Smaller Companies: A guide to bargain hunting

Clime Investment Management

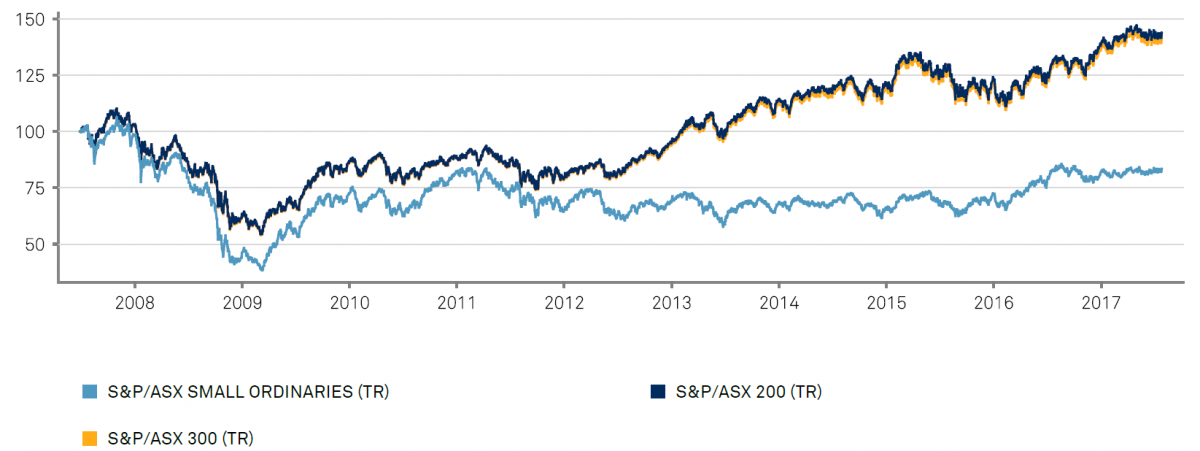

Small-caps offer opportunities for outsized returns, however it’s also an area in which to be especially cautious. Simply buying a basket of smaller companies in recent years probably wouldn’t have yielded good results, as the chart below starkly reminds. You have to be selective.

The attraction of larger caps is they’ve have stood the test of time and have left a raft of competitors in their wake. However, there are, on average, over 10 institutional analysts for every company above the $1 billion mark. In contrast, for small caps the average number of analysts per stock falls to less than one for sub-$100m market cap companies, so we have arguably better chances of finding bargains in this under-researched part of the market.

There are few more successful value investors than billionaire Seth Klarman, whose hedge fund Baupost Group in the US has generated a remarkable annualised return of 16% over the last 34 years. Recently we came across The Collected Wisdom of Seth Klarman, an excellent summary of quotes by the great man put together by Santangel’s Review in 2015. We recommend members peruse the note as it succinctly covers many key and often counter-intuitive principles guiding the value investing process.

On the subject of finding bargains Klarman offers the following 13 insights:

- “Great investments don’t just knock on the door and say ‘buy me.’”

- “It is easy to find middling opportunities but rare to find exceptional ones.”

- “When buyers are numerous and sellers scarce, opportunity is bound to be limited. But when sellers are plentiful and highly motivated while potential buyers are reticent, great investment opportunities tend to surface.”

- “Rather than buy from smart, informed sellers, we want to buy from urgent, distressed or emotional sellers.”

- “A bargain price is necessary, but not sufficient for making an investment, because sometimes securities that seem superficially inexpensive really aren’t.”

- “Institutional constraints and market inefficiencies are the primary reasons that bargains develop. Investors prefer businesses and securities that are simple over those that are complex. They fancy growth. They enjoy an exciting story. They avoid situations that involve the stigma of financial distress or the taint of litigation. They hate uncertain timing. They prefer liquidity to illiquidity. They prefer the illusion of perfect information that comes with large, successful companies to the limited information from companies embroiled in scandal, fraud, unexpected losses or management turmoil.”

- “We pursue opportunity largely off the beaten path, sifting through the debris of financial wreckage, out-of-favour securities and asset classes in which there is limited competition. We specialize in the highly complex while mostly avoiding plain vanilla, which is typically more fully priced. We happily incur illiquidity but only when we get paid well for it, which is usually when others rapidly seek liquidity and rush to sell.”

- “When you have been doing this for a while, you start to become more proficient about where to look, which rocks to look under. The rocks we look under tend to have a few things in common.”

- “You must buy on the way down. There is far more volume on the way down than on the way back up, and far less competition among buyers. It is almost always better to be too early than too late, but you must be prepared for price markdowns on what you buy.”

- “Market inefficiencies, like tax selling and window dressing, also create mindless selling, as can the deletion of a stock from an index.”

- “These causes of mispricing are deep-rooted in human behaviour and market structure, unlikely to be extinguished anytime soon.”

- “Investing is, in many ways, a zero-sum activity in which your returns above market indices are derived from the mistakes, overreactions, or inattention of others as much as from your own clever insights.”

- “Typically, we make money when we buy things. We count the profits later, but we know we have captured them when we buy the bargain.”

A common theme is that cheap stocks appear in cases where the majority of investors either don’t want them or want to know about them. It’s counter intuitive, but although it feels good to be in agreement with lots of others, wider market interest simply raises competition for returns. A key part of the hunting process is choosing where to look, and Klarman points to market downturns or companies experiencing turmoil as instances of reduced competition.

Another is that exceptional opportunities (of the not “middling” type) are rare and aren’t obvious. Financial data is great for performing research, however genuine bargains won’t be revealed via simple metrics that are available to everyone. This is particularly so for small caps, where the financials can change dramatically in a short period. Our task is to look behind the numbers, figure out how the future financials are going to change, and do it before the majority of the market.

At Clime Smaller Companies we are looking under as many rocks as we can, particularly where we think the market appears disinterested. We look forward to sharing what we’ve found with readers in the coming weeks and months.

3 topics

The Clime Group is a respected and independent Australian Financial Services Company, which seeks to deliver excellent service and strong risk-adjusted total returns, closely aligned with the objectives of our clients.

Expertise

The Clime Group is a respected and independent Australian Financial Services Company, which seeks to deliver excellent service and strong risk-adjusted total returns, closely aligned with the objectives of our clients.