S&P 500 snaps four-day losing streak, ASX 200 to edge higher

ASX 200 futures are trading 8 points higher, up 0.11% as of 8:40 am AEDT.

Major US benchmarks whipsaw back into positive territory, Chinese stocks are getting dumped on positive earnings, Nvidia shares rally amid a faster rebound in gaming demand and AI opportunity, and US initial jobless claims reiterate a tight labour market.

Let's dive in.

S&P 500 SESSION CHART

MARKETS

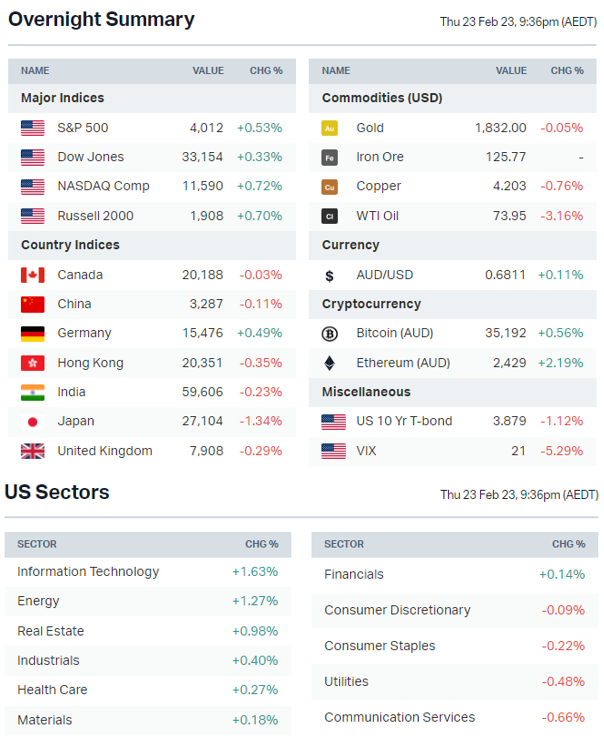

- S&P 500 snapped a four-day losing streak and reclaimed the 4,000 point mark

- Choppy session with all three benchmarks closing higher from session lows of: S&P 500 (-0.55%), Dow Jones (-0.75%) and Nasdaq (-0.65%)

- Market narrative remains unchanged, with equities' resolve being tested under a meaningful rate repricing over the last few weeks

- US dollar firmer and gold slumped close to year-to-date lows

- Oil settled higher after falling 4.0% in the previous two sessions

- Fed minutes reiterate higher-for-longer messaging and desire to see more progress on inflation (Bloomberg)

EARNINGS

Nvidia (+14%): Revenue and earnings beat, upbeat guidance amid a faster rebound in gaming demand, plans to offer AI-as-a-service.

- "AI is at an inflection point, setting up for broad adoption reaching into every industry. From startups to major enterprises, we are seeing accelerated interest in the versatility and capabilities of generative AI.” - CEO Jensen Huang

- "In hindsight, we acknowledge that our decision to remain on the sidelines ... was wrong. ... we are upgrading the stock from Neutral to Buy ... positive estimate revisions and a potential expansion in the stock’s multiple ... will drive continued outperformance.” - Goldman Sachs

Alibaba (-0.5%): Shares faded from session highs of 5.5% despite beating both revenue and earnings estimates from China easing Covid curbs.

Good results from Chinese companies is turning into bad news. Baidu experienced a similar move on Wednesday, closing -2.4% lower from a session high of 7.4% on better-than-expected results

eBay (-4.4%): Revenue and earnings mostly in-line and first quarter sales guidance was ahead of expectations. Notes strength in sales for “focused categories” such as luxury handbags and auto parts. Declined to provide full-year guidance due to the “challenging operating environment”

Lucid Group (-12.3%): Revenue miss, light FY23 production guidance, built only ~7,000 Air Luxury Sedans last year amid manufacturing challenges.

ECONOMY

- US initial jobless claims hit lowest level in four weeks as data continues to support the trend of tight labour markets (Reuters)

- US mortgage rates rebound to highest level since November (Reuters)

- US housing market fell by US$2.3tn in 2H22, biggest fall since 2008 (Bloomberg)

- South Korea producer price inflation slows to near two-year low (Reuters)

- Bank of Korea leaves rates on hold for first time in a year (Bloomberg)

- RBNZ Governor says only significant upside surprise in inflation would put 75 bp rate hike back on table (Bloomberg)

Charts of the Week

This segment of the morning wrap brings you weekly technical commentary on the ASX 200 and some of the more interesting charts in the market. These are not meant as recommendations. They are for illustrative purposes only. Any discussion of past performance is for educational purposes only. Past performance is not a reliable indicator of future return. Always do your own research.

ASX 200 – Searching for support

.png)

Right now, we’re playing the waiting game. Waiting to see where the current pullback will find support. 7200 looks like a likely candidate, but there seems to have been a sentiment shift in the US of late, and our reporting season has been tepid. Big names like BHP and CBA have not fired and, in the case of the latter, pulled back quite significantly. Zooming out, the longer-term uptrend remains intact (6900 would have to fail for it to be broken) but there’s not much immediate bullish evidence to cling to. So, we wait.

Flight Centre (FLT) – Ready for take off

FLT makes for really interesting ready. The company reported recently and my colleague David Thornton spoke with Michael Jenneke, Portfolio Manager at Credit Suisse Wealth Management, about the results. A couple of weeks back I highlighted AIA as part of the travel trade, and also noted strong technical charts for QAN and WEB. FLT is behind in terms of technical development, but has no less potential.

With results out of the way, the stock is now de-risked and with the potential to break above near-term resistance and the upper end of the sideways congestion zone that held the price action captive between June and September last year. If such a break occurs, it would represent a significant shift in the way the market is thinking about FLT and could open up a pathway into the early 20’s, if not the early May high. Still plenty of water to go under the bridge, but one to keep an eye on.

Seven Group Holdings (SVW) – The trend is your friend

I have made no secrets of the fact that I am a trend trader. Since June last year, I think you would be hard pressed to find a better looking trend than the one displayed by SVW. It has steady and consistent, without being boring. It’s of a suitable magnitude ($16 to $24.50), so there has been plenty in it. Pullbacks haven’t been too deep, perhaps apart from the one in September, and the pullbacks have been met with healthy buying each time.

This is another one that has been de-risked, with the company releasing results last week. SVW posted a 16% increase in revenue, with EBIT and NPAT growing by 17% each. Operating cashflow also increased materially. No wonder investors have been bidding this one up.

Key Events

ASX corporate actions occurring today:

- Trading ex-div: Estia Health (EHE) – $0.037, Newcrest Mining (NCM) – $0.505, Tabcorp (TAH) – $0.013, Deterra Royalties (DRR) – $0.12, Ingenia Communities (INA) – $0.52, BlueScope Steel (BSL) – $0.25, GUD Holdings (GUD) – $0.17, John Lyng (JLG) – $0.045, PeopleIN (PPE) – $0.07, Pental (PTL) – $0.013

- Dividends paid: Aspen Group (APZ) – $0.035, Goodman Group (GMG) – $0.15, BWP Trust (BWP) – $0.09, HealthCo Healthcare and Wellness REIT (HCW) – $0.019

- Listing: None

Economic calendar (AEDT):

- 10:30 am: Japan Inflation Rate

- 11:00 am: UK Consumer Confidence

- 6:00 pm: Germany Consumer Confidence

- 12:30 am: US Personal Consumption Index

Today's Morning Wrap was written by Chris Conway

1 contributor mentioned