SVB’s long shadow

The rapid and unexpected collapse of SVB Financial Group three weeks ago has shocked markets and led to systemic concerns across financial markets. While this isn’t Lehman Brothers, and we don’t expect persistent systemic stress across the banking system like we saw in the 2007/8 financial crisis, the collapse is nevertheless significant and likely to cast a long shadow. If nothing else, we expect these events to not only drive up the cost of funding for banks, but also very likely an extension and tightening of US bank regulatory standards and capital requirements. It remains to be seen how significant the associated growth shock will be and whether this will ultimately prompt the Fed to pause or even cut rates.

In this brief note we explain what happened and discuss the potential implications for the sector and the broader outlook for growth and rates. We also review current positioning at Alphinity Global.

The financial partner of the innovation economy

SVB’s business strategy specifically targeted the venture capital market, to be (in their own words) “the financial partner of the innovation economy.” Started in 1983, SVB had grown to become the US’s 16th largest bank, holding over $200bn of assets and banking approximately 50% of all venture capital businesses in the US. More recently, they had begun expanding into other adjacent areas such as investment banking and wealth management, as well as Life Sciences. This was an innovative financial group focused on an important and exciting growth market.

What happened?

But of course, as we all know by now, it all went horribly wrong. Years of loose monetary policy and quantitative easing flooded the US banking system with excess savings and deposits. With weak loan demand, much of this excess has been invested in securities portfolios, or kept as cash.

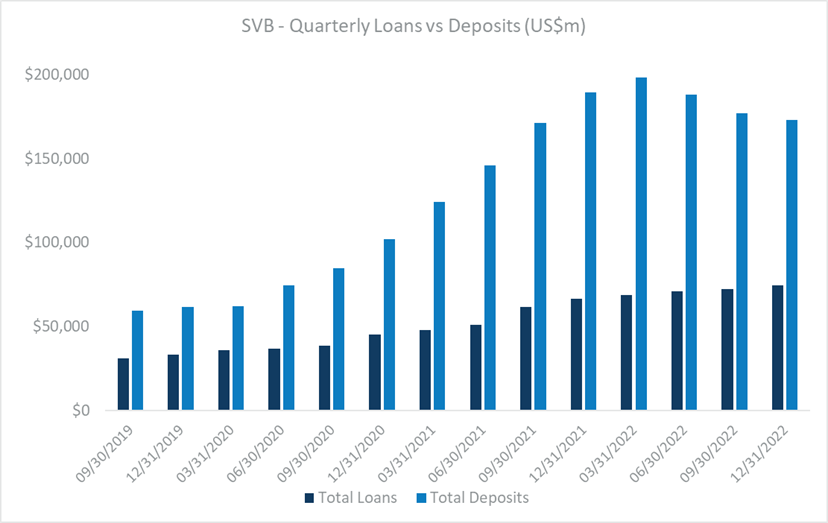

SVB – Deposit vs loan growth

Source: SIVB – 10K

In SVB’s case, deposits ballooned from $61bn at the end of 2019, to a peak of $174bn at the end of 2022. Loans also grew strongly, from $32bn to $73bn over the same period, but not nearly enough to absorb all of this liquidity; and this is where the problems began. Starting in 2020, but accelerating from early 2021 onwards, management made the fateful decision to invest much of the excess in securities to enhance short term yields and grow NII, but also locking in very low yields just as rates rose.

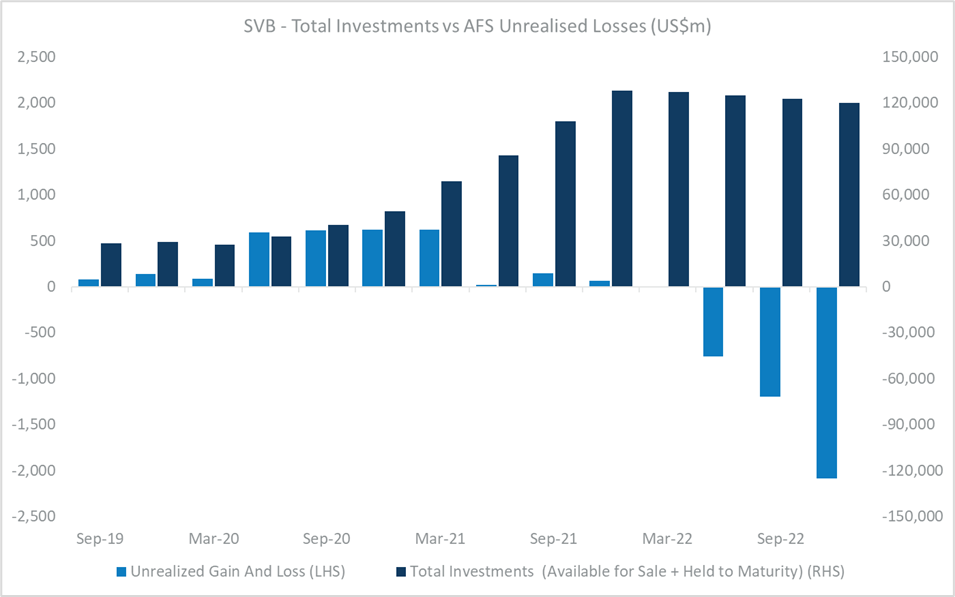

The securities portfolio in aggregate grew from only $29bn at the end of 2019, to over $120bn in 2022, and accounting rules and regulators allowed management not to take these (unrealised) losses through their P&L and against regulatory capital. As the Fed hiked and bonds sold off, unrealised losses on these securities’ portfolio ballooned, rising to the point where the bank was technically insolvent.

SVB –Total Investments vs Available For Sale Unrealised Losses (US$m)

Source: SIVB – 10K

These unrealised losses wouldn’t have been a problem, as long as deposits continued to grow and management weren’t forced to crystalise these losses. These securities, mostly mortgage-backed securities, were sound and would ‘pull to par’ if held to maturity – but of course that’s not what happened.

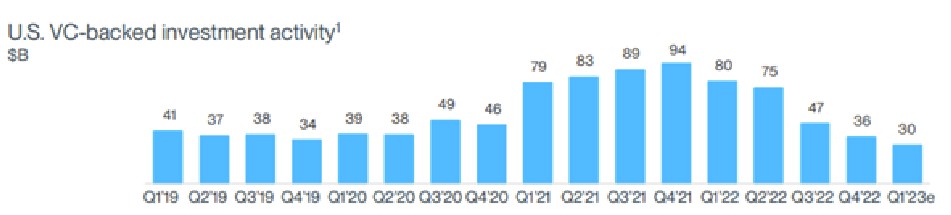

Source: Pitchbook & SVB as at 8th March 2023

SIVB’s core client base of venture-capital backed companies were under significant pressure as venture investment slowed to a near standstill last year. Deposits peaked at close to $200bn in early 2022, but steadily declined from that point as SVB’s client base began to increasingly dip into these deposits to fund operations given the collapse in the venture capital markets. Events came to a head in March, when management attempted to restructure a portion of their securities portfolio, to increase liquidity, but crystalising a significant loss in the process which required fresh equity to rebuild capital. This created a general run on their deposit base and the rest, as they say, is history.

Management and regulatory failure

In itself, however, the combination of surplus deposits, higher rates and low VC activity need not have been fatal, however a combination of (very) poor interest rate management and weak regulatory oversight meant that SVB had locked in a very significant duration mismatch between mostly uninsured, lower-quality, short duration deposits and their longer-term assets – which ultimately brought the whole bank down.

What are the implications for Banks and the outlook for growth?

- Short term contagion risks appear manageable: Systemic concerns may persist in the short term, but risks appear relatively low and manageable. US authorities have acted quickly and aggressively to provide liquidity through the new Bank Term Lending Program. This may not be over, but ultimately central banks understand the risks and have the tools and playbook available to stop further contagion if required.

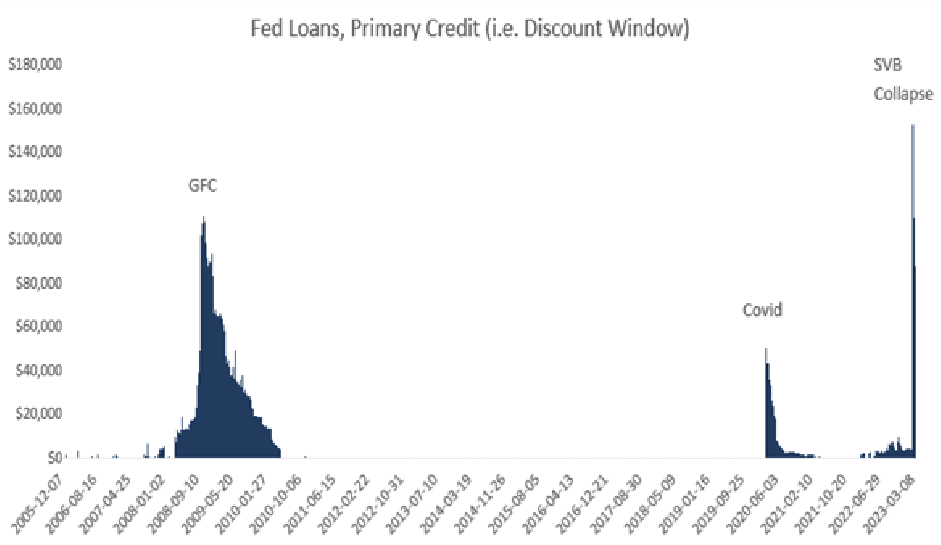

The Federal Reserve as Lender of Last Resort

Fed Primary Usage (known as the “Discount window”) spiked to an all time high of $153bn on 15 March 2023

Source: US Federal Reserve ((VIEW LINK), 31 March 2023

- Higher funding costs for banks: Net deposit outflows to money markets and treasuries became the norm in 2022 as the Fed aggressively tightened monetary policy. The SVB failure and associated systemic liquidity concerns mean that banks are more likely to compete to attract and retain deposits by paying higher rates. It’s also likely that spreads will widen on bank debt stacks, increasing the cost of future debt issuance. Finally, we expect banks to pro-actively increase their debt stack and on the asset side hold more, shorter duration, lower yielding, liquidity within their securities portfolios to reflect the shorter duration of uninsured deposits (particularly within the new internet banking age). The combination is likely to drive up funding costs across the sector over the next few years, lowering earnings and returns on equity.

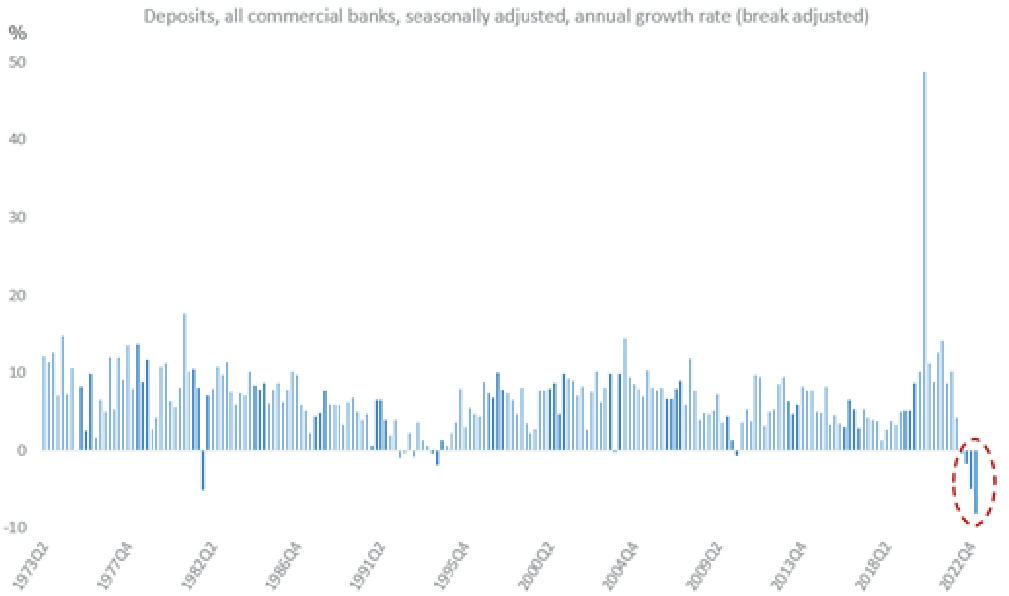

Deposit outflows at US Banks are rare

Persistent deposit outflows in 2022 driven by aggressive monetary tightening

Source: US Federal Reserve ((VIEW LINK), 31 March 2023

- More regulatory tightening is inevitable: The collapse of SVB will raise uncomfortable questions about the effectiveness of banking regulation in the US and abroad. It seems inevitable that the outcome will be a widening of the scope of regulation to include mid-sized banks, as well as a general tightening of regulatory standards. It’s also quite likely that regulators will increase their focus on liquidity and interest rate management. All of this is likely to lower risks for the system, but at significant cost for banks and their shareholders. Specifically, we expect:

- Restoration of systemic-risk supervision of mid-sized banks: The largest banks over $700bn in assets are already held to higher regulatory standards, including requirements to hold an additional layer of longer-term funding in the form of Total Loss Absorbing Capacity (TLAC), more liquidity through minimum Liquidity Coverage Ratio (LCR) rules and liquidity stress tests, and to mark unrealised AFS losses against CET1 capital. These rules are very likely to be expanded to mid-sized banks with assets of over $250bn, and possibly even below this.

- Higher capital requirements: Capital requirements for US banks were already likely to move higher and recent events make this even more likely. Fed Vice Chair for Supervision, Michael Barr had already announced a ‘holistic’ review of bank capital standards in December 2022. In addition, another tough bank stress test, plus the looming transition to Basel IV, already point to higher regulatory capital standards.

- An increased focus on interest rate risk: Banks and regulators will need to pay more attention to interest-rate risk, and the fundamental mismatch between banks’ long-term assets and short-term liabilities. This will include a greater focus on the quality of funding, as well as liquidity and overall duration management. A need to diversify funding, with higher levels of longer-duration wholesale funding to reduce duration mismatches, is also required. A key question here will be whether to expand deposit guarantees. We expect that some extension of guarantees is inevitable, although a universal guarantee seems unlikely, and we expect that any extension will likely be conditional for banks that adequately diversify risks and stay within reasonable growth limits. Assessing the quality of deposits will be challenging given the new vulnerabilities exposed by internet banking and will need to be evaluated on a case-by-case basis.

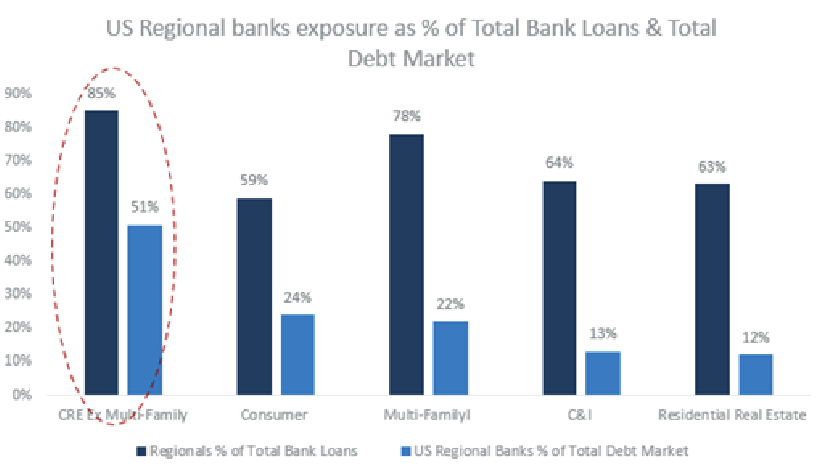

- Higher credit risks, especially in Commercial Real Estate: The bigger story here is credit conditions. Recent events provide strong incentives for banks of all sizes, but especially mid-sized banks which are closest to market concerns, to become more conservative about lending to preserve liquidity in case they need to meet depositor withdrawals. The associated tightening of lending standards could weigh on aggregate demand. And small and medium-sized banks play a particularly important role in the US economy, in particular within commercial real estate where they account for 85% of all bank lending and 51% of all debt. Consequently, commercial real estate exposure is an area of understandable concern when considering the outlook for credit.

Total Credit Availability – Regional Banks matter most for commercial real estate

Source: SNL (Bank Loans), Fed Flow of Funds (Mkt sizes), Autonomous

Outstanding questions

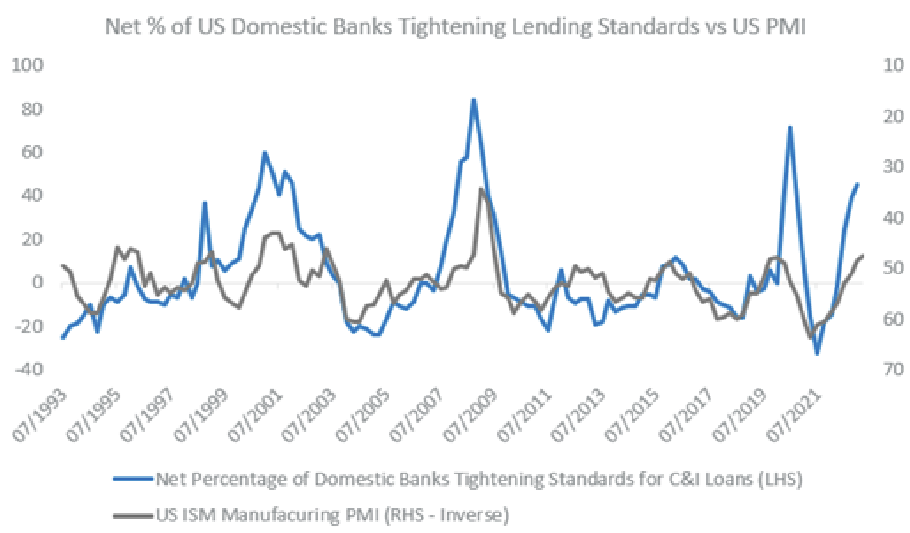

- The situation is still unfolding and some of the outstanding questions include: Scale of shock to growth & outlook for rates? The ultimate impact of a pullback in lending remains highly uncertain. Ultimately it will depend on how long it takes for authorities to address the systemic concerns, and the associated hit to consumer and investor confidence. For example, Goldman Sachs have estimated that a 2.5% fall in total bank lending would take between 25-50bps off 2023e GDP growth, equivalent to a 25-50bps increase in rates.

Tighter lending standards normally leads to lower growth

Source: Fred Economic Data /Bloomberg, 31 March 2023

- Lurking interest rate risks – will contagion spread to other financials and non-US banks? There is a growing market concern that similar interest rate risks are lurking elsewhere in the financial system, both in the US outside of the banking system, but also in Europe and elsewhere. So far we see this risks as relatively low and manageable, with European banks in particular much better regulated and managed than historically the case. Insurance companies have also come under scrutiny, particularly given their balance sheet exposures to CRE, however duration risks within the insurance sector are structurally lower than banks and consequently we also regard these risks as low

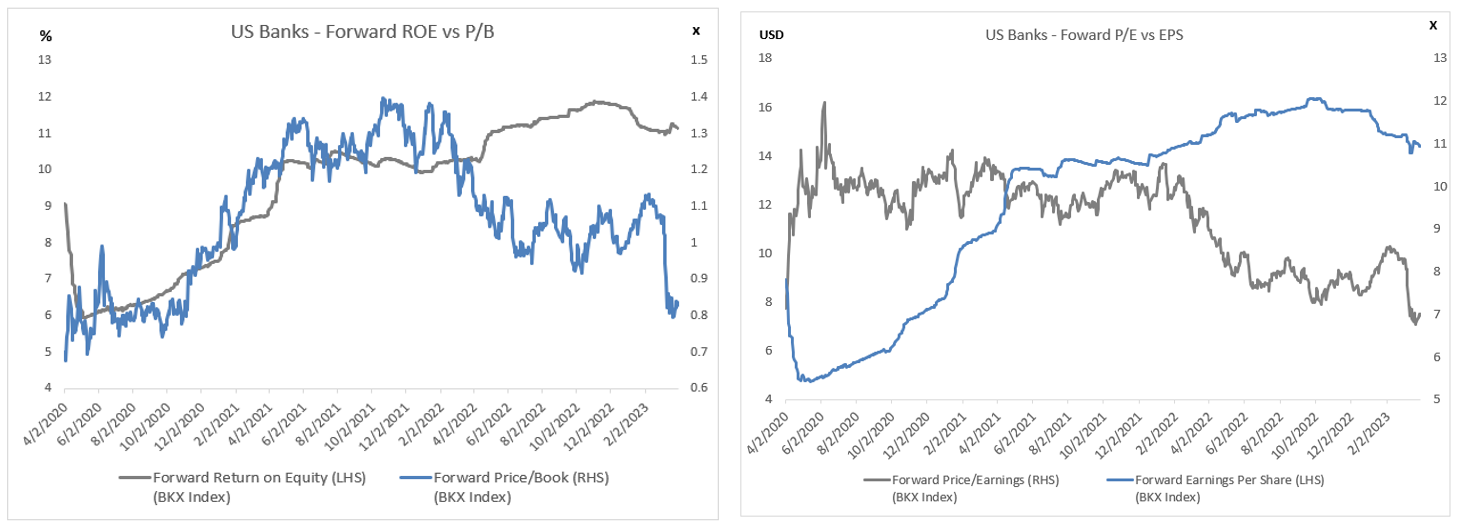

Banks appear attractively valued but face potentially significant earnings headwinds

Earnings estimates for banks and financials have held up relatively well recently (see below), supported by higher interest rates and a benign credit environment, however this may change driven by higher funding, credit and regulatory costs as described above.

Bracing for impact?

Low valuations reflect concerns about the outlook for earnings

The sector is currently trading on a forward PE of ~7.5x and a Price to Book of 0.85, both already significantly below long-term averages, suggesting that the market has already priced in at least some of these headwinds. While it is difficult to be precise about the exact timing and quantum of negative revisions, earnings downside has the potential to be significant within a recessionary environment.

Alphinity portfolio positioning

In this context, Alphinity Global is conservatively positioned within Financials across all strategies. We currently have a significant underweight to the Financials sector, and to Banks in particular. Banking stocks have already corrected significantly, and valuations are not demanding, however until earnings expectations have been adequately reset to reflect these new headwinds, and a new upgrade cycle is in play, we expect to remain defensively positioned.

2 funds mentioned