The 10 most-tipped large caps for 2022

If there’s one thing Livewire readers love, it’s a good list of stock ideas. Throughout the year we hear from fundies, brokers, and other professionals. But since 2016, once a year, we tap into the wisdom (or folly?) of the crowd and ask for your top stocks for the year ahead.

From humble beginnings, our survey has amassed a real following. For the 2016 survey, we received just 309 responses. This year, we’ve got well over 4,000. Such a treasure trove of data is always going to produce some interesting results.

This year, like in the recent past, we’ve split the tips for Australian companies into two categories: large caps, and small caps.

I hope you enjoy your most-tipped large caps for 2022.

But before we do... By publishing this list, we share information from the Livewire readership and we hope it inspires ideas for further research. This information is not, nor is it intended to be a set of recommendations. Please do your own research and seek advice from a professional.

Large caps at a glance

- The average market cap of the 10 companies is $72 billion at the time of writing. This is up from $63 billion last year

- The top three stocks received 12% of the overall vote

- Australia's largest stock, CBA, failed to make the list this year

- Pilbara Minerals had the best return last year with a 269% rally

- Afterpay, Xero, A2 Milk, Appen, and Commonwealth Bank all dropped off the list this year

- And the most tipped stock, for the fourth year running is ... You'll have to scroll down to find out!

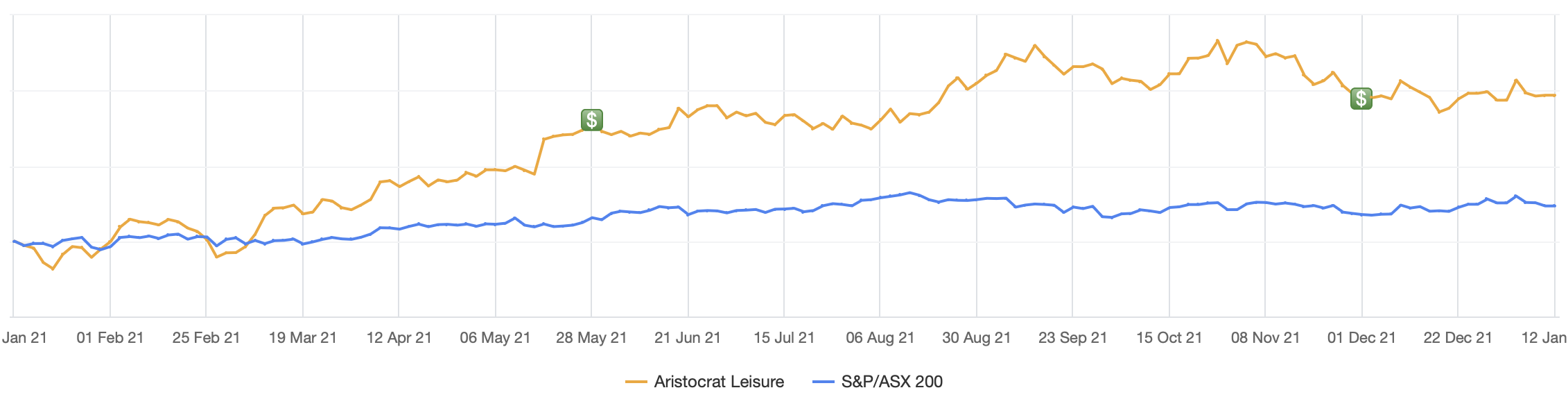

#10 – Aristocrat Leisure (ASX: ALL)

Percentage of overall votes: 0.71%

Market cap: $29.5 billion

This was probably the biggest surprise inclusion for me, as Aristocrat generally flies under the radar. Perhaps it's because of the nature of their business. Despite continuously increasing its revenues, profits, and share price, it’s only made the most-tipped list once since 2018. At a $30 billion market cap, you’d think it’d be hard to ignore this one!

Aristocrat has built their business on physical poker machines (or ‘gaming’, if you prefer), making money through selling, maintaining, and even owning these machines in clubs and casinos. But an increasing portion of earnings in recent years has come from their digital business.

Aristocrat is currently in the process of acquiring Playtech, “a leading global online gambling software and content provider”. The company made an all-cash offer which was recommended by Playtech’s board, so looks likely to go ahead.

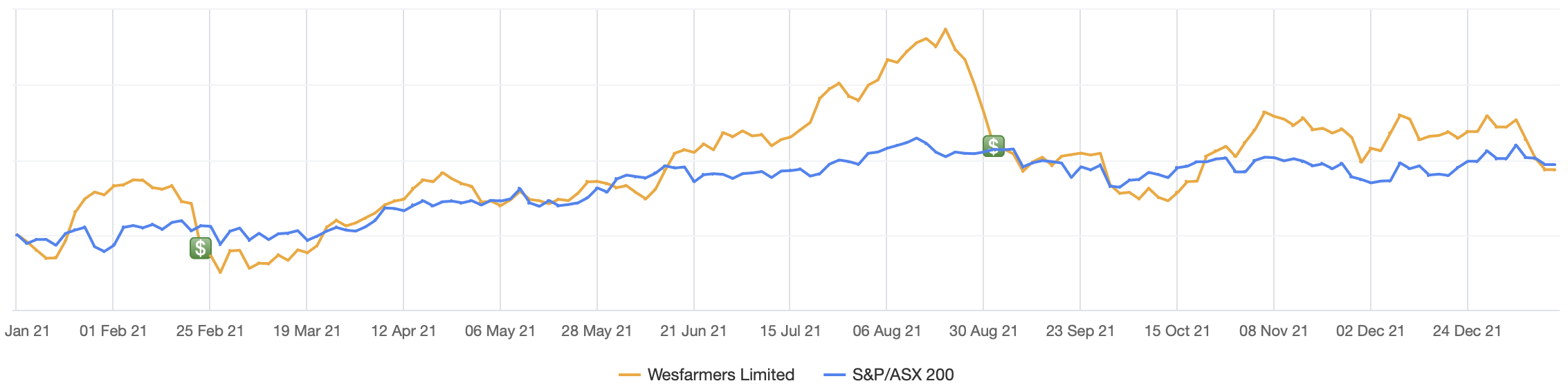

#9 – Wesfarmers (ASX: WES)

It might surprise some to hear that it’s now been more than three years since Coles and Wesfarmers de-merged. But as often appears to be the case, the decision has been beneficial to both companies. While Wesfarmers still retains 4.9% of Coles (worth around $1 billion), it’s safe to say that the two companies are now well and truly separate.

This sale has allowed Wesfarmers to go on a bit of an acquisition spree in the last couple of years. Back in 2019, they acquired Kidman Resources, which owned the Mt Holland Lithium project – this recently received a positive final investment decision. Wesfarmers also acquired online retailer Catch and made a failed bid for Lynas Rare Earths. Shareholders in Lynas will no doubt be glad that didn’t go ahead, with the stock now trading over $11, compared to a $2.25 acquisition price.

More recently, Wesfarmers was bidding against Woolworths to acquire Australian Pharmaceutical Industries. With Woolworths pulling out of the bid last week, it seems Wesfarmers is all set to complete another acquisition.

With its reputation for savvy capital allocation, investors are no doubt wondering what the next move will be.

#8 – Westpac Banking Corporation (ASX: WBC)

Percentage of overall votes: 1.03%

Market cap: $79.5 billion

After falling off the list in 2021, Westpac returns in 2022.

The stock was torched on the back of a poor result in early November, falling from a high of over $26 in late October, it fell to $20.46 in early December. Readers are clearly betting on a turnaround, though it’s far too early to tell whether management has managed to right the ship.

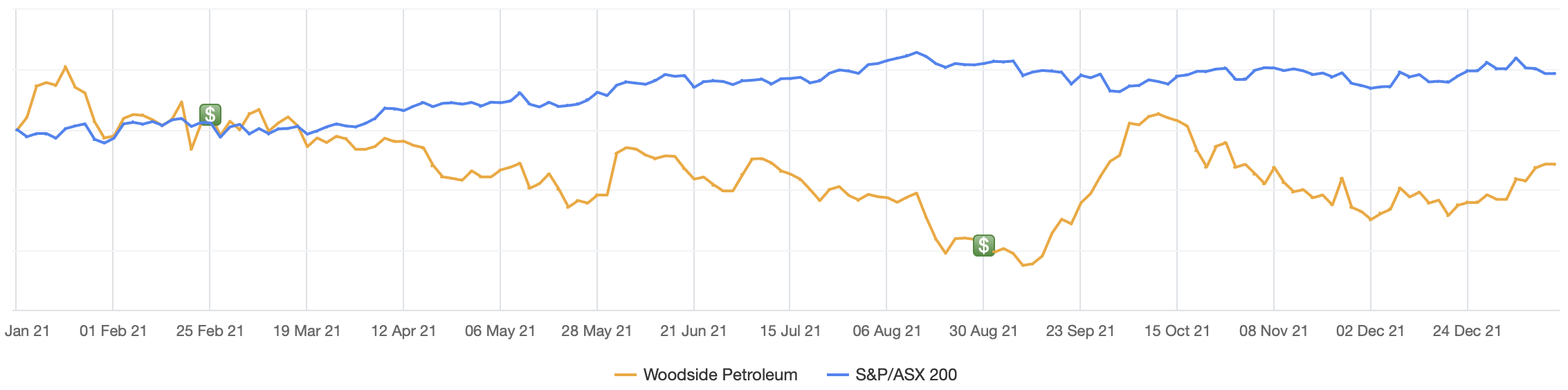

#7 – Woodside Petroleum (ASX: WPL)

Percentage of overall votes: 1.43%

Market cap: $22.7 billion

Despite the oil price rallying by ~55% in 2021, and Woodside agreeing with BHP to acquire their petroleum assets, the stock couldn’t catch a break last year. Woodside finished effectively flat when all was said and done.

Perhaps 2022 will see some of the oil price rally feed through to the stock price.

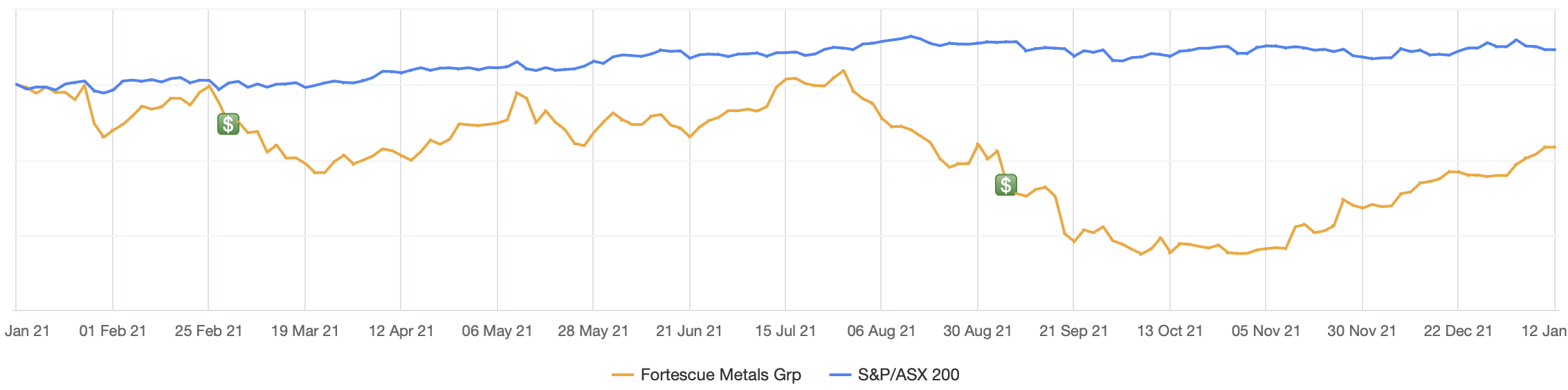

#6 – Fortescue Metals Group (ASX: FMG)

Proving that markets are forward-looking, not based on historical returns, Fortescue had a surprisingly poor year in 2021. Iron ore hit almost $220 per tonne in July, while Fortescue’s cash cost of production sits around $15 per tonne. To say those are healthy margins would be putting it lightly. As a result, the stock now trades on a PE of less than 5, with a dividend yield of over 20%. Clearly, investors are sceptical that prices can stay where they are for much longer.

But with margins and prices like that, not much has to go right for the stock to do well.

#4 (tied) – Mineral Resources (ASX: MIN)

Mineral Resources makes its debut in the top 10, and it’s not hard to see why. The company has had a great couple of years that’s seen its share price explode from the mid-teens in early 2020, to over $60 today.

Mineral Resources is a rather unique conglomerate. In addition to being one of the largest mining services businesses on the ASX, it’s also a major producer of iron ore and lithium. It’s also recently made a major gas discovery, further diversifying the business.

But this is no “de-worsified” business, to steal a phrase from the great Peter Lynch. Each one of their businesses is significant enough to have an impact on their bottom line and produces healthy returns. In fact, for FY21, the overall business produced an amazing 38% return on invested capital. Even a capital-light tech company would be happy with numbers like that.

Despite posting triple-digit growth in cash flow, EBITDA, and dividends in FY21, the company isn’t stopping there. With further projects coming online in 2022 and 2023, the growth pipeline for the years ahead is well under control.

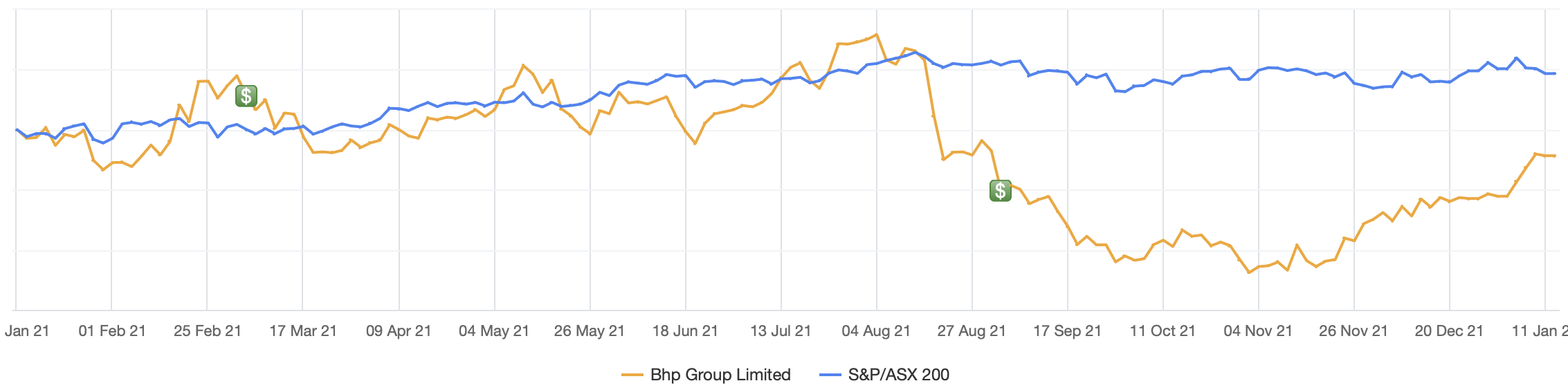

#4 (tied) – BHP (ASX:BHP)

I’m sure all Australian equity investors would be familiar with ‘The Big Australian’, so I won’t bore you with the details of the business. There were two major developments in 2021 worth noting, however.

The first was the spinoff of their petroleum assets, which were acquired by the #7 entry on this list, Woodside Petroleum. With a big portion of institutional money now falling into the ESG-aware category, this could have major benefits for shareholders. While mining remains an emissions-intensive business activity, BHP no longer produces any fossil fuels used in energy production. It does maintain its metallurgical coal assets, to date, there are no commercially viable alternatives to metallurgical coal in the production of steel.

BHP is also advancing the enormous Jansen potash project in Saskatchewan, Canada. With many pundits tipping potash as a potential outperformer in the years ahead, this could make a great replacement for the energy business. If you’re interested in potash, keep an eye out for my upcoming interview with Owen Hegarty OAM, Executive Chairman of EMR Capital and founder of ‘The Mighty Ox’ – Oxiana Resources.

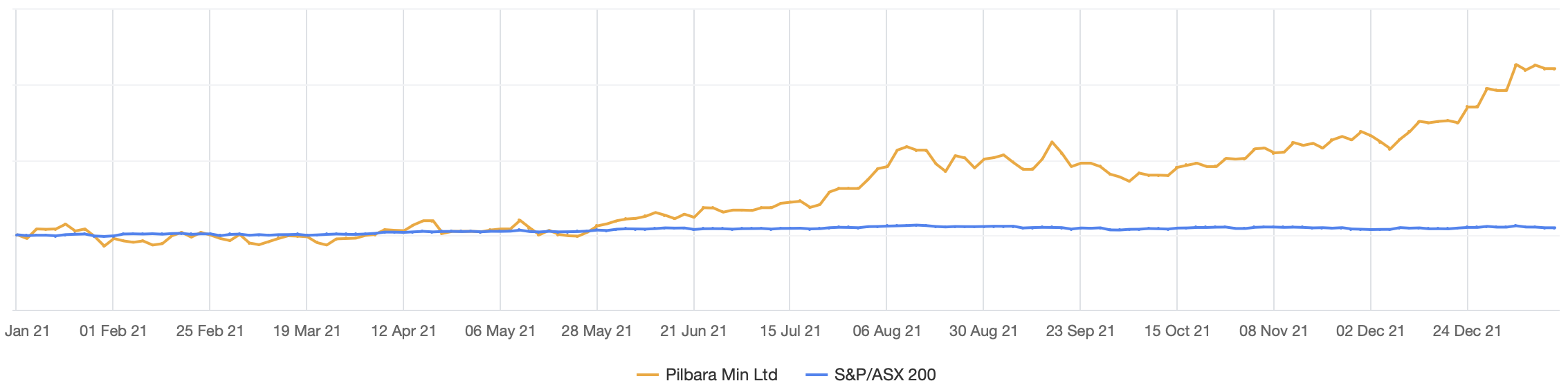

#3 – Pilbara Minerals (ASX: PLS)

Percentage of overall votes: 2.64%

Market cap: $10.5 billion

What a difference a couple of years can make. In March 2020, Pilbara Minerals was struggling. It made an EBITDA loss, suffered write-downs, and was forced to raise a significant sum of capital.

Since then, the share price has rallied over 2000%. Operations have improved, lithium prices have soared, and they managed to pick up a neighbouring project for an absolute steal after it went into receivership.

One interesting development has been their partnership with GLX Digital to create the “BMX” – Battery Mineral Exchange. This allows the company to sell its product on the spot market, potentially increasing margins and giving them greater exposure to a rising lithium price.

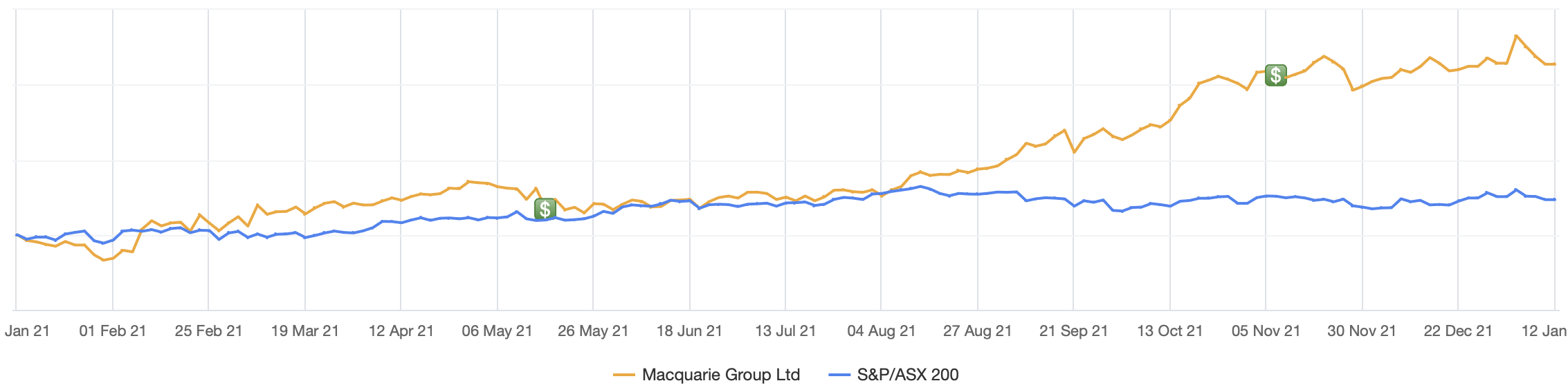

#2 – Macquarie Group (ASX: MQG)

Percentage of overall votes: 4.31%

Market cap: $78.7 billion

Another perennial favourite among Livewire readers, Macquarie Group has been in the top five on this list for four years running now. If you’d purchased it at the beginning of 2019 when it appeared on the list, you’d be sitting on a handy 110% gain by now – including dividends, but not franking credits.

Macquarie completed a somewhat mysterious capital raising late last year, adding another $1.5 billion to its war chest, despite already holding an enormous $8.4 billion of surplus capital. But investors will have to wait and see where this gets put to work, because the company hasn't yet disclosed any specific intentions for the money.

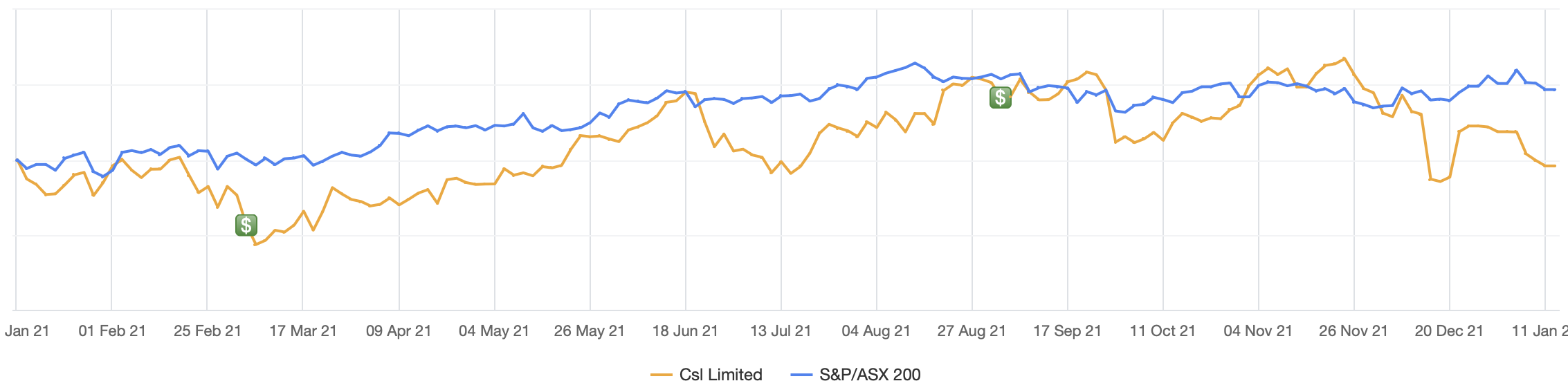

#1 – CSL (ASX: CSL)

Percentage of overall votes: 5.01%

Market cap: $133.1 billion

And the winner is … CSL. Topping the list for an incredible four consecutive years now, it’s clear that Australian investors’ love affair with the company continues. In what’s been a rare pause among an otherwise meteoric rise, CSL’s share price remains below highs set two years ago.

That hasn’t stopped the profits, however, which have grown by around 20% over the last two financial years. COVID has no doubt presented challenges for the business, making it more difficult to collect blood plasma in the USA. But with the pandemic apparently entering its final phases, readers are clearly betting on an improvement on this front.

In late 2021, CSL announced a takeover offer for Vifor Pharma valued at A$16.4 billion. If this acquisition can achieve even a fraction of the success that CSL saw from its 2015 acquisition of Novartis’ influenza vaccine business, it will no doubt be a huge boon for shareholders.

The full list

Click on the image below to enlarge...

.jpg)

Surprise omissions

Afterpay (ASX: APT)

Afterpay first made an appearance on our most-tipped list back in 2018, when the stock traded at around $6 per share, just 6 months after the merger with Touch Group. In fact, it topped the list that year, beating out perennial favourites such as CSL and BHP with 4% of the total vote. And it appeared in the top three in each of the following three years.

With the Block (or Square, as it’s more commonly known) merger now moving ahead, the stock is trading in lock-step with its American suitor today, perhaps explaining the loss of enthusiasm among Australian investors. The combined entity, which will remain listed on the ASX, would have a market cap of A$117 billion based on today’s share prices, making it the fourth-largest company on the ASX.

Xero (ASX: XRO)

Xero has been another regular entry on this list in recent years, but there’s no obvious reason it’s fallen out of favour this year. Perhaps it’s just because the stock failed to post gains in 2021. Or maybe Australians’ love affair with tech stocks is beginning to fade? I guess only time will tell.

Conclusion

The list looks distinctively different to the last few years. Gone is the plethora of 'high growth' stocks such as A2 milk, Appen, Xero, and Afterpay. Instead, the miners have made a strong comeback.

If Livewire readers are anything to gauge by, then perhaps that love affair with growth and tech stocks really is coming to an end.

2 topics

12 stocks mentioned