Recession or not, the bull case for this investment opportunity stands

As the narrative changes, inflation worries recede and markets push back towards all-time highs, we’ve been speaking with fund managers who are more bullish than bearish, to find out why they hold that view and where they are hunting for opportunities.

Today’s installment is with Jodie Bannan, co-portfolio manager for the Platinum Global Transition Fund (Quoted Managed Hedge Fund).

The Fund was established around 12 months ago and following the investment ramp-up period, the PDS explains that the "portfolio will typically have 50% or more net equity exposure". At the moment, however, it is fully invested. As Bannan states, “We were 50% invested by December and then 70% by January… we're about 90% at the moment”.

As you will discover in the following wire, Bannan and the Platinum team are bullish on the theme of global energy transition in spite of the reservations about the broader market and economic conditions which Bannan herself describes as “quite a volatile, uncertain and mixed environment”.

The dirty words

The words ‘energy transition’ conjure up emotions for a lot of investors, perhaps because they have been hijacked by political and social movements that have a barrow to push.

But Bannan very eloquently strips all that back and points out that “we've always been transitioning”.

“I think people think it's a new thing. The world has been transitioning and becoming more efficient in terms of how we produce and consume energy for decades," Bannan said.

"This is not a new phenomenon, it's just that we've heard a lot around a government or political movement and setting these net zero targets and people assume that we've only just woken up and thought about some of these things, but this has been going on a long time," she added.

It's an important point. It's natural that society is trying to become more efficient in producing and consuming energy, in the same way the new iPhone is more efficient and more functional. It’s what we do as a species - we move forward.

And it’s through that lens that Bannan is viewing the opportunity, coupled with the traditional method of looking for companies at the right price.

‘We believe the price you pay really matters, as it will influence the return you make. And we're more likely to find mispricing and the great opportunities in those areas that are temporarily out of favour with the market”, says Bannan.

Bannan adds that some companies involved in the global energy transition are going to be dealing with short-term setbacks or periods of uncertainty, or they might be experiencing significant structural change, which Bannan believes is under-appreciated by the market.

“We think the global energy transition offers investment opportunities and mispricing across both of these areas. It's a significant structural change. It's the largest capital investment cycle the world's ever attempted, and it's impacting a really broad universe of industries and economies at different points in time”.

The opportunity set

When talking about the opportunity set that is energy transition, Bannan points out that there are some preconceived views that it's quite narrow, “and that we're talking about the disruptors or the new industries that will need to make this transition happen”.

That's not how Platinum defines the companies that are going to financially benefit from the change. Bannan suggests that the opportunity set “is extremely broad and, in fact, there are a lot of old world industries that have been on this journey for decades”.

She goes on to point out that battery producers have been on the journey, developing different chemistries, for more than a decade. And Platinum has been looking at the space for around eight years. When we see electric vehicles on the road today, that means the supply chain that allows that to happen has been in development for a long time.

“We've already seen a few cycles in some of these components and enablers of the transition. If you think about the metals that we need (copper) and the materials we need for the circular economy (whether it's pulp and paper), these are not new industries”.

Looking ahead

Whilst energy transition is potentially a multi-decade opportunity, over the next 12-24 months Bannan “can find many different ways to invest and make money, despite a slowdown in broader economic growth and potential recession”.

One of the main reasons for that is that certain industries are experiencing pressure to reduce emissions right now, whilst governments are forcing the changes.

“Companies are investing capital for the change. Then you have shareholders and customers and employees all holding these companies to account and monitoring for progress. We can see new markets evolving, attracting capital investment, and many companies if they're not investing today, they really risk losing their competitive advantage or may even suffer reputation or brand damage”.

“An economic downturn will not impact the pace of that investment across a number of different industries, whether it's electrification of transport, efforts to improve energy efficiency in buildings and manufacturing”.

Where are you hunting?

Whilst energy transition is a broad brush and, by Bannan’s own admission is “impacting all of the different sectors we look at here at Platinum”, there are a few key areas of focus – a number driven by the Inflation Reduction Act (IRA) in the US.

Energy storage is one such area. “We see the South Korean battery giants, LG Chem (KRX: 051910), Samsung SDI (KRX: 006400), all wanting to invest in the US to take advantage of those subsidies”, says Bannan.

Energy Storage – Battery storage charging up

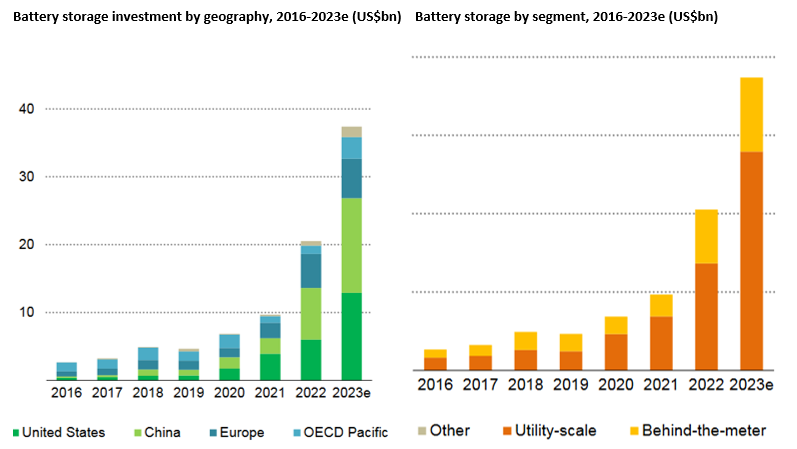

The charts above demonstrate the significant growth in investment for battery storage for both electric vehicles and grid storage applications. (Source: Platinum Asset Management

Electric transport and EVs are another area of focus for Bannan, along with grid infrastructure, whilst industries “that are having a recession now” are also of interest.

Bannan highlights pulp and paper and semiconductors as industries areas that have suffered a huge period of de-stocking over the last 12 to 18 months, which provides Bannan the opportunity to buy good companies at great prices.

“These de-stocking events that happen in certain industries we view as temporary setbacks. And so that has provided really attractive opportunities to invest. Last year gave us our position in semiconductors”.

Bannan also highlights energy production and transition metals, focusing on uranium where there are “signs of supply deficit” and copper, “a critical material we need for the build-out of many different areas in the transition, including wind and electrification of transport and grid infrastructure”.

Stock specific

When it comes to stocks, it might surprise that an ASX-listed energy generator and retailer has the biggest weight in the portfolio. The company is AGL Energy (ASX: AGL), which also highlights the previously discussed misunderstanding some investors have about exactly what constitutes an energy transition opportunity.

Bannan notes that AGL is “progressively closing its coal-fired generation and investing in renewables and firming assets, such as batteries. We think electricity demand, as many would, will grow as customers shift away from fossil fuel consumption. And AGL is very well positioned to benefit from this transition here in Australia”.

The AGL share price has rallied strongly this year and Bannan notes that at the time of the Fund’s investment “the company was dealing with how to plan for these significant changes in its business, and there are a number of internal setbacks that many would be familiar with”.

“The market had become very negative on AGL for a number of reasons. They had outages at their power generation assets that cost them both in terms of the power earnings, and hedging losses. There were falling power prices last year. There was a failed attempt to de-merge its generation and retail businesses back in 2021 and '22, the CEO exited, there was an unsuccessful takeover bid for the company by Brookfield and Grok in '22. A lot of instability at the management and board level, and earnings fell from a $1.60 per share in 2019, to 34 cents in 2022.

There was a lot of negativity surrounding the stock. That is our hunting ground" says Bannan.

Bannan goes on to explain that Platinum met with AGL management and understood the changes that they were making internally.

"We understood that they knew that they'd lost their social licence to operate its gas and coal generation indefinitely, and they were planning for these changes whether the government was pushing for it to happen or not”.

It has been a worthwhile investment and Bannan isn’t giving up on it yet.

“What we see in AGL longer term, is that it's got a great commercial, industrial and retail customer base. We think the company's in pretty good shape, with very low-cost assets, and great infrastructure on the ground to benefit from the transition. We'd be holding on for a bit longer.”

As mentioned above, Bannan also likes the battery space and holds positions in LG Chem (KRX: 051910) and Samsung SDI (KRX: 006400). But another that the Fund was buying earlier this year is Chinese battery manufacturer CATL (SZE: 300750), which is the largest large battery producer globally.

At the time positions were taken in LG Chem and Samsung SDI, as Bannan explains, CATL “was trading on over 40 times forward earnings and not very attractive for us to own at the time. We were patient with that one. When China pulled its subsidies in EVs earlier this year and we had a slowdown in momentum in China, CATL fell 40%”.

Bannan maintained the view that CATL was well positioned when it comes to batteries within its own market for electric vehicles, but also grid storage and also exporting that technology to the rest of the world, and ultimately bought the stock on the dip.

“We took a position in CATL earlier this year when the valuation was coming back to a more reasonable 20 times earnings for a company that's still able to grow its top line 30, 35% for the foreseeable future”

The final stock Bannan highlights is Cameco (NYSE: CCJ), which is the world's largest publicly traded uranium company, based in Canada, accounting for more than 20% of primary uranium supply.

Bannan likes this one because of the previously discussed supply deficit in the uranium market.

“We've got a great setup to see the uranium price really start to move up from here. Cameco is one we've invested in for a while”.

“We think it has a great opportunity to perform further from here. And they potentially have a fantastic acquisition in Westinghouse - assuming it gets approval - that will provide exposure to opportunities through the bulk of the nuclear fuel cycle".

What are the risks?

No investment opportunity is without risks and Bannan readily admits that there’s “a lot to balance” when it comes to the energy transition theme.

“If we're going to invest in some of these areas of big structural change, we first and foremost need to know what is within that company's control and what's outside of its control. We need to understand the political and regulatory environment in the areas we're investing in are aligned, they need to be supportive and encourage that investment”.

Bannan notes that while net zero targets are all well and good, they come with geopolitical tensions could frustrate the progress.

“We're seeing that in semiconductors, we're seeing that in batteries and the IRA even, encouraging investment from the Koreans into the US”.

The other point that Bannan makes is that “energy transition is a real engineering problem”.

Engineering problems require capital, government approval, and subsidies to support massive projects that need skilled workforces to design, construct, manage and operate the project – all of which carries risk.

“We need to understand, is the supply chain ready for these projects to ramp? Do we have the critical resources and materials?” asks Bannan.

“There's a lot of things that need to come together for this transition to happen. And there are a lot of things that can frustrate progress and/or derail momentum completely. There's a lot to think about”.

Fun(d) fact

A fun fact that Bannan was keen to point out is that the Fund can “short companies that have frothy valuations and can tell a good green story”.

Perhaps this is where some of the cynicism around energy transition comes from, i.e. a company’s ability to sell a good story for which Bannan has “heaps of examples”.

She adds that the Fund has been shorting green hydrogen hopefuls, EV charging companies that don’t have sustainable business models, and companies involved in heat pumps in Europe – to name a few.

“We're pragmatic. We look at those stories and think, ‘Sure, there's great growth opportunity’. But even if you think about a heat pump, it's not like selling an iPhone. You need to renovate your house. You need a subsidy from the government, otherwise the cost to do it is three to four times as much as the heating you're using today.

“There are real limitations to this growth, and that's what I'm keeping an eye out for”.

Ultimately, Bannan and the team have to believe “that the companies have sustainable business models and that they can fund their growth”.

Learn more

The Platinum Global Transition Fund (Quoted Managed Hedge Fund) aims to provide capital growth over the long term by investing in undervalued companies from around the world that are seeking to financially benefit from the transition away from fossil fuel-derived energy and goods production and consumption i.e. the carbon transition. Find out more below

Platinum Investment Management Limited ABN 25 063 565 006, AFSL 221935, trading as Platinum Asset Management (“Platinum”). This information is general in nature and does not take into account your specific needs or circumstances. You should consider your own financial position, objectives and requirements and seek professional financial advice before making any financial decisions.

You should also read the latest product disclosure statement and target market determination for the Platinum Trust® Funds and Platinum Quoted Managed Funds® before making any decision to acquire units in the fund, copies of which are available at (VIEW LINK).

Commentary reflects Platinum’s views and beliefs at the time of preparation, which are subject to change without notice.

Certain information contained in this presentation constitutes "forward-looking statements". Due to various risks and uncertainties, actual events or results, may differ materially from those reflected or contemplated in such forward-looking statements and no undue reliance should be placed on those forward-looking statements.

Past performance is not a reliable indicator of future returns .

To the extent permitted by law, no liability is accepted by Platinum for any loss or damage as a result of any reliance on this information.

3 topics

3 stocks mentioned

1 fund mentioned

1 contributor mentioned