RBA Governor Lowe: Inflation will remain elevated until housing supply is resolved

After 10 successive meetings and 350 basis points in rate hikes, the Reserve Bank of Australia delivered a pause at its meeting yesterday. While it was a sure bet in financial markets, it was a much more line-ball call among the professional economists. The Bloomberg survey had 19 economists calling for a pause and 11 in favour of a hike.

But while the pause in interest rates is great news for mortgage payers, Governor Philip Lowe cautioned consumers and investors alike not to get too excited.

"The decision to hold interest rates steady this month provides the Board with more time to assess the state of the economy and the outlook, in an environment of considerable uncertainty."

The optionality did not go unnoticed and today, journalists were given the opportunity to hear from and ask the Governor about the factors influencing this week's decision. And I'm proud to say that one of those journalists in the room was yours truly.

This wire will summarise Lowe's presentation as well as the Q&A section which followed.

.png)

RBA Governor Phil Lowe on stage alongside ABC 7:30 Chief Political Correspondent/National Press Club President Laura Tingle

Why did the RBA pause rate hikes?

Firstly and most importantly, a pause in rate hikes does not mean the end of those rate hikes. In its decision (and the address delivered by Lowe), the Board emphasised that it was pausing rate hikes only because it needed time to assess what 10 successive increases to the cash rate is doing to the Australian economy.

"The decision to hold rates steady this month does not imply that interest rate increases are over. Indeed, the Board expects that some further tightening of monetary policy may well be needed to return inflation to target within a reasonable timeframe."

Bloomberg's Australian economics reporter Swati Pandey went one step further in the Q&A section, asking if those higher rates are here to stay. Governor Lowe responded definitively in the affirmative.

"It's not a matter of being uncomfortable. If we need to keep them higher, then we will do that."

Naturally, this decision is a data-dependent one (as is for all central banks in this day and age) but the comments are certainly hawkish.

Monetary Policy: Demand and Supply

As uninspiring as it sounds, this was the title of Governor Lowe's presentation. The focus was on emphasising the difference between supply-side and demand-side inflation factors. Central banks mainly work on the latter but it's the former where the problems are, as the Governor explained in his prepared remarks.

"Dealing with the supply-side issues will be harder, not easier, if inflation stays high for too long. The Board is committed to making sure this does not happen and the way we will do so is to manage aggregate demand with interest rates."

Translation: Interest rates will keep going higher if the inflation we cannot control remains stubborn.

Beyond the pandemic, Lowe is concerned about three supply-side inflation drivers.

1) Supply and demand in the housing market

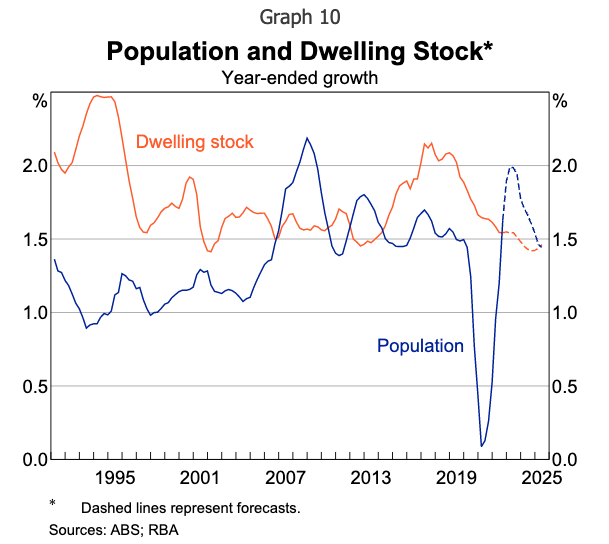

Rents make up 6% of headline inflation, and they are continuing to rise. Population growth is also of concern here. Australia is taking in more migrants but there isn't nearly enough housing to shelter them all. As Lowe said:

"It takes a long time for housing supply to respond fully to shifts in population growth – in the previous episode of strong population growth, it took around five years."

Depending on how long it takes for housing supply to balance out with demand, rents inflation may continue to remain strong for some time. That will keep headline inflation elevated, and put a thorn in the RBA's side.

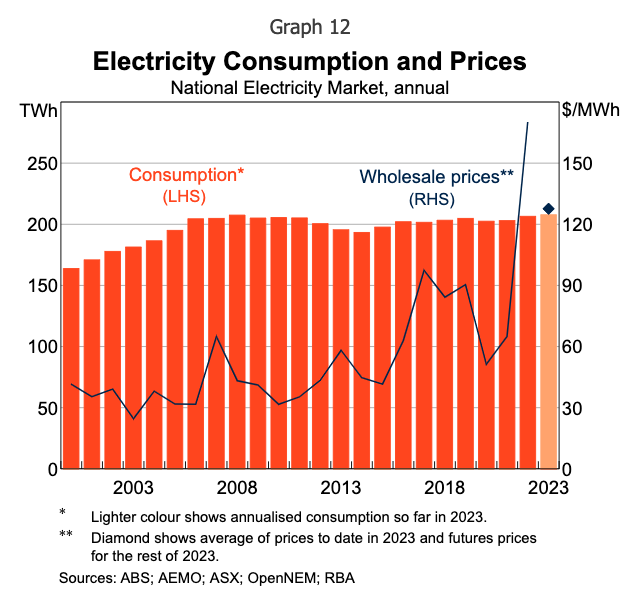

2) Energy inflation

The RBA expects electricity prices to increase by another 15% this year in addition to last year's 12% increase. While the supply-side issues have abated in some cases, it's all about the timing between ageing power plants and the installation of renewable sources elsewhere.

3) Labour productivity

In recent years, output per worker per hour has slipped to levels not seen for three years. The argument is that since the supply-side of our economy is growing more slowly than it once did, demand also needs to grow more slowly if we are to avoid persistently higher inflation. The fall in labour productivity is a more general, multi-year thematic but it is, nonetheless, part of the reason why inflation may not return to target until mid-2025.

Livewire asks Governor Lowe

As part of the address, journalists were invited to ask one question to the Governor. Most of the journalists had questions around housing and inflation. Livewire chose to take a different approach, asking the following:

The Board decided to keep rates on hold but the optionality was clear. How much of that optionality comes down to the concerns over the effect of rate hikes on mortgages (i.e. debt trap) here at home and how much of that was down to global factors like other central bank decisions or the global banking crisis of late?

This was Lowe's response:

"I wouldn't use that language (debt trap) but the higher level of household debt is constraining household consumption. It is clear. We have got highly indebted households which is facing a sharp increase in interest rates. It's not surprising that spending is slowing but that's what we needed. It's part of the rather uncomfortable truth here. We needed growth and aggregate demand to slow. It was growing too quickly relative to the ability of the economy to produce goods and services.

If we allowed that situation to continue, inflation was not going to come down. The higher interest rate is the mechanism through which spending slows. It's not the only mechanism, there are other transmission mechanisms of monetary policy including the effect on exchange rates, housing prices, and the incentive for everyone to borrow and save. We have had to do this to get inflation back down."

Why ask about debt traps?

The latter part of our question to Governor Lowe is fairly straight forward. In most RBA decisions, including yesterday's one, there is a reference to what other central banks in other jurisdictions are doing to combat soaring inflation and slowing global growth.

The RBA's inclusion of a paragraph dedicated to recent events in the global banking system also makes sense. It noted that a greater tightening in financial conditions is not good for an already-slowing global economy. It also sought to reassure the market that the Australian banking system is at little to no risk of contagion.

"The Australian banking system is strong, well capitalised and highly liquid. It is well placed to provide the credit that the economy needs."

But the first part of our question does also have an impact on financial markets even if it isn't obvious. The combination of high government debt levels and the unprecedented monetary expansion implemented by central banks around the world since the 2008 financial crisis has raised concerns about the possibility of a "central bank trap". The idea is that all these attempts to normalise monetary policy have been made all the more difficult by the unwinding of free money. And depending on who you ask, the only solution to this problem is likely going to be a deep recession.

Notable economist (and permabear) Nouriel Roubini is one of those arguing that a deep recession is the only way out. Locally, former Treasurer Peter Costello has questioned why debt levels remain so high and have not been reduced from a fiscal perspective.

Lowe's response did not tackle the debt trap concept directly but his response implied that interest rate decisions are made agnostic of mortgages despite the fact Australia is one of the most highly indebted nations on the planet. His response to our question also reflected a theme in other responses to other journalists' questions - consider the alternative had interest rates not increased.

Where do we go from here?

The economics community remains divided on this one. The AMP team led by Shane Oliver continues to call for a rate cut by the end of this calendar year while HSBC's Paul Bloxham simply believes we're going to remain at this level for some time.

In contrast, ANZ's Felicity Emmett argues the tightening bias remains and that there are more rate hikes down the line after today.

And Westpac's Bill Evans argues there will be one more rate hike in May before the rate hikes stop for good in this cycle.

A lot will be revealed on April 13th when the March jobs data hits the wires followed by Q1 inflation on April 26th. Set your alarm by it.

Note: The public broadcaster carried the National Press Club address of the RBA Governor. You can rewatch his speech here:

3 topics

1 contributor mentioned