Schroders: What the 2023 reset means for multi-asset and credit investors

As Philip Lowe prepares for his second day of grilling by the Senate Estimates Committee, the embattled Reserve Bank Governor was on the mind of Schroders’ Australian CIO and head of multi-asset, Simon Doyle on Thursday.

“Lowe made the point that they need to do something to bring inflation down because if it’s persistently high, it can cause a lot of damage to the economy and to people over time,” said Doyle, referencing Lowe’s first appearance on Wednesday.

“There will be pain required to reduce demand and bring core inflation down, but it’s a necessary evil.”

The comments were made during Doyle’s assessment of where he believes the economy and markets are within the inflationary cycle. His view is that inflation has peaked.

“Declining energy prices is helping as is the reopening of supply chains as China comes back onboard. But there’s an inherent stickiness – the longer inflation stays up and feeds into wages, the harder it is for it to come down,” he said.

Another big question here is how far inflation will come back. Doyle believes it will prove “stickier” than people would like and expect.

“That means interest rates are likely to stay a bit higher for longer. It’s not an environment that’s going to disappear quickly,” he said.

Schroders’ view is that the prior 10 years, exacerbated by the pandemic, was an unusual persistent environment characterised by:

- High liquidity

- Record valuations for most asset classes

- A distorted risk profile.

This was an unsustainable period, as proven by its unravelling in the last 18 months as inflation has risen.

“We’re not in the new paradigm yet – it could take another 18 months or so – but that transition is a period where we’re seeing rates go up, risk premiums rebuild, and a lot of those pricing distortions coming out of markets,” Doyle said.

“But once we’re through this period, I think investors will be in a much better environment.”

What the last year tells us about this one

“I think 2022 was the year that the bill came due for the largesse of the previous decade or so, and the cost of that was a repricing of assets across the board,” Doyle said.

“The thing that was unusual in this environment is that it wasn’t just equities doing badly, it was equities and bonds and credit performing badly simply because everything had become distorted.”

Three crucial lessons

This period served as a sharp reminder that

- monetary policy is not always loose,

- interest rates can go up, and

- valuations are crucial.

As a long-only investor, Doyle regards his team’s challenge as mitigating the effect of this broad market weakness.

“We didn’t get everything right but if you look at our drawdown last year, it was pretty moderate compared to the breadth and depth of weakness in asset classes,” he said.

“And it wasn’t a linear fall, but things fell and rallied repeatedly in response to different factors. I think that’s going to be the case as we move through 2023 and into 2024.”

Doyle called out the tussle between interest rates – specifically, how far they need to rise – and what this does to company profits as one of the biggest things to watch for his team.

Yields are back

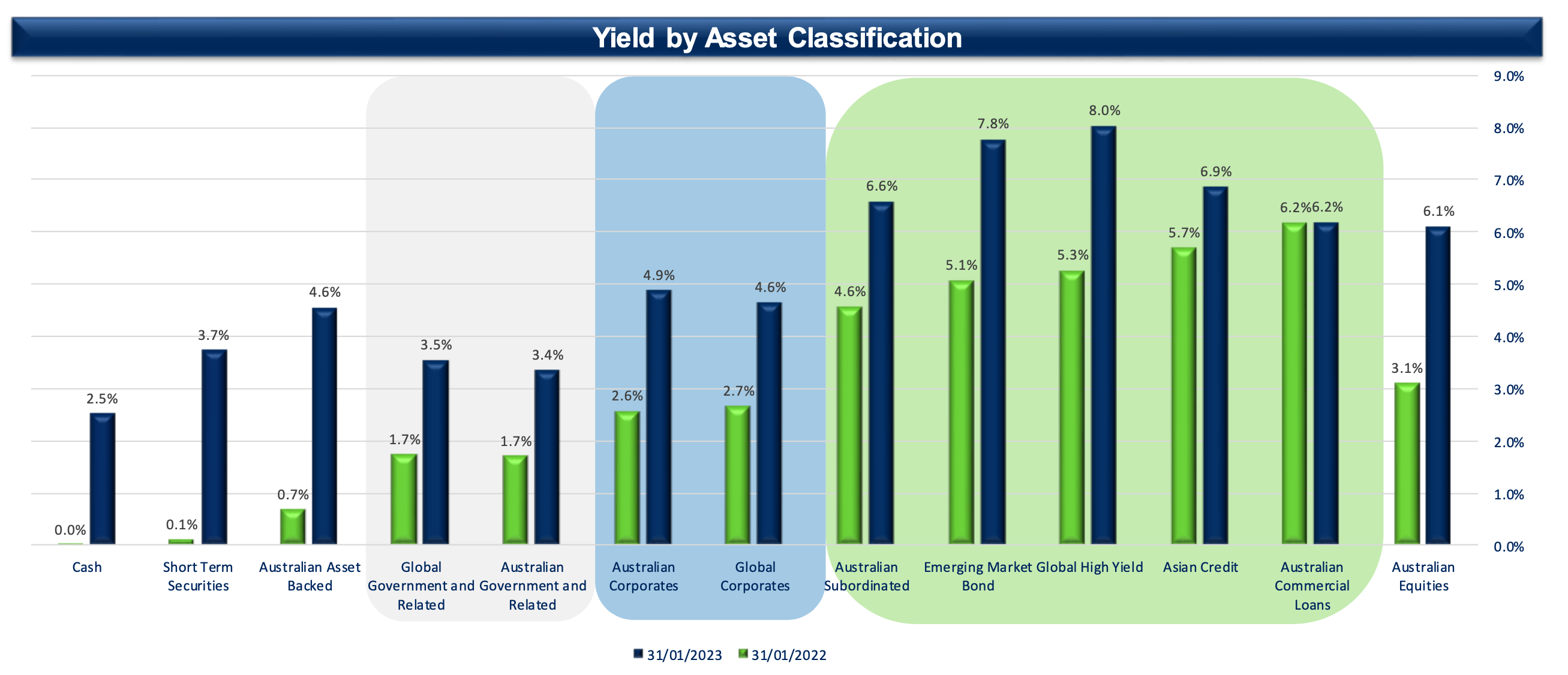

Mihkel Kase, portfolio manager of Schroders’ Absolute Return Income Fund, focused on fixed income. He noted that in this space now, credit investors no longer need to go “way up the risk curve” to access reasonable yields.

“You had to buy high-yield emerging market debt, but the positive of the reset we’ve seen is that investors can now access yields of around 5% in the investment-grade credit market," he said.

Rising yields bring opportunities

“You can buy high-quality, shorter term investment grade Australian corporate debt. I can buy a 5-year Australian bank yielding around 5%, but 12 months ago I’d have to buy high yield. There’s more yield on offer and more dispersion across markets, which gives us more opportunity,” said Kase.

Though he also echoes Doyle's views on the outlook of elevated uncertainty and volatility in the year ahead.

How they’re currently positioned

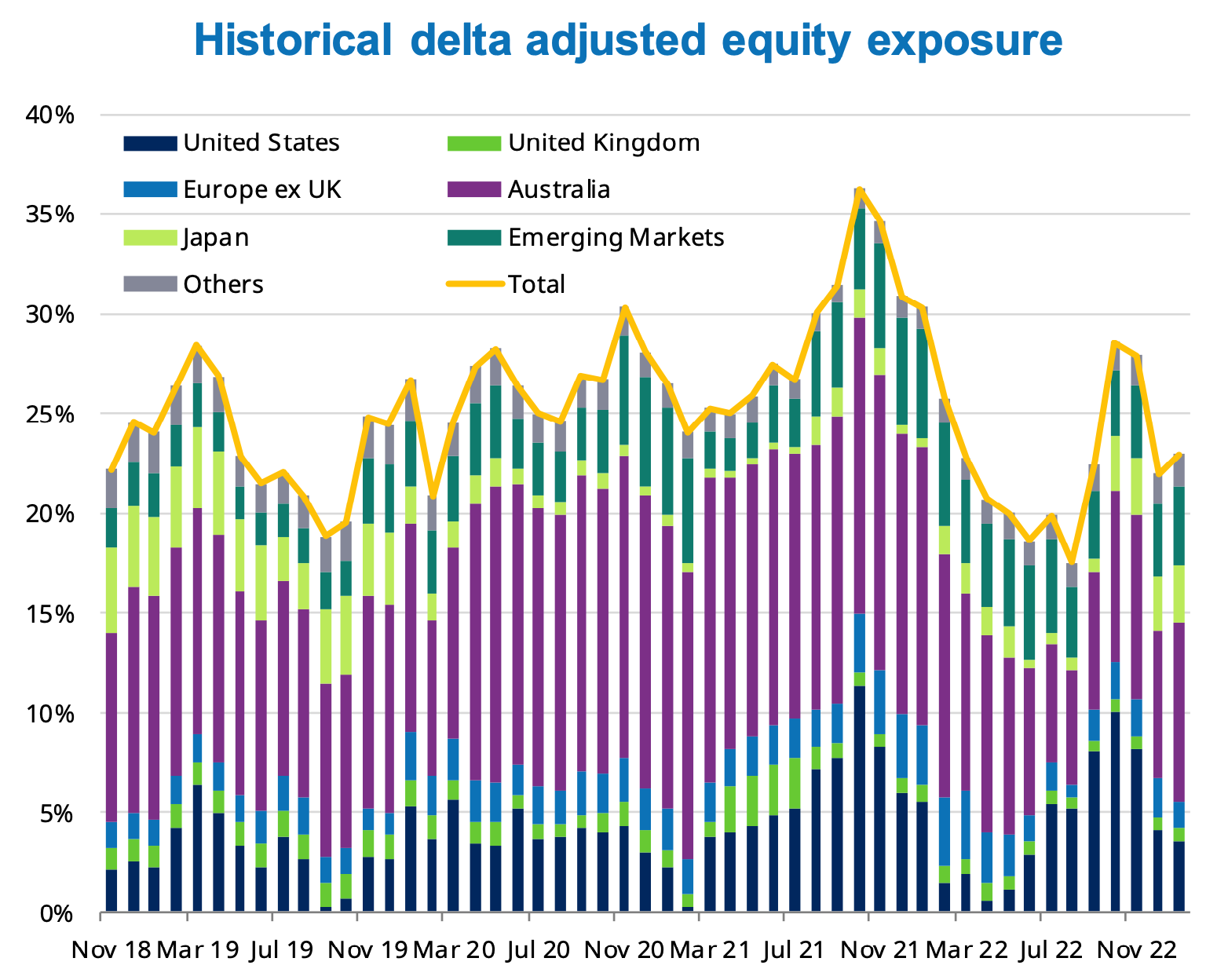

On the multi-asset side, Doyle is cautious about equities. Around 18 months ago, his portfolio held around 30% to 40% equities and 40% credit.

“But by this time last year, we’d halved that, we were down to 20% in equities and around 20% in credit, including being out of high yield. So, we’ve de-risked significantly,” he said.

Source: Schroders, Aladdin, updated to 31 January 2023.

Within the Absolute Return Income Fund, Kase had also been de-risking the portfolio, with up to 50% cash exposure and up to 6% US-dollar exposure, as a way of hedging currency risk.

“We’ve started deploying some of that cash to take advantage of those high yields, but that said, were in the Investment-grade space to take advantage.

“Yields have rebuilt, and that’s allowed us to continue delivering income to clients,” said Kase, referring to its increase of distribution from 2.5% to 4.25% per annum.

“Previously, people used to joke that fixed income was a yield-free risk. Now, the rebalance has meant you have a higher term premium, higher yields, and more diversification.”

He describes their overall position as defensive, but are starting to deploy cash “opportunistically” into higher-quality sources of yield.

Take advantage of opportunities wherever they exist

With the flexibility to invest across a broad range of asset classes, Simon and the team aim to help investors grow their wealth with a reduced risk of losing money when markets fall. Visit the Schroders website to learn more.

3 topics

1 stock mentioned

2 funds mentioned