Qiao Ma and Jun Bei Liu's reasons for investor optimism

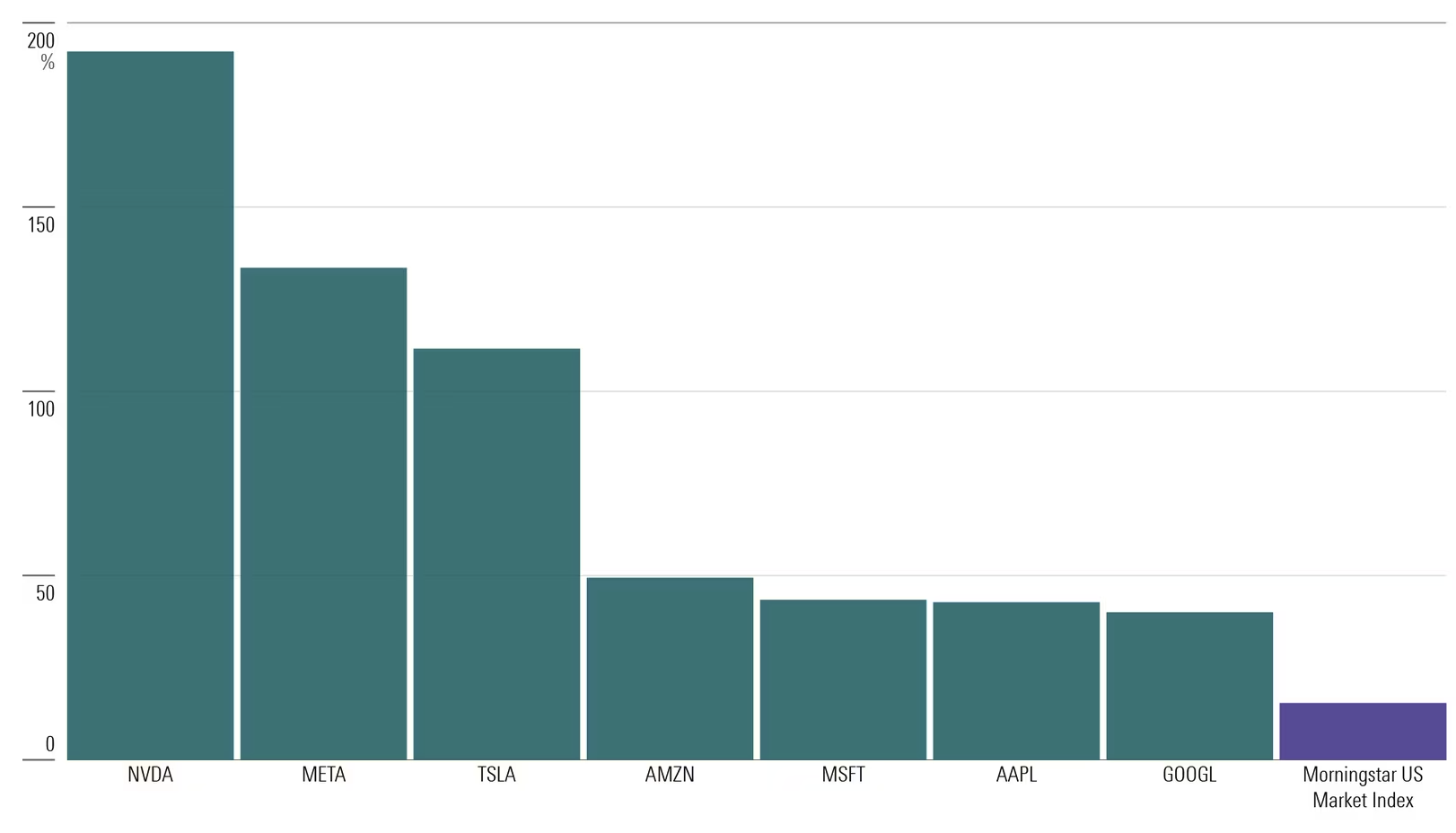

Artificial intelligence, a theme that has underpinned the share price growth of between 40% and 200% for the US’s “Magnificent Seven” technology firms in 2023 so far, was one of the core topics of discussion in a recent presentation headed up by Munro Partners' Qiao Ma and Tribeca's Jun Bei Liu.

'Magnificent Seven' 2023 stock price returns

Qiao Ma earned her stripes on Wall Street before landing in Australia about six years ago. She recently took up the role of portfolio manager at Munro Partners, heading up global equities, including the $1.4 billion Munro Global Growth Fund.

Jun Bei Liu is the portfolio manager of the Tribeca Alpha Plus Fund, one of Australia’s longest-running equity long-short funds. It’s also among our largest, with $1.2 billion in funds under management as of 30 June 2023.

But first, Qiao Ma explained why “resilience” is currently the word she associates with consumer spending and the corporate sector more broadly, particularly in the US.

“You can look at automotive and any discretionary or staple spending – and the wealth effect clearly plays a big role in this,” Qiao Ma said.

“The very tight labour market means everybody who wants a job has one, and those that stay in their jobs are actually getting paid more. That income translates into very robust and resilient consumer spending.”

Qiao Ma said this resilience “gives us confidence for the second half of the year and into the next, for the market overall”.

The poster child for this resilience more recently is the huge growth in demand (and share prices, as alluded to earlier) for AI - both the companies and the technology itself.

Which sectors will get the biggest AI uplift?

This remains an open question, with the winners (and losers) of AI still emerging – even the business models or potential use cases of chatbot technology such as ChatGPT and others remain uncertain. But in broad terms, Qiao Ma highlighted the huge uplift in demand for computing power that AI will drive. A beneficiary will be the semiconductor manufacturers.

“The first shot in the air”

Software companies are obvious leaders, but the numbers are worth highlighting. For example, some back-of-the-envelope calculations on Microsoft (NASDAQ: MSFT) suggest its new AI-enabled software, Microsoft 365 Co-Pilot, could equate to US$30 billion of “incremental, very high margin revenues.”

“If you plug into what the consensus is expecting Microsoft to do, that's roughly a 10% to 15% lift on the earnings per share for the company two years from now, in the financial year 2026,” Qiao Ma said.

The Australian AI perspective

Jun Bei noted that the Australian market will follow some distance behind the US in AI adoption, “but every company we’ve met in the last three months has talked about it” in terms of how they can utilise the technology for productivity improvements.

“But for locally listed exposure to the sector, you currently only really have the data centres. And NextDC (ASX: NXT) is very interesting, it’s been very well run and just recently expanded into Asia,” Jun Bei said.

She also talked about the rapid expansion of data throughput from companies such as Microsoft, which is tipped to grow by more than 40% over the next three years – some of which will flow through to data centre operators such as NextDC and other players.

Local inflation "sticky"

On the economy, Jun Bei believes inflation here may prove slightly “stickier” than in the US and expects to see one or two more interest rate rises here. But she sees many positive factors emerging over the next 12 months, with some already materialising.

Jun Bei sees immigration as a key cause for optimism locally, which underpins housing and many other parts of the Australian market. Australia remains in the early stages of the post-COVID recovery in immigration, with 700,000 new arrivals expected in the next couple of years, positioning us as one of the world’s highest-growing populations.

“That’s very supportive for Australia, with students a big part of that and these numbers are already well up,” Jun Bei said.

FY23 earnings season

Jun Bei Liu remains encouraged, even in the face of overwhelming negative analyst expectations ahead of the FY23 earnings season that starts next week.

“We'll hear more companies talk about that [during earnings season]. The house renovation side is holding up really, really well,” said Jun Bei.

On that front, she acknowledged this earnings season will see many companies downgrade their earnings outlooks, with commercial property as one segment that is lacking in confidence currently.

“For retailers and anyone that has fixed commitments in terms of rent and the like, and if you have debt, investors will be very much focused on whether you are a going concern,” she said.

“Those with high lease liabilities and high debt will be drilled this reporting season.”

Jun Bei also anticipates a softening in the outlook for the travel and leisure segment.

“Of course, Qantas (ASX: QAN) is still going to report a very good number as they update the market. But the outlook, as we have heard from some of the regional airlines, is that things are getting harder,” Jun Bei said.

“But as an investor, we love reporting seasons like this. We’ve been waiting for earnings downgrades and rebasing for the last six months.”

She explained that, for share prices to move higher, markets need a stabilisation of valuations and for earnings to be realistic.

“We’ve already got the stabilisation, now we need the earnings to be realistic,” said Jun Bei.

“We’re waiting for the cleansing opportunity because it’s a fantastic opportunity to take positions.”

3 topics

3 stocks mentioned

2 contributors mentioned