"Technology is still the place to be"

Investors who ignore Afterpay (ASX: APT) and other listed financial technology firms bent on disrupting banks risk missing out on impressive returns. So said Munro Partners chief investment officer Nick Griffin, when he appeared at a recent GSFM Funds Management webinar, alongside GSFM investment strategist Stephen Miller, Redpoint Investment Management CEO Max Cappetta, and Eric Souders, portfolio manager at fixed-income fund manager Payden & Rygel.

Griffin's take on Fintech, which developed into a broader appreciation of Big Tech, was just one of several interesting viewpoints from a session that aimed to "take in the outlook for the second half of 2021, with commentary on Australian and international equities and fixed income, economic outlook, and implications for portfolio construction and investment decision making".

In this wire, I'll explore the following four key takeaways of most interest to Livewire readers.

- "Technology" isn't a dirty word in markets

- A surprising source of dividends

- Inflation lessons from Korean, Vietnam wars

- Weighing the vaccine rollout

"fantastic investment opportunities"

At the webinar, Griffin's key message was to reaffirm his confidence in the technology sector.

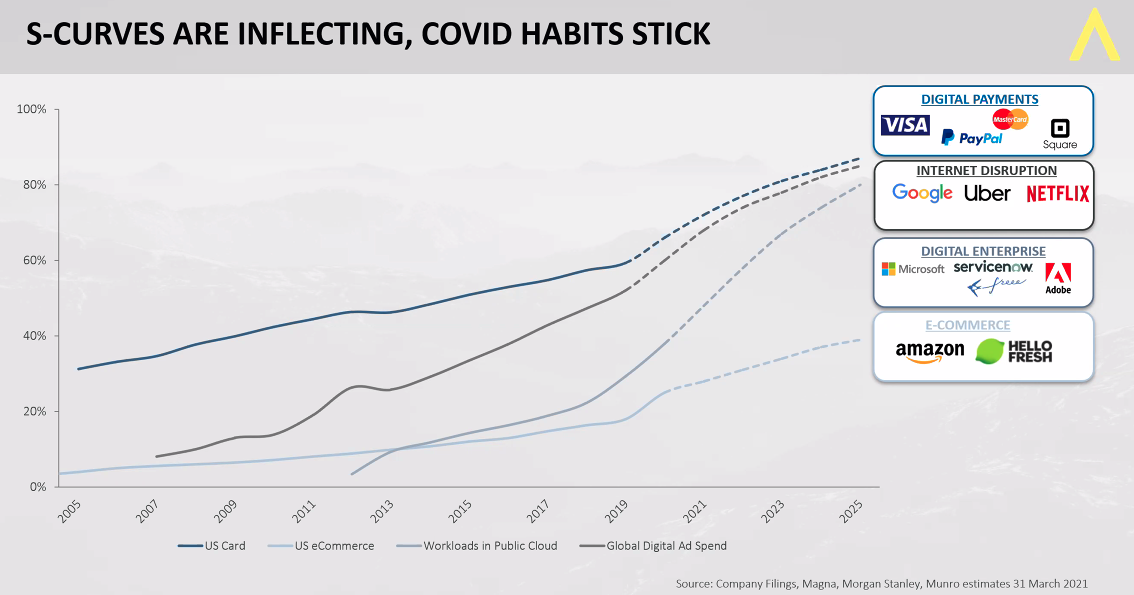

“From our point of view, technology is still very much the place to be, and I know it’s been a bit of a dirty word for the first half of 2021, but ultimately these little S-curves of adoption that we’ve seen occurring prior to COVID – whether the adoption of e-commerce or of cloud computing – all of these were on strong growth trajectories before COVID and have all accelerated because of COVID,” he said.

“We don’t see any real evidence that this acceleration is going to slow down in the short term.”

Griffin still likes core technology names including Visa, Google, Microsoft, Amazon and others on the right of the below graphic.

“This disruption continues and if anything, it has accelerated and these companies are incredibly well-positioned,” he said.

“Some people get concerned when we go further out this curve to say an Atlassian, ServiceNow or DocuSign, but all we’re doing is identifying that these are franchise companies for the future with prodigious free cash flows that are growing and are ultimately fantastic investment opportunities, from our point of view,” Griffin said.

Dividends: What to expect this earnings season

Still on equities but closer to home, Redpoint Investment Management senior portfolio manager and CEO Max Cappetta discussed the outlook for Australian income stocks, particularly ahead of the upcoming reporting and dividend season.

He noted the opportunities to capture additional income from Australian stocks by taking a very active trading approach.

“And beyond the calendar cycle, there are profitability cycles across different industries and sectors through time," said Cappetta.

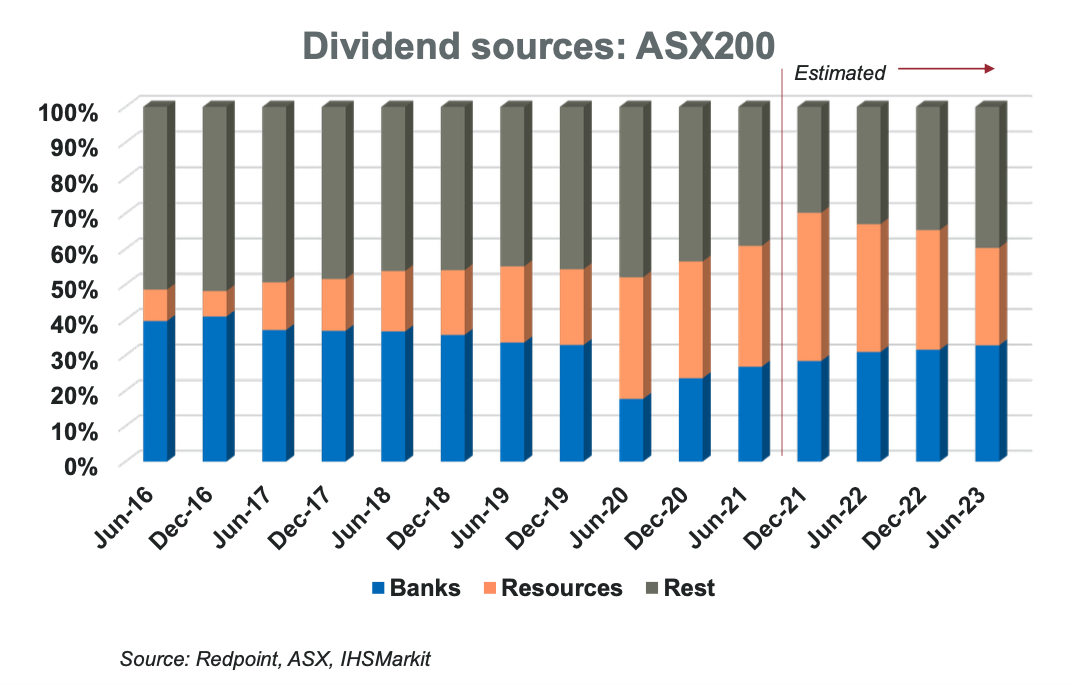

“Apportioning dividend income from the ASX200 across banks, resources and the rest of the index, you can clearly see this resurgent payment growth from the mining sector; the recent fall in bank dividends and expectations over how that’s going to reverse again over the next few years.”

“There are opportunities for capturing income if you look more broadly across the market rather than simply focusing on what might have been the high dividends stocks in the past.”

Across one of the two biggest sectors of the Australian market, Cappetta expects record dividend announcements from resources companies next month. His top picks here are Fortescue (ASX: FMG), Rio Tinto (ASX: RIO) and Mineral Resources (ASX: MIN).

“But we’re also on watch for miners of copper and lithium in terms of increasing demand for those metals related to the ongoing clean energy transition, and also engineering firms such as Worley.”

In the big four banks, he expects dividends are on the way back after being slashed and, in some cases, cancelled last year - but doesn’t anticipate a return to 2019 levels until calendar 2023.

“At CBA, there is a chance they might make it back by calendar 2022 and their next reporting date in August will give us an indication of this,” said Cappetta.

His team is keeping a close watch on Australian banks’ product innovation, which has been notably lacking over a long period. “We’re looking at how they will spend the proceeds of their exit from the wealth industry in ways that they can support client engagement and customer retention and fight off competition from emerging fintechs,” he said.

And among consumer cyclicals, which were some of the biggest COVID winners of 2020, Cappetta referred to IGA grocery store chain owner Metcash's (ASX: MTS) announcement last month of an off-market buyback, “which can be very tax-effective and deliver a large fully-franked dividend.”

Also within supermarkets, one of the local category leaders Woolworths (ASX: WOW) in May announced plans to spin off its Endeavour Group business, which includes liquor chains BWS and Dan Murphy’s along with a poker machine operator. On the back of this, there is a strong chance of a buyback, special dividend or other capital management initiatives for shareholders.

Within the local tech sector, a somewhat unorthodox source of dividends, Cappetta also singled out a couple of names in ASX-listed global logistics software firm Wisetech (ASX: WTC) and defence and metal detection company Codan (ASX: CDA).

“Their dividends are on track to more than double in 2022 relative to 2019 levels. We know that yields there are low but the discipline of actually paying dividends, for us, is a good indicator that there are strong underlying fundamentals to these companies,” he said.

Inflation: Some “inconvenient” war-time comparisons

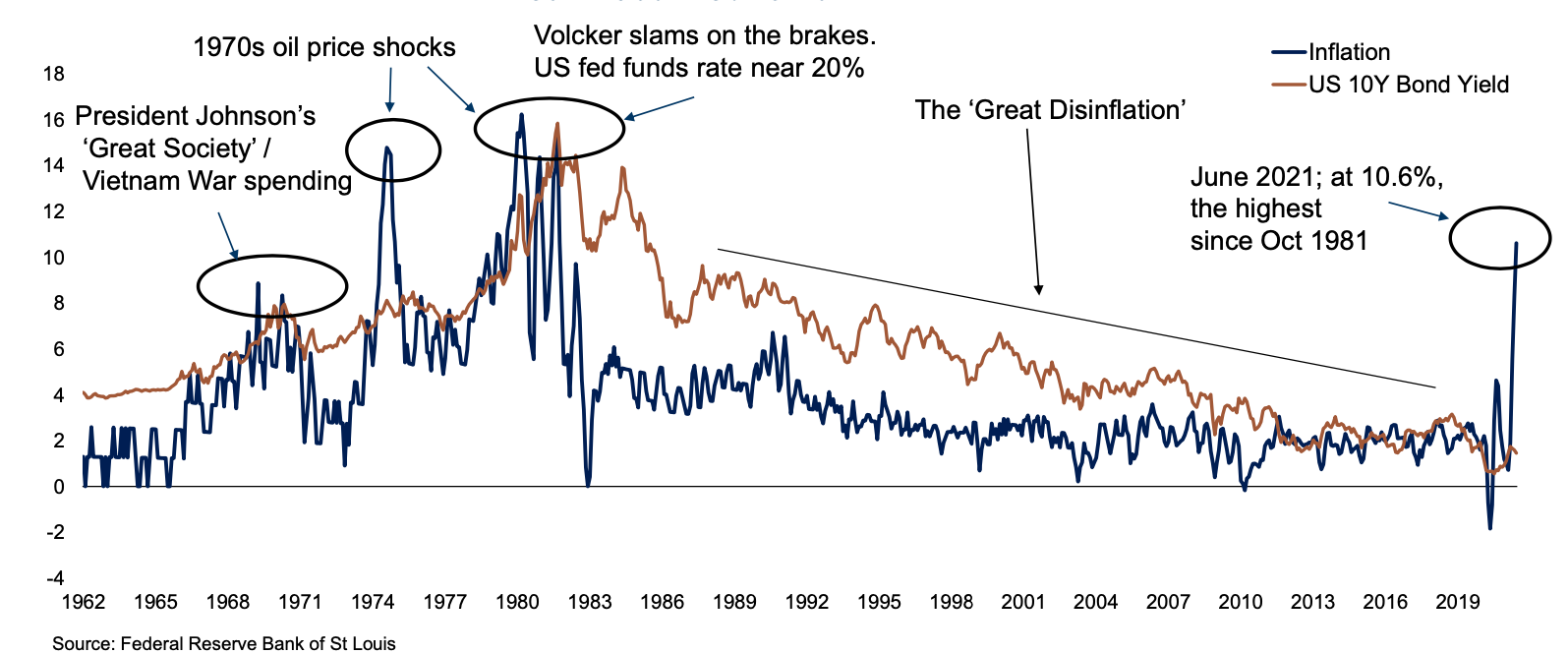

Switching gears, GSFM investment strategist Stephen Miller provided an overview of credit markets. Miller suggested the historically strong bond yields of recent years have bolstered equity markets while emphasising he doesn’t regard current equity yields as implausible.

Pointing to inflation as the potential “weak link” of bond yields – one that has been so broadly highlighted over the last six months – Miller said: “It’s fair to say the Fed and markets have bought the ‘inflation is transitory’ narrative.”

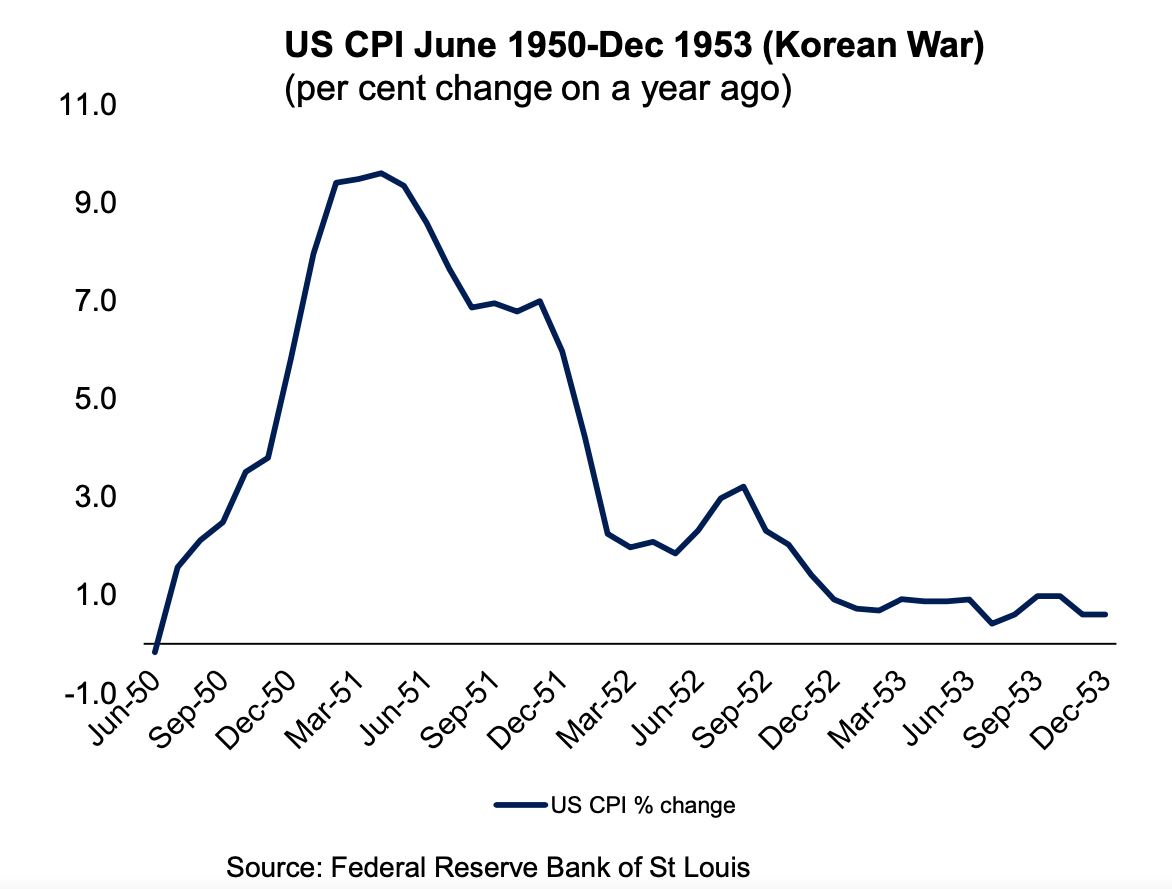

Referring to the historical periods surrounding the Korean War of the 1950s and the Vietnam War era of the 1960s and 1970s, Miller regards the first as an argument in favour of the transitory inflation view, while the latter is a counter-argument.

“There’s a good historical precedent there,” he said, pointing out that US CPI inflation was at minus 0.2% in June 1950 and hit almost 10% in less than 12 months.

“And after the Korean war, CPI was at around 3% but never got to 4% again until the Vietnam war.”

US Core inflation: Rolling 3-month annualised

US 10-year bond yield

While acknowledging there are numerous differences between our current situation and these periods, Miller believes there are several “inconvenient” parallels:

- Fiscal stimulus appears to be a multiple of the output gap

- Savings are up

- Equity and housing prices have soared

- There are structural deflationary pressures currently, including deglobalisation and declining “baby boomer” workforce participation

- Persistent supply shocks: demand growth is outstripping supply growth, with rising materials costs and diminished inventories

- The Biden re-regulation era.

“If I was looking at things that could be worth worrying about, inflation is number one…and alongside COVID, potentially the impact of tax and of re-regulation and anti-trust measures.”

On the first of these other points of concern, he highlights technology firms, the largest component of the S&P500 index, as those with the most to lose, with a relatively low effective tax rate of just under 17% versus more than 20% for energy, materials and consumer staples.

“Large-cap IT and healthcare – which typically benefits the most from shifting profits to lower-tax jurisdictions – would potentially take the biggest hit to earnings if a global minimum tax is enacted,” said Miller.

“While the Biden re-regulation agenda has laudable intent, things like increasing the minimum wage, increasing immunisation and regulation does have an impact in increasing business costs and adds to inflation.”

He also referred to estimates from Blackrock that suggest US President Biden’s push for a 28% corporate income tax, if successful, would see the S&P500’s earnings per share fall around 7% in 2022.

Weighing the vaccine rollout

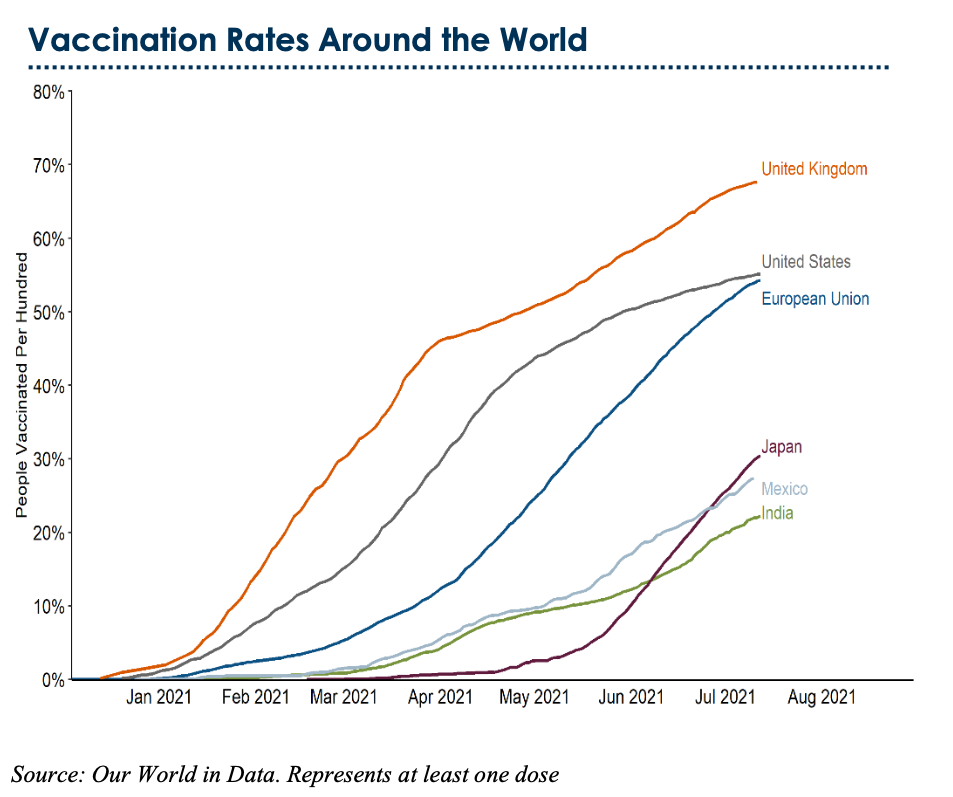

Sticking with credit markets, Eric Souders, portfolio manager at fixed-income fund manager Payden & Rygel, spoke about the global vaccine rollout.

“The cadence of countries being able to actually roll out a vaccine logistically is a big part of our decision-making,” Souders said.

Looking at the ability for countries or regions to do this, he noted that developed markets including the UK and European Union countries have either exceeded or are rapidly approaching the US’s vaccination rate.

In addition to the vaccine rollout of a specific country – or in the case of many emerging markets, their ability to get direct support from other developed countries in doing this – Payden & Rygel looks at real-time data such as:

- restaurant reservations

- air travel booking

- hotel reservations.

“We look at businesses that have very high degrees of operating leverage, such as airlines, where the value proposition just doesn’t look very good given where credit spreads are,” said Souders.

“This is why we like other areas such as residential real estate in the US: tangible assets with an improving credit profile as interest rates remain really low.”

Not an existing Livewire subscriber?

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

5 topics

7 stocks mentioned

2 contributors mentioned