Tariff whipsaw creates mixed signals and market shocks

Markets surged on hopes of a tariff reprieve, only to stumble as new details revealed deeper trade tensions with China. The whiplash underscores how fragile sentiment remains—and how tightly financial markets are tethered to shifting policy signals. For investors, maintaining cross-asset diversification, avoiding reactionary moves, and focusing on long-term fundamentals will be key to navigating the volatility ahead.

Markets remain in flux following President Trump’s announcement of a 90-day pause on most reciprocal tariffs—excluding China, where import duties were raised sharply. Initially reported at 125%, the White House clarified Thursday that the effective rate on Chinese goods is now 145%. That unexpected revision triggered a sharp reversal in investor sentiment: after Wednesday’s historic rally, U.S. equities fell steeply on Thursday, with the S&P 500 down 3.5%, the Nasdaq dropping 4.3%, and the Dow shedding over 1,000 points.

The initial market surge reflected hopes that the administration was prioritizing financial stability, particularly as bond yields reflected signs of stress. But Thursday’s clarification revealed that policy uncertainty remains elevated. Volatility spiked again, and markets quickly recalibrated as concerns about inflation, policy credibility, and the global growth outlook reemerged.

Even with March’s softer-than-expected CPI data, the economic outlook remains fragile. The U.S. average effective tariff rate is still the highest in the post-World War II era. China's retaliatory actions, including new restrictions on U.S. services imports, add to the risk that global trade slows meaningfully in the months ahead.

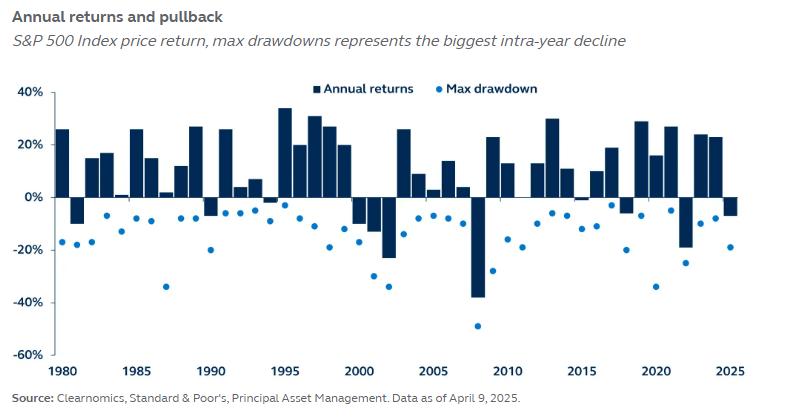

For investors, the takeaway is nuanced: policy remains reactive, not resolved. Staying invested, diversified, and flexible across asset classes is critical. Afterall, markets typically experience several large pullbacks each year. In an environment where political developments are moving faster than fundamentals, resilience matters more than ever.