Red Flags: How we avoid the Big Un & Blue Sky blowups

Quick Brown Fox

To potentially misquote Robert F. Kennedy, “Like it or not, we live in interesting times.” That certainly has been true in financial markets in recent months as volatility has returned. Fraudulent or misleading activity (or the discovery thereof) appears to be on the rise as well. Both domestically and internationally we are starting to see an increase in the number of companies that have been market darlings and yet have questionable financial statements. The rise of this trend is something we typically identify with the end of the cycle and we have a process designed to help us avoid the “blow ups” and protect our investors’ capital.

The world we live in is very complex and investment markets are a function of that. Company accounts are no different, complex accounting rules and various strategies can give the illusion of profit growth and mask what is actually happening. Perhaps the most famous case in recent decades was the rise and fall of Enron, a company that claimed to revolutionise the Energy markets. Investors initially bought the story and the stock soared. Then in rather swift fashion, the company went bankrupt and several executives were sent off to jail.

Source: The Economist

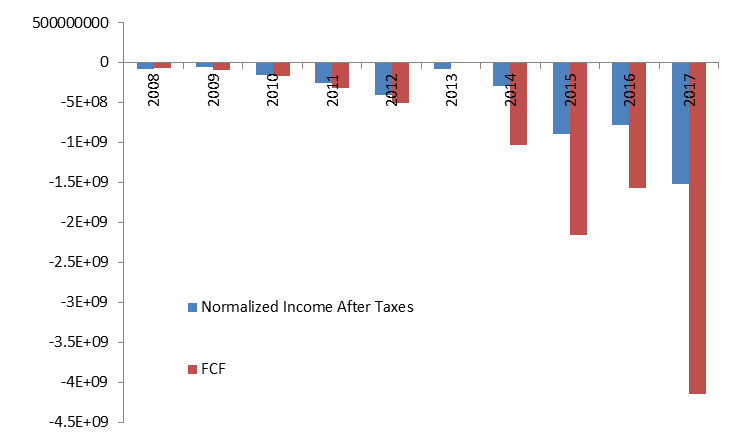

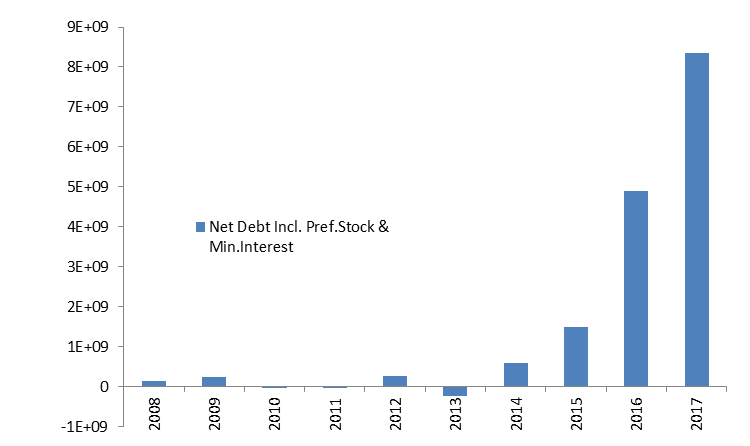

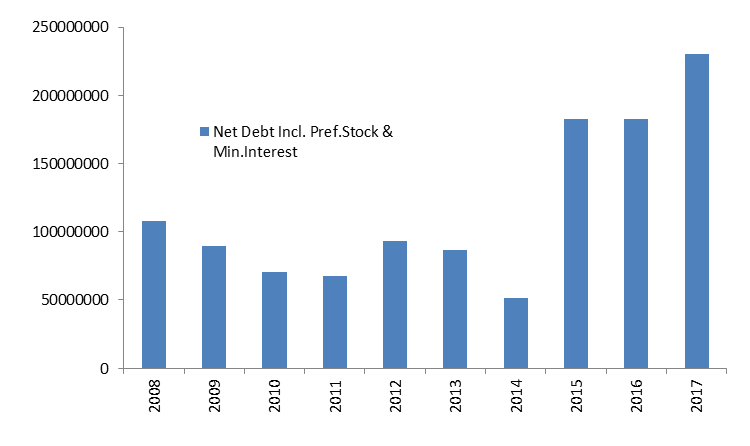

In the US one of the most hotly debated companies currently is Tesla and there are many parallels to Enron (although without the illegal aspect). The shares have been a remarkable success, having traded up from an initial listing price of $17 back in 2010 to over $300 today. Proponents of the company claim that the company is revolutionising the car industry whilst critics point towards financial statements that are troubling. In fact, last year the company had negative free cash flow of over $4bn and has accumulated a net debt position of close to $7bn. In fact the company has never made a single cent of free cash flow (as can be seen in the chart below) and is completely reliant on capital markets to fund their operations.

Source: Thomson Reuters, Company filings

Source: Thomson Reuters, Company filings

Now Tesla may make some pretty flash looking cars and we are believers in the future of Electric vehicles but we would never invest in a company that have financials that look like the above. There is one way companies go bankrupt and that is a lack of cashflow combined with too much debt. If debt markets refuse to continue to finance Tesla, the only option for the company to continue operations would be an equity raising (most likely at a heavily discounted price).

Domestically, a number of market darlings have seen significant reversals this year. Two of the best performing stocks on the ASX last year (which we wrote about in our outlook for 2018), GetSwift and Big Un have seen their fortunes reverse. Retail Food Group’s franchise model has come under pressure and recently US based short seller has released a scathing opinion piece on Blue Sky Alternative Investments. Thankfully, we haven’t been caught holding any of these companies. That is not by accident; through our investment process we look to identify red flags that indicate to us that something is not right. In order to learn we always review our decisions and is this case we have looked at why we didn’t buy the above companies and what we got right. This is not to say that we are perfect, we do make mistakes, we just try to avoid the most dangerous ones.

Starting with GetSwift, which saw its share price rise from a 20c IPO price in 2016 to over $4 last year. The company drove this rally by announcing a series of positive announcements. The company designs software for “last mile” delivery and over the course of last year they announced agreements with companies such as Pizza Hut, Fantastic Furniture, Betta Home Living and a mysterious US company NA Williams. To top it off along came an exclusive partnership with Commonwealth Bank and a global agreement with Amazon.

There was one thing missing from all these announcements and that was any indication of how much revenue these agreements might lead to. The lack of this information is a huge problem when trying to value a company. So instead of rushing in like many others, we choose to sit back and wait for evidence. That evidence came in the form of their quarterly cashflow report and despite all the positive announcements, the company was not making any money. In fact, in its last quarterly the company received just $160k from customers.

Source: Company filings

As it turns out, the announcements from the company were quite misleading. There was little to no exclusivity to some of their agreements and they typically were subject to trial periods. In addition, some agreements had been terminated and the company had not informed the market about this.

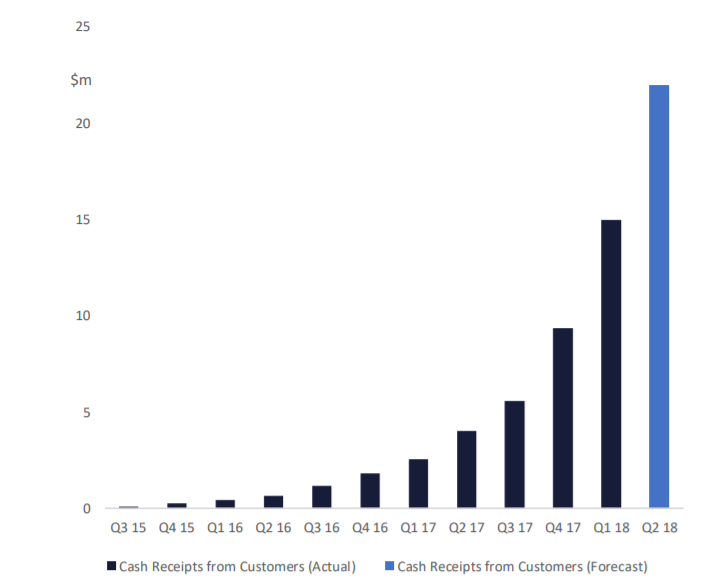

Turning now to Big Un and this was an entirely different case. Big Un is the parent company of Big Review TV, a company that specialises in marketing videos for small businesses. After backdoor listing through the failed Republic Gold in 2014, Big Un failed to really make an impact until last year. Then all of a sudden in 2017 the fortunes started to change, according to the quarterly statements operating cashflows started to surge.

Source: Company filings

The surge in Operating Cashflows coincided with a partnership with FC Capital (as well as a change in Auditor). As it turns out the company may have been misstating operating cashflows for financing cashflows. The shares were suspended in February and haven’t traded since. Based on the publically available information we are not sure that it will trade ever again. The reason we avoided Big Un is a lack of faith in the business model. The business had shown no longevity and we were unsure what type of small businesses were paying the type of annual subscription fees they were advertising (in some cases these fees were up to $12k a year). This made us question both the validity and the sustainability of the operating cashflows.

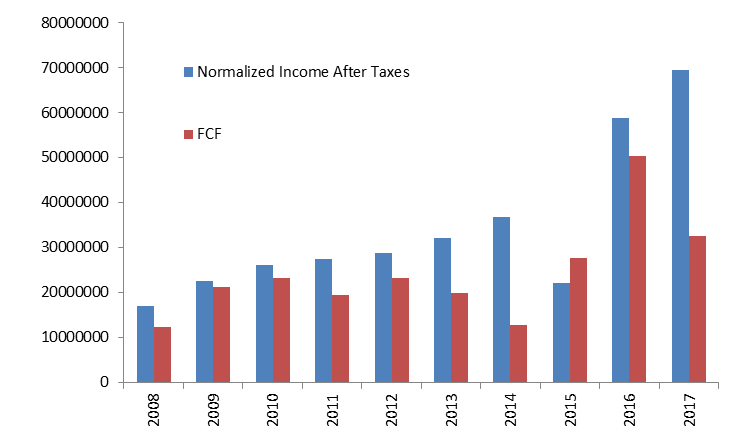

Another type of company to come under pressure recently is those with Franchise models. Retail Food Group has been the poster child with the shares having fallen from a peak of over $7 in 2016 to less than a $1 today. This has come on the back of some revelations around the profitability of their underlying franchises. From the below chart, we can see that that after profits essentially went nowhere from 2009 through to 2015. Then over the last few years profit kicked up. Notably though, Free Cash Flow always lagged Net Profit. Last year in particular saw a significant rise in Receivables as franchisees started to fall behind on their payments. Ultimately the company has now been forced to close 200 stores and write down their assets by over $100m. The $100m really represents the over statement of historical profits. The franchise model is starting to come under pressure across the board and the likes of Domino's have seen their share prices come under pressure.

Source: Thomson Reuters, Company Filings

The most recent share price scare on the ASX has come from Blue Sky Alternative Investments. This was on the back of a research note from US based short seller, Glaucus Research. The research note made some significant allegations against Blue Sky. Most notably it claims the company exaggerates its Assets under Management, misrepresents the performance of its investments and gouges investors with its fees. These are serious allegations and after a meteoric rise in the share price from an IPO price of $1 in 2012 to a high close to $15, the share price has fallen to below $6.

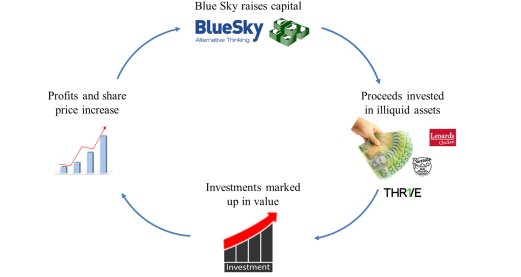

Blue Sky manages portfolio of illiquid assets. Unlike listed portfolios the valuations of these assets aren’t marked to market on a day to day basis. Periodically Blue Sky will revalue the assets and if they have been successful, charge performance fees. When asset prices are raising it creates a positive feedback loop and enables further capital raisings and hence more fees. Of course, all this is great until that loop is broken and Glaucus’s note (especially if the allegations are true) may just have that impact.

Source: Glaucus Research Group

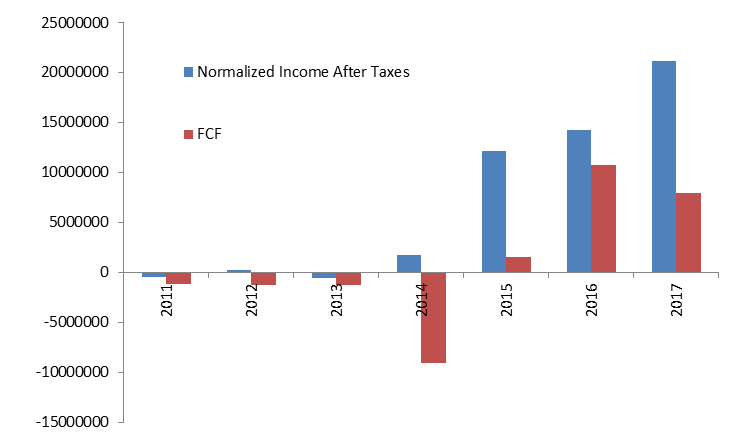

It’s the performance fees where Blue Sky books a lot of their profit. Of the $69.1m revenue that Blue Sky recorded last year, performance fees represented $22.3m. These fees are typically accrued during the life of the fund and realised at the end. That means their cashflow is lagging their profit. There is no problem here and no risk to Blue Sky, these fees are in the books and will be paid when assets are realise and funds mature. However, if Glaucus is correct and the revaluations have been overstated then there most likely be some very irate investors in their underlying funds when they start to realise assets and investors get a lot less back whilst still having to pay performance fees.

Source: Thomson Reuters, Company filings

As we stated at the start, these types of events are not usually what we would associate with the early stages of a bull market. They are what we would typically associate with the later stages. Companies such as these tend to raise capital from investors when confidence is high and people have dropped their guard. As Warren Buffett famously stated “Only when the tide goes out do you discover who's been swimming naked” and it appears the tide has been going out for some. By focusing on the quality of a company’s earnings (i.e. the cash conversion) as well as the sustainability of the business model and the strength of the balance sheet, we believe we can avoid the “Blow ups” and more effectively protect our investors’ capital.

A version of this article was also published in The Weekend Australian on 14/4/18.

1 topic

3 stocks mentioned

Guy is the Chief Investment Officer at Quick Brown Fox Asset Management. Guy has over 13 years’ investment experience as an analyst and fund manager.

Expertise

Guy is the Chief Investment Officer at Quick Brown Fox Asset Management. Guy has over 13 years’ investment experience as an analyst and fund manager.