Tesla leads the pack as EV adoption switches into gear

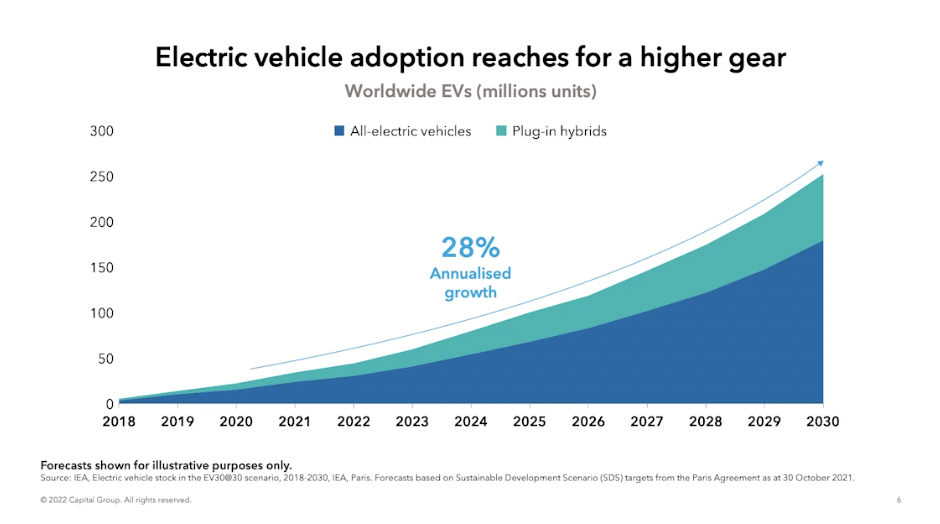

Over the next few years, we could see electric vehicle (EV) penetration increase to 70% in Europe and China, and around 50% in the US, as government incentives and regulation continue to drive momentum in the electric car market.

That's according to global investment manager Capital Group, which recently held a webinar exploring the investment opportunities that are arising as the automotive sector undergoes rapid transformation.

And while semiconductor chip supply and the lack of sufficient charging infrastructure remain key risks going forward, Capital Group's team is adamant that the days of the internal combustion engine are numbered.

In this wire, we summarise some of the key points from the investment manager's latest webinar, featuring insights from Hong Kong-based Jason Zhang, an equity investment analyst, and Piyada Phanaphat, one of the firm's equity portfolio managers. It also features London-based speakers Daniel Jacobs, a fixed income investment analyst, and Julie Dickson, an investment director at Capital Group.

In this wire, you'll read about some of the challenges and opportunities facing incumbent automotive manufacturers over the coming decade, as well as why Capital Group believes that Tesla (NASDAQ: TSLA) remains leaps and bounds ahead of the competition.

Momentum continues to drive EV penetration

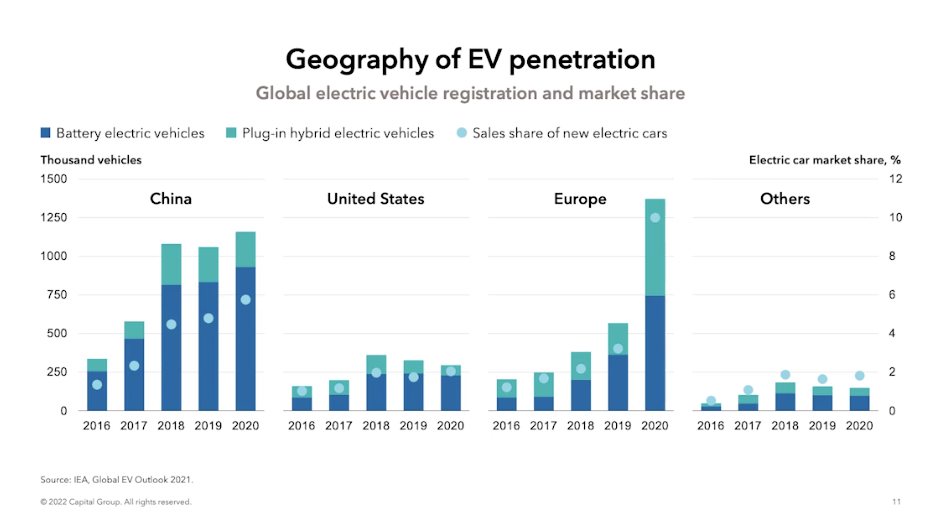

Equity investment analyst Jason Zhang believes that the momentum behind EVs has largely been driven by incentives and regulations introduced during 2020 in Europe and China.

"Over the past two years, what we have seen is a very sharp increase in EV penetration; in Europe, it's more than quadrupled from 4% to 20%. In China, it's tripled from 5% to 15%," he explained.

"The US is a laggard. Last year, penetration was only around 5%, but the regulation is coming and I think the US will catch up as well.

Zhang predicts that by 2030, we will see 60-70% EV penetration in China and Europe, and around 50% penetration in the US.

However, it would seem not all EVs are created equal. In fact, fixed income investment analyst Danny Jacobs says that purchasers have a preference for "premium" producers of electric vehicles.

"These early adopters have been able to afford the higher up-front costs of electric vehicles, and often have access to another car, if needed," he said.

"The buyer base is broadening through, as prices come down, as charging infrastructure improves, and as there are a greater number of vehicles to choose from - particularly in the more popular segments, like SUVs."

The key to further penetration, though, depends on whether EV producers are able to develop cars with cheaper batteries so they are as affordable to purchase, run and repair as traditional gas-guzzling vehicles, Jacobs said.

A key bottleneck facing the rollout of EVs: semiconductor chip shortages

However, a key bottleneck facing the production of EVs is the supply of semiconductor chips, as has been well documented in the media.

"The tricky part about semiconductor chips is that, unlike lithium, semiconductor chips are used in so many sectors and have more complex drivers than just EVs," equity portfolio manager Piyada Phanaphat said.

"Obviously, this past year has been a huge challenge and it still is a little bit coming into 2022, but my colleagues believe we are coming into secular tightness, and EV and AV is one of the contributing factors to this tightness among others."

Jacobs believes chip shortages issues will be resolved, with new supply coming online late this year and into 2023.

"Some of that will be as an agreement between the car companies and the chip makers themselves, rather than going through the supply chain, which I think is primarily where the chips were routed through previously," he said.

"The more interesting and pressing question for the auto industry is whether this chip shortage becomes the first in a series of bottlenecks to impact the industry, as they look to ramp up an entirely new supply chain for electric vehicles.

"I think it's this risk that is behind the number of agreements that we are seeing currently in the market, as the automakers are trying to either vertically integrate or secure via partnership, the resources that will be essential for them in building electric cars over the coming years."

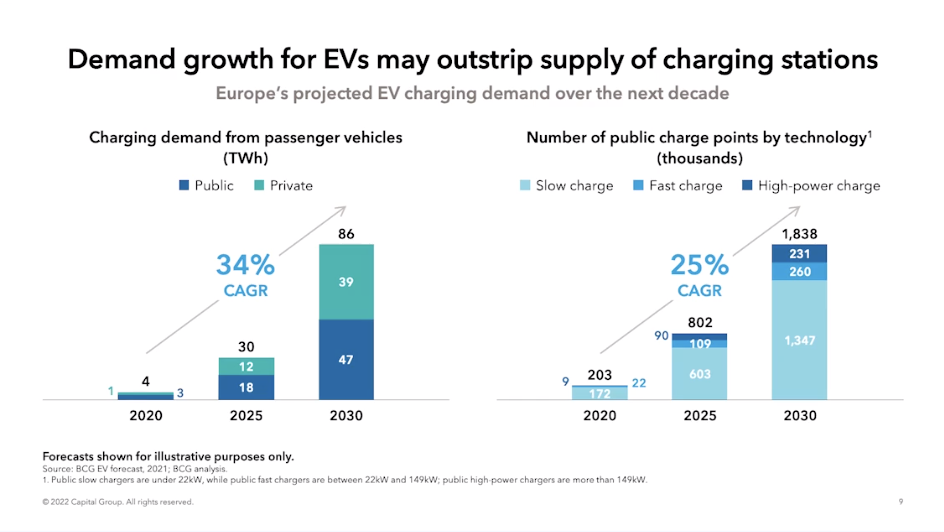

Charging networks have a long way to go

At the moment, there is a lack of sufficient supply of charging stations for electric vehicles, equity investment director Julie Dickson said.

"On top of that, we have to think about the demand that an increased number of charging points and an increased number of people owning EVs on the electric supply and grid capacity," she said.

"As governments move to create greener environments, through tax regulations and incentivised EV ownership, and by also using renewable energy as a strategic way of adding to electricity and electricity supply."

As the growth in uptake in EVs is likely to outstrip supply going forward, governments and utilities companies need to work together to create better charging solutions in the future.

"Governments are going to have to work very closely with utilities, and auto manufacturers even, to really create this EV charging supply," Dickson said.

Utilities will need to do a number of things, she said. First, they will need to develop a strategic plan to enable greater electricity supply and distribution.

"Innovation will be a key aspect of this. So for example, in certain places, we may only need slower charging points - like overnight charging in your home or near your home or during the workday at work. Or faster-charging points on the road on the way to a destination," Dickson said.

They also need to invest in educating consumers on the best time to charge their vehicles to avoid pressure points at peak demand times of electric supply, she said.

How to identify winning EV manufacturers

While traditionally hardware (such as batteries), range, cost and safety (from using said batteries) were key focus points for investors when analysing EV manufacturers, Phanaphat said that today, investors are increasingly placing attention on manufacturers' software abilities.

"Now that's not an issue anymore. As time goes on, those are also important, but the software side of things is increasingly important - like data collected, on how batteries function while driving, on optimising software, which involves communication, AV and ADAS and others," she says."

"Some of these, like ADAS - while arguably not limited to electric cars, it's actually much more elegant on EVs and has become increasingly the competing features that we look for when we look at EV manufacturers."

As traditional manufacturers of vehicles shift towards EV models, Jacobs, it's key that "they change their mindset to that of a disruptor."

"They often have very longstanding production methods and processes, which may have worked very well in the past, but equally may not be the optimal way of building an electric vehicle," he said.

Recognising these challenges will be the key to survival for these incumbents, Jacobs said, as well as a core focus on attracting the right people to help them on this journey.

The fixed costs for producing EVs are actually significantly more cost-effective, making it easier for EV-only focused manufacturers to scale, Zhang added.

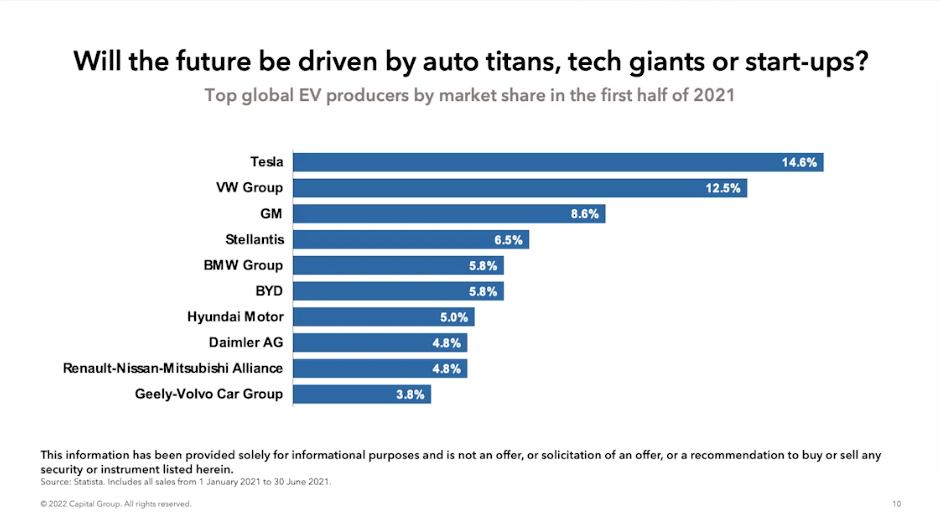

"Telsa's profitability in cash flow metrics are already better than most legacy automakers," he said.

"Tesla's RND as a percentage of revenue is now below Volkswagen and Toyota, and continues to decline as volumes ramp."

However, while EVs are lower cost on the manufacturing side they do incur other investments, like in software, he said.

"This is something the traditional EMs are not very good at. They are spending a lot of money to build up that software expertise, but it's not simply about how much you spend," Zhang said.

For example, VW is spending significantly more than Tesla on RND, but Zhang doesn't believe they will be able to catch up to their main competitor.

"Tesla has the first-mover advantage," Dickson said.

"It has a very advantageous cost structure and access to capital, making it easier and more nimble to really get into this very high end and successful growing market."

In addition, it boasts an enormous market cap, making it the world's largest auto manufacturer and one of the biggest companies in the world, she said. It also has an advantage over its competitors when it comes to connectivity and software.

"Its battery operations management system is one of, if not the market leader. Again, giving it an advantage over other manufacturers in terms of the intelligence and efficiency with which these cars run," Dickson said.

"Tesla does have a technology lead, due to its completely unique fully-connected electrical architecture, which is enabled through the software to have superior data capture and firmware improvements, that happen in real time.

"Finally, Tesla is not just building cars. It's doing a number of other things related to renewable energy, energy supply, battery manufacturing, energy storage, which also gives it an advantage."

However, as Jacobs adds, the limited number of models that Tesla produces (at this stage four) could put a cap on the number of vehicles it is able to sell to different areas of the market.

"A company like Volkswagen is able to produce the same skateboard electric vehicle architecture, and then put different bodies, essentially, on top of it - which play a little bit more to traditional consumer preferences, like SUVs," he said.

So which companies will come out on top? It certainly is going to be an interesting race to watch over the coming decade.

Put today’s investment insights into a long-term perspective

Capital Group believes in a smarter way of investing that combines individuality and teamwork into a tailored approach to help investors meet their goals. To discover more about Capital Group visit their website here.

1 topic