Splitit rattles the tin and some unusual Gold raises: this week in capital markets

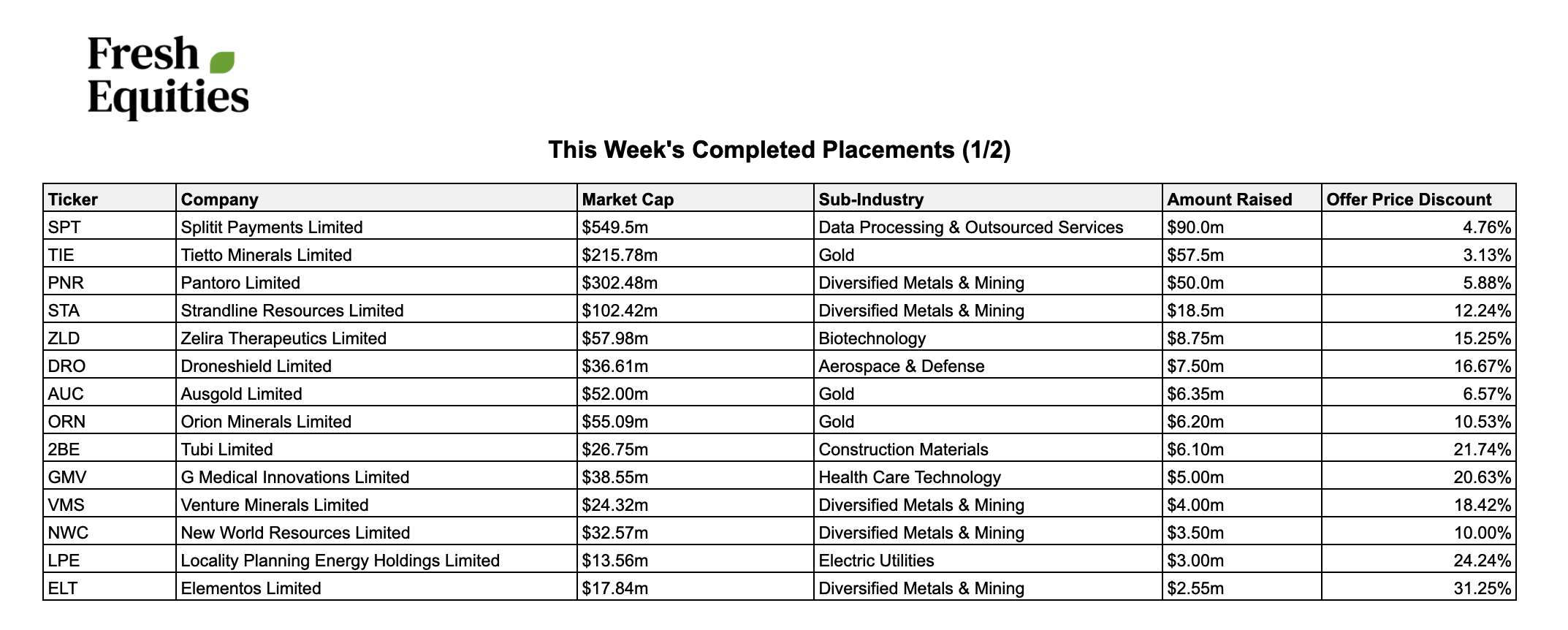

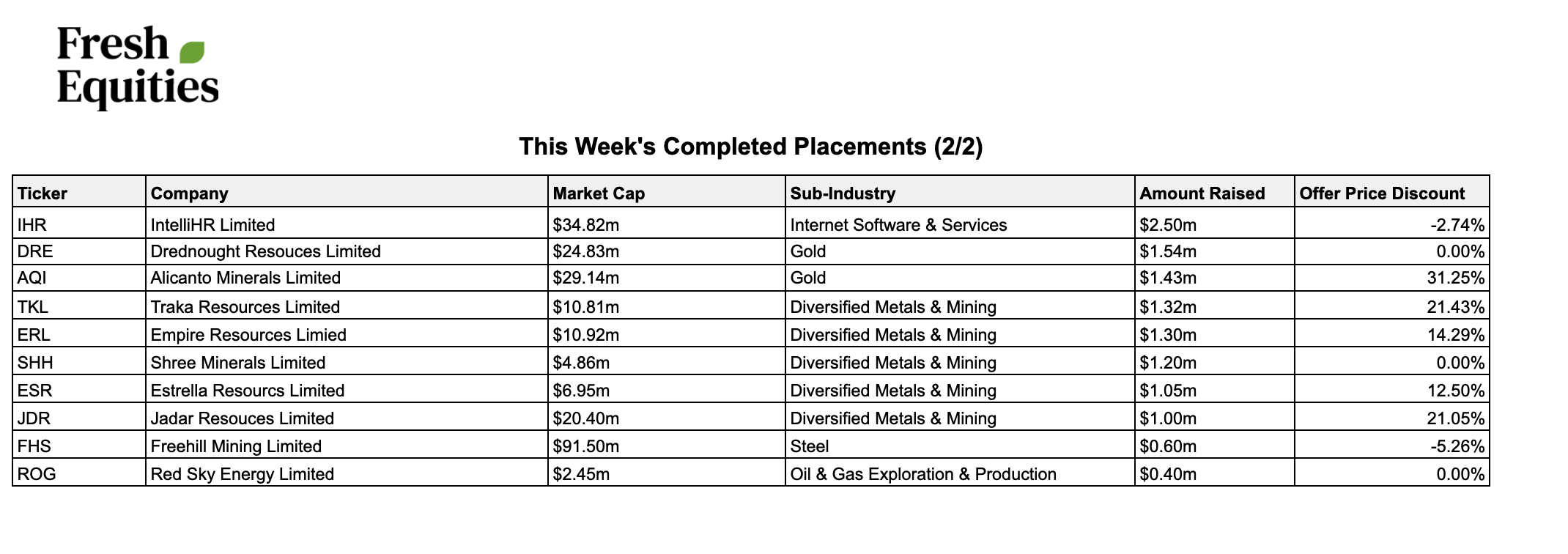

Just over $280m of funding was raised this week for listed Aussie companies. Of the 24 raises that were completed, more than 70% of the capital went to Splitit (SPT) , Tietto Minerals (TIE) and Pantoro (PNR).

The final of the big four in BNPL hits the market for a raise

When a sector goes on a run and gains the popularity of the masses, capital raises will almost certainly follow. We've seen this in the past with Tech, Lithium/battery metals, gold and now buy now pay later.

BNPL has become a crowded sector and there's more coming, but the most notable remain - Afterpay, Zip, Sezzle and Splitit. All have enjoyed enormous appreciations in share price over the last few months, and as of this week all of them have taken advantage of this by raising capital.

The last cab off the rank was Splitit, who went out this week looking for $90m. The deal was split across two tranches, $45m straight away and a further $45m in mid-September. The full amount was raised but absent from the completion announcement was any mention of "heavily oversubscribed". Brokers/companies love including this phrase in raise announcement wherever possible, maybe the appetite for BNPL is wearing off?

We hope not for the sake of Splitit's retail investors, who will be given the opportunity to participate at the same price as the placement via a follow-on SPP. Curiously, the SPP will not be launched immediately as would normally be the case. Instead, it will formally open after the first tranche of the placement has settled. This creates a bit of risk for the company (and their broker), who will need to ensure the share price stays above the offer price for a few days longer. Let's hope the placement went to strong hands.

We saw some activity from the bigger end of the gold sector

We've probably spent enough column inches talking about small cap gold explorers. They have become a fixture on the weekly tally of capital raises, and with the gold price continuing to head north this is unlikely to change. But this week there was some juicier activity in the sector that is worth exploring (pun attempted).

Gold producer Pantoro was out rattling the tin for $45m this week to advance it's half-owned WA Norseman gold project. Unlike most of their smaller peers, Pantoro already has a cashflow positive project that it is using as its 'beachhead' for this new activity. The company will use funds from their gold-producing Halls Gap project in combination with the money from the capital raise to maintain an "aggressive drilling program". Smaller existing shareholders will be given the opportunity to participate at the same offer price via a $5m SPP which launches immediately.

Tietto Minerals hit the market for $57.5m via a placement, and a further $5m to be collected through an SPP. The structure of their placement was a bit of a mouthful.

There's $45m that was arranged by the company's brokers and is fully-underwritten, a good sign of financial confidence for a smallish explorer. This will settle evenly across two tranches. Then there's a further $12.5m that will come from a combination of a Chairman's list and director participation - essentially funds that are introduced by the company. Tietto's managing director will also part with 5.1m shares through the placement. The completion announcement reports that this is "to provide for tax liabilities associated with the issue of Performance Shares" and to fund his exercise of 1.625 million options. After a decade at the helm it is good to see an MD reaping some rewards but also buying back in.

Never miss an update

Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

4 topics

24 stocks mentioned