Surprise China policy change boosts ASX aluminium and copper stocks

There’s been plenty of focus recently on a range of stimulus measures aimed at boosting the flagging Chinese economy. ASX listed resources stocks experienced strong gains through September following the announcement of a range of monetary and fiscal policies, as well as the promise of more to come.

More recently, share prices in the sector are paring back to again reflect the double-digit percentage losses for 2024 that many were suffering before September. The prices of key base and precious metals, iron ore, and many energy commodities, have drifted lower since the initial euphoria due to general disappointment over the degree of measures taken so far, and since last week, the US election result.

On the second item, the Trump + Red Sweep likely cements the USA implementing some form of tariff regime aimed at China which could reduce its demand for raw materials.

The situation with respect to the Chinese economy, and therefore commodity prices, is clearly volatile and dynamic. As if to prove this, Aussie mining stocks are rallying today on the back of a policy tweak made late Friday afternoon by China’s Ministry of Finance (MoF) to remove the 13% tax rebate for copper and aluminium semi-fabricated product exports.

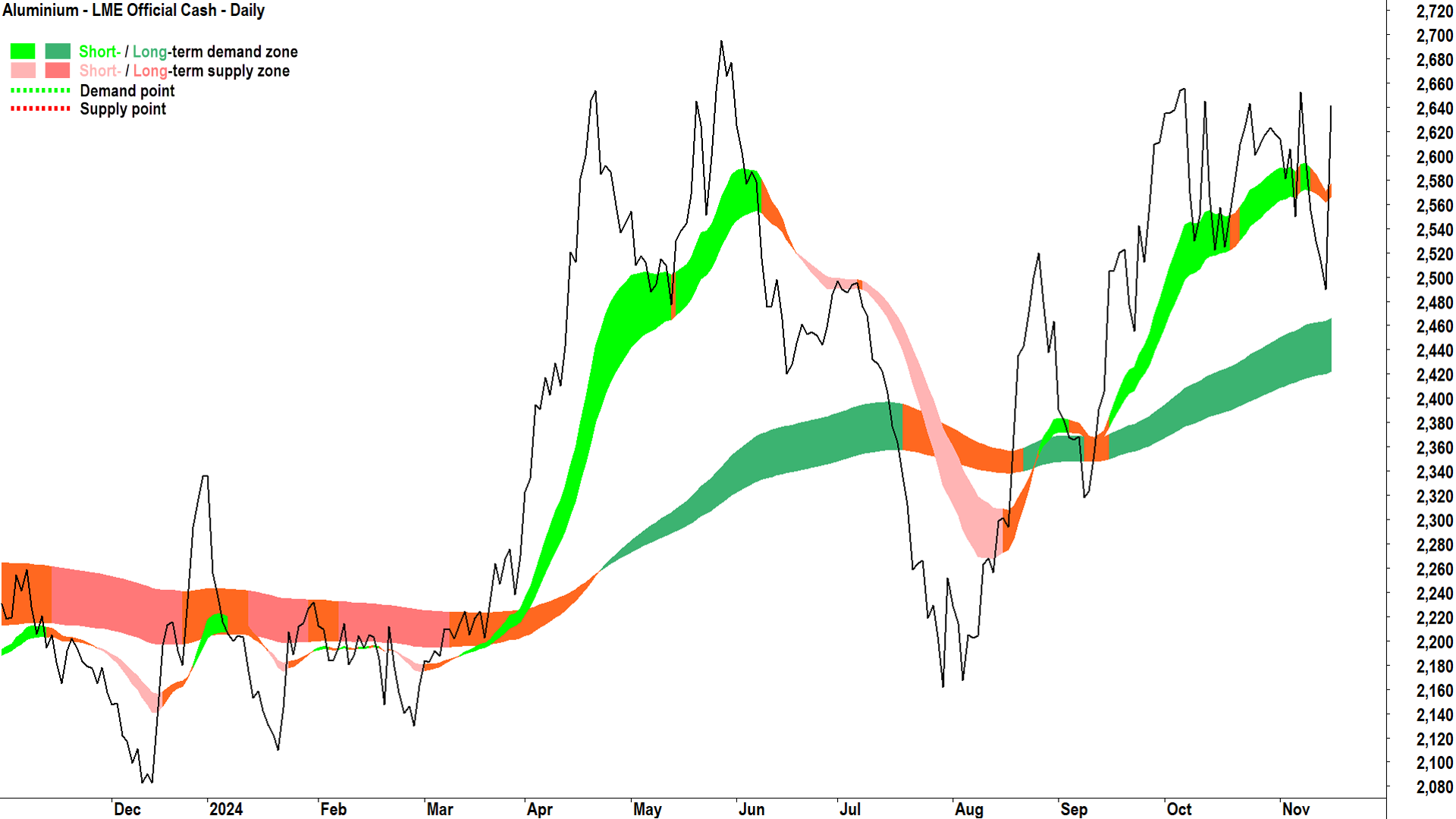

The decision triggered a substantial price spike in aluminium on the London Metals Exchange (LME) on Friday, and a modest price gain for copper. In this article, we review the short and long term impacts of the policy change and which ASX aluminium and copper producers stand to benefit from it.

Did China just fire the first shot in the global trade war?

The tax rebate, which previously incentivised exports of semi-fabricated (“semis”) copper and aluminium products, has been entirely abolished. This policy shift is expected to reshape the competitive landscape for these metals, particularly given China's role as a dominant exporter in aluminium semis and a significant player in copper semis.

The move comes amid broader market adjustments and supply chain considerations, including rising alumina prices and concerns over raw material availability in global markets. It begs the question: Is China firing the first shot in the upcoming global trade war?

Ramifications for aluminium

In two separate research reports on the policy change, Morgan Stanley and Citi agreed aluminium will experience the bigger impact of the two metals. Morgan Stanley noted, “China is a significant exporter of semi-fabricated products for both metals, although it has a larger market share within aluminium.” The broker highlighted that rising alumina prices have already buoyed aluminium markets.

Citi provided additional context, pointing out China’s total exports of aluminium semis in 2023 were approximately 5.2 million tonnes of aluminium and around 800,000 tonnes of copper semis – accounting for roughly 8 - 10% and 2% of China’s domestic consumption of each metal, respectively. Citi also anticipates a “relatively larger” impact on the global aluminium industry compared to copper.

.png)

While Citi acknowledged the immediate reaction has been bullish for aluminium, the broker remains measured in its outlook, projecting aluminium prices to stabilise in the near term: “We maintain our 0-3pt price unchanged at $2,600/t (4Q24 average $2,500/t) as we think the bullishness from the tax rebate removal could dissipate”, they said.

Ramifications for copper

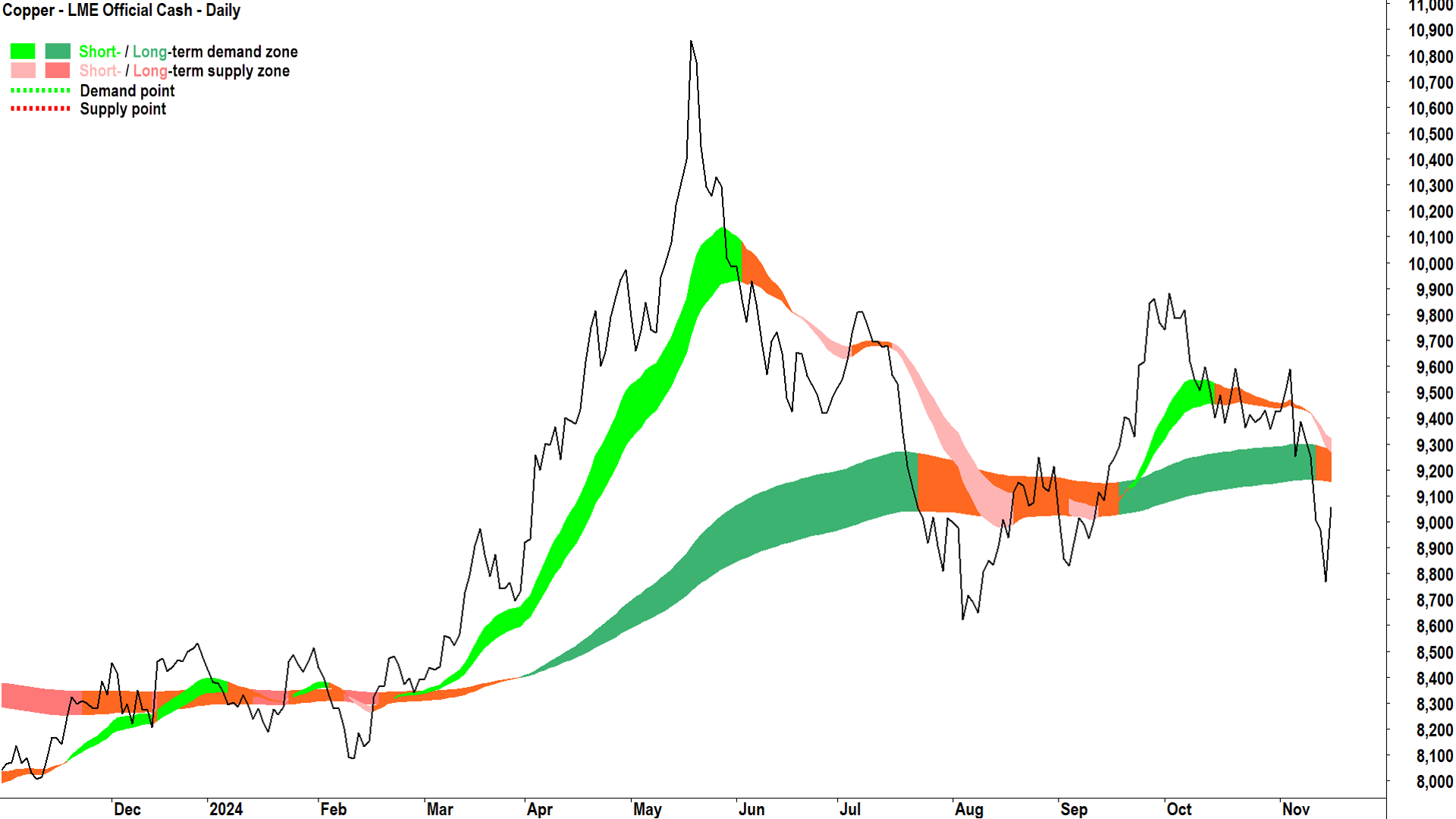

The impact on copper is expected to be less pronounced but nonetheless significant. Morgan Stanley highlighted the complex dynamics of China's copper trade. “China is overall a large net importer of copper in the form of concentrate, refined metal and scrap, and so if the new rules were to weigh on semis output, this could also reduce China's copper import demand”, the broker said.

This nuance likely explains why copper markets have lagged behind aluminium in their reaction to the rebate removal. The copper price rose 3.3% on the LME on Friday compared to aluminium’s 6.1%, and benchmark copper futures actually fell 0.5% on COMEX in the USA.

.png)

Citi echoed this cautious sentiment, noting that while the rebate removal initially supported higher price ratios between LME and Shanghai Futures Exchange (ShFE), the long-term strength might be tempered by other market factors, including fears of escalating tariffs and potential resolutions in Guinea’s bauxite supply chain.

Broader implications

For both metals, the policy adjustment is poised to disrupt trade flows, shifting the balance of supply and demand between China and the rest of the world. By making exports less economically viable, the policy could tighten ex-China supply, potentially supporting global prices. At the same time, domestic Chinese prices might come under pressure as excess supply is absorbed locally.

Morgan Stanley summed up the broader implications, stating that the changes “should be supportive for ex-China metals prices or negative for prices within China, all else equal, to help offset higher costs to export.”

Outlook and top ASX aluminium and copper stock picks

While the initial market response, particularly in aluminium, has been marked by sharp price increase, both Morgan Stanley and Citi have cautioned against overestimating the long-term bullish impact of this policy. With broader issues such as alumina price volatility and geopolitical risks potentially impacting raw materials supplies, all commodity markets are bracing for further major shifts in the coming weeks.

All things considered, Morgan Stanley’s top aluminium and copper picks are Rio Tinto (ASX: RIO) and BHP Group (ASX: BHP), each of which it rates OVERWEIGHT. The broker currently has a price target of $46.85 for BHP (16.9% upside vs 15 Nov close) and a price target of $135 for RIO (18.6% upside vs 15 Nov close).

Citi also likes BHP, but adds South32 (ASX: S32) as its other BUY-rated stock in aluminium/copper. The broker currently has a price target of $46.00 for BHP (14.8% upside vs 15 Nov close) and a price target of $3.90 for S32 (9.9% upside vs 15 Nov close).

This article first appeared on Market Index on Monday 18 November 2024.

5 topics

3 stocks mentioned