Smart beta: the adviser’s choice

We’ve talked extensively about the rise of smart beta and the disruption of active management. We think that smart beta products are a disruptive innovation with the potential to affect the businesses of active managers. Now we are finally witnessing active managers changing their businesses, highlighting that the disruption is well and truly underway.

VanEck’s most recent Smart Beta Survey shows advisers are flocking to smart beta, attracted by their performance, targeted outcome, diversification, lower fees relative to active and ease of use. Institutional investors have used smart beta as a low-cost way to invest and their genesis can be traced back to the 1970s. Smart beta strategies combine the systemic approaches of active management within the construct of a passive strategy, combining the best of both worlds.

At the forefront of smart beta innovation is another more recent innovation in investing: exchange traded funds or ‘ETFs’. Smart beta ETFs therefore combine the best aspects of active and passive management by tracking indices that deliver a chosen investment outcome, all the while retaining transparency, liquidity and ease of trading within defined rules.

We

think the disruption is well and truly underway.

This is not as surprising as it should be

Forewarning the rise of smart beta was a 2016 scholarly article published in the CFA Institute's Financial Analysts Journal. In their paper, ‘The Asset Manager's Dilemma: How Smart Beta is Disrupting the Investment Management Industry', authors Ronald Kahn and Michael Lemmon described smart beta as:

“A disruptive financial innovation with the potential to significantly affect the business of traditional active management.” (Kahn and Lemmon, 2016)

Their paper successfully illustrated that current fee levels, of the global equity universe they analysed, were inconsistent with the performance outcome. They are too high. Over 35% of global equity managers, according to Kahn and Lemmon’s analysis, will be disrupted by smart beta.

That figure might be too low.

The disruption is happening in Australia

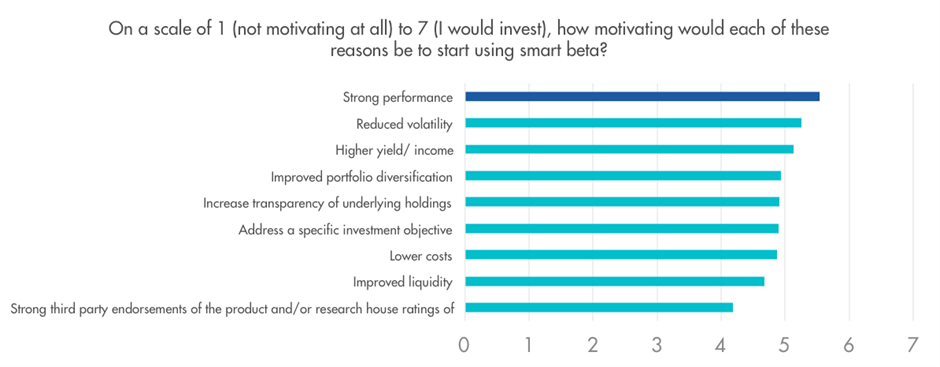

VanEck’s recent, sixth annual Smart Beta Survey, the biggest survey of its kind worldwide, once again demonstrated that the most important factor for an adviser selecting smart beta is not fees. It is performance.

Source: VanEck Smart Beta Survey, 2021

Active managers should take note. This past week S&P released its most recent SPIVA report for Australian funds and once again it does not make good reading for active fund managers. The summary states: “For longer measured periods (3, 5, 10, and 15 years), the majority of active funds underperformed their respective benchmark indices across categories.”

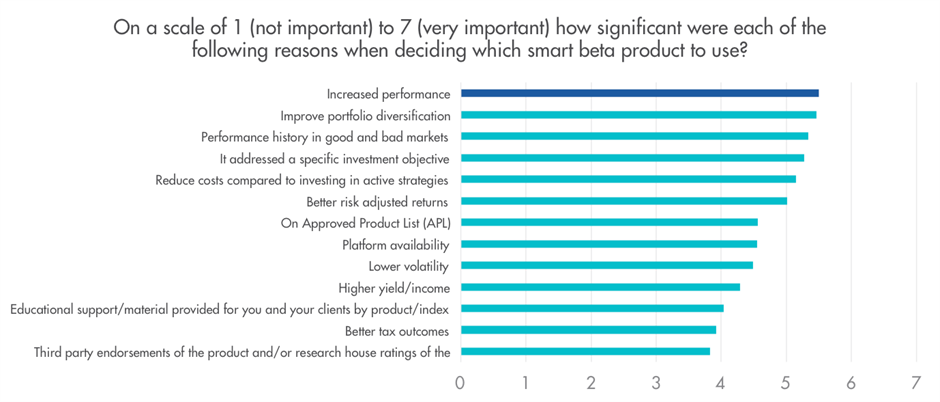

More worrying for active managers, the VanEck Smart Beta Survey indicates over 50% of advisers are using smart beta to replace active managers. The reason is increased performance.

Source: VanEck Smart Beta Survey, 2021

The survey also found 99% of smart beta users are satisfied with their strategy. This finding has been consistent in every year of the survey. The disruption is happening. In practice, we are seeing this play out in global equities; smart beta strategies can consistently deliver investors active outcomes for low passive fees. The same is true of other asset classes.

There is no doubt that those active managers with an investing edge will continue to be selected in portfolios, but there are many active managers who underperform, as S&P have found. Active fund managers often use management jargon like ‘disruptive innovation’ in their marketing when they describe how they assess the companies and industries in which they invest.

Now, to compete with existing smart beta strategies they have to recognise the disruption in their own industry. At the very least, they need to lower fees to better reflect their performance. It is one way to ensure their long-term survival. Those with performance that does not match up to fees, will not survive.

3 topics