Shane Oliver: How to be a better investor

Livewire Markets

In the mid-1990s, Shane Oliver was recently married and in the market for a new house. He was driving around Sydney's northern beaches in the middle of winter and he happened to stumble across an 'open home' where nobody had turned up. Ever the economist, he remembers that home loan interest rates had just started to creep up again after the early 90s recession - they were at about 10% - and the property boom had not yet started.

"It was weird that it even happened," he said. "How lucky could you be?"

Given today's housing market, a story like this seems almost apocryphal, hallucinatory. But, the more I spoke to Oliver, chief economist and head of investment strategy at AMP, about his investing strategy, and his deep experience as an economist, it became clear that this wasn't just dumb luck but another lesson in investing in uncrowded markets.

Shane Oliver has spent nearly 40 years working at AMP, in what he describes as "the best job in the country". When he sat down with Livewire Markets, he discussed a wide range of subjects, from the biggest influences on his investment strategy, to what he makes of WallStreetBets investors, his views on common investor mistakes and how to be a better investor, and, intriguingly, where he would invest a million dollars today.

As bright and engaging as his choice of tie, Oliver was also more than willing to share a few words of caution about the current market. In the past, Oliver has not been afraid to be contrarian and to dispute budding market optimism, and he thinks, for example, it will be a much harder slog in the years ahead and that the easy gains are behind us.

Shane Oliver's best advice for investors:

Over his investing career, Oliver has been influenced by a unique blend of investors, from legendary investor Warren Buffett, the late CEO of Vanguard Group and father of index funds Jack Bogle, and former chief economist of Deutsche Bank Dr Don Stammer.

- Make the most of compound interest: "Ultimately, the share market will deliver for you because of the power of compounding," he said, a lesson which was ingrained upon him early.

- No one got rich investing in bank deposits: The rates of return are so low, said Oliver, especially when compared to the share market. His favourite investment class because of the diversification and good returns.

- There's always a cycle, don't get blown off by it: There are all sorts of problems with trying to time markets, Oliver believes you need to accept that the cycle is part and parcel of investing. Volatility is the price you pay for investing.

- Have a process (and stick to it): It can be a technical process to compare stocks or even a mental process, but the trick is to stick with the process.

- Question the crowd: Challenge the assumptions of the crowd and know that great value can be found in uncrowded markets. Oliver has seen time and time again that, eventually, the crowds get it wrong.

- Turn down the noise: Oliver believes investors should just focus on a few key sources of information, so they can make sense of the universe they're investing in. There's a lot of noise in the world at the moment and some of these sources, such as Reddit, have ulterior motives to promote certain stocks.

- Don't use today's events to predict the future. Markets are a long game. Try not to use the short term changes today to predict the trends of tomorrow

How would Shane Oliver invest $1 million today?

Markets are like a river. You never step in the same place twice.

While market cycles come and go, today's markets are distinctly characterised by the macro trends of the past year.

"History tells us that the first 12 months out of a bear-market low - and that's what it was a year ago - sees very strong gains," said Oliver.

And so we have. The markets rebounded in the second half of 2020, with tailwinds carrying into early 2021.

But we're well into the COVID-recovery in Australia, and from here there will be a distinct impact from the unwinding of the stimulus-driven economy. So Oliver believes, despite the fact we're seeing earnings come through, moving forward it will be a "harder slog" to get returns out of shares.

With that in mind, we asked where are there still some gains to be made.

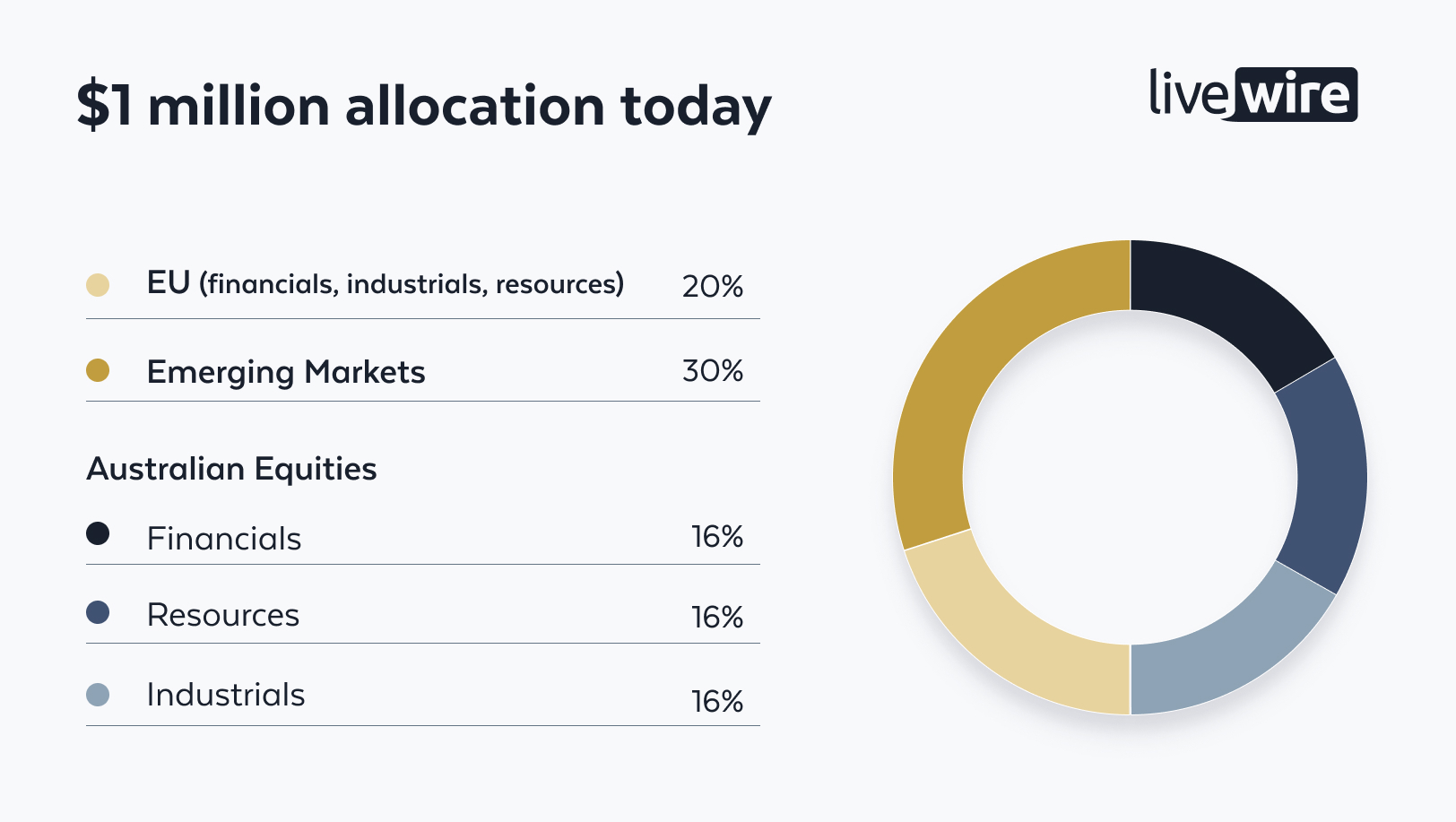

Excluding current holdings, such as his property, we put to Shane Oliver the question of where he would invest $1 million today. He said a 50/50 Australia-global mix with an emphasis on financials, resources and industrials. The emerging markets segment would have a heavy focus on Asian shares. Source: Shane Oliver (Designed by Livewire Markets).

These allocations are all hypothetical - a brainteaser exercise. But Oliver's strategy shows that the emerging markets sector has further to run for the recovery.

"I would probably put the bulk of that 30% I said in emerging markets, into Asian markets, which I see has good value and I think will benefit immensely from the ongoing reopening globally.

Oliver's track record in avoiding the crowd suggests that here we may find uncrowded waters.

... Speaking of crowded waters: WallstreetBets, Reddit, and all that

Of WallStreetBets and social media-fuelled retail investors, Oliver has seen it all before.

"What's going on with Reddit and those sorts of things now, I think, are akin to the day traders of the dot-com era," he said.

He has the right amount of cynicism about Reddit-mania. It's all noise, he said. The savvy investor knows to question the crowd.

He reminds us all that there's no such thing as a free lunch. If you're investing money from chat room advice, someone in the chat room is making money from your position.

"It's always like that. A new generation comes along and thinks the old people don't have a clue. And then they have to relearn the old lessons again," he said.

Etched in stone and dyed in the wool: A life at AMP

AMP towers are a definitive landmark in the Sydney city skyline as the eye sweeps from the Opera House to the Harbour Bridge. The taller building, a glass tower shaped like the corner of a half-solved Rubik's cube, is in the midst of a billion-dollar redevelopment. The second, squatter building, AMP's Sydney Cove was finished in 1962 and dominates Circular Quay property foreshore.

On the side of the Sydney Cove building, along the base of the western wall, reads the AMP motto "amicus certus in re incerta" beneath sculptor Tom Bass' goddess of plenty. It means "a sure friend in uncertain times" and harks back to AMP's origins as an insurer.

"That inspired me. I like companies with a noble purpose," Oliver tells us.

Oliver started at AMP nearly 40 years ago in 1984, while he was still studying at university. He had graduated with his first degree and was studying his Masters, which later turned into a PhD on market speculation. Oliver got chatting to someone from AMP at a university careers programme, took a job at AMP and has never looked back.

"They gave me a lot of opportunities in investments to focus on economics, which is what I love. So I reckon I've ended up with one of the best jobs in the country in terms of what I love, economics, and combining that with investing, and then combining that with communicating to people as to how to make the most of investment markets," he said.

Yet, of late, AMP has been the one in need of a sure friend.

As I write this, AMP has just announced it will be listing AMP Capital, rather than selling the beleaguered business. The company also announced, more quietly, that senior executive Boe Pahari will be exiting following the settlement of a sexual harassment claim.

All this has had nothing to do with Oliver's role, which he insists is quite separate from the operations of the company, but he hasn't been impervious to the turmoil around him. Oliver described it as "depressing and distressing", but he is confident about AMP's future.

"I think if you can stick to that noble purpose, you can find your way back. And that's why I've been pretty happy to stay at AMP. It hasn't always been smooth sailing. I mean, the last few years have been tough, but I must admit, having that noble purpose, knowing that a lot of people at AMP do come to work to do the right thing inspires me. And that's why I'm confident about AMP's future," he said.

As a youngster, Oliver thought students of economics could only become teachers of economics. (We are what we see modelled to us, after all). Instead, he rose through the ranks to become chief economist at AMP. But in a way, he has become a teacher of economics. His weekly newsletters "Oliver's Insights" are an education unto itself, and he is one of the prolific market commentators, with AMP recording 7,000 written articles quoting Shane and nearly 2,000 broadcast appearances in 2019 alone.

The "nice" investor

It was just sitting there at the end of Oliver's Twitter bio. "Head of Investment Strategy & Chief Economist at AMP Capital. Into boats, gardening, pop music, bright shirts & ties, economics, investing, my family ... and being nice."

Being nice? I had to ask.

For those blissfully unaware, Twitter, and the subset which linger in the financial world of FinTwit, is most aptly described as a trash fire. I say this with the greatest self-deprecation and awareness as I, too, am stuck in a love-hate relationship with this app.

"Well, I've always thought it's important to be nice to people because I believe in karma to some degree," he said.

"But the reason I put it on my Twitter account was that when I started tweeting, I was initially shocked at some of the comments I get back. People seem to turn their filters off on Twitter and that leads to comments that they probably wouldn't make face to face, but they're quite happy to make on Twitter," he said.

"I think it's important to stand up and say, 'Yeah, I want to be nice. I want to be respectful and generally be a nice person.'"

After our chat, there were three things about Shane Oliver that struck me as parallels to the world-leading investor, Warren Buffett.

The first was that, despite equities being his first love, he believes one of the best investments he ever made was his family home. The second was the fervour for the magic of compounding - Buffett is called the King of Compound, after all.

And the third was simply being nice.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

1 topic

1 contributor mentioned

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...