Stock Picks for 2021

Mike Tyson once said “Everybody has a plan until they get punched

in the mouth”. This year we survived being punched in the mouth. In fact, it was a great year from an investing standpoint. The volatility allowed nimble funds like ours to exploit a once in a decade opportunity to time the market (which can be done).

The year ahead looks much more stable. The adults are back in charge of the US, the vaccine is coming, relations with the Chinese can only get better, and the probability is that the world will gradually recover its pre-pandemic levels of economic activity.

We have every hope that in 2021, we can settle into an equity market routine that favours analysis over guesswork and predictability over anxiety.

We call it our "Quiet Bull Market Theory". We can but hope, but the odds are improving and I think we've all had quite enough of the precipitous risk of the last twelve months.

Outperforming in a steady bull market requires two things: the first is easy, being fully invested. We've taken that decision for now (subject to daily re-assessment).

The second is picking the right themes beneath the market trend. We call them the "Tides". It's a lot easier picking stocks when the tide is running with them. Picking those tides requires a bit more thought but this is our best guess.

THE THEMES AND SOME STOCKS FOR 2021

HEALTHCARE: As 2020 was the year of the pandemic, 2021 will be the year of the vaccine. Not only will the vaccine production be in focus but also the delivery logistics. Australia is a world leader in medical innovation. Whether that is through Cochlear (COH), Resmed (RMD) or vaccine maker CSL Limited (CSL), we are pioneers in medical technology. This will continue. Although CSL has not been involved in the CV19 vaccine development, the government has joined with CSL to create a hub of excellence for the next virus, and the next. 2021 will be another year where Australian innovations change lives. At the smaller end there are companies likes Mesoblast (MSB), Polynovo (PNV) or 4D Medical (4DX). Science has come to the rescue this year and will be important in the new year. Australia is a clever country and there are plenty of opportunities to pursue.

INFRASTRUCTURE AND BUILDING MATERIALS – Many governments around the world have vowed to build their way out of recession, with the Australian government no exception. The infrastructure building boom on the eastern seaboard was already the most expansive in the history of our country pre-COVID – and commitments to build and grow have only been accelerated since. At last count, the Federal Government has committed to a record $110bn in spending over the 10 years from 2020-21. That’s a lot of concrete to pour. Key names in the space are Boral (BLD), CSR Limited (CSR), Lendlease (LLC) and Downer EDI (DOW).

RESOURCES - Fuelling the construction will be materials. Iron ore has been a crucial economic support on 2020 and we expect its importance to carry over into the new year. The obvious names here are BHP Group (BHP), Rio Tinto (RIO), and Fortescue (FMG), with the latter having the most potential upside as a pure-play, despite the recent record high. Copper, seen as an economic bellwether, is trading at a seven-year high and with the EV boom happening in Europe and China, we will continue to see the lithium space and rare earths do well. Stocks to watch include OZ Minerals (OZL) and Sandfire (SFR).

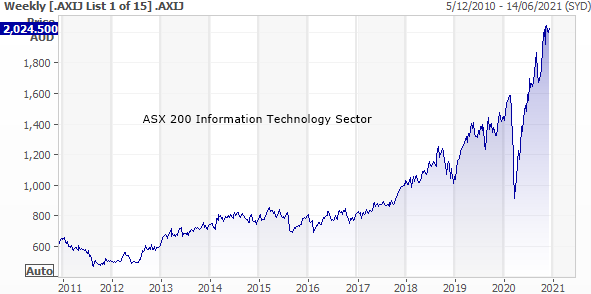

TECHNOLOGY: With a rotation currently underway from growth to value, some are questioning whether the tech trade is dead. Like Oscar Wilde, we believe reports of its death have been greatly exaggerated. Whilst the tech trade might slow or even pause, let’s not forget that tech has been the biggest growth engine in the US for the past decade. Whilst it’s not quite the same in Australia (tech was fourth-best from Dec 2009 – December 2019), our tech sector is still in its infancy and growing. New players will emerge. 2020 has been all about buy-now-pay-later (BNPL) and the rise of Afterpay (APT). APT is the tech sector leader but there are plenty of other tech stocks out there. From accounting software Xero (XRO) to platform providers of services, such as realesate.com (REA) and carsales.com (CAR), to online shopping, financial information and emerging technologies, it is a vast sector. Covid has encouraged many companies to accelerate their digital plans and this will continue.

AGRICULTURE: Notwithstanding our current relationship with China, there is still a massive opportunity to provide quality products to our Asian neighbours and the rest of the world. The damage to A2 Milk (A2M) and Treasury Wine Estate (TWE) could prove to be a great buying opportunity - when the detente happens, and it could, in a flash. Outside of an improvement in trade relations with China, we are the food bowl of Asia and agricultural stocks should continue to do well. They are a capricious bunch given the vagaries of the weather, Elders (ELD), Australian Agricultural Corp (AAC) and even Rural Funds Group (RFF) all offer exposure to one of Australia's greatest industries.

ENERGY: Oil has been a casualty of Covid and it is yet to recover fully. 2021 is set to be the year of the renewables as Biden embarks on his ambitious agenda - $400 billion over 10 years – and as the UK bans the sale of petrol vehicles from 2030. These moves will put significant pressure on the Morrison government to follow suit, as Australia’s current noncommittal policy will no longer be good enough. All that said, let us not forget the fossil fuel plays. Oil isn’t going away and price rises could eventuate in 2021 as the world recovers, people begin to fly again and public transport is avoided for health reasons. Hydrogen is all the talk at the moment but remains problematic, whilst the transportation issues with this gas and LNG are similar. The main energy plays include stocks highly correlated to the oil price - Oil Search (OSH), Woodside (WPL), Origin (ORG), Santos (STO), Beach Energy (BPT) and Karoon (KAR) - now the fifth-largest oil producer on the ASX and one to keep an eye on. We could even see some positives for AGL Energy (AGL) going forward as the wholesale energy market stabilises.

SPACE AND DEFENCE: The tension with China will ensure the defence sector is of interest. Here in Australia, there are a few smaller defence contractors of note; shipbuilder Austal (ASB) is one and Electro-Optic System (EOS) has not only weapons sighting systems covered but also a growing space business. Orbital Corp (OEC) is a sleeper in the sector with propulsion systems for drones through its partnerships, including Boeing. In small caps in the defence sector, Xtek (XTE) has some attractions in body armour and a broad range of defence and security force products.

CYBERSECURITY - Cybersecurity will continue to be a huge market and we have a number of players in the sector including Tesserent

(TNT) which we first covered at 4c.

RECOVERY STOCKS - We have listed some of these in our previous wires. Here are some of the post-pandemic plays - recovery stocks and vaccine beneficiaries: Travel - QAN, SYD Transport - TCL, ALX, AIA REITs - URW, SCG, DXS, LLC, GPT, MGR Energy - OSH, WPL, ORG, STO, WOR Investment Banks - huge rises in the US - MQG our most obvious player Banks - WBC, ANZ, NAB, CBA BOQ BEN Insurance - QBE (likes rising US bond yields), SUN, IAG Cyclicals - AWC, IPL, ORI, AZJ

RECOVERY STOCKS OUTSIDE THE ASX 100 - Travel - WEB, FLT (8.2% shorted), EVT, ALG, HLO, SLK, EXP, REX Education - IEL Gambling - ALL, CWN, SKC, SGR REITs - SCP, GOZ, CQR, COF, NSR, CMW, ABP, AVN, INA, WPR Energy - BPT, COE, KAR, SXY, ZEL, GNE Banks - BOQ, BEN Funds management - PTM, PPT Insurance - IFL, GMA Financial - CGF, VUK, PDL IRE, LNK, CCP Aged Care - EHE, JHC, REG Cyclicals - ILU, NUF, DOW Housing - A host of stocks from the banks to estate agents.

Whilst this is a comprehensive summary, the Marcus Today team have gone one step further and narrowed down the list to seven Key Stocks for the Coming 12 Months. To find out how to access this document, click HERE.

3 topics