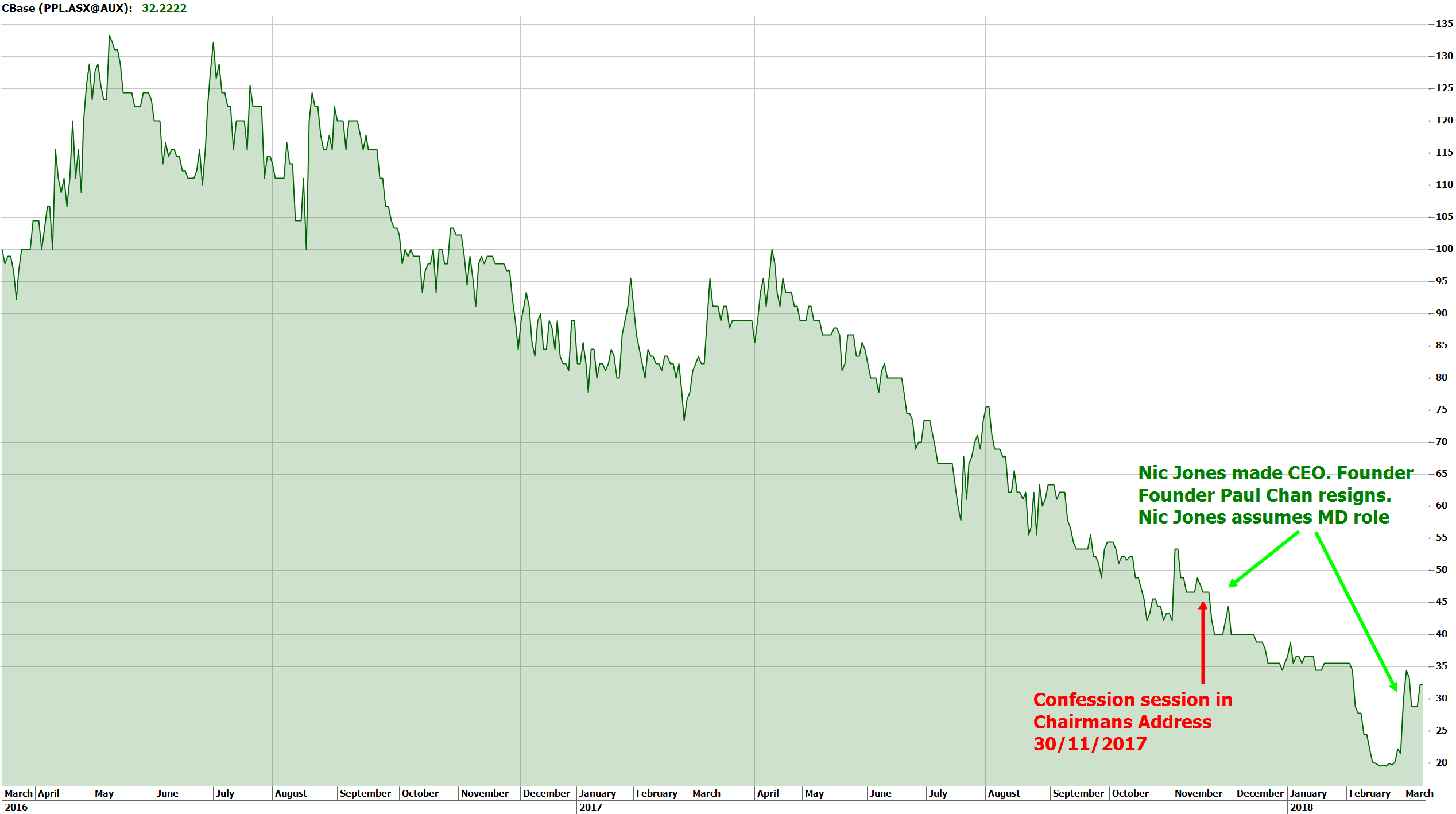

Pureprofile Limited (PPL.ASX) Cheap turnaround + is chairman spill setting up corporate play?

PPL has suffered a 2-year price decline and tore up around ~$40m in value since acquiring the Cohort business. I am more convinced now a turnaround is underway. Why? This is a real business that can benefit following management changes and substantial write-downs. I met with the MD recently, and if successful in delivering on his plan, the company may deliver NPAT between $1m - $4m in the next 2 years. The company could also be a prime corporate play at these levels. There is currently a requisition to remove and replace the Chairman with the former Cohort Founder/CEO, which may be cloaking the interests of other industry participants. Either way, at an $18m mkt cap ($0.15c), both scenarios are worth discussing. (VIEW LINK)

2 topics

1 stock mentioned