Quality investing: Not just a wallflower

For years, the investment community has been caught in a seemingly endless debate between two schools of thought: growth versus value. While investors, portfolio managers, and market analysts have fervently championed one approach over the other, a third philosophy has been quietly outperforming: quality investing. Quality investing not only provides superior, above-average returns but also serves as a bridge between the polarising worlds of growth and value. Here, we delve into the nuanced world of quality-growth investing, offering fresh insights into the true meaning of 'growth.'

Quality companies are typically profitable, generate strong cash flows, and can reinvest those cash flows effectively. They display high financial productivity without much financial leverage, often reflected in strong free cash flows, high returns on investment (ROI), and high returns on equity (ROE).

Quality companies don’t just generate cash; they are adept at reinvesting it in opportunities that yield even higher returns - they are skilful in nurturing and expanding their resources, sharpening their competitive edge. This proficiency creates significant barriers to entry, allowing them to maintain elevated levels of financial productivity for more extended periods than market expectations suggest.

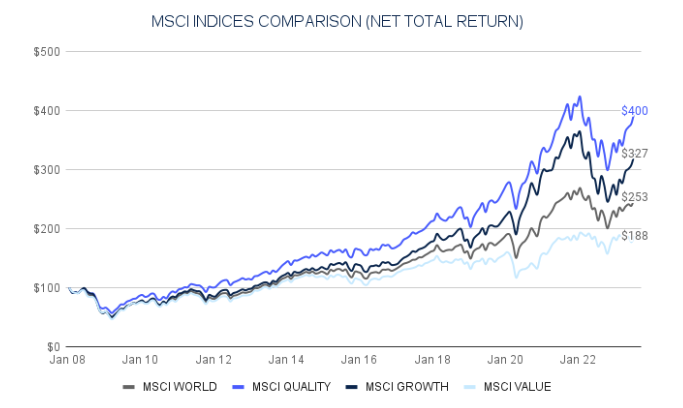

More recently, quality companies have consistently outperformed value and growth stocks, delivering a striking risk-reward profile that captures upside potential while mitigating downside risks. However, it's critical to define what we mean by quality and growth and, notably, concerning the latter, differentiate between the symptoms and fundamental drivers.

While typical factor approaches focus on largely backwards-looking quantitative measures to define these styles, our approach identifies high-quality companies in the growth phase of their lifecycle that can sustain competitive excellence over more prolonged investment holding periods. Simply, these companies are uniquely positioned to weather the inevitable ups and downs of market cycles, economic shifts, and fluctuating interest rates - they are resilient.

Metrics of Excellence

Our investment philosophy leverages two market inefficiencies: the growth anomaly and time arbitrage. Generally, the market undervalues exceptionally high-quality companies that exhibit capital efficiency and organic growth. It also tends to prioritise short-term factors or temporary themes.

Our research process has been deliberately designed to seek out the specific characteristics that these high-quality companies exhibit. The metrics underpinning these truly exceptional companies include high ROICs and ROEs (they are profitable), growing revenues with attractive margins (they are growing above the economy and operationally efficient), and low leverage.

Quality companies possess the potential to both endure and expand at a faster pace than their counterparts, resulting in exceptional long-term capital appreciation. The pivotal role of financial efficiency cannot be understated, as it directly influences aspects such as stability and minimized debt.

The market often undervalues these companies, presuming that competition will erode their advantages more quickly than they do. In reality, many of these businesses continue to thrive because they are both high-quality and in a growth phase, perpetuating a virtuous cycle of compounding returns.

Redefining 'Growth'

Growth factor investing focuses on companies with the potential for significant earnings or revenue growth, usually without concern for current valuation metrics. Growth stocks often come with higher volatility, but they also offer the chance of higher returns.

The typical metrics for identifying growth stocks include price-to-earnings (P/E) ratios, earnings per share (EPS), and sales growth. While growth factor investing has merits, it doesn't give the whole picture, often missing companies with high-quality fundamentals that can compound returns over time.

However, it's essential to clarify that 'growth,' in our context, does not align strictly with the typical factor style. Instead, it pertains to a company's life cycle phase. These companies are those in the expansion phase of their operations, they have moved beyond the startup phase, with growing customer bases, increasing revenues, and often achieving profitability.

Unlike in growth factor investing, the lens here is not just on past performance as a marker for future potential but also on the company's current robustness—its quality. The focus is not just on growth itself but the quality of that growth.

Quality and Growth: The Perfect Symbiosis

One would think that quality companies with such attractive metrics would be investor favourites. Yet, these organisations are often underrated. Prevailing market theory suggests that high financial productivity will inevitably draw competition, eroding the competitive advantage. However, this is a shallow understanding.

What distinguishes quality companies is their ability to generate large amounts of cash and reinvest it efficiently back into the business without eroding their high returns. Quality companies often create formidable barriers to entry through technological innovation, regulatory advantages, or strong brand loyalty. This helps maintain high financial productivity for extended periods, defying market expectations.

Such companies perpetuate a virtuous compounding cycle in various aspects like automation, technology, or research. Over time, this cycle solidifies, leading to increased cash generation and enhanced investor returns.

Importantly, quality companies often intersect with those in the growth phase of their business life cycle. Such companies are beyond their startup phase, and their key metrics, including customer base and revenue, are expanding. Typically, these are bucketed under the growth umbrella.

By identifying those companies in their growth phase, indicating a certain level of resilience and operational efficiency, investment portfolios have a heightened ability to generate capital growth.

These organisations offer the best of both worlds: they are not only financially productive but also embody the promising future typically associated with growth stocks. Hence, they provide a ‘quality-growth’ investment avenue, capturing both stability and the potential for high returns.

Harnessing Dynamic Competitiveness

By ensuring investment portfolios hold quality investments, these quality fundamentals act as the bedrock. By seeking out profitable companies, generating high cash flows, and having competitive barriers protecting those returns, investors are provided with a buffer against economic shocks. Here, we appreciate the role of capital preservation.

However, the durability of a company's competitive advantage is crucial for long-term returns. Resources at a firm's disposal may include proprietary technology, strong network effects, valuable brands, and a treasure trove of hard-to-assemble data, among others. These resources serve as protective moats that sustain a firm's competitive edge.

Resources not only differentiate a company but also create barriers to entry, thereby offering a safety net against market volatility and competition. At ECP, we spend most of our time understanding these drivers and the company's Dynamic Capability to ensure the longer-term sustainability of this competitive advantage.

An active investor with a deep understanding of these drivers of competitiveness and productivity has a significant edge, particularly when understanding their ability to sustainably renew their advantage through time.

On average, the market undervalues truly sustainable competitive advantages. By identifying a company that holds a Dynamic Capability, investors can identify undervalued assets whose long-term returns are more robust than the market currently anticipates, while driving competitiveness - a virtuous compounding cycle.

Investing doesn’t have to be an either-or decision between growth, value, and quality. In a world that likes to categorise and compartmentalise, Quality-Growth investing offers a more nuanced and potentially more rewarding path. By considering both business quality and whether it is in the growth phase of its lifecycle, this strategy aims for a balanced, high-performing portfolio that can withstand various market conditions.

Recognising Excellence

Quality investing is not merely a style but a comprehensive philosophy that provides a roadmap through the complex financial landscape. It has a track record of consistent performance over the long term, providing predictable above-average returns. This longevity arises from an investment focus on companies with robust financial metrics and strong competitive barriers, elements that together contribute to resilience and growth potential.

Consider Xero Limited (ASX: XRO), with its dominant cloud-based accounting platform, is well-positioned to withstand economic turbulence while maintaining its value proposition. Similarly, specialised firms such as PWR Holdings (ASX: PWH), a leading advanced cooling solutions provider, harness a competitive edge that fortifies them against economic downturns.

By recognising these fundamental characteristics that define quality companies, investors can more confidently weather market cycles. An understanding of what makes these companies tick is crucial for long-term success, allowing investors to reap greater rewards by focusing on these quality attributes.

A permanent allocation to high-quality companies in their growth phase in an equity portfolio can enhance returns and lower risk. Such companies not only offer growth but also come with the stability often found in quality stocks, making for a less volatile and more predictable investment journey - growth you can rely on.

In other words, quality isn't just a box to tick; it's a strategic focus that can serve as a reliable cornerstone in portfolio construction. By strategically positioning portfolios towards these high-returning companies, investors can not only bolster their portfolio's performance but also better protect themselves from downside risks.

Redefining Active Investment

A quality-growth approach takes into account both the quality of the business today and its potential for future growth, offering an investment strategy that delivers consistent, above-average returns.

For investors, the economics of a business drives long-term investment returns. By focusing on quality companies in the growth phase of their life cycle, an investor is pinpointing those with an enduring productivity advantage, supported by strong structural tailwinds, and can defend and expand their competitive advantages.

A quality-growth investor starts with quality fundamentals as a base foundation. This means looking for companies that are not only financially productive but also can reinvest capital at high rates of return. Moreover, the quality companies in the growth phase signify not just potential but also a certain level of proven resilience and efficiency.

5 topics

2 stocks mentioned