Quality in M&A crosshairs

We have seen several recent examples of M&A capital hunting for high quality businesses. This note details the experience through our short list of high quality companies taken over in a relatively short space of time.

M&A executed across our list of portfolio candidates over recent times highlights:

- Quality assets bid - the consistent underlying bid for quality assets is impressive, if quality assets trade too cheaply they won't last long in their current form. This somewhat underwrites valuations for true quality assets.

- Buy v build - post the recent inflationary years, whether assets are trading cheap or rich, it is now cheaper to buy v build in many cases

- Breadth of demand - perhaps the most interesting has been to see demand right across the spectrum of sectors and asset types - ag infrastructure, technology, financials and commodities, cyclicals & defensives, growth & value.

Deal details and premiums earned by holders (assuming held to completion):

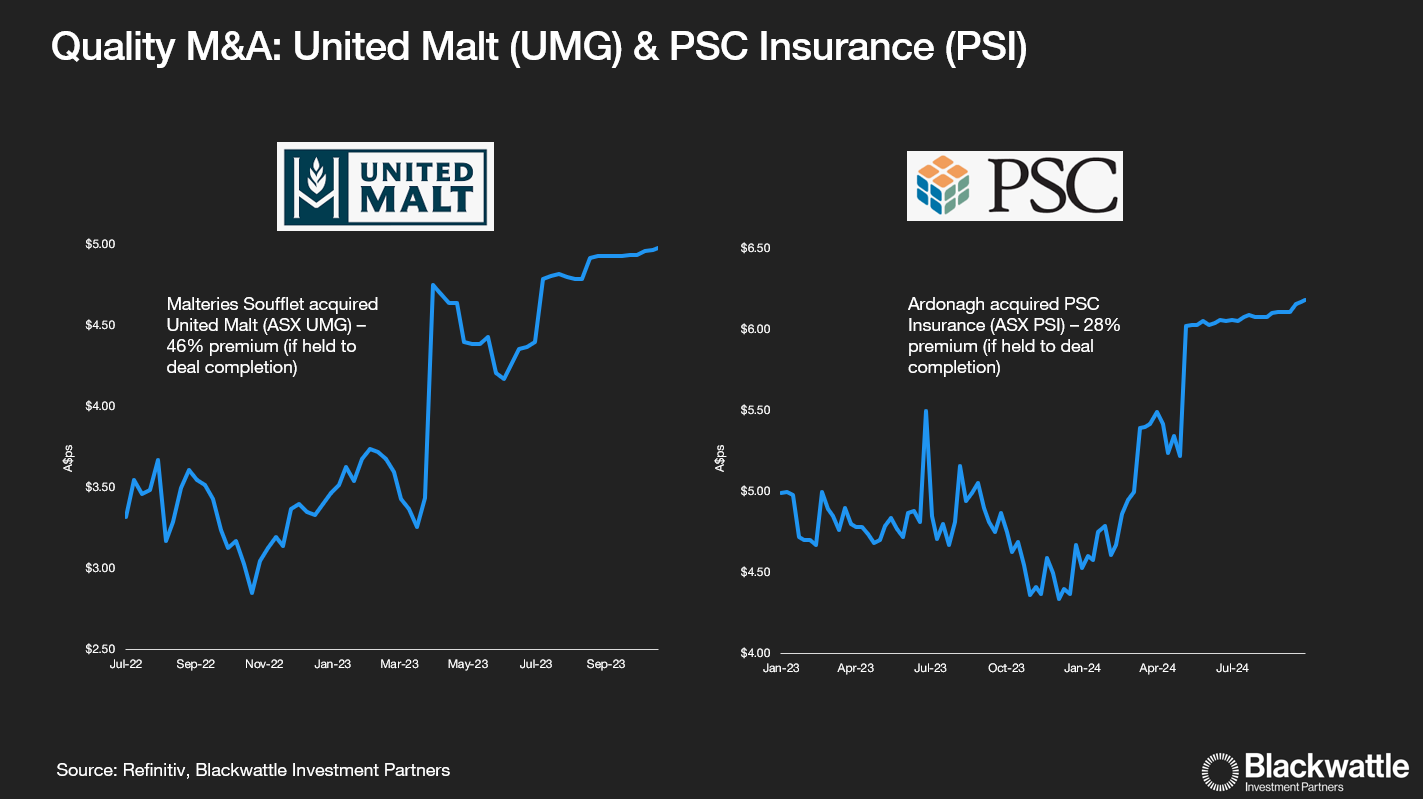

- United Malt (ASX: UMG) - Acquired by Malteries Soufflet in late 2023 - 46% premium

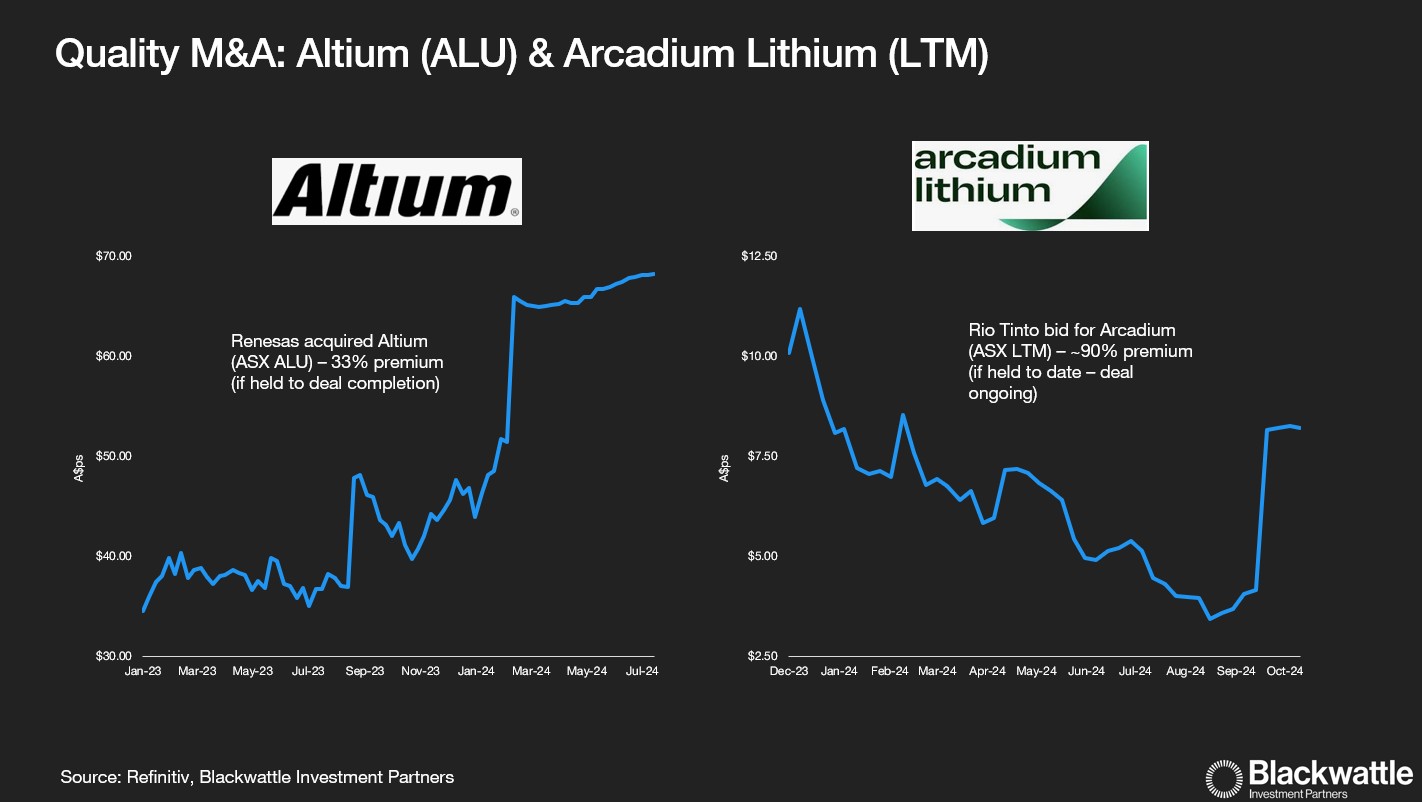

- Altium (ASX: ALU) - Acquired by Renesas in mid 2024 - 33% premium

- PSC Insurance (ASX: PSI) - Acquired by Ardonagh in mid 2024 - 28% premium (from undisturbed price)

- Arcadium Lithium (ASX: LTM) - Bid for by Rio Tinto (ASX: RIO) in late 2024 - 90% premium to date (bid ongoing - expected to complete mid 2025)

The examples we have seen over the last 12-18 months include a broad range of businesses across highly diverse sectors. Each has been acquired (or at least bid for & yet to complete) by another industry participant - larger, better access to capital, staff and arguably better placed to accelerate investment to achieve strategic growth plans.

For all the talk of private equity dry powder, two of the acquirers were at least part owned by PE firms looking to build scale in Global Malt, Malteries Soufflet (PE: KKR) and Insurance Broking, Ardonagh (PE: MDP).

Industry OGs Renesas (ALU) and Rio Tinto (LTM) took varying views to their acquisitions of smaller peers. RIO is taking advantage of cyclical weakness in lithium whilst Renesas was happy to acquire a strong business seemingly getting stronger in Altium.

Valuations ranged somewhat however in 3 of these 4 cases the listed market had expressed concerns about the suitability of the listed business with its strategy or position in the sector, which prevented the market from fully valuing the businesses:

- United Malt - Diverse global agricultural business however strategy lacking in capturing the attention of the market. Very high quality asset base.

- PSC Insurance - Significant founder and insider ownership prevented the business from being admitted to indices which arguably left the business out in the cold from an institutional ownership perspective. Undoubtedly very well run exhibiting the highest margins in the sector.

- Arcadium Lithium - A unique vertically integrated asset base not readily recreated, however the market was increasingly dubius around the ability of the company to fund the material production growth over the coming 5+ years, reinforced by the current low phase of the cycle.

The last of these cases is different in that an apparent valuation discount / cyclical pressure was not present:

- Altium - Renesas paid a fair premium on top of a long held hefty EV/EBITDA multiple of ~40x which highlights just how valuable a very high quality business on solid footing can be as the foundation of plans to establish a new growth platform.

Premiums are commonly expected at the rule of thumb level of 30% to get deals approved. The experience of this handful of transactions aligns closely in the first 3 seeing 46%, 28% and 33% respectively. The last however, LTM, is a ~90% premium, which from the chart above highlights how brutal the lithium cycle has been this year, the bid not even returning the stock to the levels it traded around at the start of the year.

The experience of the last while highlights the benefits of owning a highly diverse list of quality companies in concentrated positions. Whether they be improving from a challenged starting point or unquestionably high quality, demand is almost always present for quality assets from varying competitors and investors.

We take from this significant confidence that material capital is being deployed in diverse sectors supporting investment plans for these businesses, demonstrating strong confidence in global outlooks over the years ahead.

Which high quality company will be next to see corporate attention?

Follow Pete Wilson, Michael Teran and I at Blackwattle for insights into Quality Investing.

Disclaimer: The information contained in this post is not intended to provide any financial or investment advice and does not take into account or consider the recipient’s investment objectives, financial situation, or particular needs.

3 topics

5 stocks mentioned

1 contributor mentioned