Should BHP pay big dividends, or buy back its shares?

After a bumper six months, BHP (ASX:BHP) is awash with cash. And it will soon be rewarding its shareholders. In its recent results announcement, the big Australian miner said it will pay a record interim dividend of US$1.50 per share. But are shareholders better off with a big dividend or a share buy-back?

BHP reported its interim financial results, with earnings predictably reflecting the strength in the underlying commodity exposures of its assets. The result was in-line with expectations on an operational level, although Net Profit after Tax benefited from a lower tax rate. Cashflow was also strong, reflecting a lower capex spend than expectations.

Listening to the 1H22 results call with management, one thing that stood out was the number of questions revolving around BHP’s capital management initiatives – namely the decision to buy-back shares vs paying out a dividend. The dividend payout ratio of 78% for this half was well above its 50 per cent minimum policy, albeit a reduction from its June half 2021 dividend. This is not a new issue (I have heard different variations of this question asked numerous times over the past five years!) but is worth revisiting given the dynamic nature of share prices and financial markets.

Returning capital back to shareholders

First – it’s important to note a buy-back and dividend both represent a form of returning capital back to shareholders (i.e., surplus cash that is in excess of operating and investment requirements), albeit one is a tangible return to shareholders as you receive a dividend check, while the other is arguably “less” tangible as the lower share-count resulting from a share buy-back helps earnings per share in the future. It’s also important to remember that dividends are not a free lunch, as share prices adjust post their ex-dividend date to reflect the amount per share being paid out.

So why the interest in how to return capital?

It is because, as Mike Henry astutely points out on the call, a perception around whether the board sees BHP shares as being “good” value. This is because BHP – like everyone else – is making an investment decision when assessing to buy back its shares, albeit with a competitive advantage in terms of having a deeper understanding of its operations and arguably having a longer-term view on share-price performance.

As BHP rightly points out, its earnings are cyclical by nature given its commodity-like exposures. And despite the rally in base metals, its earnings are still overwhelmingly “overweight” iron ore – which still accounts for over 60% of its operating EBITDA. With commodity prices being near record highs, an argument could be made that BHP buying-back shares would see it operating in a pro-cyclical manner – something which the miners have been accused of doing back in the early 2010s.

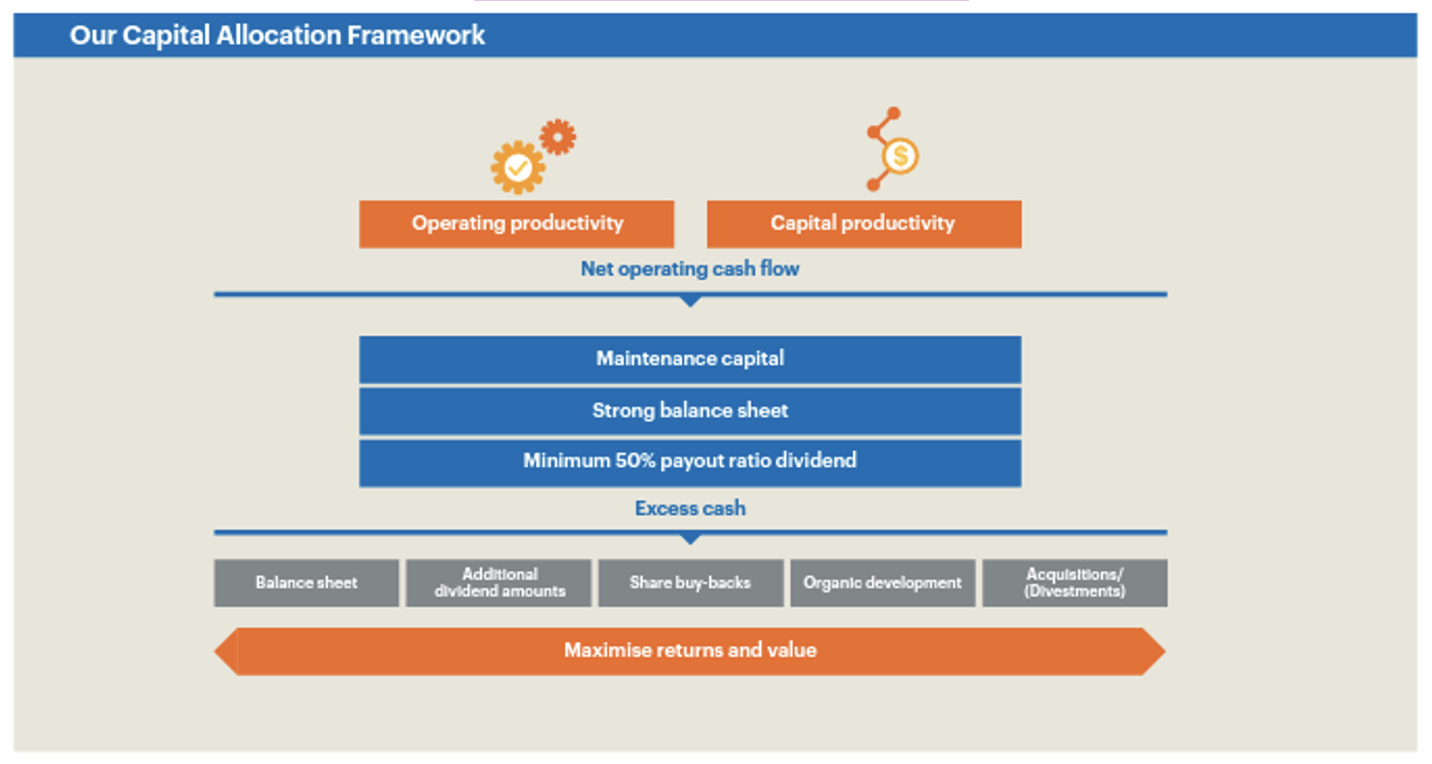

The other aspect to consider is BHP’s capital allocation framework. When BHP introduced its framework in 2017, the company outlined its key priorities for operating cashflow as per below.

BHP’s capital allocation framework

Source: Company 2017 Annual Report

After allocating operating cashflow to maintenance capital, balance sheet integrity and a dividend with a minimum 50 per cent payout ratio of underlying earnings, surplus cash would compete with the five areas below – balance sheet, additional dividends, share buy-backs, organic development and acquisitions / (divestments).

The preference for any company (and not just resource companies) would be to have investment opportunities that exceed the company’s cost of capital and meet hurdle return requirements. This would enable the company to invest in projects that would add medium-long term value to its shareholders in the form of greater earnings power and most likely share price appreciation.

However, this requires an opportunity set that can soak up over US$15 billion of operating cash-flow at an acceptable rate of return – something which BHP arguably does not possess following the divestment of its energy assets (shale in 2018, and the remaining conventional assets to Woodside later this year). BHP must also take into consideration what its investment in additional supply may mean for prices – where the benefits of new volume are eroded by price declines. For example, expansion of iron ore supply at current prices will yield very attractive returns, but may have an impact on pricing for its existing production and may even spark a race with major competitors RIO, FMG and Vale.

The other consideration that any company with surplus capital has is whether to buy-back its own shares in favour of investing in organic and / or inorganic opportunities on top of dividends.

For example, if the BHP Board and management held a view that its current share price reflects a long-term return of 10 per cent “through-the-cycle”, this 10 per cent return would then compete against organic growth opportunities for that surplus cash. In the case of a share buy-back, there is also significantly less risk – you know the exact price you are paying for the shares versus the operational and execution risks that exist for greenfield or brownfield development opportunities.

In BHP’s case, it also has the simultaneous advantage of returning surplus franking credits in the form of an off-market buyback, which will allow the company to buy-back shares at a cheaper price versus the market price – with the discount usually in the 10-14 per cent range.

At the end of the day, the fact that BHP’s Board elected to return capital in the form of dividends may be construed as a view on where we are in the cycle and whether at around $50 per share the shares represent good value….. or is more likely just a balanced decision that needs to be constantly reviewed depending on the risk-return profile of investments.

Never miss an update

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

1 stock mentioned