"Resources have never looked better" - Tribeca's 3 themes and 6 stocks

Whichever way you look at it, the commodities sector is in a purple patch. Across energy, mining and agriculture, “fundamentally, the sector’s never looked better,” says Ben Cleary, founder and portfolio manager of Tribeca Investment Partners’ natural resources team.

Companies across the commodities sector are benefiting from large supply-demand deficits that started in 2021. Cleary believes these deficits will only expand over the next decade, growing the opportunity for producers' earnings to outperform.

Even as the world’s demand for resources remains high, particularly as the COVID recovery continues, reinvestment is expected to stay low as production struggles. At the same time, greater awareness of, and allocation toward, ESG takes effect.

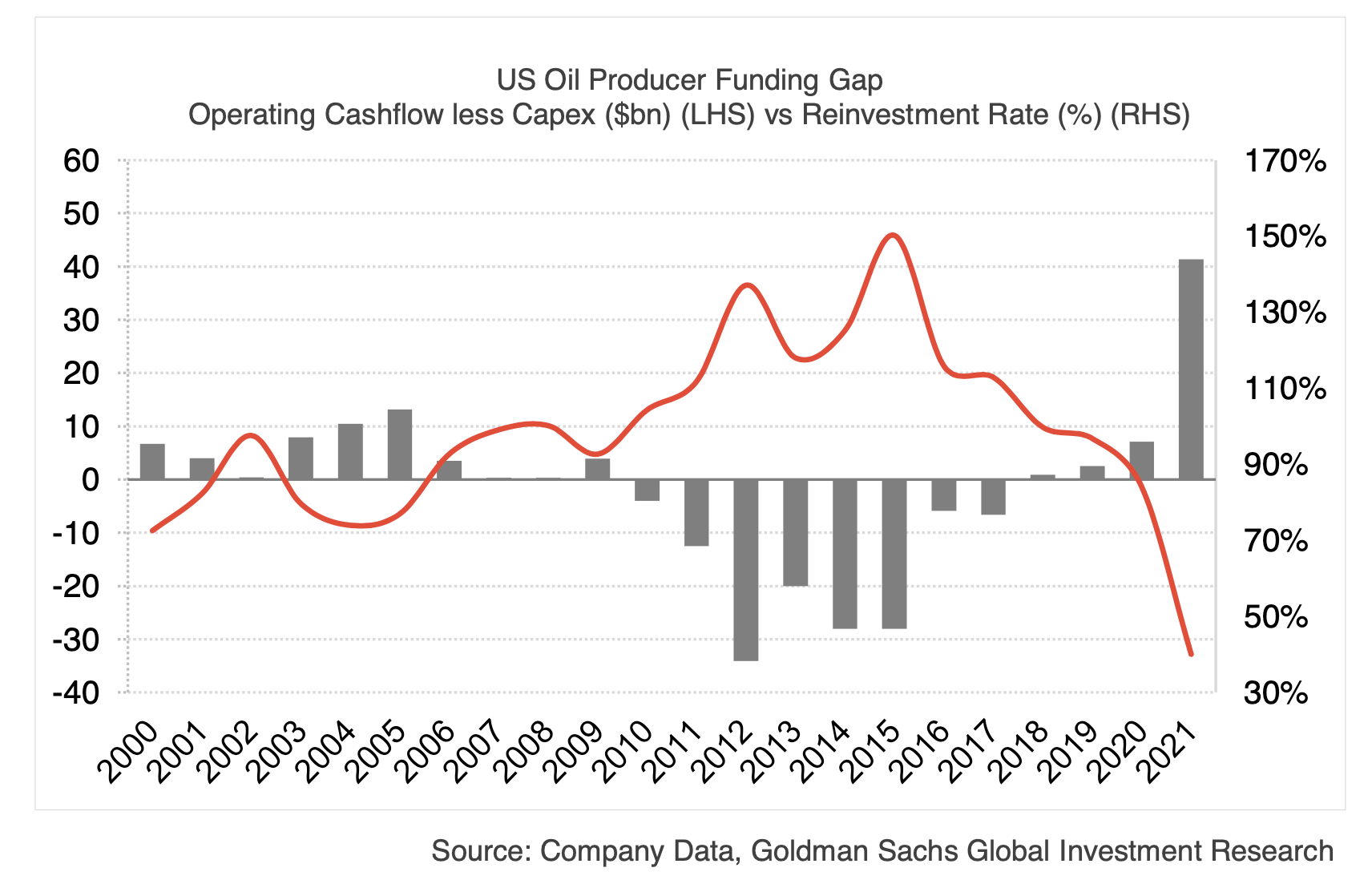

Cleary points to the oil and gas sector as an example of the extent of a funding gap that's leading to the supply shortfalls, as shown in the table below.

“You’ve got the biggest producers in the world telling their shareholders they’ll continue to return capital in substitute for growth capital. That’s why you’re not seeing a meaningful supply response despite materially higher commodity prices,” he says.

And on the policy front, Cleary believes world markets underestimate the effect of the transition toward net-zero carbon emissions.

He references BlackRock CEO Larry Fink, who in January 2020 made his landmark announcement about pulling back from fossil fuels. He has since announced the firm is not divesting but is instead backing “foresighted” companies. And many other massive institutional players have followed suit.

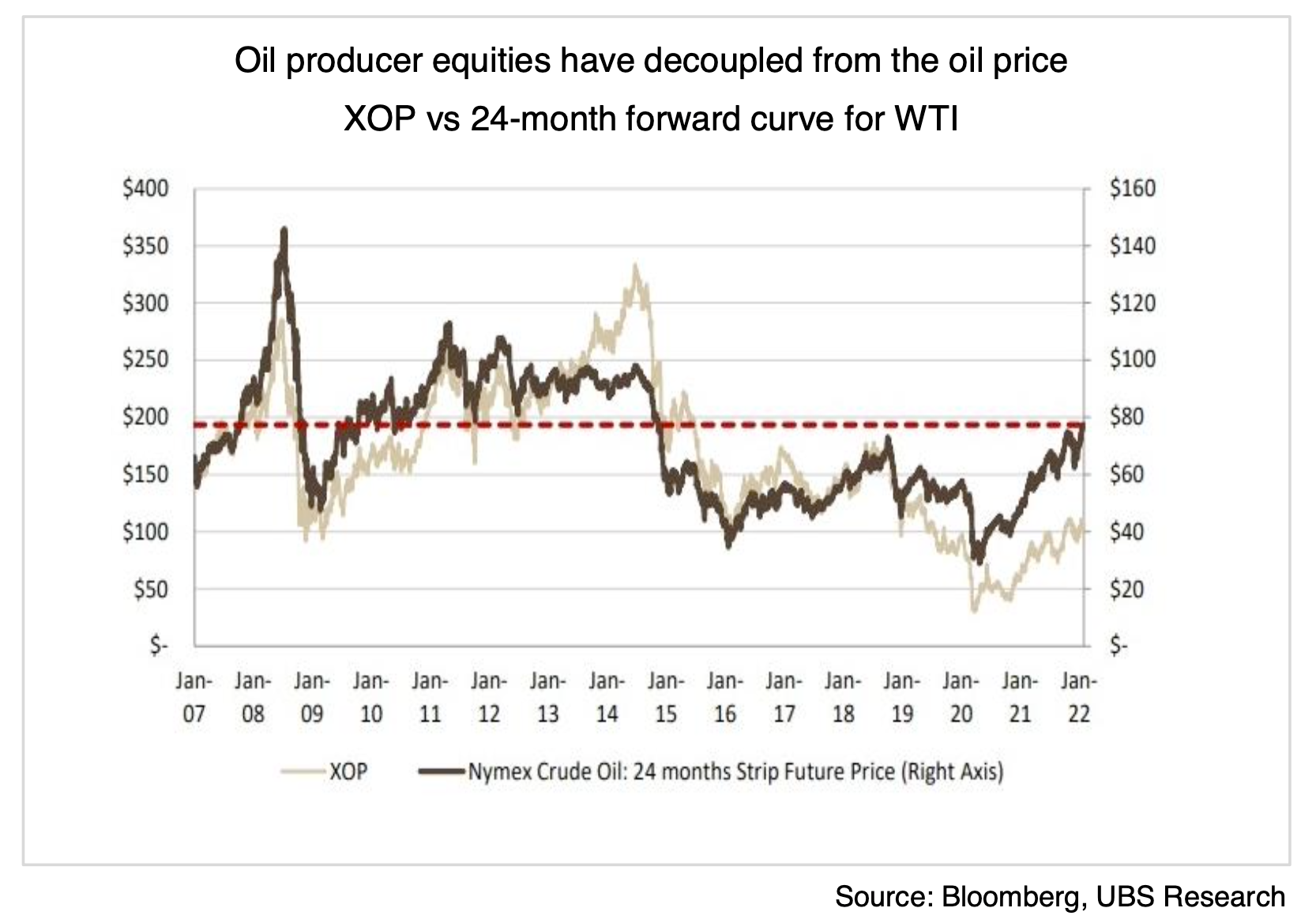

“From the time Fink made those initial comments the sector has materially decoupled from the oil price. But with that weight of money coming back into the sector, that gap can close.”

Highlighting the scale of the pull-back that occurred, the market cap of the US energy sector (US$2 trillion) is materially smaller than that of Apple (US$2.8 trillion).

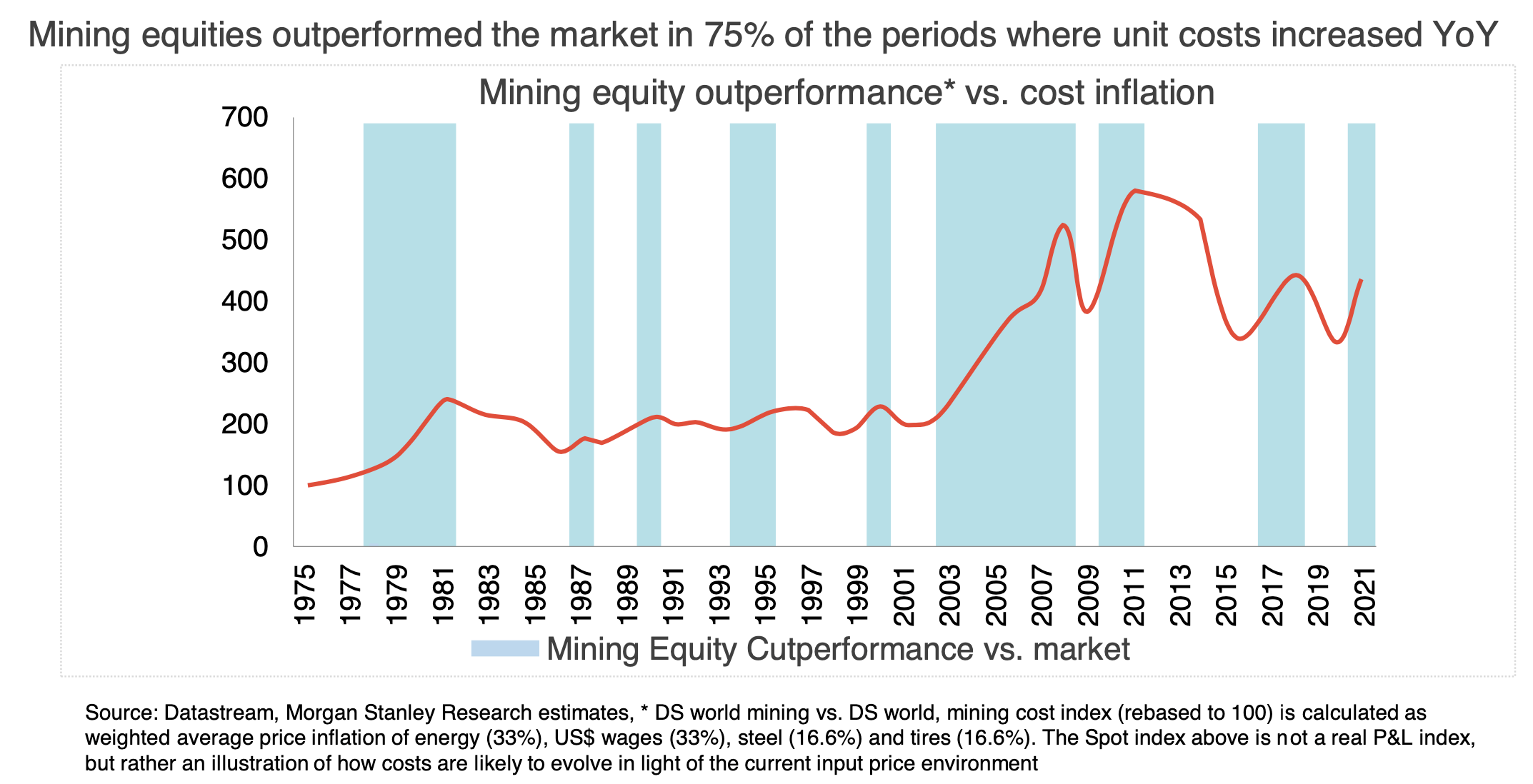

And of course, there’s inflation, which benefits commodity producers, with high prices for everything from iron ore to gold, copper and battery metals translating to strong company earnings across the sector.

"Dysfunctional" ESG ratings

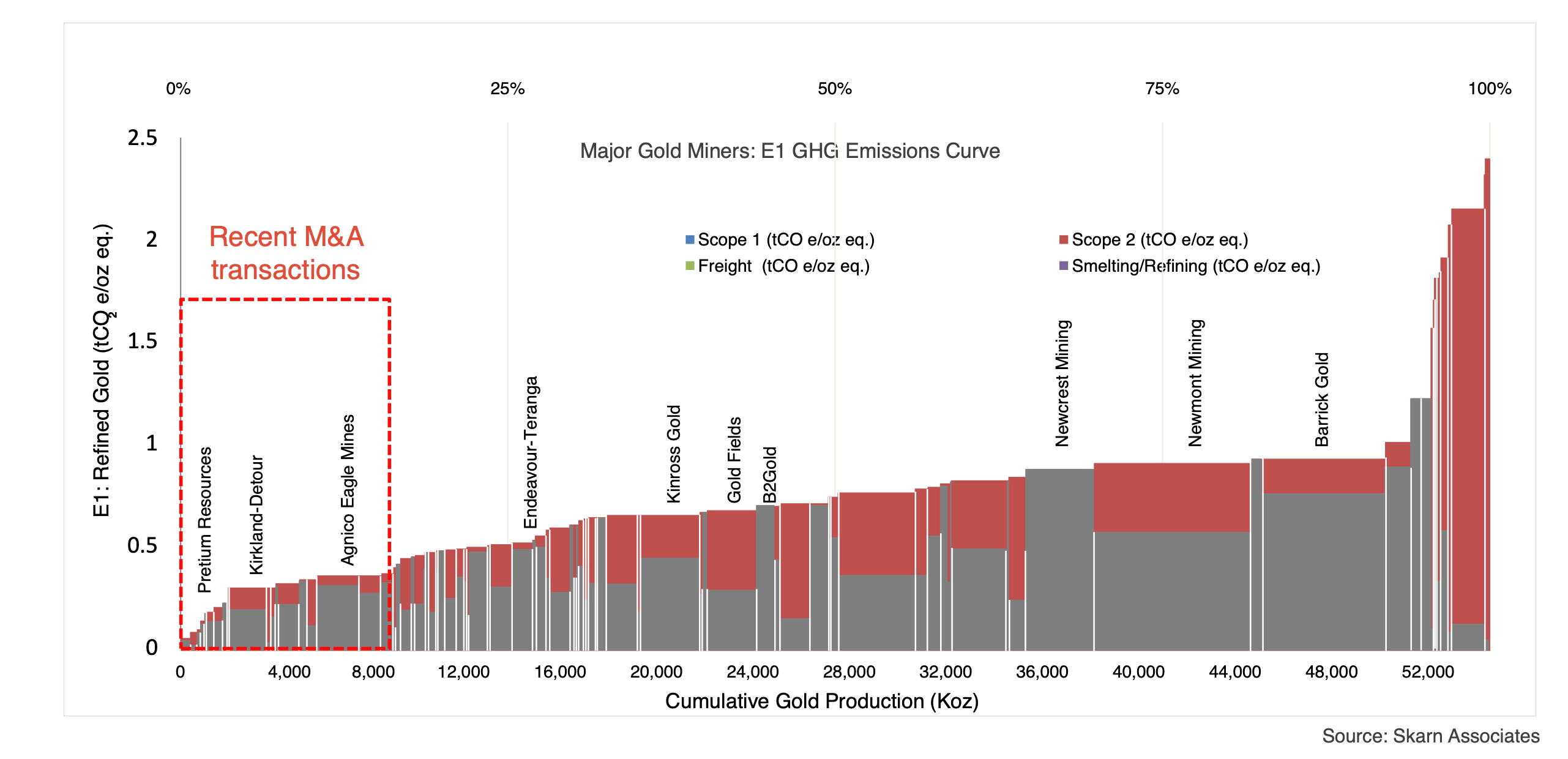

Cleary also calls out what he regards as “virtue signalling” in the form of dysfunctional ESG ratings. Using the world’s largest gold mining company Barrick as an example, he notes the ratings of the 20 analysts who cover the stock are in a very tight range of just a couple of per cent. “But from an ESG perspective there’s a 40% range, so clearly there’s an alpha opportunity for fundamental investors, who can take advantage of these broad spreads.”

In this context, he says it’s crucial to understand emission curves for the various commodities sectors. For example, among gold miners, companies with the lowest emissions will deliver the most impressive returns.

M&A at the bottom of the emissions curve

“We believe that it’s at the bottom of the emissions curve where you’ll see the best multiple expansion over the next 12 months," says Cleary.

And it's here where he expects to see accelerating M&A activity in 2022, pointing to BHP Group (ASX: BHP) as an example. The world’s biggest miner has been expanding its dealmaking team and evaluating rivals such as Freeport-McMoRan Inc and Glencore Plc.

At current levels, the sector is now generating almost four times the amount of cash flow as it was during the last M&A cycle, which suggests a wave of new activity is set to unfold.

Again pointing to gold as a case study, Cleary says the sector has about five-times upside based on average share prices now versus its level in the early 2000s. “And you’ve seen it decouple from the spot price of gold, so there’s still great risk-reward in these sectors.”

The terrible events in Ukraine also play into the commodities thematic. As sanctions levied by most western countries take effect, it has highlighted the very real supply risks of relying on nationalised assets, Russia being the largest supplier of Europe’s natural gas.

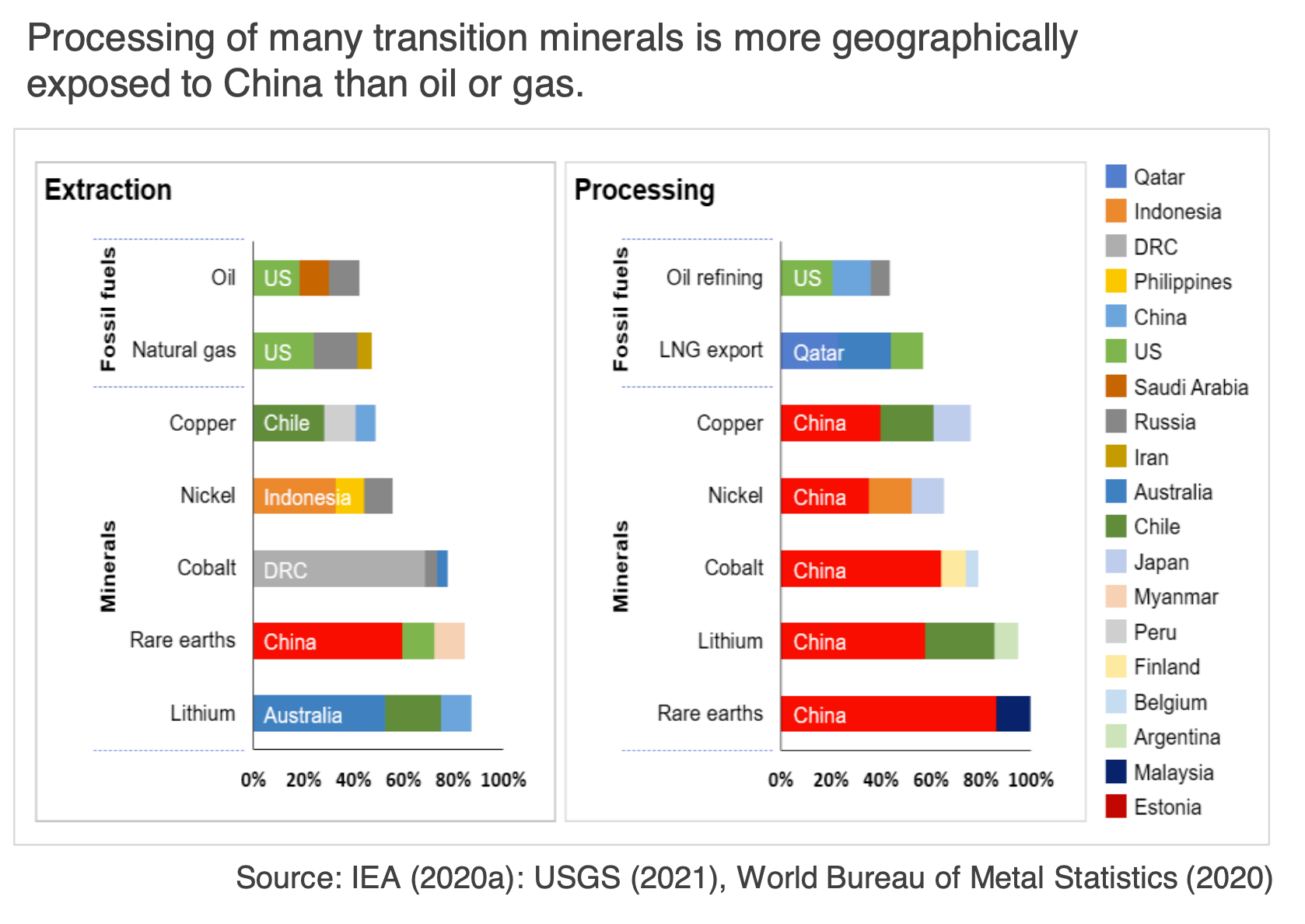

Similar concentrations of supply exist in other countries. In the processing of many minerals required for the transition toward decarbonisation and renewables, China holds the whip hand. And Chile, home of some of the world’s largest copper producers, has also firmly hitched its economy to the metal, with accompanying “nationalisation-type” policies, says Cleary.

3 sub-sectors set to benefit

In summary, the three key themes Cleary’s team are pursuing are:

- Electrification and decarbonisation across base and speciality metals – including copper, nickel and lithium.

- Infrastructure and fiscal stimulus, via exposure to the producers of “transition fuels” such as natural gas, diversified miners and agricultural commodities

- Money supply and inflation, via companies mining precious metals and providing services to the broader sector.

Santos (ASX: STO) - one of the world’s largest natural gas companies, especially since completing its acquisition of OilSearch in December. Tribeca tips the Adelaide-based company will benefit from the blacklisting of Russian supplies of natural gas by Western nations, in the wake of the Ukraine conflict.

Todd Warren, Tribeca’s head of research, also likes that the company's projects are primarily established “brownfield” assets. Such projects are inherently lower risk.

And Santos is also rolling out a long-term carbon capture and storage project targeting 100 million tonnes of carbon dioxide sequestration. This will store not only the company’s own emissions but also those of many others.

Among a couple of global names held by Tribeca are Hong Kong-listed aluminium producer Chalco. The firm’s share price has traded as high as US$25 in the past, at a time when its EBITDA was a fraction of current levels. In 2007, Chalco’s share price was four times higher than now, and Warren's confident the share price will climb back and possibly push higher still.

London-listed miner Glencore is a diversified miner with key exposures to battery metals lithium, nickel and cobalt.

3 ASX battery metal players

Among battery metals companies, Tribeca highlights some ASX-listed firms sitting outside the well-worn areas of lithium and copper producers. These include:

Syrah Resources (ASX: SYR) – a $900 million market cap company that produces graphite, a crucial element in the manufacture of lithium-ion batteries.

5E Advanced Materials (ASX: 5EA) - a producer of boron, this company (previously known as American Pacific Borates) is also listed on the NASDAQ. Boron is traditionally used in fertilisers, fibreglass and specialty ceramics. “But it’s also a key ingredient for solar glass, as used in EV drivetrains and also wind turbines. It should see 10 times demand growth over the next few decades,” says Warren.

Alpha HPA (ASX: A4N) – with a $450 million market cap, the low-carbon, high purity aluminium produced by this company is critical in the manufacture of batteries and LED lighting. Demand for LEDs is tipped to double over the next three years. The first product delivery from Alpha HPA is set for August 2022, and Tribeca's natural resources team believes the company could achieve more than $250 million of free cash flow once the second stage completes soon after.

.png)

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

5 stocks mentioned