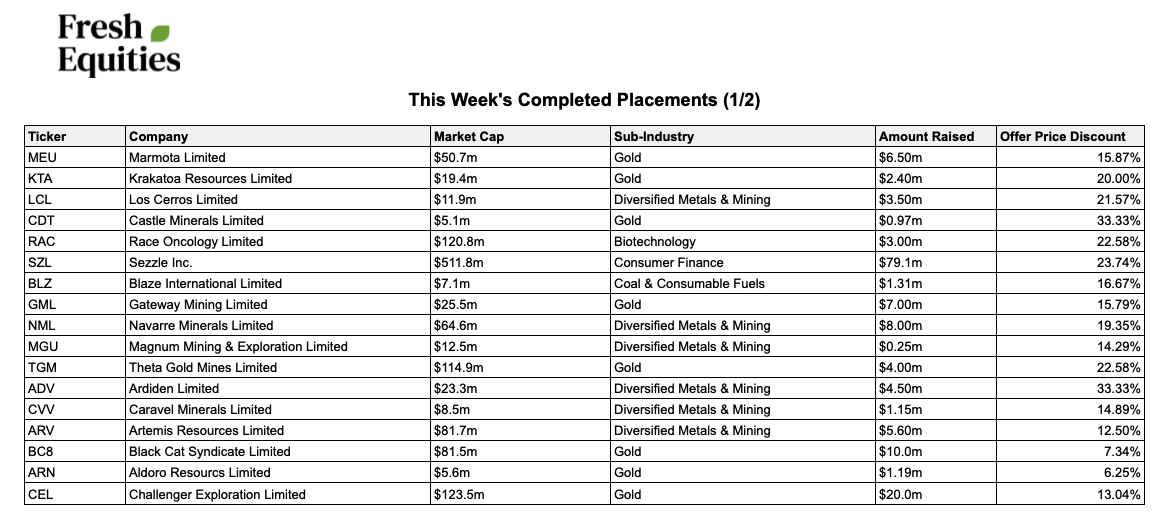

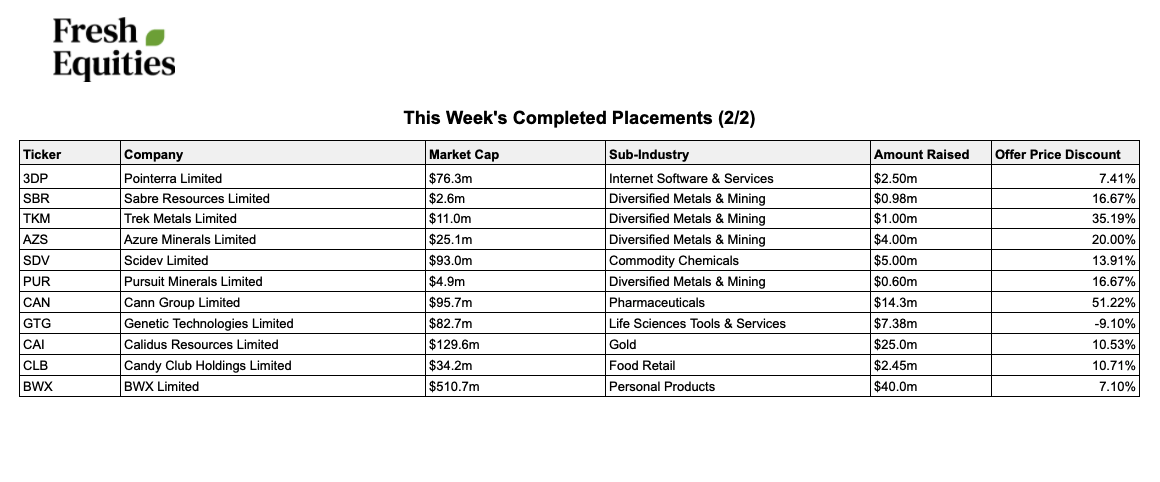

Small deals, but plenty of big bids: this week in capital markets

The gold rush continues, and this week it took up most of the action. 19 of the 28 placements that closed were for small cap mining companies, almost all of these had some exposure to a gold asset. It's money for jam in a lot of cases. There seems to be an insatiable investor appetite for exposure to gold, we are seeing most small cap goldies raise without an issue. This is strange given that these sort of raises don't appeal to everyone. Most of these companies are sub <$100m so not quite in the range of most institutional investors, and too illiquid for private wealth. But for those that understand the sector (which seems to be a lot of us), the frequent news flow and exposure to strong commodities is hard to pass up.

Who's taking all these deals?

We have some of the most active (by volume) capital markets in the world. Our favourite method of raising, placements, is scarcely used in most international markets. Placements are favoured because they allow companies to raise money quickly and in a targeted way.

For those unfamiliar with the placement process - an ASX company enters a trading halt and bidding officially opens, the next 2-4 days are spent collecting firm commitments from investors, after this the deal is done and the company has raised up to 25% of their current market cap. Usually 30-100% of a placement is filled before the trading halt by wall-crossed investors. But it's pretty unique to our market that there's so many investors who make an investment decision in the space of what can sometimes be a few hours during the halt. When you look at placements done for ASX 200 companies like Qantas, Kogan etc it makes sense that an investment decision could be made quickly, these companies are well known and well traded. However there are several hundred placements a year for small companies, which are lesser known, more speculative and often thinly traded. Placements have become a big market for investors and companies.

So why is there so much volume?

1. We have the right industries. Australia is fortunate enough to be mineral rich, which is a very capital intensive and high news flow business - both perfect conditions for a capital market. We're also a big hub for biotech and science, both of which require ongoing funding and produce frequent news flow to support the share price after dilution.

2. We have a large amount of capital to contribute. Australia has compulsory superannuation, which creates a large and constantly growing pool of investible money. Professional super managers and SMSFs are both chasing returns and discounted placement stock is a good way to start.

2. We all like to trade. In Australia over a third of the population hold and trade public company shares. To top it off, there's over 135 brokers in the country that are collecting clients and pitching over 800 placements a year.

Small deals, but big bidding.

We may not be able to go to the pub here in Victoria, but the mining sector seems to be out and about. Navarre Minerals collected $8m from investors this week to fund further activities at their Stawell based gold project. We recall that the company originally set-out looking for $4-5m but received such strong response from the gold-loving community that the raise was upsized by a factor of two. Even with an upsized total, there was still plenty of investors with bids cut back.

Calidus Resources took the mantle for the largest raise in the sector this week. The raise launched on Wednesday looking for $20m to finance further exploration at their flagship Pilbara gold project. On Thursday the deal was upsized to $25m and closed with excess demand. The company's largest shareholder, Alkane Resources (12.7%), subscribed for their pro-rata allocation in the placement.

There were a lot of small deals with big interest this week. We still believe that there's another round of big raises coming, this time for growth and acquisitions. There's an overhang in the market that needs to clear before these larger deals will launch. The situation in Victoria, uncertainty around the continuation of government stimulus and a looming reporting season are all factors.

Get investment insights from industry leaders

Liked this wire? Hit the follow button below to get notified every time I post a wire. Not a Livewire Member? Sign up for free today to get inside access to investment ideas and strategies from Australia’s leading investors.

5 topics