RBA held interest rates steady at 4.1%, Bank of Canada left interest rates unchanged at 5%

Let’s hop straight into five of the biggest developments this week.

If you’d prefer to watch this update, rather than read it, please click below.

1. RBA held interest rates steady at 4.1%

The RBA sat on its hands yet again as they held interest rates at 4.1%, which was a third consecutive interest hold. With inflation easing to 4.9%, from the December peak of 8.4% and the labour market cooling, the RBA is betting on the continuation of these trends as the economy slowly inches towards its 2-3% inflation target.

2. Australia’s GDP q/q grew 0.4% in Q2

The Australian economy demonstrated relative tenacity to post a 0.4% growth in the second quarter of 2023. Despite relentless monetary policy tightening, the economy maintained the momentum from the 0.4% upwardly revised growth in the first quarter to post another 0.4% growth in line with market forecasts. Growth in the second quarter is underpinned by demand for Australian exports, which wrapped up a solid 2.1% GDP growth for the annual benchmark.

3. Bank of Canada left interest rates unchanged at 5%

The BOC left interest rates unchanged at 5% for a second straight month, a decision which was in line with market expectations. A sharp GDP contraction in the second quarter, in combination with weak consumer demand compelled the decision for rates to be held at 22-year highs. This was despite the BOC governor voicing concerns of elevated inflationary pressure. This admission left markets under the impression that this may be a pause before further rate rises.

4. US ISM services PMI surged to 54.5 in August

The US service sector expanded in August to 54.5, which beat market expectations that priced in a minor decline to 52.5. This was the eighth expansion in nine months, giving the US further hope of a soft landing. Seasonality assisted with record revenues and activity levels.

5. US unemployment claims fell to 216k

The US labour market continued its dynamism in the last week of August with a sharp fall in unemployment claims to 216k. This marked a major upset to markets that expected an increase to 232k from the previous reading of 228k. The figure is the lowest since mid-March, a testament to the relative strength of the US economy.

Below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

From being last week’s worst performer, the VIX soared on better-than-expected economic data from the US, in response, equities sold off. The Russell 2000 being the worst performer, down 3.3%. This strong economic data raised bets of further rate hikes. The strong data has driven the USD higher, hitting new 6 months high. Petroleum products rose on heightened demand from China as well as general global demand, coupled with a drop in supply. Category 4 Hurricane Lee is currently moving across the Caribbean, which has provided some respite to the selling in commodity markets over the last two days. Outside of this, commodity markets have been relatively quiet over the course of the week.

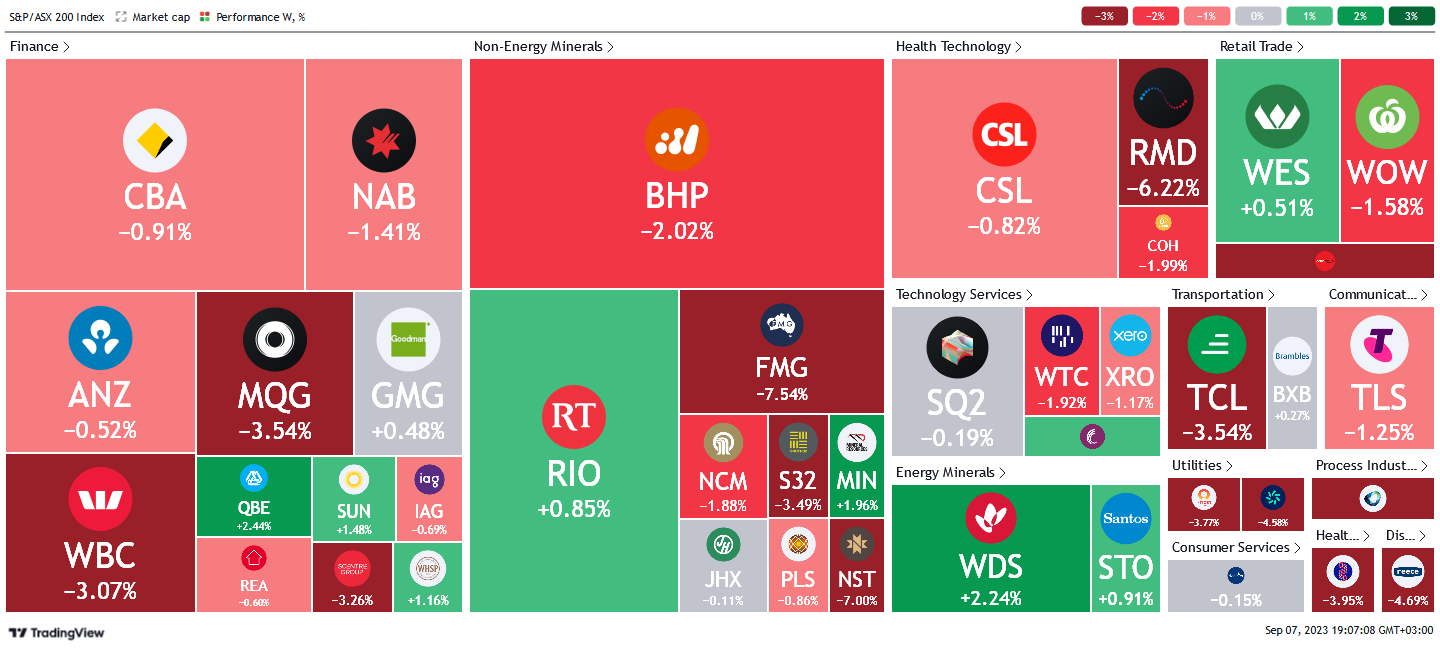

Here is the week's heatmap for the largest companies in the ASX.

The ASX 200 has sold off sharply with only minor glimmers of green across all sectors. Financials led the selling with SCG, MQG (mediocre FY report) and WBC being the worst performers. QBE and SUN showed solid relative strength. FMG continued to decline as management changes, iron ore prices and general sentiment towards them soured. MIN (acquisition announcement) and RIO managed to hold onto slim gains. Healthcare suffered another poor week, with RMD hitting its lowest price in over 2 years. Energies were the only real bright spot, with WDS and STO having solid weeks as energy commodities rebounded.

Below shows our proprietary trend following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

5 topics