Regal: Don’t catch the falling knife, wait for it to stick in the floor

Regal’s CIO Phil King has quietly made a name for himself as one of Australia's high-profile fundies.

After working at Macquarie and a London hedge fund, he returned to Australia and started Regal Funds Management in 2004.

By 2006 it had around $20m in assets under management.

Less than 20 years later, it now manages around $18 billion thanks to its innovative investing strategies (and a series of aggressive acquisitions).

Regal had earned a reputation as a true pioneer, with strong track records across many of its funds until a big bet on failed biotech Opthea recently blew up in its face.

The Regal Investment Fund (ASX: RF1), started in June 2019, offers exposure to a selection of Regal’s alternative investment strategies with the aim of “producing attractive risk-adjusted absolute returns over a period of more than five years with limited correlation to equity markets.”

It returned 46.31% in 2020 and 36.72% in 2021, net of fees, and until recently, had returned an average of 15.7% net p.a..

But following the recent market turmoil and the Opthea fallout, RFI was trading at a 9.2% discount at the end of March.

In a webinar today, King spoke to RF1’s recent performance, the Opthea situation, Regal’s current outlook and where they see the best returns.

The elephant in the room

Regal had infamously accumulated a large position in fallen biotech company Opthea (ASX: OPT), which ceased trading in late March after its late stage clinical trials failed.

The fund was forced to write its 9-figure position down to zero and King took full responsibility for the losing bet.

It has also prompted a change in Regal’s investing policy to ensure it didn’t happen again.

As King wrote in a letter to investors at the time, “what I can confirm is that stocks with event-driven binary outcomes will be limited to a far smaller weighting within our strategies going forward.”

After its value tripled, Regal found itself with too many eggs in the Opthea basket.

“Even though we'd started selling some, with hindsight, we clearly hadn't sold enough and we should have been selling more aggressively just to stop it becoming such a last part of the portfolio,” said King.

The failed trials came as a “complete surprise” to Regal, according to King.

“Opthea was a position that we'd held for a number of years and we had high conviction,” he said.

“We'd met with multiple people within the company, we'd spoken to people in the industry, and we'd even done our own proprietary survey of ophthalmologists in the US.”

The Opthea debacle is Regal, and King’s, most high-profile misstep and coupled with the recent market selloff, leaves RF1 in a far less rosy position than it was a year ago.

Looking ahead

While obvious uncertainty remains given Trump’s erratic approach to tariffs, King believes there’s a “good chance” we’ve seen the bottom in stocks.

With retail and quant investors now dominating the equities markets, King says the recent selloff is more momentum- and sentiment-driven than structural.

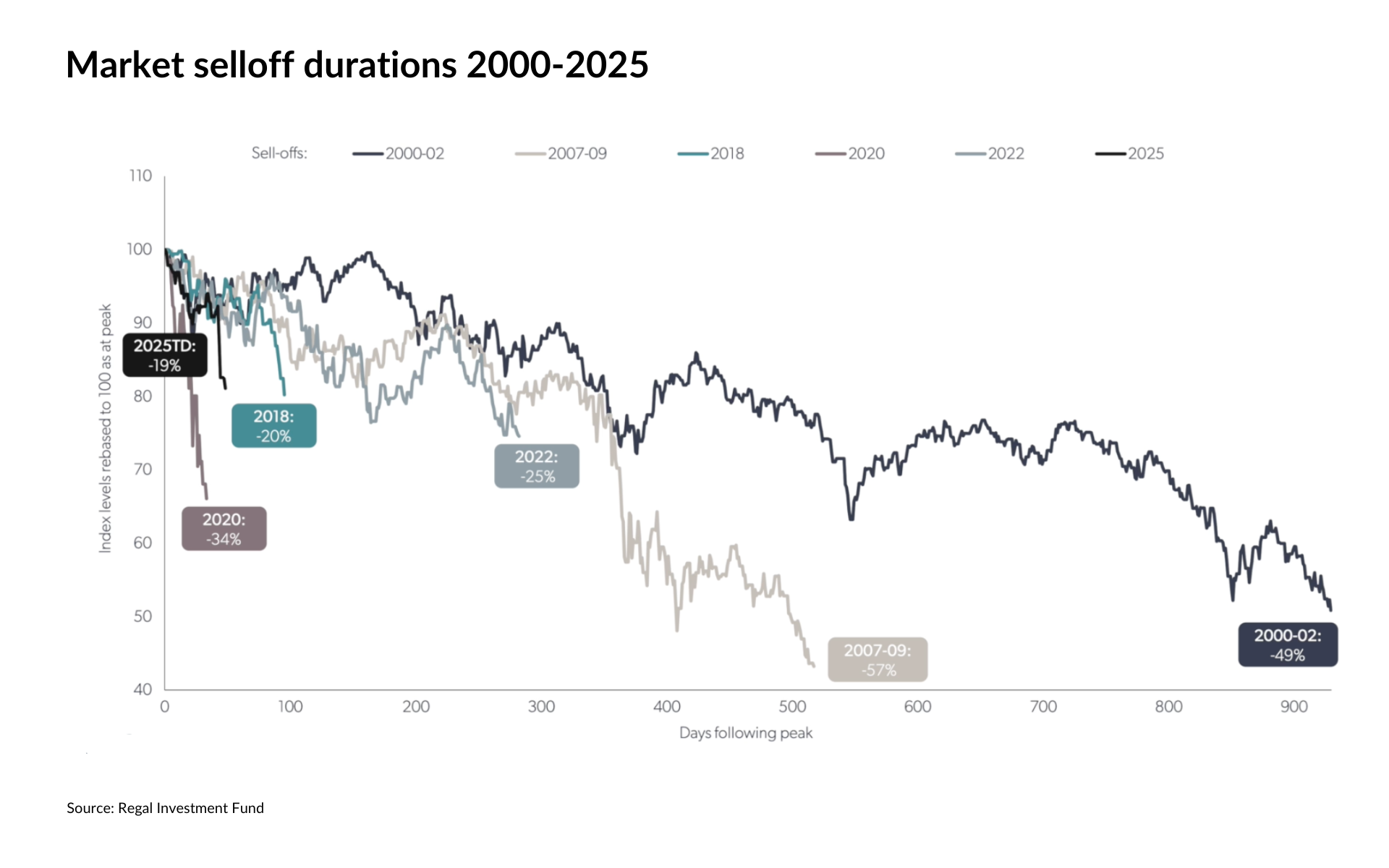

“In our view, this selloff is a lot more similar to what we saw in Covid or the 2018 US-China trade war than it is to some of the other bear markets over the last 20 or 30 years,” he said.

Throw in the spike in the VIX volatility index and right now could be a “good buying opportunity," according to King.

He referenced a quote from Regal’s investment director, Charlie Aitken, on the much-discussed falling knife:

“You don’t catch the falling knife, you wait for it to stick in the floor and then you pick up the vibrating knife.” - Aitken

Where the opportunities are

King believes the Australian stock market has become too top-heavy, with outsized valuations on the largest companies.

“Whether it's the four big banks or the supermarkets, there's very little EPS growth at the top end of the Australian market and as a result it's very hard to justify some of the multiples these stocks trade at,” he said.

“Australia remains one of the most expensive markets in the world despite having some of the lowest growth.”

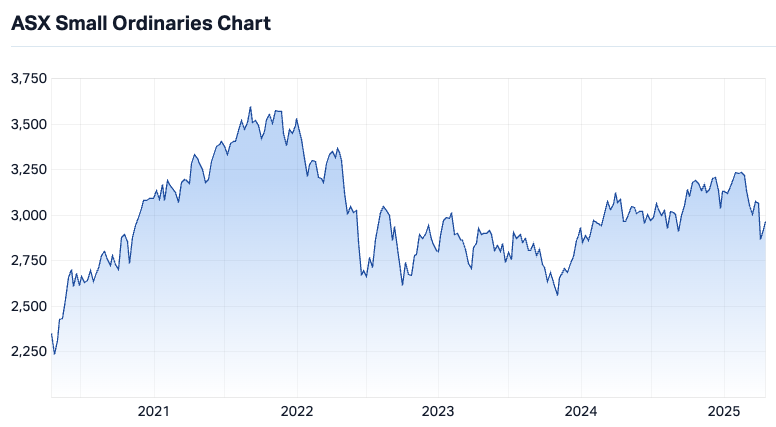

A combination of passive funds and superannuation have driven up the prices of Australia’s theoretical blue-chips, which has created opportunities at the other end of the market.

King expects the Small Ordinaries to outperform the large caps and growth stocks thanks to better EPS potential.

“Value has actually outperformed growth over the last quarter by one of the largest margins on record, and we think there's a good chance that this continues over the foreseeable future,” said King.

He also sees more opportunities further afield in other equities markets.

“In our global strategy, we've been moving away from the US for the last 12 months or so and we've been increasing our exposure to both Europe and Asia,” said King.

Closer to home, commodities represent another area of interest.

"Some of the mining sectors that have great outlooks like copper and uranium have sold off more than some of the more challenged sectors like lithium and iron ore," said King.

"Even though many gold mining equities have moved higher, they have not kept pace with the gold price considering the leverage that they have," says King. "A lot of these gold miners will be having record profits over the next few years."

"We think earnings estimates are around 50% too low compared to spot prices. And so we think that there should be some very large earnings upgrades over the next few years and we think that the mining, the gold mining sector should continue to do extremely well."

3 topics

2 stocks mentioned