Strategies to sleep well for small cap investors

We believe the true test of being on the right investment path is whether you can sleep well at night. If you find yourself awake in the middle of the night mulling over your investment portfolio’s downside risk you probably need to make some changes. In this article we discuss some key strategies to ensure you can sleep well as a smaller companies’ investor.

“Ultimately, nothing should be more important to investors than the ability to sleep soundly at night.” Seth Klarman

Think long term

“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.” Warren Buffet

This is always the starting point for successful investing in our opinion, and is easier said than done for most investors. Thinking long term about investing requires immense discipline, focus and patience, particularly when Mr Market is giving you live quotes on a minute by minute basis. However, it is only over the long term that wonderful businesses are able to reveal their true colours and shareholder creation potential to the broader market, and selling too early precludes investors from benefiting from this potential.

Value invest for a margin of safety

"We sleep better at night knowing that we are focused on investing in true bargains." Bruce Berkowitz

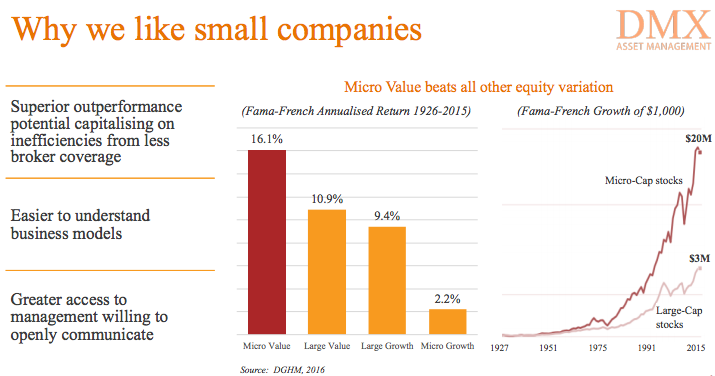

At DMX Asset Management we believe that value investing in high quality smaller companies is a superior long term strategy, and this view is supported by the long term historical data:

We take comfort from knowing that we are buying into high quality businesses at a significant discount to their intrinsic values, which largely de-risks the investment process in our opinion. And we sleep well at night knowing that high quality businesses generally trade at or above their intrinsic values over the long term. These high quality businesses are growing their earnings today, and are well placed to continue to grow their earnings over time, and it is these growing earnings profiles that will determine a company’s value in the longer term, and which long-term holders are well placed to capture.

Take portfolio risk control seriously

“Investors should always keep in mind that the most important metric is not the returns achieved, but the returns weighed against the risks incurred.” Seth Klarman

"If we can't tolerate a possible consequence, remote though it may be, we steer clear of planting it's seeds" Warren Buffett

Managing portfolio risk requires focus, discipline and time. And let’s be honest, risk management is not the most fun part of investing. However, it is a key strategy for sleeping well, and we have a number of portfolio risk control management strategies we employ:

- Upside versus downside risk – we will only invest in a stock if the upside potential significantly outweighs the downside potential;

- Gauge conviction level objectively – we will ensure that our portfolio weightings reflect our conviction levels in each stock; to ensure objectivity all team members are consulted for honest feedback;

- Prepare for liquidity changes - and remember the portfolio’s overall liquidity position;

- Keep some bullets in the gun – we will always maintain a solid cash weighting in order to take advantage of opportunities as and when they arise;

- Have a plan in place for if things go wrong – we will always prepare for a worst case scenario just in case.

Don’t watch/judge daily stock moves

"Don't watch the market closely. If you’re trying to buy and sell stocks, and worry when they go down a little bit … and think you should maybe they should sell them when the go up, you’re not going to have very good results." Warren Buffet

This is arguably the hardest piece of advice for most investors to follow in an era of constant digital information and news-flow. However, it is also one of the best pieces of advice for investors who intend to own a stock for the long term.

Even the best performing stocks in the market go up and down on a daily, weekly, monthly and yearly basis. Volatility in stock price moves is part and parcel of being a listed company, and cannot be avoided in the public markets.

The challenge most investors have today is understanding that short term stock moves are irrelevant. Many investors fall into the short term-ism trap and if a stock is not performing here and now they will become concerned and sell the stock.

We believe this is why so many investors under-perform the market; they allow the market’s emotions to influence their own emotions which pushes them to take the same action as everyone else at exactly the wrong time.

In our experience this focus on short term stock moves is becoming more and more prevalent as investors are becoming more and more short-termist. This is great news for long term investors because it results in an increasingly inefficient market which is largely driven in the short term by technicals and sentiment rather than the faithful long term guide, company fundamentals.

Avoiding this trap is simple: Make sure you are on the ASX investor release email list for all your stock holdings to ensure that you are kept up to date with the latest news from your investments. Then, most importantly, ignore all short term share price moves.

CONCLUSION: Investing in under-valued smaller companies requires discipline and focus. By following the strategies mentioned sleeping well at night remains a core part of our approach.

1 topic