Tech bounces back (and the 8 stocks fundies are buying)

I don't know about your office (home or otherwise), but a lot of noise could be heard in the grand halls of Livewire Markets yesterday. And amid the sea of chatter, one question echoed loud and clear:

What the what is going on with tech?

In case you've been living under a rock, tech names like Zip Co (ASX: Z1P), Megaport (ASX: MP1), Life360 (ASX: 360), EML Payments (ASX: EML), and Xero (ASX: XRO), to name a few, all knocked it out of the park yesterday. This is all the more noteworthy because they've been infamously out of favour since the beginning of this tumultuous year.

In fact, trading volumes in the S&P/ASX All Tech Index soared more than 42% yesterday, lifting the benchmark just over 3% higher. Meanwhile, the NASDAQ 100 has lifted nearly 4% over the past two days.

It all comes as long-duration investors receive their first piece of good news in six months – the yield on US 10-Year Treasuries has finally fallen.

So, what does this mean for investors - should you dive headfirst into tech's murky waters? Or is this just a dead cat bounce?

To find out, we spoke to 1851 Capital's Martin Hickson, Donny Buchanan from Lakehouse Capital and Munro Partners' Kieran Moore.

Why now?

Glad you asked. Well, according to our three fund managers, investors need to look no further than the bond market. In fact, over the past two weeks Aussie 10-Year Bond yields have lost ground:

As have their counterparts in the US, with the 10-Year Bond yield falling from 3.4% to 2.8%.

"That's obviously supportive of long-duration assets, such as technology stocks. And subsequently, we have started to see some of the unprofitable tech stocks bounce back from their lows," Hickson said.

But why are long-term rates falling now? Moore believes there are three different factors at play:

- The US economy is slowing - with a possible recession on the cards.

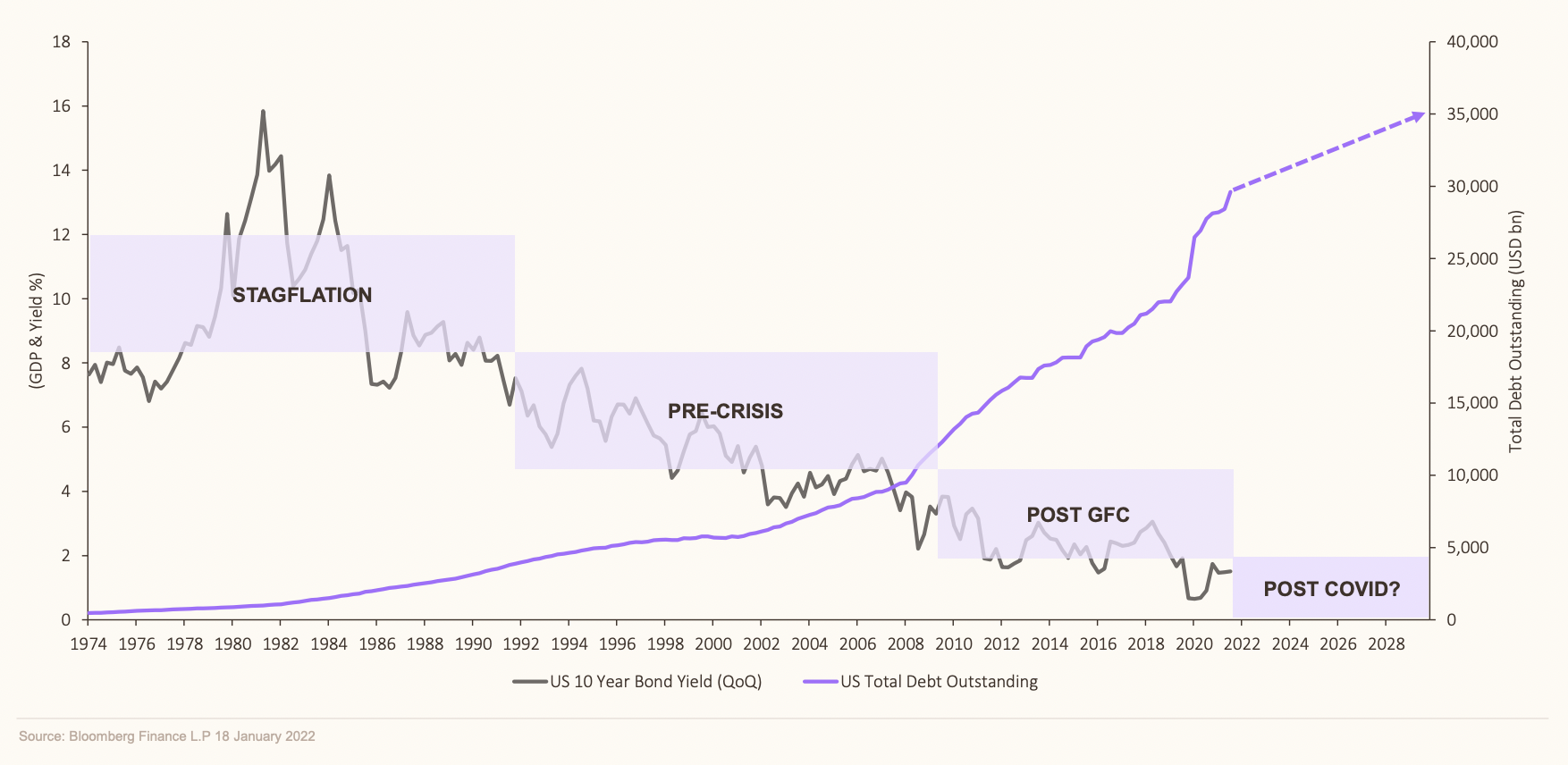

- Record levels of global debt.

- Reversal of monetary and fiscal stimulus.

That said, working for a global growth investment manager, Moore and his team hold the view that long-term interest rates have to stay in a relatively lower range than what the market is expecting.

"Our view has always been predicated on the fact that the world simply has way too much debt," he said.

"In previous inflationary periods, we've seen interest rates at much higher levels. We don't think that's on the cards this time around. And we think interest rates - at least long-term interest rates, should stay relatively low. And provided that holds, then investors, in the long run, should gravitate back toward companies with sustainable earnings growth."

By that, he meant tech. As he explained, tech businesses have "more resilient earnings in the face of a slowing economy or recessionary-type environment".

Similarly, Buchanan agreed that it's "logical" that this could be a bottom, given the change in direction in long-term bonds.

"I couldn't tell you if this will stick any more than the other bounces we've seen," he said.

"But a lot has changed over the past 10 months, since the Federal Reserve changed its stance on inflation. And I don't think that current share prices reflect the fundamentals of some of the quality names within the tech space."

But Hickson warned this rally could just be a dead cat bounce.

"A lot of those unprofitable tech stocks are down 70% to 80% from their highs six or seven months ago and we still haven't bought into these unprofitable tech stocks," he said.

"We think a lot of them still have balance sheet concerns. They will need to raise money. And so we think that there is a risk of capital raisings ahead. And we're unsure as to how long this rally will last."

Aussie stocks outperform their US counterparts

Interestingly, local tech darlings seem to have outperformed their US counterparts in the recent rally. As an example, Zip lifted more than 14% on Wednesday, while Tesla - truly a bellwether of long-duration growth stocks - has lifted just more than 6% in the past two days.

Hickson believes it's because Aussie tech favourites have recently fallen victim to tax-loss selling.

"Given how much a lot of these names have fallen over the last 12 months, there's been significant tax loss selling across these stocks. And that has obviously concluded on June 30th," he said.

"We believe that a lot of them are now rallying because that selling pressure has now cleared - that would have finished on Thursday last week. So I think it's a combination of the yield dynamic, but also the fact that tax-loss selling is now completed in Australia."

Meanwhile, Buchanan believes it's because a "pretty wide valuation gap has opened up between US and Aussie tech stocks".

"I recently saw that small-cap software is trading on a forward enterprise value to revenue multiple of just under four times versus US software at a little over seven times. That's a pretty wide gap," he said.

"I'd also note that the multiple for ASX small-cap software names is at its lowest point since the height of the COVID-19 panic sell-off in March. 2020. And its also about 25% below its seven-year average, which looks through a more normal interest rate cycle."

He also noted that the Australian tech peer group is smaller and less liquid than its US counterpart - and during recent market volatility, investors have flocked to more liquid names in their flight to safety.

"That leaves the lower liquidity names falling further. And as an aside, I can't recall another time when there have been so many small caps as heavily shorted as they are now," Buchanan added.

"That trade has worked well, given how far prices have fallen in the small-cap space and in particular, small-cap tech.

"That said, there's a flipside to this. Unless those companies go to zero, the shorts are going to need to find liquidity to exit those positions. And that's in a market with reduced liquidity. So it could make for an interesting setup if some of those illiquid, small-cap shorts are unwinding into what could be a sustained market rally. There could be some large, short-term moves."

What this means for you going forward

Tech names continue to look attractive, especially with Fed futures pricing in cuts between May and June 2023, suggested Moore.

"That's a really quick turnaround after some pretty aggressive hiking in 2022. So in that scenario, again, it's really hard for long-term interest rates to go significantly higher," he said.

With that in mind, Moore believes this bounce could be sustainable - at least in the short term – particularly as we move into second-quarter earnings in the US.

Thanks to the "Fed-induced slowdown in the US," Moore believes earnings cuts could lie ahead for companies exposed to industrial or cyclical sectors.

"Tech should continue to outperform because of its comparatively better earnings resiliency," he said.

"Will we get a more sustainable bounce over a period of months into 2023? We probably need a little bit more clarity around what the Fed ultimately does with its interest rate policy. Where does it eventually settle? But in the short term, it probably can."

Meanwhile, Buchanan believes we are witnessing the unwinding of a crowded trade, as money shifts away from commodity and energy names.

"Tech valuations now look attractive relative to other opportunities out there, and commodities are getting sold off on increasing recession concerns," he said.

"You saw an 8-9% drop in oil prices last night. And the last time oil prices were at $140 a barrel was in about mid-2008. And they fell about 70% plus over the next six months as the economy went into a recession."

Moore also called out a high proportion of "financial speculators" – rather than refiners and producers – behind much of the money in oil contracts.

"So you can see trades like that unwind quickly. And I think we are seeing that now - with money moving from commodities to tech," he said.

The stocks Hickson, Buchanan and Moore have been buying

Moore agreed we're witnessing the reversal of a crowded trade in commodities and energy stocks, and believes we could see the market move towards companies with strong fundamentals – namely tech – this earnings season.

So, which companies is he buying? Moore pointed to companies like Microsoft (NASDAQ: MSFT) - which trades on a mid-20s PE multiple and should grow its earnings by between 5% and 10% over the next decade.

"It basically owns its industry. It can lift prices without anyone turning it off or switching to another service. So provided interest rates stay in this relatively low range, then companies like Microsoft and other businesses in the tech space should really start to look pretty attractive," he said.

Other examples include companies in the software as a service (SaaS) and cloud computing space. These are sectors the Munro team believes have significant growth ahead of them.

"Companies like ServiceNow (NYSE: NOW), which is starting to look much more attractive from a valuation point of view and has a really good strong structural tailwind behind earnings growth, as well as companies like Salesforce (NYSE: CRM) and Atlassian (NASDAQ: TEAM)," he said.

Meanwhile, on the local front, Buchanan and the Lakehouse team have been buying companies such as Audinate (ASX: AD8) in recent months.

"We think it's one of the most competitively advantaged businesses on the ASX. It's well managed and emerging from a confluence of COVID and supply chain-related issues," he said.

"Nearmap (ASX: NEA) is another one where we see strong momentum in its core North American growth market with the imminent rollout of Hypercam 3. We think that offers some upside that the market is not fully appreciating, in terms of margins and contract wins due to some added features and optionality in terms of further geographic expansion."

He also pointed to Xero (ASX: XRO), a company that is facing cost inflation - like many - but unlike its peers, it can (and is) lifting prices.

"It has announced price rises across its subscription base at 7.5%-9%. They begin in September 2022. And that's on top of underlying subscriber growth in the high teens," Buchanan said.

"When they've previously increased prices, it's had little impact on their customer retention rates, which run deep into the 90% range. This business is of the quality that it can flex its pricing power in an inflationary environment to maintain its cash flow growth and continue reinvesting to expand the business.

"You don't see that every day and there aren't many businesses I can point to out there that have flexed that level of pricing power already."

Meanwhile, Hickson isn't dipping his toe into the more speculative end of the market. But there are some tech names in his portfolio.

"We do own some technology stocks, but the ones that we own are profitable," he said.

"An example would be Hansen Technologies (ASX: HSN). It's got a long track record of generating earnings and cash flow, a price-to-earnings ratio of 20 times, a very strong balance sheet, and is well managed."

So what would need to change for Hickson and the 1851 Capital team to wade into the tech sector's waters?

"They would need to fix their balance sheets for one, and they would need to be close to that breakeven point of profitability, where they can self sustain themselves by generating cash flows, rather than being reliant on capital markets to fund their growth," he said.

Never miss an update

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

10 stocks mentioned

2 contributors mentioned