The $11B undiscovered real estate play

I recently contributed to Hans Lee's $10,000 idea series, recommending three high quality companies including Intercontinental Exchange (ICE), a global operator of exchanges and clearinghouses that facilitate trading in a wide range of financial and commodity markets. Founded in 2000, ICE has emerged as a leading player in the industry, offering a diverse portfolio of products and services to market participants worldwide.

But there’s more to ICE than financial services, as I remarked in the article:

“Intercontinental Exchange is currently working to revolutionise the mortgage ecosystem through a series of strategic acquisitions. One such acquisition is of Black Knight, a key player in the mortgage space. Although a decision from the FTC is still pending, we are of the opinion that the acquisition will proceed following the divestiture of Optimal Blue (a subsidiary of Black Knight).”

Last weekend the US Federal Trade Commission entered into an Agreement Containing Consent Order with ICE. When the acquisition of Black Knight closes on 5 September, ICE will secure a critical piece of the puzzle in its ambition to digitise the analogue US mortgage ecosystem.

The Black Knight deal brings the cumulative investment in the mortgage industry to more than US$23 billion, as ICE previously acquired Mortgage Electronic Registration Systems (MERS) in 2016, Simplifile in 2019 and Ellie Mae in 2020.

The acquisition of Black Knight is significant for several reasons, quite apart from the quantum.

1. US mortgage ecosystem is ripe for disruption.

The loan underwriting process in the US is complex, expensive and slow with the typical mortgage taking around 60 days to complete. And despite the rapid digitisation of so many industries, this one remains anachronistic, principally because so many participants profit from the inefficiency.

The lengthy loan application process, based on paper documents like tax returns and credit scores means lenders face fluctuating borrowing costs, especially as interest rates have surged over the past two years through the application process. Once a loan agreement is finalised, the lender and borrower need to track loan repayments, and regulatory guidelines mandate the retention of related documents for many years.

ICE seeks to disrupt this model by leveraging its expertise in market infrastructure, data analytics and technology solutions. By doing so, it aims to make it more efficient, transparent and digital-friendly. Today, only a small percentage of mortgages are transacted digitally as CEO Jeff Sprecher remarks;

“There’s only a single-digit percentage of mortgages today in this country that have gone through a digital note process. That’s the opportunity,”

2. ICE lowers costs for all stakeholders and improves efficiency

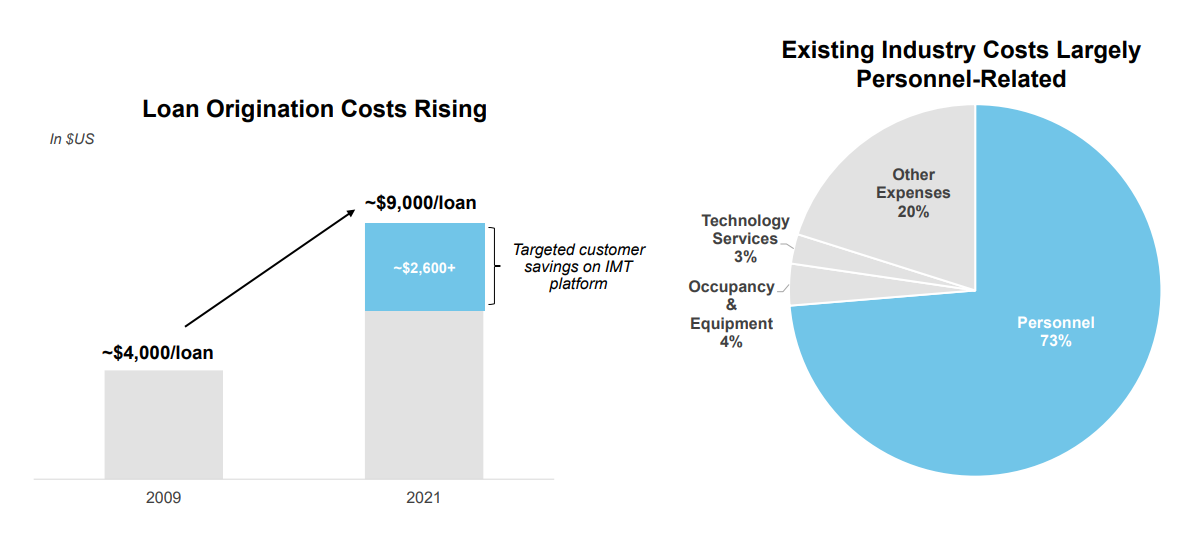

Not only is the current process slow, it is also expensive with the cost of loan origination more than doubling from US$4,000 in 2009 to US$9,000 in 2021. This makes sense when the industry’s staff expenses account for a whopping 73% of total costs. ICE believes it can lower expenses by more than US$2,600 per loan through digitisation and automation, resulting in reduced friction, improved transparency and a better experience for consumers. And for ICE it expands its total addressable market in mortgage technology to US$14 billion while providing both revenue and cost synergies for shareholders.

3. Data is the new oil

There is also a strategic rationale for ICE beyond digitisation. It stands to benefit from its access to unique data and analytics across the mortgage workflow through:

- Access to more timely information enhancing the underwriting process and providing customers with deeper insights into rapidly changing market dynamics

- Greater transparency with detailed access to portfolio valuation, performance and risk for servicers and investors

- Ability to leverage ICE’s expertise in fixed-income and capital markets, especially in the mortgage-backed security (MBS) market

ICE valuation rises

Black Knight raises ICE’s revenue and operating profit. There is also a combination of revenue and cost synergies to be realised over the coming years. ICE has acquired nearly 20 companies over the last decade, and management has a good track record of realising synergies ahead of schedule.

Following the acquisition of Black Knight, we updated our model, leading to an increase in our valuation. While the mortgage market remains under pressure in the US following the rapid rise in rates, we are excited about ICE’s long-term prospects and look forward to following its progress as it expands services while improving the mortgage ecosystem for all stakeholders.

4 topics

2 stocks mentioned

1 contributor mentioned