Sentiment divergence in iron ore stocks

Andy Grove, formerly the CEO of Intel back in the day when it knew how to make chips, was one of my favorite corporate leaders.

It is to him that we owe this aphorism:

Only the paranoid survive.

This was before the days of 360-degree reviews.

I am guessing that those at Intel who were not paranoid got a new job :-)

All jokes aside, it is a good watch phrase for a hyper competitive market.

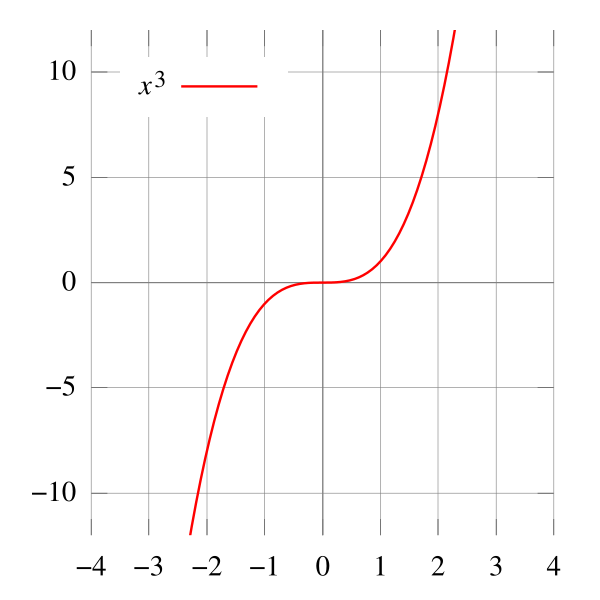

That said, I think that Andy Grove did not help the global cause of mathematicians in his use, and some would contend, misuse of the term inflection point.

I think that when Andy Grove used the phrase he meant turning point.

To foster confusion, mathematicians often refer to tuning points as stationary points, which does not seem very intuitive at all, since that is where the trend reverses.

Inflection points are where you pause a while and keep going the same way.

Stationary points are the turning points, where you stop, turn around and go off in the exact opposite direction.

How very math nerd of me!

Yeah whatever...

Gee, I always wanted to admonish Andy for ruining my vocabulary.

The application to markets is now right before us in the iron ore market.

We just had a huge rally in iron ore stocks.

Now we must get a little paranoid and think about which moves survive.

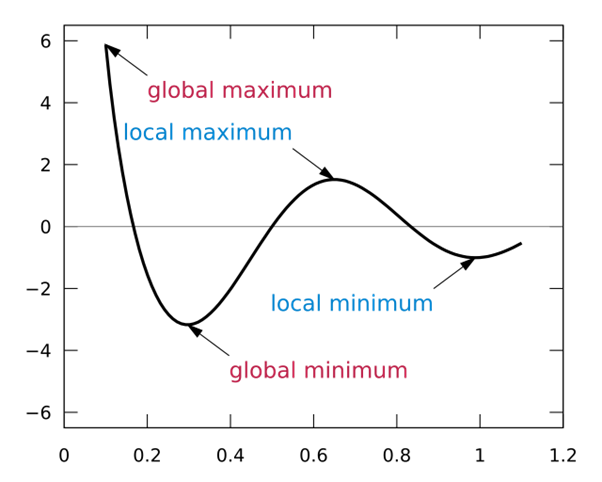

Who is turning? Who is inflecting? Who is moving? Who is stationary?

BHP and RIO look fine

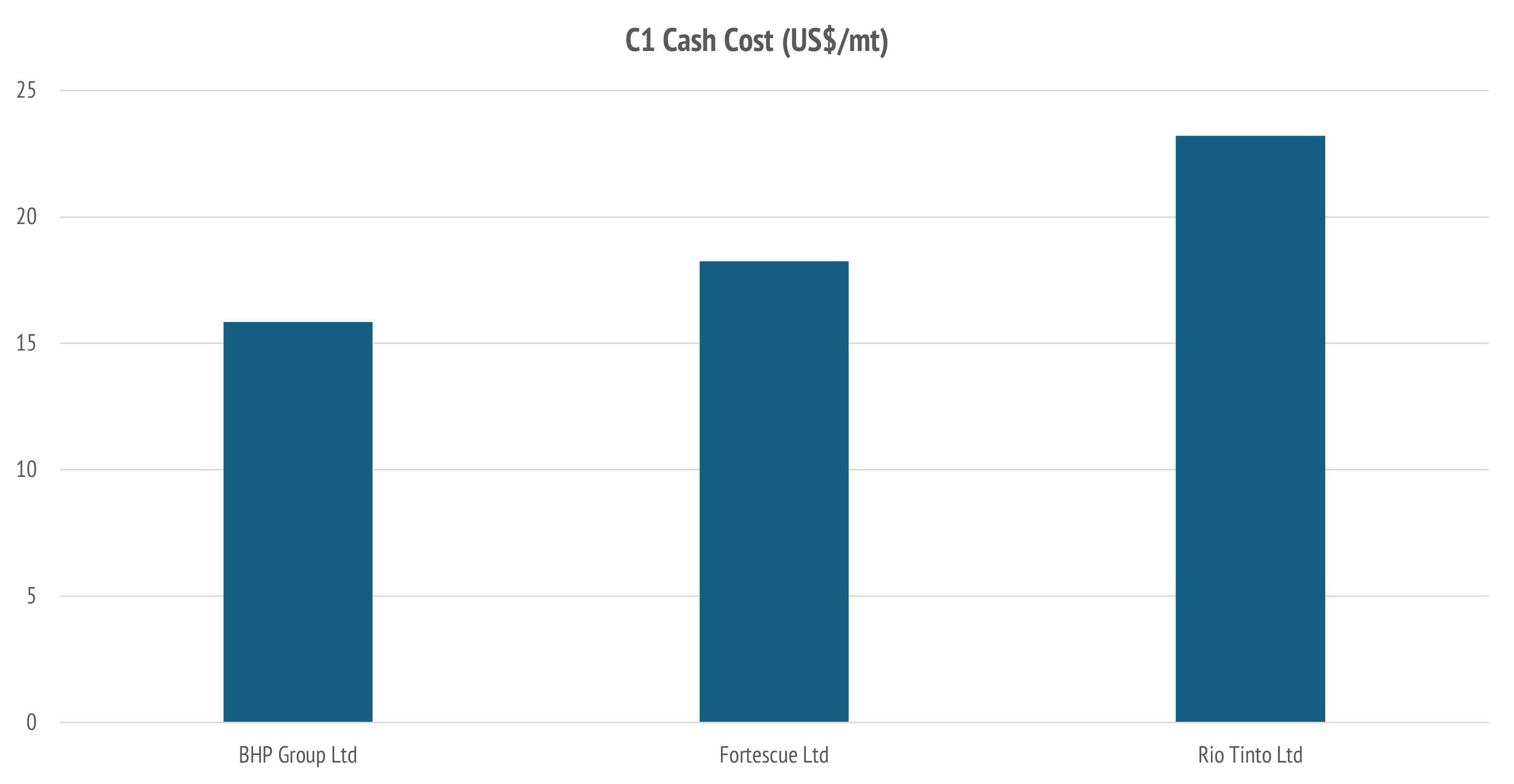

The cost leadership of BHP is clear.

Of course, even with iron ore in the US$80-100/mt range all three make great money.

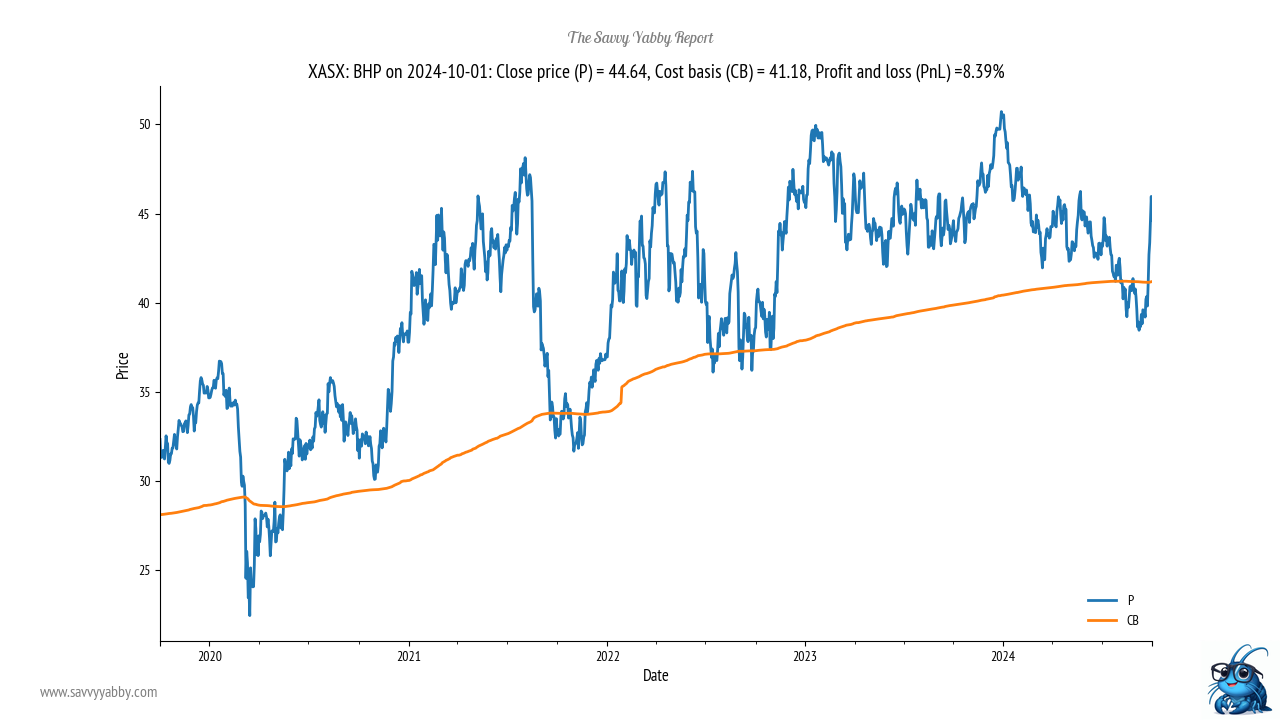

This is why the bear market in BHP Group ASX: BHP looks to be over.

The above chart shows my estimated cost of entry for BHP investors. They are back in the black and their bear market looks to be over now. That was a short bear market.

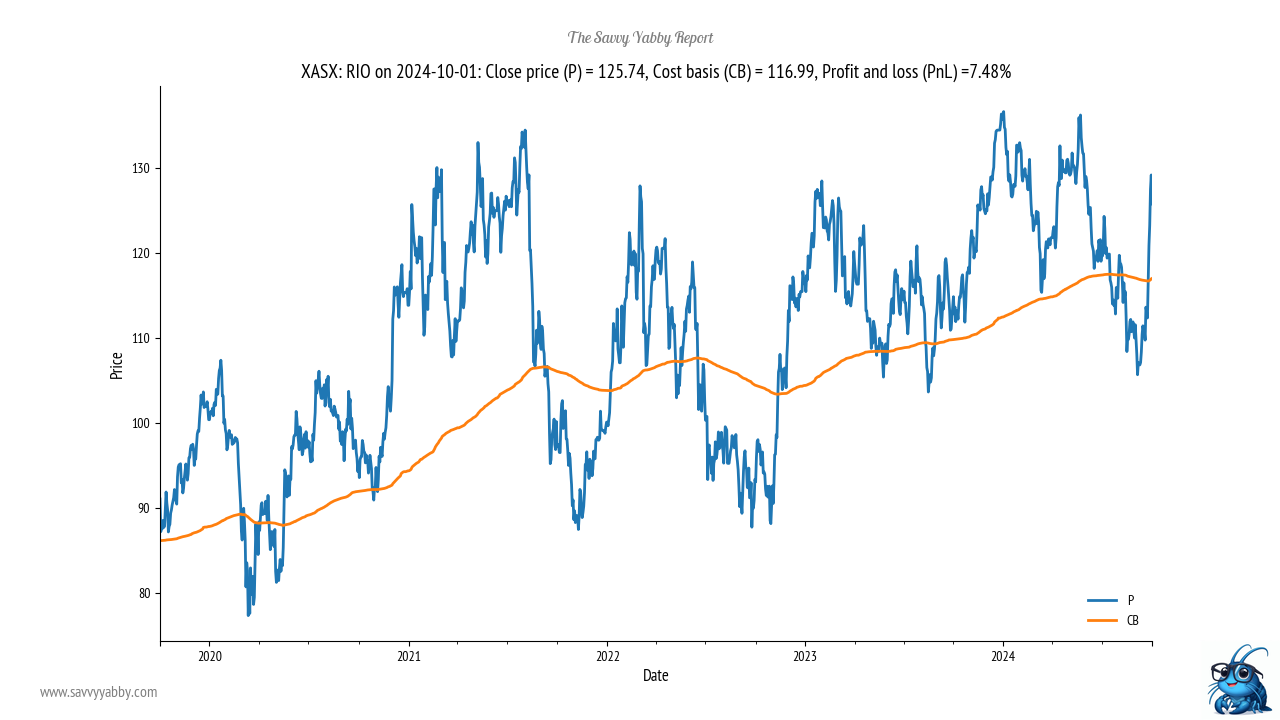

The same is true of Rio Tinto ASX: RIO.

Notice that Rio has been a little more volatile than BHP Group in going in and out of bear trading periods, but it is higher cost, and so has greater operational leverage.

FMG is having a nervous moment

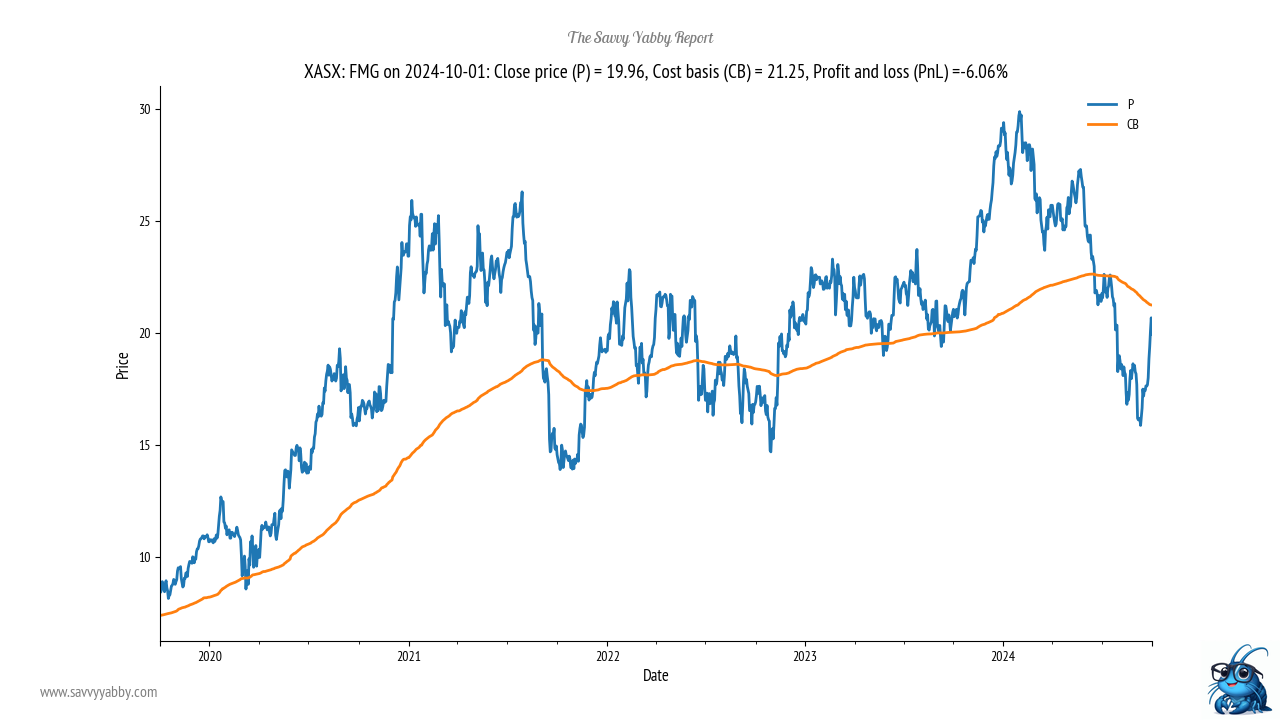

In contrast, Fortescue ASX: FMG went deeper into a bear market and started earlier.

The cash costs for Fortescue are fine at these levels of iron ore, but there is a test of sentiment right now around the $21.25 level.

We need to see if that is a turning point or inflection point.

I expect the stock to do a little work here as it was a very sharp rally off the low.

MIN has bull market excess to digest

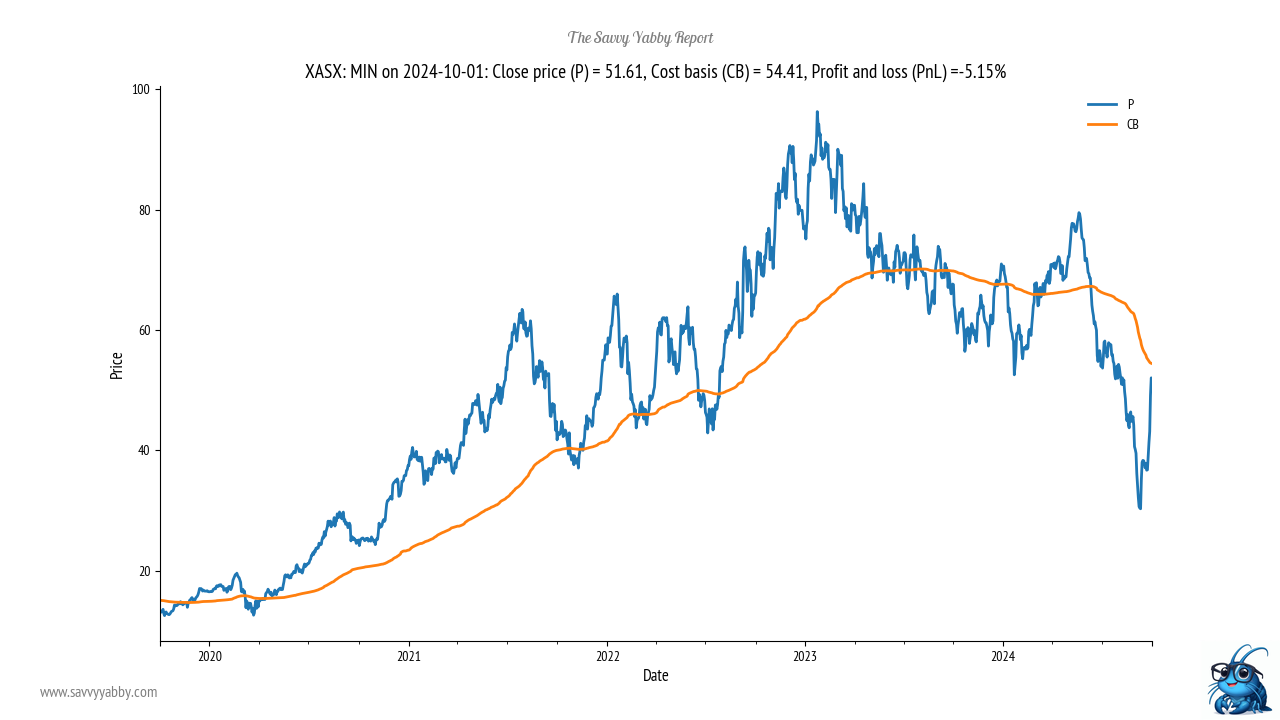

Mineral Resources ASX: MIN had the sharpest rally of all.

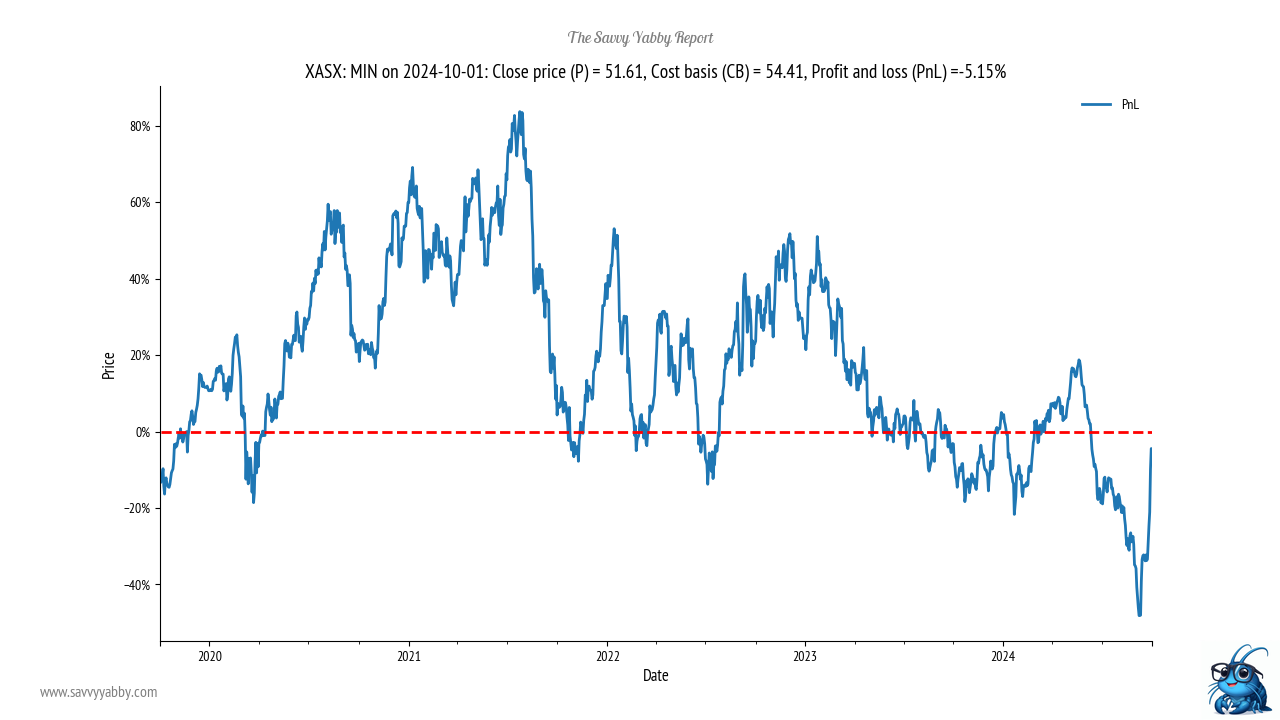

The stock is back up trading just below cost basis at $54.41. You can see from the plot of the unrealized profit and loss estimate that the drawdown exceeded -40%.

While the iron ore price seems to be out of the danger zone, Mineral Resources is approaching a break-even level on sentiment.

This is where "get-even-itis" is likely to take over.

There are still concerns about their spending spree buying up stakes in lithium explorers and developers at the peak, the profitability of new iron ore projects, the health of the balance sheet, and the wisdom of China bashing.

Call me strange, but I don' t understand why a CEO whose company sells the bulk of product to China would be in the business of dissing the country.

I am out and not likely to be a buyer at this level.

I think the stock is a sell.

Conclusion

Sentiment analysis is just one tool in a financial market. However, at times like this it can give some valuable clues on what the market may be thinking, and which stocks to seek better entries on, and which to set aside for now, or sell into the rally.

Not surprisingly, boring old BHP Group looks to have clearly exited the bear market.

Rio Tinto looks to be not far behind, but is more volatile, so may offer a better entry.

Fortescue should have no issue making a profit with current iron ore prices but is leveraged to their future investment plans. I think the stock will do some work here before it exits a short but sharp bear market that was worse than the two majors.

Mineral Resources looks like the problem child among the big four.

CEO Chris Ellison has made bold moves in the past, and investors were rewarded. However, it can take a while to reposition the deck cargo in a storm so as not to get sunk by it. I think they need to do some work on the balance sheet and reassure investors that they will sell their products to China.

For instance, the USA is about 5% of the global steel market, but only 1.5% of the iron ore market. China is more than 50% of both markets.

Having a market for your product matters.

Having good relations with the buyers in that market matters most.

Good luck and happy investing!

3 topics

4 stocks mentioned