Rampant M&A is classic late cycle behaviour

The local market had a strong positive day on takeover optimism, despite weak US market lead and weak China data. Relatively low turnover continues into the eighth week without a double-digit turnover day. Size mattered as large caps were the best, while micro-caps were the worst. Tech and banks were the best sectors while materials and industrials were the laggards.

Iron ore has collapsed to the $180 range while more China regulatory moves are playing out. China data on the weekend suggests weaker growth ahead as the government moves hard to curb commodity prices and inflation worries. China continues to drive changes at the cost of markets and economic slowdown and we continue to see more action taken. It does not look like they are finished with the adjustments yet.

Central Bank manipulation of the markets is making it hard for investors with conflicting macro signals. The US Fed has centre stage as the US dollar is the global currency. Most global debt is issued in US dollar and the nation remains the dominant global economy - though is clearly past its peak - while the Fed continues to shy away from clearly indicating when tapering will begin. That leaves the market to guess at every macro data point.

Since the main economic indicator in play is the job market strength, the Non-Farm Payrolls (NFP) will be a major risk event, with the bigger question being what the market will do. The market wants weak economic data to keep stimulus for longer, though just strong enough to hurt corporate earnings.

The Fed will latch onto any weakness as a reason to keep QE going for longer. That would suggest that a strong NFP should get the taper tantrum. But history suggests that we will get a parade of Fed presidents telling the market to ignore the strength in the NFP, as it is due to some one off events…that’s right…it’s transitory. The problem with macro is not that it is unclear, but that it hinges on how the market wants to take it.

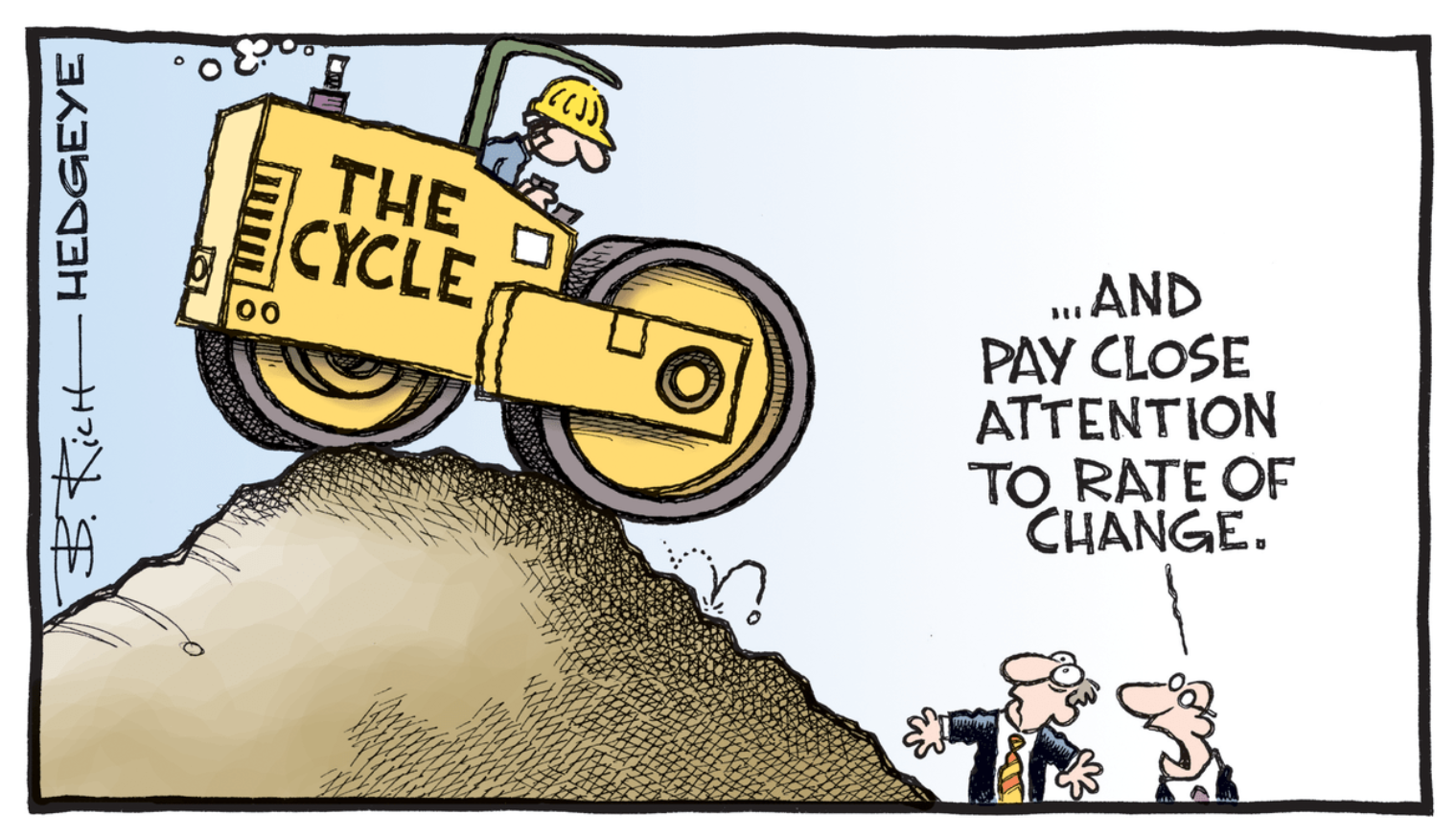

The markets will always remain optimistic until it’s not. The risk for investors is trying ride the late cycle wave. Everyone knows the music can stop any time, but risk only matters if you believe the Fed will let the cycle play out - and the market clearly believes otherwise. Time will tell if that can be sustained. It may be different this time!

It is clear that we are late in the cycle when the rush for M&A is rampant. The lack of growth initiatives and lagging capex over the years have left many stocks with very little growth ahead of reporting season.

The rush for M&A is hitting a fever pitch. The top 20 to 30 best-performing stocks today were takeover candidates in every sector. Let’s look at the two main plays of recent days in Afterpay (ASX: APT); and the Santos (ASX: STO) merger with Oil Search (ASX: OSH).

On the first of these, it is interesting that Afterpay is being taken out at an almost 20% discount to the company's peak share price of just under $152 in February. After pushing a big growth outlook, management has backed the deal without even opening up a bidding play. It shows that the industry is near maturity and needs a partner to get to the next level. New entrants into the sector probably made management face the reality of the company's weak moat.

And on the latter, the energy merger is another interesting deal with a former market darling. The irony of this deal is that Santos used to be the problem child, while Oil Search was one of the default choices in the sector. How the times have changed.

Seasonal cycles suggest the market peaks this week in the US as reporting season deluge hands over control to macro data. It may be different this time!

Key data points of the last 24 hours

The annual inflation rate in the Euro Area increased to 2.2% in July of 2021 from 1.9% in June, above market forecasts of 2%. It is the highest reading since October of 2018, flash estimates showed. Energy is expected to have the highest annual rate in July (14.1%, compared with 12.6% in June), followed by food, alcohol & tobacco (1.6%, compared with 0.5% in June); services (0.9%, compared with 0.7% in June); and non-energy industrial goods (0.7%, compared with 1.2% in June). The monthly rate was -0.1%. Annual core inflation which excludes energy, food, alcohol and tobacco edged down to 0.7% from 0.9%. Excluding energy only, inflation was 0.9%.

Core consumer prices In the Euro Area increased 0.70% in July of 2021 over the same month in the previous year, preliminary estimates showed. Core inflation slowed from 0.9% in June and came lower than market forecasts of 0.8%.

The Euro Area economy expanded by 2.0% on quarter in the three months to June 2021, rebounding from two consecutive periods of contraction and beating market expectations of 1.5% growth, a preliminary estimate showed. The bloc's economic recovery gained momentum on the back of the continued re-opening efforts, helped by the rapid pace of COVID-19 vaccination and ongoing government support. Among the bloc's biggest economies, Germany, France and Spain returned to growth, and Italy's expansion gathered pace.

The Canadian economy likely expanded 0.7% mom in June of 2021, due to the easing of public health measures in many provinces, preliminary estimates showed. In May, however, the GDP contracted 0.3% month-over-month, following an upwardly revised 0.5% decline in the previous month, in line with forecasts. Overall, 12 of 20 industrial sectors were down as activity retreated in both goods-producing industries (-0.4% vs 0.4% in April), mostly weighed down by construction (-2.3% vs 1.9%) and manufacturing industries (-0.8% vs -1.1%); and in services-producing industries (-0.2%), primarily real estate, rental & leasing (-0.4% vs -0.8%), retail (-2.7% vs -5.7%), and wholesale trade (-0.6% vs 0.3%).

Producer Prices in Canada increased 16.80% in June of 2021 over the same month in the previous year. The industrial product price index in Canada was flat month over month in June of 2021, compared to initial estimates of a 0.4% fall. The biggest influence was the decline in lumber and other wood products (-6.8%). If lumber and other wood products were excluded from the calculation, producer prices would have risen 0.6%. On the other hand, meat products were up 3.7%, a 6th consecutive monthly rise, due to seasonal demand and supply chain disruptions as well as higher prices for animal feed (in the months leading up to June). Year-on-year, industrial producer prices increased 16.8% year-on-year in June of 2021, higher than initial estimates of 16.2%, but easing from 16.9% in May.

Personal income in the US edged 0.1% higher in June 2021, trying to recover from a revised 2.2% drop in May and beating market expectations of a 0.3% fall. The increase in personal income in June primarily reflected an increase in compensation of employees driven by private wages and salaries, while government social benefits decreased. Within government social benefits, "other" social benefits decreased as economic impact payments declined. Unemployment insurance also decreased, led by decreases in payments from the Pandemic Unemployment Compensation program.

Personal consumption in the US surged 1% mom in June of 2021, rebounding from a 0.1% drop in May and beating market forecasts of a 0.7% increase, as consumers shifted spending to service-sector industries, such as restaurants and travel. The rise in spending on pharmaceuticals, gasoline, food services, accommodations, and other energy goods more than offset a decline in purchases of motor vehicles and parts.

Core PCE prices in the US which exclude food and energy increased 0.4% mom in June of 2021, easing from a 0.5% rise in May and below forecasts of 0.6%. The annual rate, however, edged up to 3.5% from 3.4% but was below market forecasts of 3.7%. Fed officials have been reiterating such price pressures are transitory because of fiscal stimulus, supply constraints, and rising commodity prices. There is also a low base effect from last year weighing as the coronavirus pandemic dented economic activity and lowered prices.

The official NBS Manufacturing PMI for China fell to 50.4 in July 2021 from 50.9 a month earlier and missing market expectations of 50.8. This was the weakest pace of increase in factory activity since a contraction in February 2020, amid the Delta variant of COVID-19 outbreak in the eastern city of Nanjing, higher material cost, and extreme weather. Output (51.0 versus 51.9), new orders (50.9 vs 51.5), and buying level (50.8 versus 51.7) all rose at softer paces; while export sales declined the most in three months (47.7 versus 48.1). Meantime, employment shrank for the fourth month in a row despite the rate of falls softening from the prior month (49.6 versus 49.2. On the price front, both input cost (62.9 versus 61.2) and selling prices (53.8 vs 51.4) went up faster. Looking ahead, sentiment weakened to a one-year low (57.8 vs 57.9).

The official NBS Non-Manufacturing PMI for China dropped to a five-month low of 53.3 in July 2021 from 53.5 in the previous month, amid an outbreak of the Delta variant of COVID-19 in some parts of the country, particularly in the capital of China’s eastern Jiangsu province, Nanjing; and severe floods in central China. New orders shrank for the second consecutive month (49.7 versus 49.6 in June), export orders declined for the fourth month running (47.7 versus 45.4), and employment continued to fall(48.2 versus 48.0). Prices data showed input cost inflation was little changed from June's seven-month low figure (53.5 versus 53.4) while selling prices went up the least in three months (51.3 versus 51.4). Finally, confidence hit its lowest in six months (60.7 versus 60.8).

Job advertisements in Australia declined by 0.5% month-over-month to 206,819 in July 2021, after a downwardly revised 1.5% gain a month earlier to the highest since 2008. This was the first drop in job ads in 14 months, as COVID-19 related lockdowns cooled demand for labour. "This reinforces our expectation that the impact of New South Wales’s extended lockdown on employment and the unemployment rate will be limited; hours worked and underemployment will again bear the brunt," said ANZ senior economist Catherine Birch.

"Many businesses are 'hoarding' labour to avoid the costs and delays of rehiring once restrictions ease, particularly given reported difficulty finding labour and the record-high job vacancy rate," she added. On an annual basis, job ads surged 94%.

The Caixin China General Manufacturing PMI fell to 50.3 in July 2021 from 51.3 in June, missing market estimates of 51.0. This was the lowest reading since April 2020, amid the Delta variant of the COVID-19 outbreak in Nanjing, higher material cost, and extreme weather. Output grew the least in 16 months, input buying rose at the softest pace in four months, while new orders fell for the first time since May 2020. Meantime, export sales remained stable while employment was little changed and outstanding workloads went up slightly. At the same time, supply chain delays persisted, with average delivery times increasing solidly. On the price front, inflationary pressures softened as input cost rose the least since November 2020 and the rate of output charge inflation slowed, with selling prices rising slightly. Looking ahead, sentiment slipped to a three-month low, on concerns over how long it would take to get the global pandemic under control and ongoing supply chain disruption.

Comments on the US market last close

The US market was negative due to weaker growth running into rising inflation and delta wave worries. Asia was mainly negative as was Europe, which then flowed onto the US. NASDAQ -0.71%, RUSSELL -0.62%, S&P -0.54% and DOW -0.42%. The VIX popped back above 18 again. PCE data was rising but tick below expectations. It's funny how forecasts for positive catalysts are weak and easy to beat, but negative catalysts are high and harder to beat.

The St Luis Fed President suggested the US Fed should flag tapering in the September meeting and finish tapering by March. As much as I would love normalcy, central banks are not going to give up control. Like power, fiscal stimulus is addictive for markets. Yields were lower with metals, while the US dollar climbed on risk off.

Oil held up better than metals. Markets are realising the world is likely to go through different opening up cycles over the next few years and that will keep growth weak and inflation persistently elevated. The US Centre for Disease Control's backflip on mask-wearing by vaccinated individuals is driven by their ability to carry substantial viral loads and spread it while still asymptomatic.

There seems to be no other solution other than a vaccination rate north of 80% to keep the risk down. The CDC indicated that 74% of infected cases in Massachusetts were fully vaccinated. Unvaccinated individuals are in real risk from vaccinated carriers. We are learning new things each week.

You can view the full Sunset Strip report, with charts and the end of day market stats, on the following link.

Not an existing Livewire subscriber?

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

1 topic

1 contributor mentioned